Why Invest in Silver? 5 Reasons to Diversify with Silver Today

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 6th September 2023, 11:57 pm

Silver as an investment has a checkered history of success. At times, silver prices have soared—such as in 1979 and 1980, when prices skyrocketed by 450%—and other times have seen silver prices collapse or stagnate.

Despite its history, silver is still seen as a risk management tool and indeed a safe haven asset for many risk-conscious investors. This is especially true today, in an era where silver has tended to produce modest returns, low volatility, and decreasing mine supply.

In 2022, silver finished the year with a 3.52% positive return, building on the approximately 2.5% return posted the year prior. In 2023, amid gradually decreasing global mine production, silver is becoming a scarcer resource than ever before, leading some observers to wonder whether supply constraints may put upward price pressure on the white metal.

Suffice it to say that silver is one to watch in the years ahead. Whether you’re a retirement investor or a growth investor, you may want to consider doing due diligence on silver. If played right, the precious metal could make a positive addition to your portfolio.

While stocks and bonds are popular choices, savvy investors understand the importance of incorporating tangible assets into their portfolios. One such asset that has stood the test of time is physical silver bullion. Let’s explore the reasons why you may want to consider adding silver to your investment strategy.

Table of Contents

1. Silver is Considered a Safe Haven Asset

Silver has long been recognized as a safe haven asset, similar to gold. During times of economic uncertainty or market volatility, investors often flock to precious metals as a store of value. This was particularly evident during the global financial crisis of 2008 and the COVID-19 pandemic. In both cases, silver prices surged as investors sought refuge from the turmoil in traditional financial markets.

For example, during the 2008 financial crisis, silver prices increased from around $10 per ounce to nearly $14 per ounce in a matter of months. Similarly, when the COVID-19 pandemic hit in early 2020, silver prices saw a significant boost, climbing from $17 per ounce to over $28 per ounce within a few months. These instances demonstrate how silver can act as a hedge against economic uncertainty and even recessionary economic activity.

2. Growing Industrial Demand

Unlike gold, silver has a wide range of industrial applications, which contribute to its value. It is a vital component in the manufacturing of electronics, solar panels, medical instruments, and even antibacterial coatings. This industrial demand provides a consistent level of support for silver prices.

The rise of renewable energy sources and the green technology sector has further increased the demand for silver, as it is an essential component in solar panels. As governments around the world invest in renewable energy infrastructure, silver's role in this industry is expected to grow, potentially driving up its price over the long term.

Industrial demand for silver grew by 6% in 2022 due to a sharp 12% increase in photovoltaic panel production worldwide. As solar energy proliferates and household consumer electronic manufacturing increases, silver demand is likely to rise in step. According to the World Bank, silver prices are expected to rise 6% in 2023 due to industrial demand factors.

(Interested in investing in precious metals such as gold and silver? Check out our exclusive list of the top-rated precious metals IRA companies on the market).

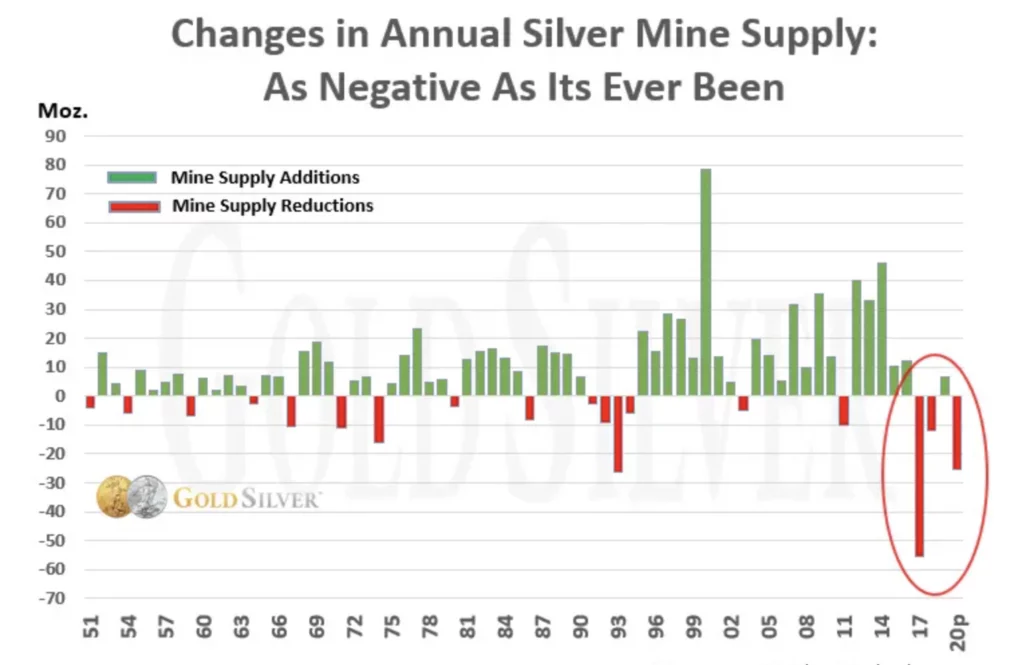

3. Limited (and Falling) Supply

Silver is a finite resource, and its supply is constrained by mining production. Unlike fiat currencies, which can be printed endlessly, silver cannot be artificially created in large quantities. This limited supply can lead to upward price pressure when demand increases, creating opportunities for investors.

Global silver mine production has fallen below 10% of its record highs which were reached in the mid-2010s. As silver mine deposits dry up, we could continue to see upward price action for the white metal on both the demand and supply side.

Source: CPM Group

4. Silver is a Portfolio Diversification Tool

One of the golden rules of investing is diversification. A well-diversified portfolio spreads risk and reduces the impact of market volatility on your overall holdings. By adding physical silver bullion to your investment mix, you can achieve this diversification. Silver's low correlation with traditional assets like stocks and bonds makes it an attractive addition to a balanced portfolio.

Below are notable examples of when silver prices rose at the same time that the stock market fell in value, illustrating silver’s non-correlated to the equities market.

The Global Financial Crisis (2008):

- During the peak of the financial crisis in 2008, the S&P 500 Index dropped by approximately 38%

- In contrast, silver prices surged from around $10 per ounce in September 2008 to nearly $20 per ounce by February 2009, marking an increase of approximately 100%

The European Debt Crisis (2011-2012):

- As concerns over the European debt crisis gripped financial markets, the S&P 500 experienced periods of volatility and uncertainty

- Silver prices saw a notable rise during this time, reaching approximately $48 per ounce in April 2011, up from around $18 per ounce in September 2010

The COVID-19 Pandemic (2020):

- The COVID-19 pandemic triggered a sharp stock market decline in early 2020, with the S&P 500 dropping by approximately 34% in a matter of weeks

- In response to the economic uncertainty, silver prices increased from about $17 per ounce in January 2020 to over $28 per ounce by August 2020 (i.e., +65%)

These instances demonstrate the inverse relationship often observed between silver prices and stock market performance during times of economic turmoil. Investors turned to silver as a safe haven asset, driving up its prices as a hedge against market volatility and economic uncertainty.

5. Silver’s Historical Performance

Historically, silver has shown impressive price appreciation. While it may not always match the meteoric rise of certain tech stocks, its stability and growth potential make it a reliable long-term investment. Over the past few decades, silver has tended to outperform inflation, helping investors preserve their purchasing power.

Silver: The Next Breakout Commodity?

Over the past decade, we’ve seen gold prices rise by an impressive 42.6%—a truly remarkable ascent among commodities. Due to changing market fundamentals, we could see silver follow a similar trajectory in the years to come.

Investing in physical silver bullion can be a wise decision for those looking to diversify their investment portfolios and protect their wealth during times of economic uncertainty. Its status as a safe haven asset, combined with industrial demand, limited supply, and historical performance, makes it a compelling option for investors.

While past performance is not indicative of future results, the unique qualities of silver make it a valuable addition to any well-rounded investment strategy. If you’re interested in diversifying with this precious metal, consider reading this guide to investing in silver within a self-directed IRA. This way, you can capture the upside potential of silver on a tax-free or tax-deferred basis.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,325.82

Gold: $3,325.82

Silver: $36.46

Silver: $36.46

Platinum: $1,365.19

Platinum: $1,365.19

Palladium: $1,139.37

Palladium: $1,139.37

Bitcoin: $111,339.83

Bitcoin: $111,339.83

Ethereum: $2,773.71

Ethereum: $2,773.71