How Much Is A Gold Plated Quarter Worth? (2025 Update + Price History)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 6th August 2025, 09:02 pm

Contrary to popular belief, a gold coin or bar aren't always worth their weight in gold. Many plated gold quarters are worth no more than a standard 25-cent U.S.-minted quarter. Although these coins contain a thin layer of gold—usually about 0.003 inches thick—they’re virtually impossible to resell because they have little to no melt value.

🛡️ Worried About Inflation or Market Volatility?

Gold prices are surging in 2025—and more investors are turning to physical gold IRAs to protect their retirement savings.

🎯 Want to learn how it works?

👉 Click here to request Noble Gold’s FREE 2025 Gold IRA Kit — includes everything you need to know about diversifying with gold, IRS-approved coins, and tax-deferred investing.

A genuine gold quarter, however, is worth a pretty penny. If you’re a lucky owner of one of the 91,752 government-issued gold quarters in circulation, you’ve got a resellable collector’s item worth far more than its face value.

Curious to know what your gold quarter is worth? Below, I’ve broken down the current market price of a gold quarter, analyzed its price history, and commented on whether they're a sound investment during periods of economic instability and rising inflation.

Table of Contents

Gold Quarter Value 101: A Crash Course

Gold quarters are relatively new inventions, but gold coins aren’t. In the United States, gold coins were first introduced with the passage of the Coinage Act of 1792. This statute led to the minting of a $10 coin (Eagle), a $5 coin (Half-eagle), and a $2.50 coin (Quarter-eagle). Gold quarters are not to be confused with Quarter-eagles, which are also made of gold but are worth considerably more.

In the 19th and 20th centuries, commemorative gold coins were issued periodically by the U.S. Mint, including the 1903 Louisiana Purchase Expo dollar, the 1916 McKinley Memorial dollar, and the 1922 Grant Memorial dollar.

By the late 20th-century, the collectors’ aftermarket for gold coinage grew such that the U.S. Mint began issuing coins not intended for circulation (NIFC). These commemorative gold and silver coins were issued purely for collectors’ markets and include such rare coins as the 2014 National Baseball Hall of Fame and Museum coin ($5 face value) and the 2000 Library of Congress bimetallic eagle ($10 face value).

Standing Liberty Centennial Gold Coin (2016)

The only officially sanctioned gold quarter to ever enter circulation is the Standing Liberty Centennial Gold Coin, issued in 2016, with a 99.99% 24 karat gold composition and a face value of 25 cents. The coin weighs 0.25 troy ounces and features a “W” hallmark on its obverse side in reference to its minting location in West Point, New York. Only 91,752 Standing Liberty Centennial quarters have ever been produced by the U.S. Mint.

The aftermarket value of a Standing Liberty Centennial gold quarter is derived from its melt value which, in turn, derives from the current spot price of gold. Given that the coin contains 0.25 ounces of gold, its resale value is approximately a fourth of the price of a one-ounce gold bullion bar.

At the time of writing, the per-ounce spot price of gold bullion is $2,352.87 (At time of press). Therefore, a U.S.-minted gold quarter, which contains 0.25 ounces of pure gold, is currently worth $588.21 in pure melt value.

However, this assumes that the coin has a sharp strike with a full original luster but up to two or three noticeable contact marks (MS-66/67). A gold quarter in “perfect uncirculated” mint state (MS-70) without any wear, scratches, or contact with other coins as detected by 5x magnification can often sell for 15-25% more than its weight in gold.

To find the melt value of your gold coin, use our price of gold calculator. Our calculator uses up-to-the-minute data to calculate the market price of aftermarket gold based on its weight, purity, and bid price.

Price History of Gold Quarters

Since their original minting in 2016, gold quarter prices have fluctuated according to the spot price of gold bullion. Below, I’ve listed the year-end price history of MS-66/67 condition Standing Liberty Centennial Gold Coins for every year they have been in circulation:

- 2016: $289.78

- 2017: $324.12

- 2018: $320.41

- 2019: $348.25

- 2020: $483.87

- 2021: $438.70

- 2022: $463.50

- 2023: $495.26

- 2024: $588.21

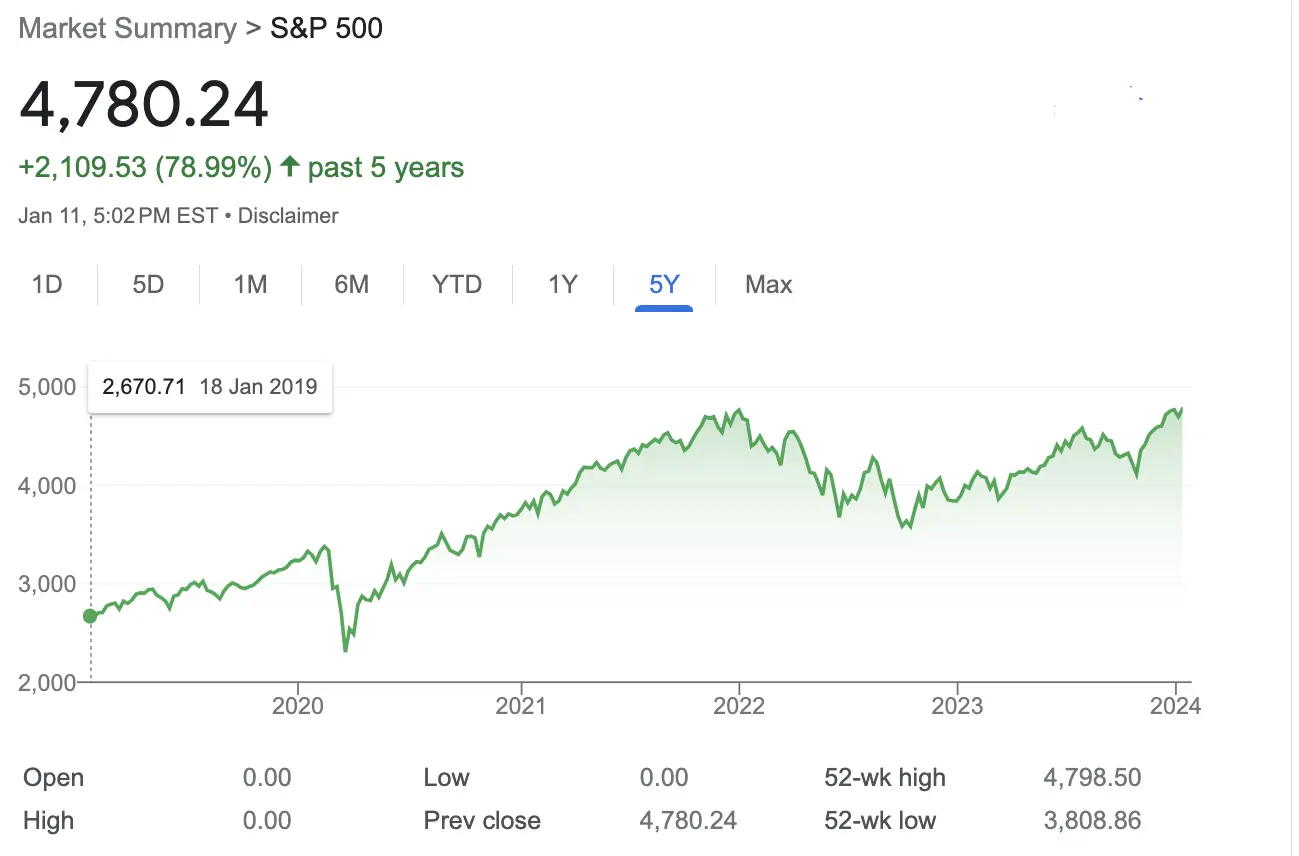

The value of gold quarters has maintained a strong upward trajectory over the past 5-year period. Between 2019 and 2024, gold quarters have appreciated +47.11%. The appreciation of gold quarters rivals that of the U.S. stock market, as measured by the S&P 500 index, which grew by approximately +78.99% in the same period, as depicted by the chart below. The key difference, however, is that gold's price appreciation has remained relatively consistent over the years, whereas the S&P 500 has experienced high volatility in recent years, with rapid and unpredictable price swings from one day to the next.

Source: Google Market Summary

Did You Know? You can legally add IRS-approved gold coins like the Standing Liberty Centennial quarter to your IRA or 401(k). It's one of the few ways to hold real gold in a tax-advantaged retirement account.

👉 Request Noble Gold's Free 2025 Gold IRA Kit here to learn which coins qualify and how to get started.

Are Gold Quarters a Worthwhile Investment in 2025?

Gold quarters are an excellent portfolio diversifier and hedge against instability in the equities market. In late 2024, the price of gold entered all-time high territory by breaking through the critical $2,660 per ounce resistance point. Some analysts are talking about a cup and handle pattern forming in the price of gold which could see a $3,000 price per ounce sooner rather than later.

Looking for a way to diversify and protect your retirement?

With inflation still high and markets unpredictable, physical gold IRAs may offer a reliable way to hedge your savings. Noble Gold makes it easy to roll over your 401(k) or IRA into gold.

📘 Click here to request their free 2025 Gold IRA Guide — no obligation, just information.

The general sentiment among analysts and market watchers is that gold’s bullish trajectory remains intact through 2025. Following its strong performance in 2024, driven by a mix of geopolitical tensions, persistent inflation, and shifting monetary policies, gold has continued to attract investor interest as a reliable hedge against uncertainty. Key drivers include ongoing inflationary pressures despite gradual Federal Reserve interest rate cuts, increasing central bank gold purchases, and heightened demand for physical gold amidst global economic uncertainty. If these conditions persist, a gold quarter with 0.25 ounces of gold could be worth approximately $625 in melt value.

Gold’s Performance as a Safe Haven

Gold continues to shine as a safe-haven asset during periods of volatility and systemic instability. The metal’s ability to preserve value, even during stock market downturns, underscores its role as a hedge in diversified portfolios. For example:

- During the global financial crisis (October 2007 to March 2009), gold prices increased by 25.5%, while the S&P 500 dropped by 56.8%.

- The dot-com bubble collapse (March 2000 to October 2002) saw the S&P 500 lose 49%, whereas gold prices rose by 12.4%.

- In 2020, during the height of the coronavirus pandemic, gold hit a then-record high of over $2,000 per ounce as investors sought refuge from market volatility.

Current Market Dynamics

In 2025, gold’s enduring appeal is bolstered by several factors:

- Central Bank Purchases: Central banks worldwide continue to diversify their reserves away from fiat currencies, with gold buying reaching record levels in recent years.

- Geopolitical Risks: Ongoing tensions in Eastern Europe, the Middle East, and Asia-Pacific create uncertainty that supports gold demand.

- Economic Instability: Slower-than-expected global economic recovery and high sovereign debt levels have investors turning to tangible assets like gold.

- Weaker U.S. Dollar: As the Federal Reserve continues to ease interest rates, a weakening dollar further boosts gold prices in 2025.

Why Consider Gold in Your Portfolio

Gold remains a reliable hedge against inflation, currency devaluation, and market instability. For long-term investors, gold has shown steady appreciation over decades, complementing riskier assets like equities. Amidst ongoing uncertainties in 2025, gold IRAs and 401(k)s offer a tax-advantaged way to incorporate gold into retirement portfolios.

As history demonstrates, gold outperforms in times of crisis, making it an indispensable tool for risk-averse investors aiming to safeguard wealth. Whether through physical gold, ETFs, or a gold-backed IRA, gold continues to serve as a cornerstone of financial security in uncertain times.

Pro Tip for 2025: Monitor geopolitical developments and interest rate announcements closely, as these remain the key determinants of gold’s trajectory this year.

Gold Quarters Frequently Asked Questions (FAQs)

How many gold quarters are there?

Excluding gold-plated quarters, there are 91,752 authentic gold quarters in existence that have been minted by the U.S. government since 1792.

Are gold coins a good investment?

In the past 5-year period, gold coins have appreciated in value by about +66%, which outpaces the S&P 500, which has appreciated by +56% in that time. Although past results are not indicative of future performance, the fact remains that gold quarters and coins hold great potential as an investment asset.

How much is a gold quarter worth?

Based on the current spot price as of mid-March 2021, the price of an authentic gold quarter is approximately $435 on the aftermarket.

Why are there gold quarters?

Originally, gold quarters were minted as a form of currency and legal tender by the U.S. Mint. Eventually, these were phased out in favor of non-precious metals, although the U.S. Mint still periodically issues commemorative gold coins and quarters as collector's items.

What is a 24k gold plated state quarter worth?

Unfortunately, 24k gold plated state quarters are virtually worthless as a collector's item. Since they do not have any melt value, they are not bought or sold on the aftermarket. Therefore, they're worth little more than their face value (~$0.25).

How much does a gold quarter weigh?

Officially sanctioned U.S. gold quarters weigh 0.25 troy ounces, or about 7.8 grams. For reference, a regular copper-nickel quarter weighs 5.7 grams.

1788 Quarter Value

Many of our readers have recently asked us about the 1788 quarter value, which is officially titled the 1788 Statehood Quarter Dollar. The 1788 Virginia quarter value is approximately 25 cents, or its face value. This coin was minted in 2000 to commemorate the year that Virginia received statehood, and is composed of copper and nickel at a 3:1 ratio. However, it is sometimes misconstrued as a gold coin, which it is not.

Ready to Take the Next Step?

Whether you're exploring gold for the first time or ready to open a precious metals IRA, Noble Gold’s free guide has everything you need to get started.

The Bottom Line

Gold-plated quarters aren’t valuable, but genuine gold quarters are worth several hundred dollars apiece. Their exact resale value depends on the spot price, which varies day by day. Since its inception in 2016, the Standing Liberty Centennial gold quarter has increased in value by +77.25%, boasting gains that rival the hot yet highly volatile U.S. stock market

During times of instability such as these, investors should consider gold and gold quarters as safe-haven assets. To get started adding physical gold bullion to your investment portfolio, check out this comprehensive list of IRA-approved gold coins and bars. For a full list of top-ranked gold investment companies for your IRA or 401(k), take a look at our exclusive list of the 10 best gold IRA companies in America.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $4,533.60

Gold: $4,533.60

Silver: $79.29

Silver: $79.29

Platinum: $2,490.69

Platinum: $2,490.69

Palladium: $1,986.97

Palladium: $1,986.97

Bitcoin: $87,502.26

Bitcoin: $87,502.26

Ethereum: $2,925.59

Ethereum: $2,925.59

I have a Gold quarter, and like to know the value. (With Drummer on back.)

I have a gold quarter Tennessee how much is it worth 1999gold quarter

i have a 1989 gold quarter how much is it worth

I have 5 2003 state of Arkansas, Alabama, Missouri, Illinois,an Main quarters collection and I was wondering if there worth anything

I have a 2003 Illinois 21st century gold quarter any offers?

i have a 1989 gold quarter how much is it worth

I have a 2000 golden quarter and a golden dime

I have a 2008 new Mexico P gold garter dose any one know its worth

Great article about the gold quarter I can see investing monies on them. Gold investing over silver bullion investing.

Hey liam, I have a 2019 gold quarter and on the back it says “River of no return” on the rim and underneath it, it says “Wilderness” I’d like to know how much it’s worth. 🙂

I have a 1789 North Carolina first n flight 2001… Is this one of the gold plates quarters???

I have a 2017 gold Missouri quarter. What is the value ?

Hi Charles, what’s the gold purity/content of the coin?

I have a gold colored 1994 Washington quarter and I am wanting to know if it’s worth anything more than it’s face value?

I have a 2001 gold quarter from Kentucky 1792. I want to know how much it’s worth.

Value of 2001 Kentucky gold quarter

I have a gold quarter Rhode Island 2001

I have a Connecticut 1999 gold quater with the charter oak on it. Just wanted to know if it’s worth something besides a quater.

I have a 2002 gold D mintmark Louisiana purchase 1812 quarter possibly a double die how much is it worth?