- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

U.S. and Developed Countries Playing Dangerous Zimbabwe-Styled Money Printing Game

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th July 2020, 08:19 am

This past week the news emerged that the total U.S. federal government debt is now up to over $26 trillion. Keep in mind that this figure stood at only around $20 trillion in the final quarters of 2019. The response to the devastating global coronavirus pandemic may have required such enormous financial firepower to be expended, but in any case it will have long-lasting national economic and financial consequences.

Aside from the massive increase in debt that amounts to a staggering 30 percent, the Federal Reserve has also complemented these massive expenditures with impressive monetary deployments of its own. It has been busily printing money as fast as the proverbial printing press will run. This creation of “magic money” poses a serious and even existential threat to the economy and financial well-being of the United States and its inhabitants in the coming months and years.

Now We Have All Become Zimbabwe

After having blown itself up and securing the dubious honor of boasting the worst runaway inflation in not only recent memory, but also likely in the entire history of the world itself, Zimbabwe decided to try again its old failed policies of money printing starting last year in 2019. They first launched a brand new currency called the Zimbabwe Dollar (better known as the RTGS dollar). In no time at all, they had already inflated away the value of this new currency. It took them less than a year (also probably good for another odious new world record) to jack up their own currency's inflation to over 785 percent and still rising. That is what you call hyperinflation on a major scale.

Yet it seems that the Zimbabwe government has learned a few hard-won lessons from its last experiment with runaway hyperinflation. Instead of only printing additional massive quantities of money this go round, the government of Zimbabwe got the jump on its own wary citizens and instituted tight capital flight controls. They halted their stock exchange until further notice recently in order to stop investors from taking out their money from the national equities markets.

Only a week or two ago, they took things a step further by closing down huge portions of their national financial system. This was mostly dominated by mobile payment systems and platforms. The goal was again to head off any attempt at investors and the wealthy engaging in “unpatriotic” capital flight to other more stable currencies and safe havens like gold (or possibly bitcoin and the cryptocurrencies) in other countries. Only time will tell how effective they have been in trapping their fellow Zimbabwe citizens' cash and capital within the nation's financial system and banks.

It is easy to point an accusing finger at Zimbabwe, but remember that aside from the strict capital controls, the United States, Great Britain, the European Union, Japan, and most other developed Western nations have engaged in the same runaway money printing over the past few months. It has been done on a widespread international and deliberately coordinated scale not seen in several centuries at least (if at all).

Western Developed Economies Running Down Zimbabwe's Discredited Money Printing Path With Wild Abandon

It is most astonishing today that despite the horrible and still recent example in Zimbabwe of what happens when the music stops, nearly all nations of the world are running down the Zimbabwean inflationary path with wild abandon. Practically all central banks everywhere have created literally trillions in new currency units ex nihilo since the pandemic began in earnest back in February and March. The guilty as charged parties run the spectrum from the U.S. and the Americas through Europe, Asia, and Latin America.

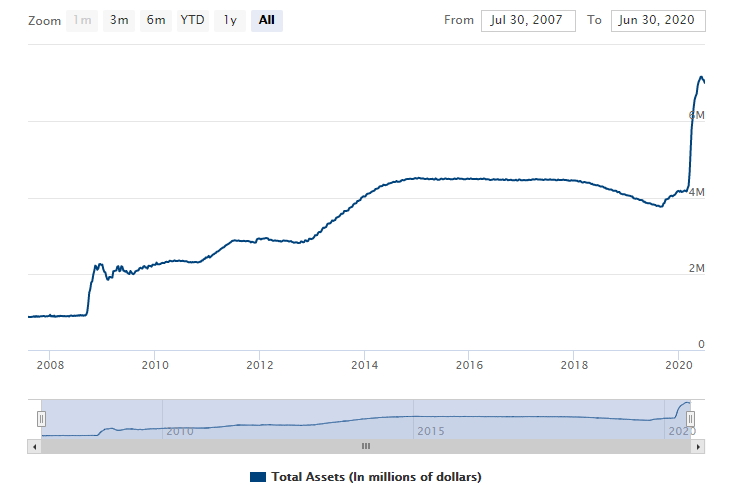

Just in the U.S. alone, the Federal Reserve has massively blown out its own balance sheet by an astonishing $3 trillion since only March as the chart below disturbingly reveals:

They have made it clear that the nation's central bank has only just begun. Since March too, the Federal Government in Washington has also boosted its national debt pile by $3 trillion more. They did this in a heroic but ultimately futile effort to bail out every struggling business and individual across the nation.

It was only 20-25 years ago that the sum of $1 billion was deemed to be an enormous amount of cash in the United States. When the Washington establishment became accused of having frittered away several billion dollars, this was still unconscionable. After 9/11 this quickly began to change. Coupled with never-ending wars in Iraq, Afghanistan, and Syria and the Global Financial Crisis of 2007-2009, the government money creation people really got down to business. In the Great Recession era alone, banks needed bailouts amounting to over $800 billion.

That sum represented a mind-numbing figure originally. Finally though, dumbstruck citizens became all too accustomed to the huge number of nearly a trillion dollars. Fast forward ten years, and today's central bankers and politicos throw around several trillion dollars very matter of factly, as if it were nothing at all.

Consider the U.S. annual deficit nowadays. Every year the country is running a full trillion dollars in deficit. In only May, the national debt rose by a stunning half a trillion dollars, catapulting it over the $26 trillion figure. Most shockingly, this is not really even headline news any longer.

Billions of Dollars Do Not Even Phase Americans or Washington Politicians Anymore

It has taken just over 20 years for a billion going from being an inordinate sum of money to a mere rounding error on spending reports from Congress. A trillion hardly makes the evening news any longer. Sadly, the pandemic is truly the greatest dream ever realized by the elected officials in Washington.

They gained a completely free excuse to print (from thin air) seemingly limitless amounts of cash in order to pay for any pet project that they desire, so long as they can loosely connect it with pandemic-related relief measures. This goes for anything from free healthcare, to universal basic income for the financially disadvantaged, to new roads and infrastructure. All that it takes now to do almost anything in Washington is to print more money and take on still more debt.

Modern Monetary Theory Teaches That Zimbabwe Should Be The Wealthiest Nation on Earth

Economists today apply the intelligent sounding label of “Modern Monetary Theory” to what Zimbabwe did in the past two decades and what the G7 economies are busily doing today. The concept is simple. You can create real prosperity through printing more money instead of having to increase productivity to add value through wealth creation. If this idea were really true, then Zimbabwe and Venezuela would be the two richest nations on earth. Yet sadly in both cases, these nations have been irreparably harmed (if not permanently ruined) by the policies which they pursued in creating almost endless amounts of local national currency.

The sad part is that Zimbabwe did not learn its lesson the first time around after its disastrous financial experiment of the past few decades. More disturbing still is that the rest of the world has still not learned anything at all from their tragic example either. You would expect the wealthy countries to think over the Zimbabwe experiment and have the reaction that “we should not ever do it.” Instead, the developed countries of the world have embraced this completely failed and discredited example out of sheer desperation.

Reckless Money Printing In the Developed Countries Around the World Will End Badly

Sadly the news out of the U.S., Europe, Japan, and much of the rest of the world shows that there is a massive race to the bottom on to see who can become the next Zimbabwe first. Yet in reality, the countries of the world expect to somehow magically achieve a different outcome than Zimbabwe and Venezuela realized. You can not stop the government from printing and borrowing money hand over fist with reckless abandon.

You can consider acquiring some safe haven IRA-approved gold though. It goes without saying now that gold makes sense in an IRA. It is a good idea to learn more before investing through reading about Gold IRA Rollovers versus transfers and Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68