My Digital Money Review (2025): Is This Crypto IRA Newcomer Worth Your Business?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 13th June 2025, 02:45 am

- Phone : (833) 636-2008

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

The Pasadena-based My Digital Money (MDM) is a newcomer to the crypto IRA scene (launched April 2021) but backed by a management team with plenty of cryptocurrency and alternative investing industry experience. Founded by the same self-directed investment professionals that brought you Noble Gold Investments and Noble Bitcoin, MDM is a security and privacy-minded crypto IRA service that comes at a relatively steep price point. However, its premium features, best-in-class privacy and security protocols, and easy, intuitive interface make it a winner in a market dominated by companies that sell user data or are often too technical for novices.

Pros:

- Military-grade security protocols; perfect security track record

- Respect for user privacy, no data sold to third-party advertisers

- Transparent about all fees and includes no hidden charges

- Partnership with Equity Trust Company for IRA custodian services

- Simple and intuitive online platform and dashboard

- Access to all major cryptocurrencies

Cons:

- New company with lots still to prove

- Slightly higher per-trade platform fees for Tier 1 users (1.9%)

My Digital Money (MDM) is a cryptocurrency IRA solution that brings cutting-edge security and hassle-free simplicity to retirement investors looking to invest in Bitcoin and altcoins. The brainchild of founder Collin Plume, My Digital Money was founded in April 2021 as a full-service crypto investment service. In the short time since its founding, it has gone on to become one of the most talked-about names in crypto IRA investing.

MDM is the successor of Noble Bitcoin, which itself was the crypto-oriented subsidiary of Noble Gold Investments. Noble Gold has since abandoned its Noble Bitcoin branch, which now operates as a separate and independent entity under the My Digital Money banner.

In an industry not without its share of scandals, scams, and con-men, My Digital Money seeks to bring security, integrity, and customer-first transparency to the Bitcoin and crypto IRA space. In fact, MDM recently made news for slashing its monthly user fees and rolling out a $50 Refer-a-Friend program. Yet, as a young crypto IRA company, it still has much to prove.

As of 2025, My Digital Money continues to offer fractional precious metals in their accounts, with updated monthly storage fees starting at 0.045% depending on the asset class and custodian. Investors can now also choose between allocated and unallocated storage options.

(Already sold on My Digital Money? Click here to open an account with our exclusive sign-up link.)

Table of Contents

- My Digital Money Reviews, Ratings, and Complaints

- My Digital Money Management Team & Founders

- What Is “My Digital Cash”?

- My Digital Money Fees, Prices, and Minimums

- My Digital Money's Most Popular Products

- Fractional Gold, Silver, and Platinum

- What We Like About My Digital Money

- What We Don’t Like About My Digital Money

- How to Get Started With My Digital Money

- Do We Recommend My Digital Money?

My Digital Money Reviews, Ratings, and Complaints

As a relatively new company, My Digital Money doesn't boast a large number of user-generated reviews or ratings. Likewise, verified customer complaints are scarce relative to older alternative investment firms. Regardless, there are all of the publicly available ratings and accreditations that My Digital Money holds as of Q1 2024:

- Better Business Bureau: “A” Rating (Not Currently Accredited)

- Facebook: ⭐⭐⭐⭐⭐ (Based on 1 User Review)

- SourceForge: ⭐⭐⭐⭐⭐ (Based on 1 User Review)

- SlashDot: ⭐⭐⭐⭐⭐ (Based on 1 User Review)

While My Digital Money reviews are clearly scant, you can't expect much more from a company as young as they are. As the cryptocurrency IRA company matures with time, we will revisit this review to update this section with accurate data.

Nonetheless, My Digital Money has received universally positive reviews to date. At the time of writing, there are no user complaints (verified or otherwise) posted anywhere online. This gives us a fairly high degree of confidence that this company is the real deal and isn’t in the business of disappointing its customers—something that their history as Noble Bitcoin, a widely respected Bitcoin IRA company, confirms.

My Digital Money Management Team & Founders

Collin Plume (Chief Executive Officer)

At the helm of My Digital Money is Collin Plume, the Chief Executive Officer (CEO) and company founder. With over 16 years of industry experience behind him, Mr. Plume has a wealth of precious metals and cryptocurrency investing knowledge that guides the day-to-day operations of the company.

Aside from serving as the CEO and founder of My Digital Money, Collin concurrently acts as CEO of Noble Gold Investments. He has maintained this role since August 2016. To date, Collin has been featured, interviewed, or quoted in such esteemed outlets as Forbes, FXStreet, MarketWatch, and Barron’s.

Collin is also something of an influencer and thought leader within the alternative investing space. As of Q1 2024, Mr. Plume boasts an impressive 13,400+ LinkedIn followers who appear to be most interested in his statements and insights into the crypto and precious metals markets.

Guy Gotslak (President & Co-Founder)

Like his co-founder, Collin Plume, Guy Gotslak has a long pedigree of business leadership that he brings to the table at MDM. A graduate of Northwestern University’s Kellogg School of Management (BS, EMBA), Mr. Gotslak is a self-described “highly analytical, versatile, and customer-focused executive”. Guy Gotslak now has over 2,400 LinkedIn followers. He has also appeared on several crypto investment podcasts in 2024 and early 2025, including ‘Crypto Uncensored' and ‘Altcoin Insights

Mr. Gotslak’s Crunchbase profile lists his work history at Eccella Corporation as a U.S. General Manager and Co-Founder (2012-2018). His LinkedIn profile also lists the following roles:

- .Net Engineer (MySpace, 2008-2010)

- Vice President of Global Solutions (NGDATA, 2018-2020)

- President & Chief Solution Advisor (Techlion Solutions, 2020-2022)

Guy’s experience in alternative investing and cryptocurrency is, admittedly, somewhat limited. Although his role at Techlion Solutions worked tangentially with the financial services industry, he himself had never worked directly in finance or cryptocurrency until co-founding MDM.

Wesley A. Huber (Crypto Analyst)

Lastly, Wesley A. Huber is a professional sports betting analyst best known for his role as a Social Media Manager at Friday Beers LLC, the owner of the popular Friday Beers Instagram franchise. However, Mr. Huber is employed concurrently by My Digital Money to serve as a Crypto Analyst in the Greater Los Angeles Area.

Previously, Wesley served as the Director of Operations for FolioBeyond, an Associate Director of Treesdale Partner (with a focus on fixed-income alternative assets), and a Managing Partner of ATX Mining LLC.

What Is “My Digital Cash”?

My Digital Money is sometimes referred to as “My Digital Cash”. Therefore, they can be thought of as the same company simply under a nickname. For example, the company’s official Instagram handle is “mydigitalcash”, which indicates that the management team has formally embraced the name.

In our opinion, My Digital Money should make the association between these two brand names clearer. It was certainly a bit confusing to parse through the various references to MDM and MDC without knowing if there was a formal connection linking them.

My Digital Money Fees, Prices, and Minimums

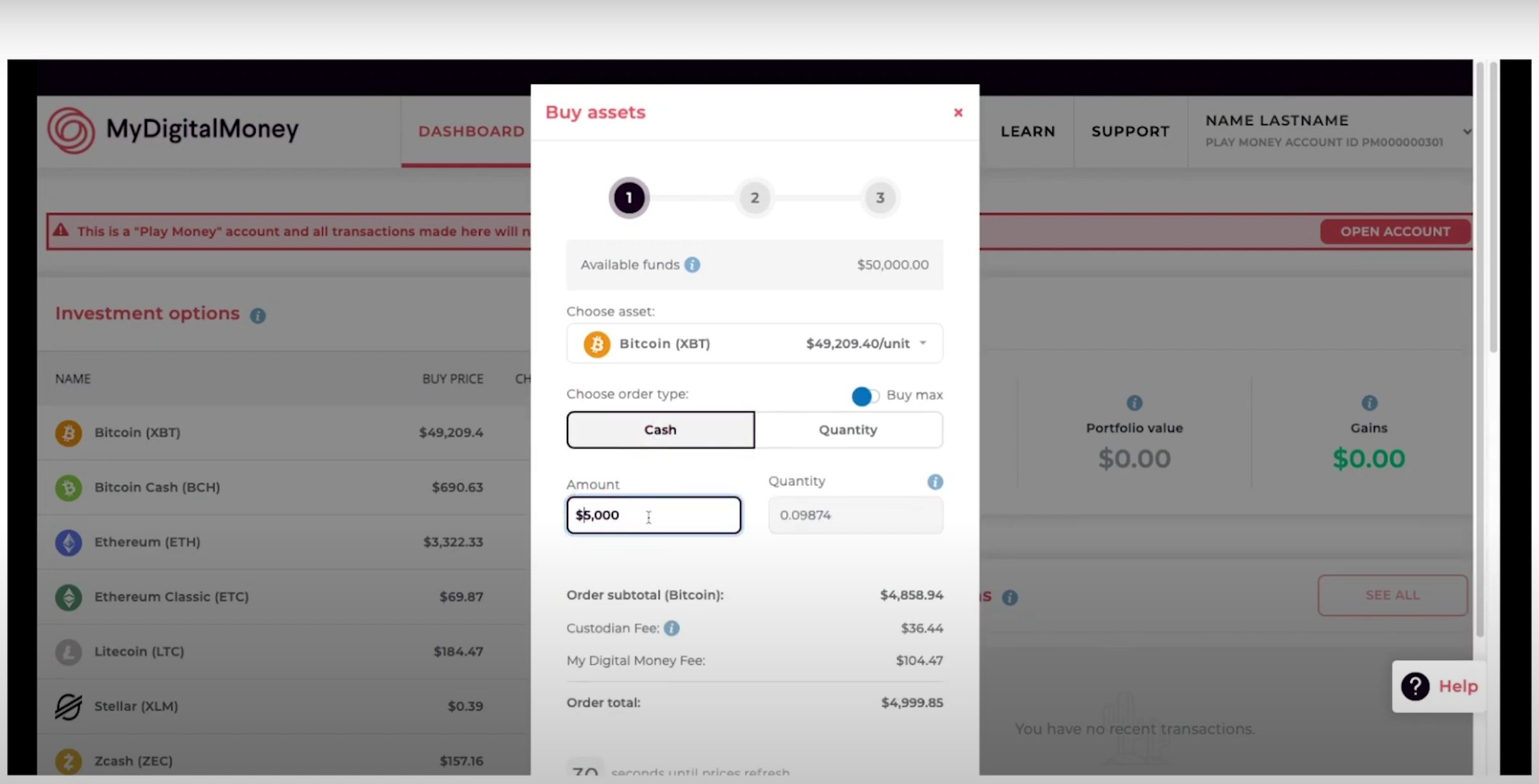

As of Q2 2025, My Digital Money has simplified its pricing in which all new qualified accounts receive $50 or a free NFT (non-fungible token). However, it remains to be seen whether this promotion will remain a permanent part of their product offering. All up-to-date pricing information and My Digital Money fees and minimum deposit criteria are listed in the chart below.

| One-time loading fee | $50 |

| Monthly custodian fee | $0 for Crypto IRA or Cash Account |

| Per-trade platform transaction fee | 0.75% to 1.9% |

| Per-trade custodian transaction fee | 0.5% |

| Investment minimum | $0 (Individual cash trading account), $10,000 (Crypto IRA account) |

| Fractional metals monthly storage fee | 0.0417% |

My Digital Money maintains that their fees are subject to change from time to time. To verify whether the fees listed above are accurate, please visit the Fees section of their website.

It's also important to note that, according to a March 2022 official press release, all monthly fees have been eliminated.

Although other platforms offer slightly lower fees (e.g., Coinbase’s 0.50% per-trade fee + 1.49% for Coinbase wallet purchases), MDM is in a similar price range. The kicker is that, with MDM, you don’t have to worry about having your data sold to third-party advertisers (more on that later). Coinbase and Robinhood openly sell their customer data in order to offer lower fees.

My Digital Money's Most Popular Products

My Digital Money’s product lineup is relatively straightforward.

- Cash Account: A non-IRA crypto investment account using cash (US dollars)

- Crypto IRA: A tax-advantaged retirement savings account (Roth or Traditional) holding select cryptocurrencies.

My Digital Money's IRA-compatible cryptocurrency lineup now includes over 25 assets. Popular tokens include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Avalanche (AVAX)

- Chainlink (LINK)

- USD Coin (USDC)

- Polygon (MATIC)

- Stellar (XLM)

- XRP (Ripple)

- Litecoin (LTC) They have also begun offering staking options on select tokens within cash accounts.”

Representatives of My Digital Money have previously mentioned that they plan to roll out a full self-directed crypto trading platform in which all digital assets are available. However, it's uncertain whether all cryptocurrencies are currently available for trading on their platform. Nonetheless, the company plans to make all cryptos available in the near future. Here is the current full lineup of assets available on the platform.

If you want a truly self-directed investment experience, MDM might be the right service for you. Although sometimes critiqued for allowing investors to purchase “high-risk” cryptocurrencies, MDM does well to enable their investors to make investment choices that best suit their individual risk tolerance—even if this includes riskier assets.

Fractional Gold, Silver, and Platinum

My Digital Money allows investors to include fractional quantities of precious metals assets in their digital investment accounts. Through their partner custodian, Equity Trust, My Digital Money facilitates IRA or 401(k) precious metals transfers at low fees. Since purchases are made on a fractional basis, investors can purchase as little as $10 worth of gold or silver—making precious metals more accessible and affordable to the average retirement investor.

As of 2025, fractional precious metals can be held in My Digital Money trading or investing accounts for a 0.0417% monthly storage fee.

What We Like About My Digital Money

As a new player on the scene, My Digital Money has the advantage of learning from the past mistakes of other companies and finding better, more intuitive solutions. Below, we’ve listed a few aspects of MDM that, in our opinion, elevate it above its competition.

User Interface & User Experience (UI/UX)

For many, crypto IRA investing is a relatively complicated process that, given the hurdles involved, simply isn't worth the effort. Fortunately, My Digital Money does a pretty good job of doing away with that.

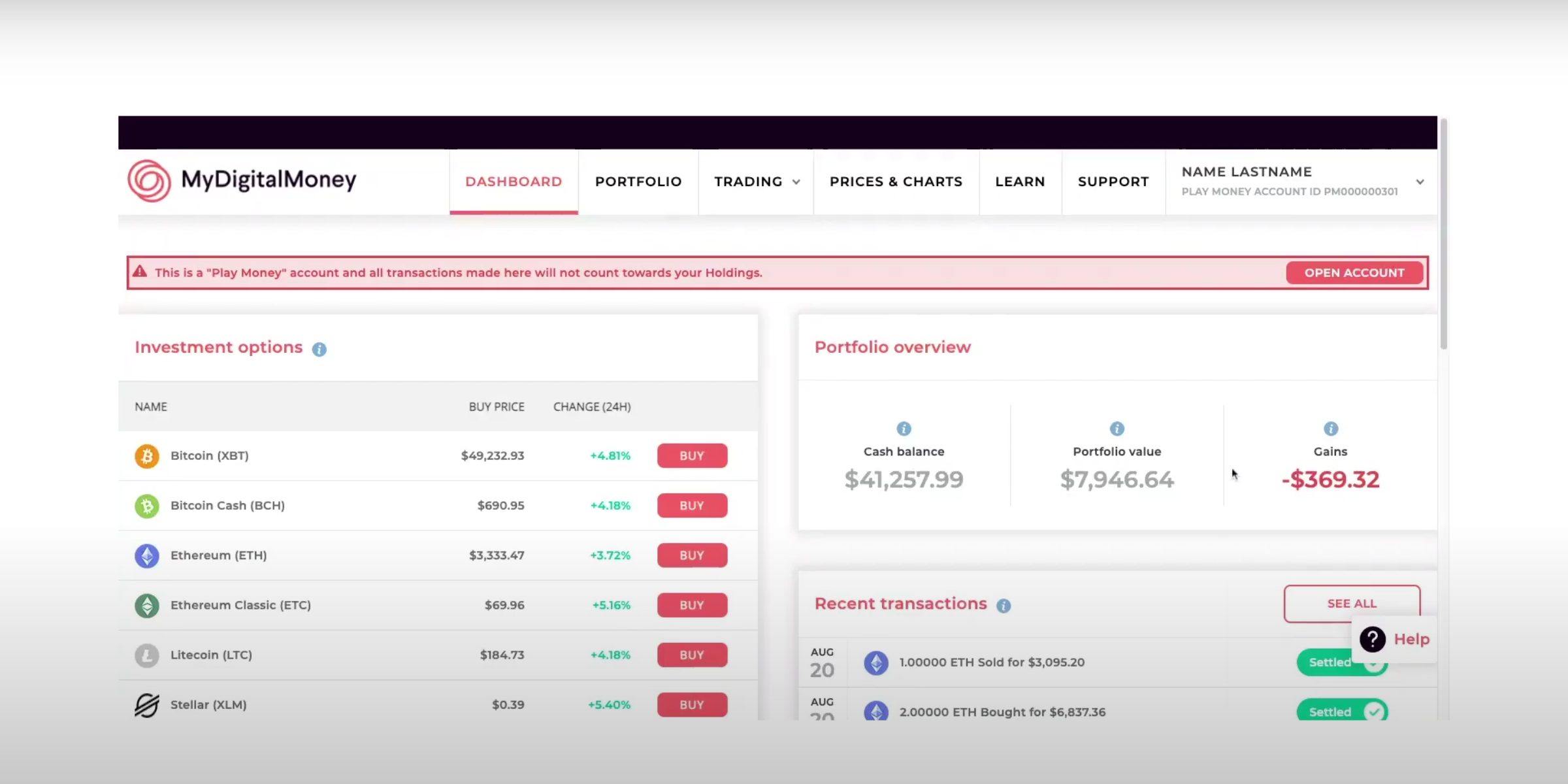

The My Digital Money UI/UX is streamlined and easy enough to get the hang of such that novice investors and crypto newcomers shouldn't have any issues getting started. It's also easy to keep track of your gains and losses on the main dashboard. The right-hand dashboard panel labelled “Portfolio overview” clearly indicates your cash balance, portfolio value, and gains.

Unlike more technical investment platforms, MDM is accessible to investors young and old with any level of computer literacy. You don't need to be a computer whiz, expert analyst, or even know how to invest in cryptocurrency in order to use MDM, and, in our books, this is a huge selling point for the service.

After all, cryptocurrency is all about democratizing finance. But is it truly “democratic” if it's inaccessible to average, everyday investors? My Digital Money is one of the few companies truly dedicated to advancing the accessibility of crypto, and for that we appreciate their service all the more.

Continuing Education

While MDM is not a financial advisory, they do have a library of educational content available for free on their website to help users make better investment decisions. This is fairly standard practice, as most crypto and self-directed IRA companies have a similar section on their website dedicated to continuing education and trading fundamentals.

Privacy and “Military-Grade” Security

My Digital Money markets itself as a customer-friendly service that refuses to sell your personal financial data to third-party advertisers. A cursory glance at their Terms and Conditions and Privacy Policy reveals nothing suspicious and, while they do collect cookies and allow third parties to access them, no sensitive information is sold or transmitted to external parties.

The company also claims that they utilize “military-grade” security protocols to keep their customers’ data and assets safe. Although many companies use this term as a marketing buzzword, MyDigitalMoney informed us that their “servers are stored in ex-military grade bunkers in a secret location.” More information about their military-grade security can be found here.

Partnership with Equity Trust Company

Equity Trust is an established leader in the self-directed IRA space, so it's great to see that MDM has partnered with them to provide IRA custodianship. Equity Trust oversees more than $40 billion in assets and has a perfect security track record, so investors should be able to invest with confidence knowing that their assets are in good hands.

In essence, MDM takes the hard work of choosing an IRA custodian out of the picture. Instead, you get streamlined access to Equity Trust, one of the best players in the game who have years of experience managing and safeguarding cryptocurrency investments.

Swing Trade “Trigger Orders”

One interesting functionality is the “Trigger order” box on the main dashboard. Here, swing traders can buy and sell crypto tokens automatically based on pre-set price movements. This way, you can set yourself up for gains without having to sit around on your computer throughout the day watching the markets.

Trigger orders are now integrated with a new ‘Smart Automations' feature, allowing users to build multi-layered strategies that combine stop-loss, take-profit, and trailing orders.

What We Don’t Like About My Digital Money

The downsides and disadvantages of MDM are scant relative to the upsides. However, one thing that investors may be turned off by when it comes to opening a crypto IRA with MDM is their fee structure, especially day traders and swing traders. MDM charges a per-trade transaction fee (up to 1.9%) that can eat into one's gains if they trade frequently.

However, as previously stated, MDM investors get a strong return on what they pay for. A $1,000 trade, for instance, garners a stinging $190 fee, but ensures state-of-the-art security and helps pay for MDM’s around-the-clock (24/7) U.S.-based customer support team. All in all, the per-trade fees pay for themselves by offering value that other companies don’t.

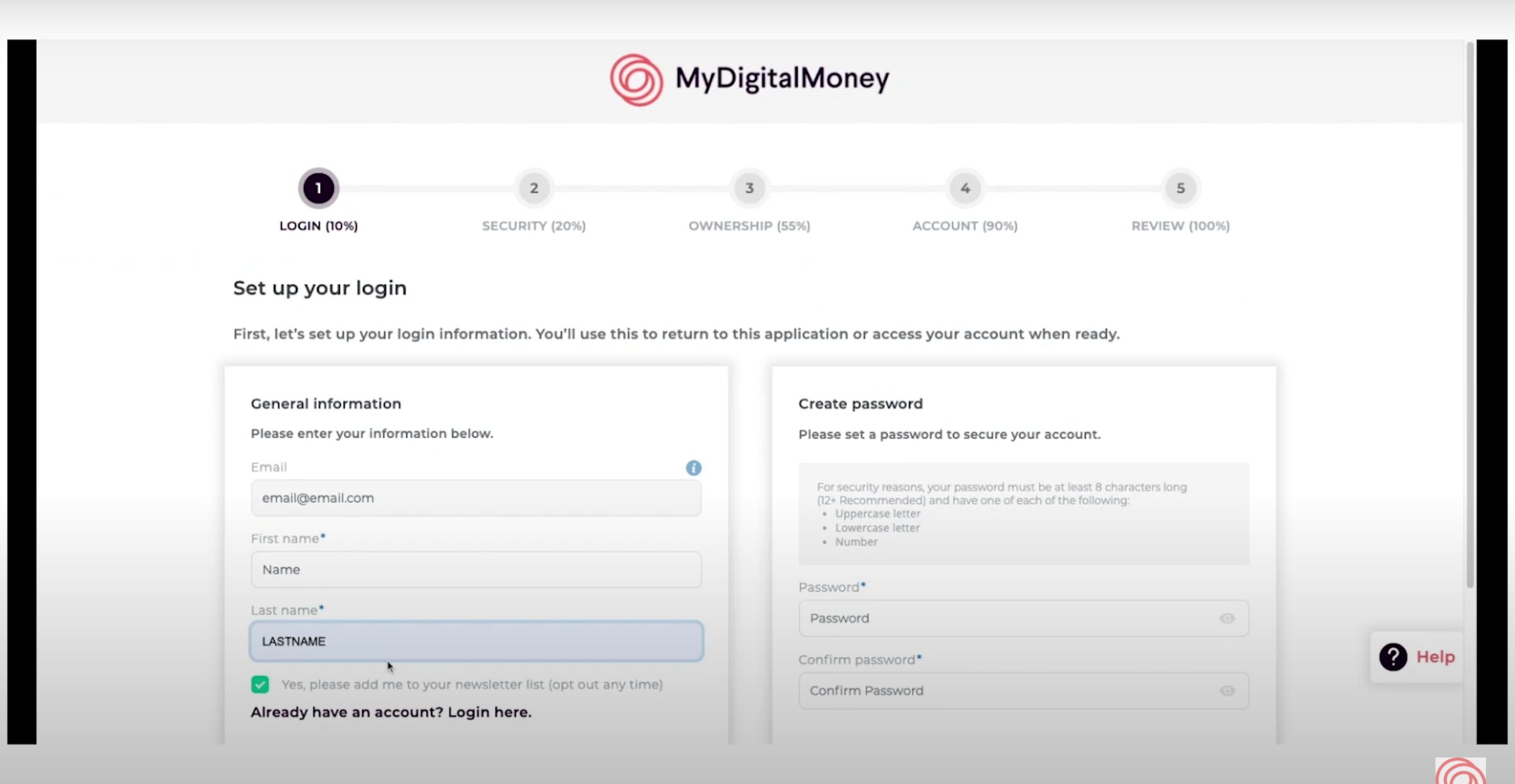

How to Get Started With My Digital Money

Opening an account with MDM is as simple as navigating to their sign-up page and filling in the requisite information. There are three short sign-up pages that require basic personal information (i.e., phone number, email contact) as well as more sensitive data (i.e., SSN, date of birth).

There are some requirements for users that limit certain investors from using the My Digital Money platform. At the time of writing, all MDM users must:

- Be a U.S. citizen

- Be over the age of 18

- Have a legal address located in the United States

Once your account is made, you can tour the dashboard with “play money” (as depicted in the screenshots), or fund your account and get started trading or investing for keeps.

Funding Options

Users have a few different options when it comes to funding their account. These are relatively standard and are more or less the same across all Bitcoin IRA platforms. Below, we've listed each of them:

- Transfer from an existing IRA: Funds from a pre-existing Traditional IRA, Roth IRA, or SEP can be transferred from another IRA custodian to My Digital Money in the form of an in-kind transfer (i.e., no liquidation of assets) or direct distribution without triggering a taxable event. This process can take up to three weeks.

- Rollover from employer-sponsored plan: Funds from a pre-existing employer-sponsored plan such as a 401(k), 403(b), TSP, or 457 can be rolled over into a My Digital Money IRA. This process may take up to 4 weeks before funds appear in the user’s account.

- Contribute new funds: Original contributions can be made via check or bank wire.

As of 2025, the IRS allows a maximum contribution of $7,500 per annum for individuals under 50, and $8,500 for those aged 50 or older. Roth and Traditional limits are combined, not separate.

Do We Recommend My Digital Money?

Yes, In 2025, My Digital Money continues to stand out for its privacy-first, security-heavy approach to crypto IRAs. With upgraded features, zero monthly fees, and broader crypto asset access, it's a compelling choice for long-term retirement investors. We suggest contacting two or three of the best crypto IRA companies before making a final decision regarding your alternative asset provider.

For privacy-minded investors, My Digital Money is a breath of fresh air, especially in a market flooded with companies (such as Robinhood and Coinbase) that sell user data as a core aspect of their business models.

The MDM platform has fees, yes, but you certainly get what you pay for. After all, when investing for your retirement, it’s probably a safer bet to invest where you know your assets are safe, secure, and subject to the highest standards of customer care. Not to mention the fact that your data is kept private without being sold to third parties. In exchange for their relatively small fee, you get a level of peace of mind that's hard to come by in the crypto investment space.

Privacy, security, and user-friendliness are the key selling points for MDM. The downside is that you’ll pay for it. However, nothing in this world is free, and especially not peace of mind. If you're an investor who values this, My Digital Money is an excellent choice for your crypto IRA.

- Phone : (833) 636-2008

- URL :

- Global Rating

- Very Good

User Rating

- 0 No reviews yet!

The Pasadena-based My Digital Money (MDM) is a newcomer to the crypto IRA scene (launched April 2021) but backed by a management team with plenty of cryptocurrency and alternative investing industry experience. Founded by the same self-directed investment professionals that brought you Noble Gold Investments and Noble Bitcoin, MDM is a security and privacy-minded crypto IRA service that comes at a relatively steep price point. However, its premium features, best-in-class privacy and security protocols, and easy, intuitive interface make it a winner in a market dominated by companies that sell user data or are often too technical for novices.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,328.02

Gold: $3,328.02

Silver: $37.77

Silver: $37.77

Platinum: $1,404.65

Platinum: $1,404.65

Palladium: $1,226.98

Palladium: $1,226.98

Bitcoin: $117,368.41

Bitcoin: $117,368.41

Ethereum: $3,090.52

Ethereum: $3,090.52