How to Invest in Cryptocurrency: A Beginner’s Guide

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 10th February 2023, 07:18 pm

Every year cryptocurrencies move closer and closer to worldwide adoption. According to a CNBC report, global cryptocurrency use skyrocketed 881% between 2020 and mid-2021 by total volume exchanged. Although the asset class is barely a decade old, its total value is now measured in multiple trillions of dollars.

Given crypto’s meteoric rise, the question on everyone’s mind is: how do I invest in cryptocurrency? Luckily, it’s not a difficult process to get started investing in crypto. With the abundance of Bitcoin IRA companies on the market, it has never been easier to invest in cryptocurrency and start building wealth with Bitcoin in a tax-advantaged environment.

Before you get started, make sure you do your due diligence. Although cryptocurrencies are incredible financial tools, they’re not for everyone. That’s why we put together this comprehensive guide on everything there is to know on the subject, including how to invest in cryptocurrency safely and cost-effectively.

Table of Contents

What Is Cryptocurrency?

A cryptocurrency is a digital form of currency that can be used as a medium of exchange or store of value. In other words, it does the same thing as U.S. dollars, euros, or any other major currency issued by government decree—only it’s neither owned nor controlled by any sovereign government.

Rather, cryptocurrencies such as Bitcoin are built on decentralized peer-to-peer networks called blockchains. Therefore, no single group can “print more of it” in order to pump more units into circulation. Bitcoin, for example, is programmed to have a maximum of 21 million units (BTC) ever mined and entered into circulation, of which over 18 million already exist.

Of course, there are many other fundamental elements of Bitcoin and other cryptocurrencies that are a bit beyond the scope of this article. However, in short, some of the most important attributes of cryptocurrencies include:

- Trustlessness: Blockchain networks function in such a way that nobody has to trust anybody else for the system to function; the network has a transparent public ledger in which anyone can verify any transaction at any time.

- Immutability: A Bitcoin transaction is irreversible and permanently recorded on the blockchain, thereby reducing the chances of fraud or cybersecurity threats.

- Decentralization: Since nobody owns or controls a blockchain network, it is more resistant to attacks, collusion, and is more fault-tolerant.

- Inflation-Resistant: There are hard limits coded into each blockchain’s token system, meaning that there’s a maximum supply of each coin and therefore any increase in demand will create a corresponding increase in price.

Why Invest in Cryptocurrency?

Luckily, the technical mumbo-jumbo is over (Phew!). Now that we know how cryptocurrency works and what makes cryptocurrency the truly revolutionary technology that it is, let’s discuss why an investor might want to buy some.

1. Stable Value Storage

Like precious metals and other natural commodities, a central banker cannot simply create more cryptocurrency at the push of a button. Mathematical algorithms put caps on the amount of any given cryptocurrency that can enter into circulation. Therefore, the price cannot be manipulated or augmented by authorities or bad actors.

It’s no surprise that Bitcoin is often referred to as “digital gold”. Like the yellow metal, Bitcoin is anti-inflationary and is impervious to hyperinflation in the same way a paper currency is. Instead, Bitcoin is a stable store of value that is naturally deflationary.

2. Upside Potential

Make no mistake, cryptocurrencies are speculative assets. Since they were only first founded in 2009 with the release of the Bitcoin white paper, cryptocurrency as a whole is extremely young, at least as far as investment classes go.

As a nascent asset class, there’s still a lot of room for mainstream financial adoption that hasn’t yet been realized. Therefore, many investors have crowded into the Bitcoin space in order to benefit from its potential price increase in the event of a hypothetical future where cryptocurrencies are used for everyday purchases and banking.

Some of the world’s leading investors, including ARK Invest CEO Cathie Wood, believe that Bitcoin’s price ceiling is around the $500,000 mark. At the time of writing, that figure is about 10 times what each BTC currently sells for on the market.

3. Regret/FOMO Minimization

Let’s be honest, nobody wants to miss out on the next big thing. This is a huge driver in Bitcoin’s appeal to the public. Since it’s a highly disruptive technology, cryptocurrency could, in theory, replace our existent financial networks and chains of trust, at least in part. If this comes to fruition, you might regret not investing in Bitcoin when it was still a speculative asset.

4. Anonymity and Privacy Protection

Bitcoin and other cryptocurrencies are anonymous assets, meaning that your real name isn’t publicly recorded on the blockchain’s ledger. If you value your financial privacy, cryptocurrencies are an excellent resource for making purchases that fly under the public radar.

5. Safe Haven Asset in Times of Crisis

As “digital gold”, cryptocurrencies are often considered safe haven assets that can cushion the blow if the stock market experiences a downturn.

Since Bitcoin has historically maintained a very low correlation with the S&P 500, declining stock prices usually have no impact on the price of Bitcoin. Therefore, diversifying with Bitcoin can help investors hang onto more of their wealth if a stock-heavy portfolio takes heavy losses.

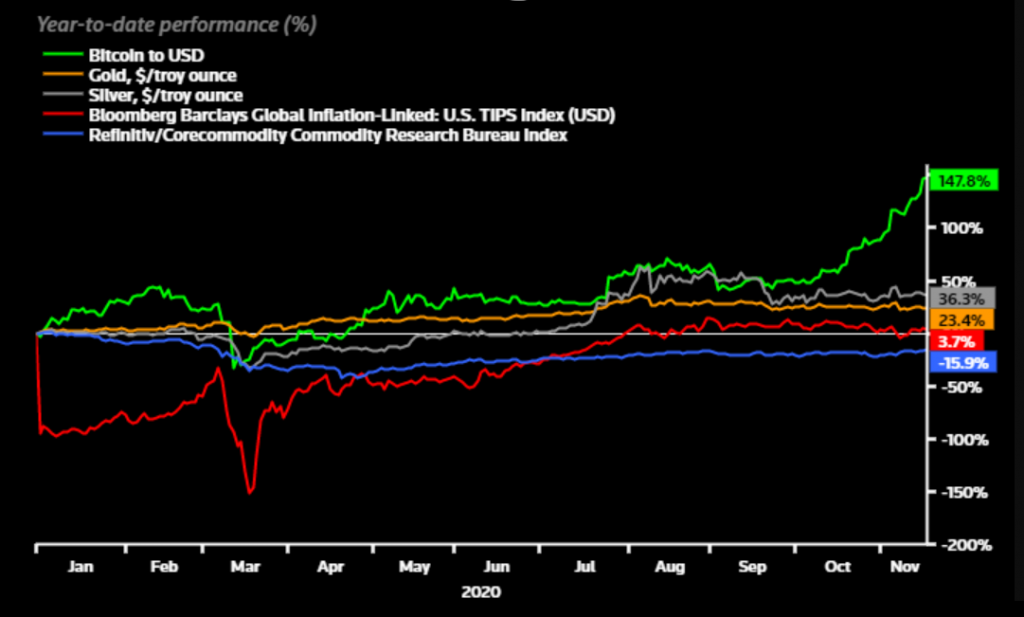

In the disastrous event of a financial crisis, Bitcoin may be considered a stronger and more reliable store of value than fiat currencies. The chart below (Fig. 1) demonstrates how well Bitcoin performs relative to other “disaster hedge” assets like gold, silver, and inflation-resistant stocks, particularly during the 2020 Coronavirus Crash and the subsequent recession.

Figure 1. Source: Reuters

Another key example that demonstrates the hedging benefits of Bitcoin is the Venezuelan hyperinflation crisis, in which Bolivar-denominated cryptocurrency purchases reached an all-time high at over $9 million converted per week, a fortune in the poverty-stricken South American country. Between 2019 and 2021, local business owners converted Bolivars to Bitcoin daily as the local currency became essentially worthless and Bitcoin came to be seen as a stable refuge from runaway inflation.

How to Invest in Cryptocurrency (Safely & Responsibly)

There’s no one-size-fits-all approach to investing in cryptocurrencies. Below, we’ve outlined a safe and secure structure for investing in crypto. However, how you invest will ultimately depend on your individual tolerance for risk.

1. Decide on Your Crypto Investment Strategy

Before you learn how to start investing in cryptocurrencies, first figure out whether you want to take the DIY route and invest all on your own, or whether you want to seek third-party assistance. For first-time crypto investors, we recommend the latter approach since it minimizes the margin for error and includes full FDIC insurance on all your cryptocurrency assets.

If you want to invest on your own, without the support of a cryptocurrency IRA company, then you can get started by creating an account on any of the top Bitcoin exchange platforms. Funding an account can be completed in a matter of minutes, and you can do so using any of these top-rated exchanges:

- Coinbase (1.99% fee)

- Crypto.com (0.4% fee)

- Kraken (0.26% fee)

- Binance.US (0.1% fee)

- Gemini (0.35% fee)

Be warned, however, that investing through any of the above exchange platforms presents higher risks than simply investing through a Bitcoin IRA company. If you choose any of the above platforms, you’re fully responsible for every purchase and for storing your cryptocurrency securely. There’s no recourse available if your account is compromised or lost.

If these risks don’t appeal to you, then you’re better off choosing a cryptocurrency IRA company. Investing through a cryptocurrency IRA firm is relatively straightforward, and I’ll outline the steps involved below.

2. Choose a Trusted Cryptocurrency IRA Company

There are three main benefits to investing with a Bitcoin IRA. First, you can save potentially thousands of dollars on capital gains taxes as your assets grow in value. Second, you benefit from peace of mind as your assets are insured and held in highly secure digital vaults. Third, third-party companies simplify an otherwise complicated cryptocurrency investment process.

At this stage, it’s critical that you do your homework and identify a cryptocurrency company that suits your goals and needs. To make this job a little easier for you, we’ve put together a full guide to our reader’s top-rated Bitcoin IRA companies.

If you want a short overview of each of our top picks, here’s a short list of the top U.S.-based companies that offer low-cost Bitcoin IRA services:

- Bitcoin IRA: $100M in comprehensive insurance offered on all crypto wallets through Lloyd’s of London.

- Coin IRA: Wide selection of cryptocurrencies on offer, including Bitcoin Cash, Ethereum Classic, Litecoin, and XRP.

- Noble Bitcoin: Boasts top ratings from BCA and BBB customer satisfaction agencies.

- BitIRA: Full-service provider offering instant, on-demand crypto trading.

3. Choose Your Target Allocation

Your next step is to choose how much of your savings you want to dedicate to cryptocurrency investments. As a riskier investment class, cryptocurrencies are best used as a diversifier in one’s portfolio in order to complement stocks, bonds, and other conventional assets. Your portfolio should not consist primarily of cryptocurrencies alone.

How much you decide to allocate to cryptocurrencies depends on how much risk you’re willing to accept. If you’re willing to take on more risk, an allocation of 15-20% of your portfolio’s value might be ideal for you. On the other hand, those on the more conservative side might prefer to invest about 5-10% of their portfolio in this asset class.

4. Contact a Company and Fund Your Account

After you’ve decided on your target allocation, simply contact the Bitcoin IRA company that best suits your financial needs (or, better yet, contact several) and inquire about opening an account. In most cases, accounts can be opened online or over the phone in a matter of minutes.

From there, you can add funds to your account instantly via credit card, or by money order, wire transfer, or several other ways. Once funded, you can pick and choose which cryptocurrencies you want to be stored in your wallet, and you can track their growth every day via your IRA custodian’s simple user interface.

How Do You Buy and Store Bitcoin?

After “how do you invest in Bitcoin”, the next most common question we’re asked is “How do you store Bitcoin?” There are several options available to investors when it comes to storing their digital currency, with some options carrying less risk at the expense of convenience. Below, we’ve listed the most popular ways of holding and storing your cryptocurrency.

- Cold Storage Wallet: Physical hardware that can be purchased online for holding your cryptocurrency keys, similar to a personal bank vault.

- On-Exchange: Holding your crypto on a public exchanged account, such as Binance or Kraken, is a convenient although risky way to store your coins since it involves significant counterparty risk (i.e., what if the exchange company files for bankruptcy?)

- Third-Party Custodian: If you invest in a cryptocurrency IRA, you can trust an insured third-party custodian (e.g., Noble Bitcoin, BitIRA) to store your assets on your behalf.

For newcomers to the crypto scene, your best bet is to store your coins through a third-party IRA custodian. This way, you won’t have to worry about misplacing your wallet keys which, if lost, would render all of your assets permanently irretrievable.

Don’t Wait: Take Control of Your Retirement With a Crypto IRA

Right now, the aggregate value of all cryptocurrencies in existence totals nearly $2 trillion, and this number trends upward virtually every year. Savvy investors won’t pass on the opportunity to get in on an investment opportunity of a generation—maybe, even, of a lifetime.

For many investors, the risk-return proposition of Bitcoin and many other cryptocurrencies is clear: the incredible upside potential far outweighs the risk of losses. Responsible investors dedicate a small portion (i.e. 5-20%) of their portfolio to cryptocurrencies within a tax-advantaged IRA. This way, they can build tax-deferred or tax-free wealth with crypto while avoiding the possibility of devastating losses.

Now that you know how to invest in cryptocurrency, there’s no reason why you can’t get involved. Start investing today! When you’re ready to take the next step, check out our list of the top Bitcoin IRA companies that can help you invest in cryptocurrency safely and securely.

This commentary is provided for general informational purposes only and does not constitute financial, investment, or tax advice nor does it constitute an offer or solicitation to buy or sell any services referred to.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.86

Gold: $3,355.86

Silver: $38.42

Silver: $38.42

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,714.11

Bitcoin: $117,714.11

Ethereum: $2,956.39

Ethereum: $2,956.39