Rising Oil Prices Are A Growing Cause of Economic Concern

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 7th May 2019, 11:09 am

Since the year began you have watched oil prices really soar. This has been supported by a number of factors, including OPEC cutting supplies, additional fighting in Libya, and American sanctions against both OPEC nations Iran and Venezuela. The two international oil benchmarks London Brent Crude and U.S. West Texas Intermediate have skyrocketed higher by about 30 percent and 40 percent respectively.

To make matters worse, experts in the oil industry now concur that today's crude oil market is increasingly sensitive to price shocks from unanticipated and sudden disruptions. While they may not agree what the greatest upcoming risk is, they are unanimous that it will send oil prices significantly higher. This will trip off substantial inflation when it happens. It explains yet again why gold makes sense in an IRA. More than ever you need something in your investment and retirement portfolios to hedge their value if a new wave of oil-led inflation crushes markets. Now is the time to start seriously pondering the top five gold coins for investors and learning about the Gold IRA rollover versus transfer rules before the next price shock hits oil markets.

What Is Behind the Dramatically Rising Oil Prices?

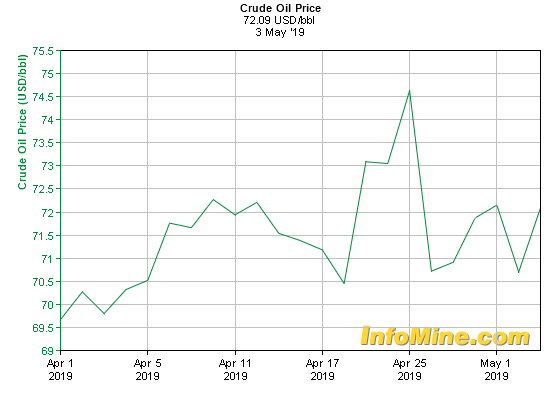

The simple explanation for what is happening to oil markets is this: the supply market is dramatically tightening. It signifies that a worldwide glut of crude on the markets has all but drained away. Demand and supply have moved closer into equilibrium. This chart below reveals how oil prices have moved significantly higher even over just the last month of April:

This makes global energy markets subject to an easy slip into supply shortfalls. The various energy analysts commonly agree that you should be concerned about the rising risk factors facing the oil markets today. The only debate remains which of these currently disrupting forces is having the more serious impact now and for the future.

Libya's Renewed Threats to the Oil Market

One oil analyst who has been following the deteriorating situation in Libya closely is Stephen Brennock of PVM Oil Associates. He recently warned that:

“Oil production in the country has yet to be disrupted however I suspect it is a matter of when not if. General Haftar and his Eastern Libyan forces are determined to seize Tripoli and with it comes the inevitable risk of supply outages.”

Brennock is referring to the rising strongman of Libya, General Khalifa Haftar who is the head of the Eastern Libyan military who holds the majority of the country already. Two weeks ago, he began a major offensive against Tripoli the capital that the internationally recognized government still holds. It has only massively intensified the chaos that has riddled Libya since 2011. This continuing civil war has increased fears that full-blown war may soon erupt between these two main political powers in North Africa's critical oil producing country.

Renewed Iran Sanctions and New Venezuela Ones Threaten Oil

Another factor playing havoc with oil markets depends on what U.S. President Donald Trump's administration will do regarding the sanctions waivers presently enjoyed by eight nations importing Iranian oil. He has to continuously renew these privileges (every six months) which are keeping a stream of Iranian oil reaching markets. Global Head of Commodities Research Edward Morse of Citi Group warned that:

“The market is very constructive, it's fairly tight and we think it's going to be in the $70 range through the second quarter and into the third quarter depending on what happens. And there's a lot of variable between now and then.”

Other analysts agree with Morse's take on the situation. Global Economist Cailin Birch of The Economist Intelligence Unit shared:

“I would say I am most worried about the role U.S. sanctions will play against Iran… It is the most important issue on the supply side and of course an incredibly complex one.”

As U.S. foreign policy under the administration can be unpredictable at times, the risk exists that the Trump administration will revoke the oil waivers against Iran in the near future. Every six months, the president has to decide if he will extend the waivers that permit the eight nations to import their oil off of Iran, which is suffering from a wide range of American economic sanctions.

Even though President Trump maintains a “maximum pressure” policy against Iran, he issued the waivers to the eight exempt nations back in November so as to stop oil prices from soaring even higher. The exemptions have also given the president another way to handle relations with foreign nations, the majority of which are against the Trump Iran policy. While the administration has an end goal of forcing Iranian oil exports to zero, analysts continue to believe that the president will extend these waivers for now, more concerned with and focused on the Venezuelan sanctions as he is. Brennock opined:

“Expectations are rife that Washington will tighten the sanctions screw on the OPEC nation in line with its ultimate goal of reducing Iran's oil exports to zero. Needless to say, the oil market is currently experiencing a supply deficit and any further reduction in supplies from Libya and Iran would cause the market to overtighten and prices to overshoot.”

OPEC Plus and Other Black Swan Events Threaten Oil

OPEC + is always the wild card in oil supplies. The phrase OPEC + relates to an energy alliance that was forged between OPEC members with other large energy producers like Russia. Their goal is to stop 1.2 million barrels a day from reaching market to the end of June in response to the prior oil price collapse back at the conclusion of year 2018. Head of Commodities Research Jeff Currie of Goldman Sachs weighed in on this issue, with:

“When you think about what we've learned over the last year — OPEC has shown its ability to increase production very high, reduce production substantially, so a lot of flexibility there… What have we learned about China? They can stimulate, and they can de-lever. We've seen a big stimulus in January, but de-levering last year. What have we seen with the U.S.? They've gone hawkish and they've gone dovish… What that starts to do is take out your tail risk both to the upside as well to the downside. So, your question is: Where does the risk in the system go? If we think about it, if it's the policymaker swinging policy back and forth, that is where the risk really needs to start to reside, it goes in the sovereign balance sheets… So, if I look at it, a black swan event, more likely than not it's going to come out of one of the sovereigns.”

Gold is the Protection Your Portfolio Needs from Oil Driven Inflation

In the end, inflation is coming, whether from oil price shocks or continued devaluation of the U.S. currency (courtesy of the Federal reserve ending their asset tightening and likely resuming their purchases of U.S. Treasuries). Your concern should be how you counteract the effects of the inflation on your investment and retirement portfolios. IRA-approved gold is a perfect vehicle for this need. The yellow metal has thousands of years of proven track record in safeguarding investors' assets the world over.

You do not even have to run out and buy a large bullion gold bar to get started. Nowadays you can buy gold in monthly installments and then store it overseas if you like in top offshore storage locations for your IRA gold. When you are ready to buy, consider these top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.85

Gold: $3,355.85

Silver: $38.41

Silver: $38.41

Platinum: $1,434.24

Platinum: $1,434.24

Palladium: $1,243.37

Palladium: $1,243.37

Bitcoin: $117,749.21

Bitcoin: $117,749.21

Ethereum: $2,952.91

Ethereum: $2,952.91