- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Revered Investors and 87% of Americans Foresee Doomed Economy

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 15th May 2020, 01:33 pm

Stocks plunged most of the week after Federal Reserve Chair Jerome Powell became one of the most famous outspoken voices on the danger the U.S. economy finds itself in these days thanks to the lockdown imposed from the coronavirus. Powell warned that much more action has to be taken in order to salvage the failing American economy.

He was far from alone. This week also saw legendary guru investor Warren Buffet's stock market indicator reach an all-time high, signaling a coming stock market crash, even as a number of other prominent billionaire investors warned that stock valuations were crazy relative to the actual economy now.

Fed Chair Warns Congress Economy Needs Much More Support

Wednesday saw the Fed Chairman in front of a Congressional testimony committee warning the American lawmakers of the lasting damage that will soon be done to the national economy if more dramatic measures still are not soon taken. Powell began with a doomsday scenario where he predicted massive unemployment and mass bankruptcies in his prepared remarks before Congress. He warned that it was time for policymakers to prepare to take more concrete steps to stave off catastrophic longer-term economic damage. Head of U.S. Rates Trading Gregory Faranello of AmeriVet Securities warned that:

“There are a lot of variables in terms of really how the economy opens here. It's going to be very uneven.” The Fed might implement other measure like “some yield curve control. From a capital perspective and a leverage perspective, the Fed can grow the existing programs that they have online.”

Even this likely would not be enough to save the ailing economy in which one-fourth of American workers are now filing for unemployment as of this past week.

Favorite Stock Market Indicator of Legendary Warren Buffet Signals Major Crash Coming

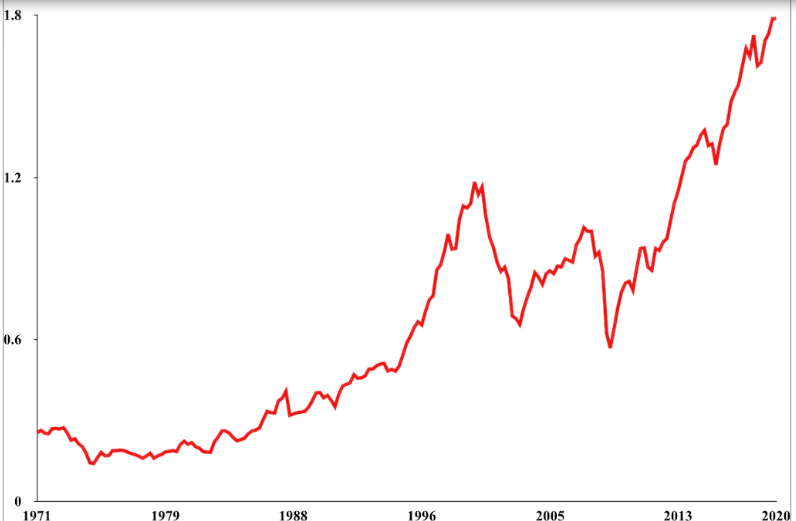

The multi-decade, legendary investor Oracle of Omaha better known as Warren Buffet has a long-time favorite stock market indicator that he follows religiously. It just set an all-time high yesterday on Thursday May 15th, declaring that the U.S. stock indices are massively overvalued and so indicating that another market crash is coming. His Warren Buffet Indicator gathers the total market capitalizations in all of a nation's publicly traded stocks then divides this figure by the country's quarterly GDP. Investors have come to rely on this to judge if the markets are undervalued or overvalued as compared to the economy size.

Buffet revealed the inner workings of this indicator in a December of 2001 dated Fortune Magazine article. He called this “probably the best single measure of where valuations stand at any given moment.” This indicator possesses a long and storied history for forecasting downturns over the decades. It roared to 118 percent back in 2000 directly ahead of the dot-com bubble crash. It similarly exceeded 100 percent ahead of the 2008 Global Financial Crisis. Buffet stated that:

“Nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal.”

This indicator set an all-time high on Thursday with the rebound in the U.S. stock markets from the coronavirus-induced selloff against the 4.8 percent drop in the annualized Gross Domestic Product from last quarter. The present level of it is far higher than the average read from the past two decades, as the chart below clearly demonstrates:

A number of prominent commentators on the markets have wondered aloud if U.S. stocks are not too highly valued compared to the rapidly braking economic growth, alarming data, and skyrocketing unemployment from the last month.

Buffet Is In Good Company With Other Major Legendary Investors Looking for Market Crash

Warren Buffet is far from a lone voice crying in the wilderness with this latest assessment of his. The so-called Bond King Jeff Gundlach recently announced that he is banking on the markets crashing now. The DoubleLine CEO told CNBC this past Monday that the relief measures put into place by the Federal Reserve are not sufficient to stave off a second plunge in markets.

The current economic data showing surging unemployment is particularly worrying, but investors are simply shrugging off the critical data and what it means for the future of the American economy, according to Gundlach. Prices will collapse when they acknowledge the reality of the news. Gundlach warned that:

“I'm certainly in the camp that we are not out of the woods. I think a retest of the low is very plausible. I think we'd take out the low.”

Two other legendary investors are also onboard with these assessments. The legendary investors David Tepper and Stan Druckenmiller weighed in following the unprecedented market comeback of the past month. Tepper stated Wednesday that going back to 1999, the stocks are the most highly overvalued that he has ever witnessed personally. Tepper claimed that the valuations are literally “nuts” on certain individual Nasdaq stocks.

Druckenmiller Tuesday referred to the idea of a V-shaped recovery, or concept that the economy will somehow immediately snap back up after the pandemic and lockdown ease, as a pure “fantasy.” Other Wall Street money managers are starting to realize this as well. Investors are just beginning to recognize that the $3 trillion stimulus from Treasury and support from the Federal Reserve are not sufficient to make up for the runaway unemployment, wave of unfolding bankruptcies, and never-ending pandemic saga. The managers who have espoused their agreement with this grim view include Paul Singer, Bill Miller, and Paul Tudor Jones, each of whom have put voice to their fears on the economy and market valuations.

Indeed, even eternally optimistic investment banking legend Goldman Sachs is now predicting that the GDP of the U.S. will plunge by 39 percent on a second quarter annualized basis, worse than their previous negative prediction of a 34 percent decline, per the Jan Hatzius and fellow strategists' note from Wednesday. Goldman expects that year long growth will amount to negative 6.5 percent when the dust settles.

They also see unemployment being an ongoing drag on the economy and output going forward. Goldman forecasts a peak unemployment rate of 25 percent, up from their previous prediction of only 15 percent. They are assuming now that a higher number of workers will see their jobs disappear under the status of permanently unemployed.

New Normal Looks Awful, Lasting, and Perilous

Americans now believe in overwhelming numbers that the U.S. economy is doomed post-coronavirus lockdown. Fully 87 percent said they see the economy collapsing because of the crisis. A growing consensus sees the American economy being eerily similar and even worse than the one that followed 2008-2009's Global Financial Crisis.

The growth will remain disappointingly lacklustre once the reaction rebound occurs. Unemployment will stay sadly higher than after the last crisis. Worst of all potentially, the government debt levels and Federal Reserve balance sheets will be staggeringly higher, forcing interest rates to remain low for years to come. Nobel laureate Economist Joseph Stiglitz agreed, expanding on these themes with:

“Our economy will have lost something of value. We will be scarred, and the recovery will be slow.”

Unfortunately, the news surrounding the predicted New Normal 2.0 economy is discouraging no matter how you read it. Many investors have turned to the safe haven of IRA-approved gold. The continuing economic fallout from the national economic shutdown is the most powerful reminder of why gold makes sense in an IRA. Now is a good time to consider reading more about a Gold IRA rollover versus transfer and the Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81