- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Record High Corporate Debt Bubble Threatens Another Great Recession

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

In the last few weeks, the news has emerged that corporate debt has reached its highest all-time level in recorded history. Possibly worse news is that half of this debt rates at only BBB, a single level over junk status. It only needs another recession to kill the demand for corporate debt and reduce their cash flows dangerously. This would cancel buybacks and end with massive junk bond market insolvency. The danger is so real that it could easily put us on the path to another massive round of bailouts and even substantially higher sovereign debt.

Corporate Debt Has Doubled Since the Great Recession

Corporate debt has in fact doubled in size since the catastrophe of the 2008 Great Recession and the Global Financial Crisis. While stock markets have soared to ridiculous levels since then (with a recovery still on Fed life support over a decade later), the excess in the bull market is most pronounced in the sector of corporate debt. This has knock-on effects on the corporate debt to GDP ratio, which is now at the greatest level in recorded history.

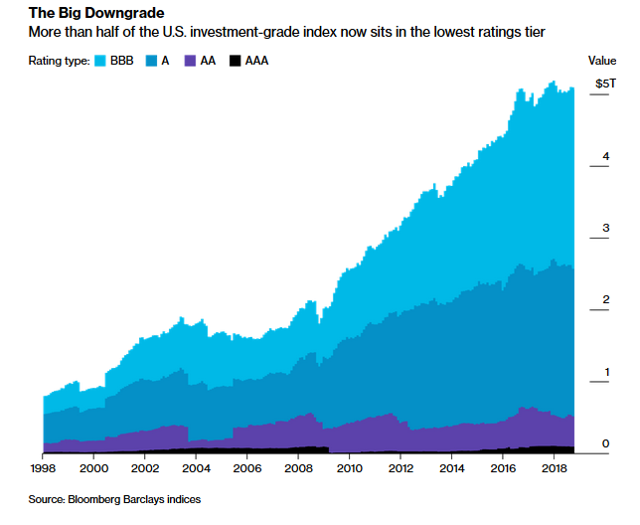

All of this debt has led to a drop in credit quality in corporate America as you might expect. It shows up in the statistics. Approximately 50 percent of the entire corporate debt market earns only a BBB rating. This is a mere step above junk level for half of all American corporate debt. This chart below reveals the absolute boom in BBB-rated debt in the last few years:

Consider some of the big name companies in the American corporate world and their debt nowadays. AT&T the telecom giant has racked up an astonishing $191 billion in total debt. Ford Motors is now $157 billion in debt with an extremely dangerous (and difficult to manage) 450 percent debt to equity ratio. Both General Motors and General Electric are also juggling levels of debt that have them continuously running the risk of being downgraded.

Buyers of Corporate Debt to Disappear in Next Recession

The real danger to the markets will come when the entire house of cards is shaken in the next recession. What is keeping the equity markets at their current lofty levels is corporate stock buybacks financed by cash flows heavily augmented by debt issuance. The demand for stocks from households, the rest of the world, and institutions (now net sellers in point of fact) has declined substantially. Corporations have made up the difference to keep up demand for shares.

When the next recession happens, financial institutions, pension systems, and foreign buyers will all undertake their traditional flight to safety. Unfortunately for corporate debt, these are the buyers of it. Less corporate debt being purchased will mean substantially fewer share buybacks. As many BBB debt buyers flee the corporate debt markets in their run to safety, cash flows will be dropping. A great number of the BBB-rated corporations will then be downgraded into junk territory. It is impossible to predict what percentage this will be without knowing how severe the recession is.

As the share buybacks holding up markets come to a standstill, nothing will emerge to sustain high-flying equity prices. What will make it worse is that the junk bond market is not even half as big as the BBB-rated market. This junk market undergoes a severe shortage of liquidity when recession first rears its head.

The almost liquidity deprived junk bond market will not be able to handle a massive BBB downgrade wave (particularly with so many of these companies as the traditional blue chips). It all means that such significant downgrades will force the junk bond market into insolvency, causing already high yield spreads to get wider. Those firms that depend on such junk debt financing will then face very real risks of going into default.

Fed's Probability of Recession Index Reaches Critical Territory

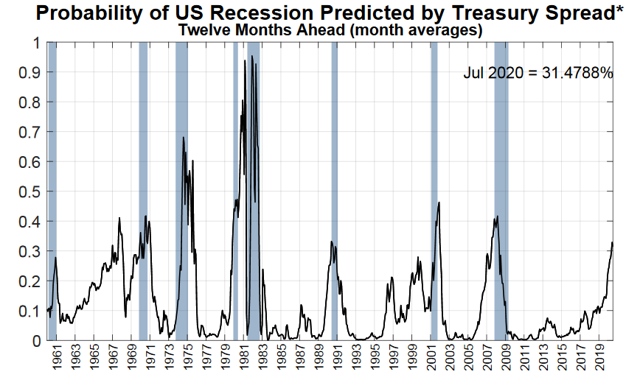

In case you still think that this scenario is unlikely or far fetched, consider what the Federal Reserve believes on the subject. Their NY Fed Probability of Recession Index topped 31.4 percent in August. In all of its history, this index has only peaked at or above 30 percent one time without a recession transpiring in the following 12 months. This was back in 1967. In other words, readings over 30 percent have anticipated every recession in modern history, as this chart below reveals:

The New York Fed is clearly warning you that the odds of a recession are highly probably between now and next August.

Will the U.S. Bail Out Overly Indebted Corporations En Masse?

The next question is: how will the United States federal government respond to this historical, looming corporate debt crisis? The answer is not good news. The American government will have no choice but to bail out these overly indebted corporations on a grand scale. Some economists believe that the government can not take on so much more debt, but there is an unfortunate precedent to argue that it can.

Japan currently has around a 250 percent debt to GDP ratio. The U.S. own debt to GDP is just under 110 percent. It means that the federal government will be able to absorb more debt in order to save the high-yield corporate sector from total collapse.

There are a few factors that will come into play. There will need to be sufficient political willpower to bail out the mega corporations. Such a bailout will create severe economic drag on the economy as the interest servicing from even much higher debt devours an ever-increasing share of the federal government's expenditures. Besides this, the U.S. will have to fund upwards of $122 trillion in unfunded liabilities (like Social Security and Medicare) with similar deficit spending.

What Will Be the Options Available to the Federal Government for the Corporate Bailout?

There are a few options available to the U.S. federal government. They could follow in the footsteps of Japan (and to a lesser degree Europe) and keep the current monetary experiment going for a range of from a few years to several decades of economic stagnation. The United States might also default on its debt, which would have dire consequences. The country could vote for austerity to bring the budget back under control (in political suicide). It might try President Trump's idea of growing out from under the debt (so that the debt dwindles as a percentage of rising GDP). Finally, the government could simply inflate away the debt by monetizing it through devaluing the dollar.

World's largest hedge fund manager Ray Dalio believes that the government will opt for a combination of the above possibilities. He stated that:

“So there will have to be some combination of large deficits that are monetized, currency depreciations, and large tax increases.”

Whichever options they take, the results ultimately will be painful for you the consumer and investor.

Will the U.S. Devalue the Dollar to Neutralize Skyrocketing Sovereign Debt?

Devaluing the currency is a tempting choice for the government to deal with its massive debt that will only be massively greater once it bails out the corporate bond market. One of the side effects of a significantly lower valued dollar will be rising costs across the board. This helps to explain why gold makes sense in an IRA.

One way you can hedge your dollars effectively is by obtaining IRA-approved precious metals in your retirement accounts. You can read about Gold IRA rollovers versus transfers and Gold IRA rules and regulations as well as Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68