- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Recession Feared as Black Monday Week Decimates Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

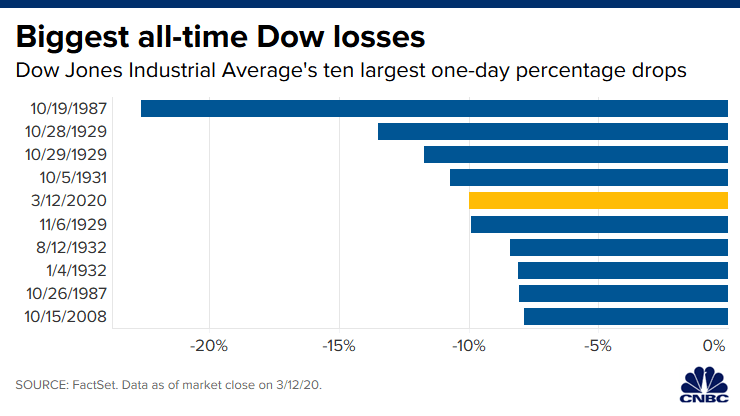

This past week saw two of the worst stock market declines in U.S. financial markets history. The first trading day of the week was labeled a “Black Monday” as the Dow Jones Industrial Average plunged over 2,000 points. Thursday saw even more severe declines as the S&P 500 plummeted 9.5 percent while the Dow freefell over 2,352 points for a 9.99 percent down finish. These declines were the worst percentage drops dating back to 1987 (and the highest point drop ever for the Dow). The Nasdaq Composite also closed down 9.4 percent on Thursday. Both the Dow and S&P are now officially in bear markets, each down over 20 percent from their recent historic peaks set just last month as CNBC reported.

Fed's Extraordinary Measures Not Seen As Enough By Markets

Thursday's second historic drop of the week revealed that investors were not confident in the increased funding measures taken by the Federal Reserve or the federal government's fiscal plans. Investors feared that these policy measures would be insufficient to make up for the economic fallout related to the coronavirus.

On Thursday the Federal Reserve announced it would engage in three special repo operations in their increased program to ensure that liquidity continued to flow. The U.S. central bank institution poured over $198 billion into the American financial system in both long term and overnight offers. For a short while Thursday stock market losses decreased. Yet when the dust had settled, the market finished the day at its lows for the session. This chart below shows how the Thursday losses stack up against other record high stock market declines (according to percentage drops). It was the Dow's fifth worst percentage decline in all of the U.S. markets' history:

Uncertainty continued to plague the markets as the week wrapped up. Senior Vice President of Wealth Management Kathy Entwistle of UBS shared that:

“The coronavirus is scary and people don't know what to expect. It's like the tsunami is coming. We know it's going to hit any day and nobody knows what the outcome is going to be.”

Major metropolitan governments also continued to take dramatic action, heightening the sense of fear. In New York City, the Mayor Bill de Blasio announced a state of emergency. This included imposing restrictions on businesses and major events. Chief Investment Officer Brad McMillan of Commonwealth Financial Network warned that:

“There are no guarantees here, and things could get worse. If the number of cases continues to increase, the economic damage will go from hitting confidence to something worse. If the economy deteriorates, markets will reflect that shift.”

Bull Market Officially Ends for U.S. Stocks

Markets remained disappointed with the White House reaction to the coronavirus outbreak this week. U.S. President Donald Trump restricted travel from Europe to the U.S. for 30 days. The administration will offer financial relief for those who are quarantined or ill.

While traders waited to hear what other actions U.S. officials would take over the weekend, markets continued to suffer through the week. The S&P 500 had its first close in full bear market territory Thursday, at off over 26 percent from its all time high set in February. The Dow had already seen the end of its longest lasting bull market (of 11 years duration) on Wednesday.

Thursday's crash also represented the second instance this week when the whole market circuit breakers had been triggered to stop stocks from free falling. Early in the session, the S&P 500 had dropped seven percent, forcing trading to be halted for 15 minutes. Even with the halt, the Dow still settled at its fifth most serious drop in U.S. market history, per FactSet. This was worse than even the largest single day drop in the height of the 2008 Global Financial Crisis. The most recognized fear gauge for Wall Street known as the VIX (CBOE Volatility Index) leaped to over 76, the highest point it had seen going back to 2008.

Most everything tanked in the financial markets purge. The Russell 2000 Index (the benchmark representing small cap stocks) plunged around 11 percent. Oil fell drastically. Even safe haven asset gold dropped on Thursday. Credit market spreads substantially widened. Traditional safe haven U.S. Treasuries also closed Thursday lower.

Economists Argue that Recession May Already Have Overtaken the U.S.

Consumer spending is suffering in the wake of the ongoing uncertainty and fear. This is what analysts have been most afraid of lately. Senior Global Market Strategist Scott Wren of Wells Fargo Investment Institute warned that:

“The crux of the angst investors are feeling as the coronavirus spreads surrounds what might happen to consumer spending. Consumers sitting at home and not out spending money because they fear catching the coronavirus is the ultimate negative outcome. It has been the U.S. consumer who has been driving the recovery bus during this long expansion.”

Remember that recessions are not when the economy is bad. They occur as economic circumstances are not as optimal as they were during the economic cycle peak. Similarly, expansions also start as the economy bounces off the bottom to start rising again. Looking back, economic historians will likely pick February as the month where the expansion from June of 2009 peaked.

It would mean that the expansion totaled 128 months, the all time record according to statistics kept at the National Bureau of Economic Research (which date back to 1854). Chief Economic Adviser Mohammed El-Erian stood firmly in this camp, with his announcement that:

“We are going into a global recession. After what's been happening the last few days, we are going to see a spread of economic sudden stops. The trouble with economic sudden stops is its not easy to restart an economy.”

El Erian feels that the sell off will not cease up until the point where the bear market reaches fully 30 percent down.

Some other economists have been quick to declare that a recession is likely imminent. Chief Economist Mark Zandi of Moody's Analytics states that the recession odds for the year are minimally 50 percent. Meanwhile State Street Associates (in association with MIT) offered new research that the American economy already was ripe for a recession before the coronavirus hit. Their data showed that in January, the odds of a recession in the coming six months were roughly 70 percent, despite the fact that the stock markets had been up approximately 22 percent as compared to just last year.

Continuing Stock Market Declines Hurt Economic Growth In Several Ways

The eye watering drop in the markets from February hurts economic growth significantly. Businesses become pessimistic while consumers feel poorer. Senior Managing Director and Head Will Kinlaw of State Street Associates revealed that the odds of recession with stock prices where they now are stands at over 75 percent. Should stocks reverse all of their past year gains, this chance would increase to 80 percent, per Kinlaw.

Unfortunately the news this past week about the two historic stock market plunges and rising fears of recession in the U.S. and around the world is not at all good. It does help explain why gold makes sense in an IRA. Diversification is one way to help safeguard your portfolio. You can learn about Gold IRA allocation strategies and a Gold IRA rollover versus a transfer procedure by reading more. It is also a good idea to consider the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68