- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Latest Sign of Impending Recession? Even Wealthy Are Tightening Spending

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 1st December 2019, 07:21 pm

This past week, the news emerged that the even the rich are now tightening up on their belts. An exclusive report from Yahoo! Finance revealed that the rich have significantly reduced their spending and purchases versus the past year. According to several respected national economists, this is another early warning sign of an impending recession in the United States. The reason is that the top 10 percent of U.S. households (by income amount) account for almost half of the total American economic consumption.

Federal Reserve Analysis Shows That Wealthy Spent One Percent Less in the 2nd Quarter

Moody's Analytics has decoded the Federal Reserve's latest analysis on the spending habits of the wealthy. The news is anything but good. It showed that spending from the top 10 percent of earning households dropped by one percent for the second quarter versus the same quarter of 2018. To make matter worse, the four quarters tracking of expenditures' averages from the highest earners has dropped for the last three quarters on a yearly basis. This is the first decline of this kind dating back to the Great Recession from years 2007 to 2009, per the report from Yahoo! Finance.

Chief Economist Mark Zandi of Moody's Analytics warned that this could mean big trouble for the American economy, with:

“High income consumers have been the Atlas holding up the U.S. and global economies. But they appear tired, and if they founder, so too will the economic expansion.”

These are dire words from a leading and respected economist.

Isn't Overall Consumer Confidence Still Growing Though?

The reason that this is not a larger headline in mainstream media than it is comes down to the overall consumer spending category, which is still growing. Yet the pace of the entire category has also dwindled. Per the Yahoo! Finance report, outlays from American households grew by only 2.9 percent in the third quarter year over year analysis. This represented a significant drop from the 4.6 percent shown in earlier quarters this same year.

It matters hugely as the U.S. economy relies on consumption for its underlying basis. The average American has been moving the American economy forward by spending cash that they simply do not possess. Yet signals are emerging constantly that their credit cards have neared max-out status. The mainstream media may have tried to ignore these signs, but they can not any longer. Economist Jim O' Neill told a CNBC interviewer that the American economy is fast becoming “riskily dependent” on the “over-leveraged consumer.”

Per Jim ‘O Neill:

“The economy's strength… depends so much on consumption, which is fine unless financial conditions tighten unexpectedly when a lot of indebted U.S. consumers won't be able to afford to keep up the consumption they're doing.”

A Number of Troubling Reasons Exist for the Wealthy Tightening Up Their Spending

CNBC has been following the decline in spending of the wealthiest for the last several months. The sales for luxury real estate have not been this bad since the end of the Global Financial Crisis. Art auction sales have witnessed their first slow down for the first time in a number of years. Retail outfits catering to the rich and famous are similarly experiencing struggles. The revenue for high-end jeweler Tiffany's declined by four percent for the Americas region during the second quarter. Nordstrom has endured three consecutive quarterly revenue declines even as Barney's the luxury cafe has filed for bankruptcy protection.

CNBC has concluded that the “recent data suggest that the U.S. wealthy are beginning to shut their wallets.” At the same time, the “savings of the rich has also exploded, more than doubling over the past two years, suggesting that the wealthy are hoarding cash.”

The Yahoo! Finance report identifies several revealing reasons for why the wealthy are tightening up on their spending. These include the following concerns:

- Home prices are no longer climbing as rapidly as before – The top one-third most costly homes' prices only increased by 3.1 percent for October versus the same month a year ago. There has been an increase in luxury homes' inventories even as their sales have crashed and burned. Some economists see it as a troubling warning indicator that the housing bubble 2.0 has already burst.

- Fears surrounding the stock market abound – Despite the fact that the U.S. stock markets have attained all-time record highs over the past few weeks, the overall market has only gained a mere 6.2 percent since September in 2018 (from its significant drop last fall). A great number of the rich worry that not only is this market significantly overvalued, but that it is also setting itself up for a substantial crash.

- The President Trump tax cuts struck down many important deductions – this means that the tax burdens on many wealthy Americans are now higher.

- Wage growth of the wealthy has almost flat lined.

The rich are simultaneously displaying a general sense of economic unease bordering on alarm. This explains why their normal reaction would be to reduce spending and increase savings for what they anticipate to be difficult days ahead. The wealthy are always more in tune with how the economy is really doing than everyone else. This makes them the proverbial canaries in the coal mine.

Meanwhile Auto Loan Delinquencies Are Surging Higher

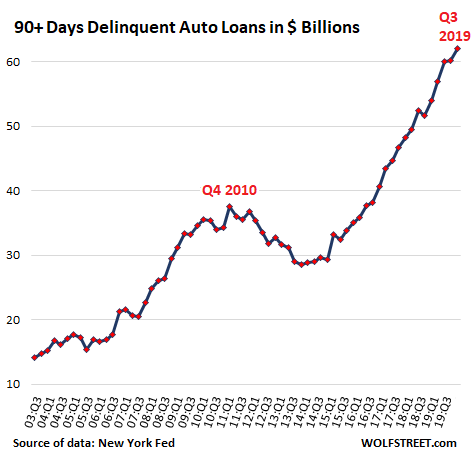

Another recent troubling piece of economic news concerns auto delinquencies. While the aggregate auto loans and leases outstanding category (for both used and new cars) has grown by 4.3 percent versus the year over year period for the third quarter, per the Federal Reserve's latest data release, auto delinquencies are in fact rapidly increasing.

Most troubling is the fact that auto loan delinquencies have now touched a 19 year long high this year. For Q3, they reached an all-time record amounting to $62 billion. In fact, such delinquent auto loans now comprise 4.71 percent of all car loans outstanding, only slightly higher than the total for third quarter 2009. It is only a little bit lower than the all-time record of fourth quarter 2010 at the time when literally millions of Americans suffered from unemployment. The chart below details auto delinquencies for the first and third quarters (dating back to year 2003):

Beware the Impending Collateralized Subprime Auto Loan Crisis

You should know that the overwhelming majority of these now-delinquent car loans are in the subprime category. Approximately 22 percent of these total car loans fall into the subprime category. Today, the subprime loans tally to around $300 billion. A shocking $62 billion of them are now severely delinquent, amounting to almost 20 percent of all such outstanding subprime loans.

The real fear concerns what will happen to these countless subprime car loans that have been repackaged by banks, much like what they did with mortgages in the critical years before the crippling housing crash that caused the Great Recession. Bloomberg has already astutely noted that the financial pain with smaller auto lenders

“parallels with the subprime mortgage crisis last decade, when the demise of finance companies like Ownit Mortgage and Sebring Capital Partners predicted the enormous losses soon to come out of the overall financial system.

What is happening across the auto industry does have real consequences for the rest of the U.S. economy. WolfStreet states that it resulted from years of feckless auto lending, with:

“It's a sign like so many others in this economy, that the whole credit spectrum has gone haywire over the years. Thank you, Fed, for having engineered this whole thing with your ingenious policies. So now there's a price to pay — even during good times.”

As this is occurring while the economy is supposedly stronger and unemployment is at a multi-decades low, what will the results be when the economy actually turns down?

One way that you can diversify your retirement holdings is by purchasing IRA-approved precious metals. Gold makes sense in an IRA because of the ongoing financial malfeasance practiced by the still too big to fail banks and their financial cronies. You can read all about the requirements for a Gold IRA rollover versus transfer. It is prudent to consider the Top Gold IRA companies should you opt to hedge your portfolio with precious metals.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06