I Bonds Pros and Cons: Read This Before Investing

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2024, 09:34 pm

We continue to see an inflationary period stretch out and I Bonds could be an effective way of alleviating the negative effects. But before you jump into these inflation-linked bonds let’s take a look at I bonds pros and cons, what they are, and where you can buy them.

Table of Contents

What Is an I Bond?

I Bonds are savings bonds issued by the United States treasury. These bonds are issued for individual investors and can only be purchased for a limited amount. The main characteristic of these savings bonds is the interest payment is linked to inflation.

This type of bond was designed to protect your savings from inflation. Every six months the interest rate on the bond is adjusted for inflation. This feature works great when inflation is high or increasing. Of course, it doesn’t have the same appeal when inflation is low or declining.

As of January 2024, I bonds pay 5.27 percent in interest. That's quite a lot higher than any interest rate you might find on a bank savings account, or any other treasury-issued bond or note.

Interest payments are paid back to the bond. This means you do not receive any interest payments until you cash in the bond, or it reaches maturity. The upside is that your interest rate is compounded as you earn interest on interest.

When Do I Bonds Mature?

I Bonds are issued for 30 years. However, you can cash in your bonds before that with a few limitations:

- You must hold I bonds for at least one year

- Before the 5th year, you can cash in your bonds with a penalty

- After year five you can cash in all of your savings without a penalty

The United States treasury will apply a penalty of three months of interest if you cash in your savings bonds between year 1 and year 5.

I Bonds Interest Rate

The interest payment on I bonds is made up of two separate rates.

- Fixed Rate

- Inflation Rate

The fixed rate, as the term suggests, doesn’t change for the duration of the bond, and is set by the US treasury. This rate is set every May 1 and November 1 and is applied to all I Bonds issued during the following six months.

The inflation rate may change, and it usually does, as it will reflect the current inflation rate. This part of the I bond interest rate is set by the Consumer Price Index for all Urban Consumers (CPI-U). The index includes all items except food and energy, and the treasury uses the non-seasonal adjusted rate.

This combined rate is often called the composite rate or earnings rate. As we can see it has one fixed and one variable component. The variable component is also set every 6 months on May 1 and November 1. However, it changes every six months during the life of the I bond.

I Bond Interest Rate Formula

The formula the United State treasury uses to calculate the composite rate also adds an extra element to the equation. We detail the formula below.

Composite Rate =[(Fixed Rate+(2*Semiannual Inflation Rate)+(Fixed Rate x Semiannual Inflation Rate)]

The treasury adds a multiple of the fixed rate times the semiannual inflation rate to the sum of the fixed rate and the inflation rate.

Using a live example, the current composite rate for I bonds, as of November 1, 2022, is made up of the following:

- Fixed Rate: 0.40%

- Semiannual Inflation Rate: 3.24%

Substituting this data into the above formula we get:

Composite Rate=0.40%+2*3.24%+0.40%*3.24%=6.89%

When interest rates are very low and or there is a deflationary period the sum of the fixed rate and the inflation rate may give a negative number. The US treasury in this case will never set the composite rate below zero.

Interest Rate Changes

Note that although the composite rates change every six months and are announced on May 1 and November 1, your I bonds will only see their composite rate change depending on the month in which they were issued.

The table below shows when changes to the composite rate come to apply depending on the issue date:

Compound Interest

The compounding of interest greatly improves the return of a fixed-income asset such as I bonds. To take a simplified numerical example consider you invest in a bond with the following characteristics:

- Maturity: 30 years

- Interest Rate: 3% semiannual

- Initial Principal: $10,000

With a standard treasury bond, you would receive 60 payments of $300 each for a total of $18,000 plus the principal of $10,000 at the maturity of the bond.

While compounding interest would mean your total of interest payments increases to $48,916. That’s an increase of 172.5 percent over the total for simple interest payments. With compounding at maturity in the above example, you would receive $58,916 compared to $28,000 with simple interest.

Having said that, the interest rate on I bonds is not certain and can vary greatly over time. The example above serves simply to illustrate the effects of compounded interest payments.

How Are I Bonds Taxed?

I bonds are subject to Federal income tax but are not subject to state or local taxes. These bonds may also be subject to state estate or inheritance taxes and Federal estate or gift taxes. You may avoid taxes if you use the money to pay for higher education expenses.

How Many I Bonds Can I Buy?

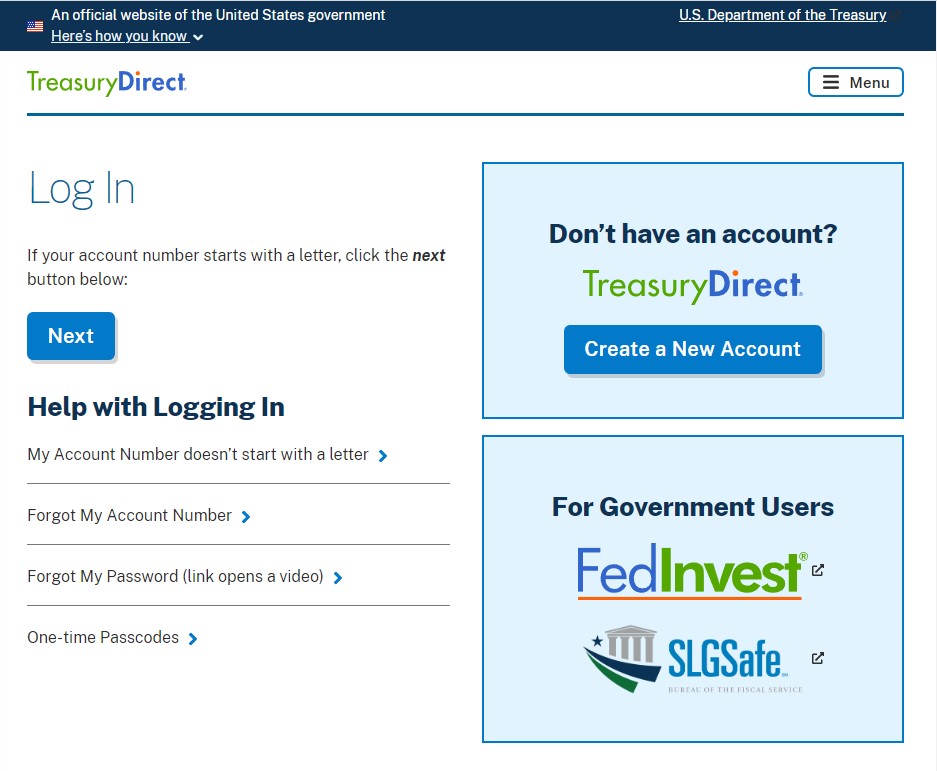

You can buy up to $10,000 in electronic I bonds through the Treasury Direct website, you’ll need to create an account. And you can purchase up to another $5,000 paper I bonds with your IRS income tax refund.

You can buy paper I bonds starting from $50 in increments of $50, your $5,000 limit is renewed with each tax year. With electronic I bonds, the minimum size you can buy is $25, while increments can be of any size.

For example, if you wanted to, you could purchase $33.50 of electronic I bonds. With electronic I bonds the $10,000 limit is also reset each year. And there are no limits on how many I bonds you may own altogether.

I Bond Pros

Secure investment

These bonds are issued by the United States treasury, that is to say by the government, and can therefore be considered very low risk. Although they are issued with a 30-year maturity, you can cash in these bonds after one year. This tenure, although a restriction, also reduces the overall risk.

Interest Payments Increase with Inflation

In a rising or high-inflation environment these bonds will perform particularly well. Not only do they follow inflation, but they also have a fixed component in the interest rate that should help the bonds outperform inflation.

Compounded Interest

I bonds carry compound interest. For some investors, who like to receive a coupon payment on a regular basis this might not seem so attractive. However, compound interest greatly increases the total returns on any asset.

The interest paid every six months is added to the principal, and you then get the interest for the following six months on the new larger principal amount. Over just one payment it may not seem much, but when you add that up over 30 years it makes a big difference.

Returns Are Not Correlated to the Stock Market

The returns for I bonds are set by the treasury following the inflation rate as determined by the CPI-U. Therefore, the returns on these bonds should have no correlation to the performance of the stock market.

I Bond Cons

No Secondary Market

You cannot sell your I bonds in a secondary market or hope to take advantage of an increase in the value of the bonds by doing so. You must hold the bonds till maturity or cash them in after one year if you wish to retrieve your money.

Minimum One Year Tenure

The one-year tenure makes the investment liquid for twelve months. However, you can see it as the cost of investing in an inflation-linked asset. One that is also backed by the United States and very low risk considering the potential upside.

Income Stream Not Certain

Bondholders often appreciate the fixed income streams of treasury notes and bonds. You receive a fixed amount every six months which creates the so-longed-for passive income. With I bonds, income streams are variable, and you do not receive any of the interest payments until you cash in the bonds.

Where Can I Buy I Bonds?

You can buy both electronic and paper I bonds, in both circumstances you must buy them directly through the United States treasury.

I Bonds Pros and Cons Conclusion

When considering the I bonds pros and cons these are the conclusions we came to. In the search for portfolio diversification, I bonds can add value to that aim. Their returns are not correlated to the stock market or other assets, for that matter.

This creates the effect of reducing the overall risk of your portfolio. Further diversification from stocks and bonds is always a good idea.

And under the scope of reducing portfolio risk, gaining exposure to different returns, and protecting against extreme financial events we recommend alternative assets such as precious metals and cryptocurrencies.

The threat of inflation and recession is always present, and any wise investor will want to spread their investments across a variety of assets to limit the damaging effects of traditional securities. However, gold and precious metals also hold intrinsic characteristics that can protect your portfolio in times of high inflation.

Bottom Line

If you are considering adding alternative assets like gold to your investment portfolio, you may want to do so through a gold IRA. These retirement accounts allow you to watch your investments grow in a tax-enhanced environment. You can read our reviews on the top gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24