Inflation vs. Recession: What Are the Differences?

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 31st May 2023, 09:32 pm

We have seen a lot of talk recently about inflation and recession. But what are the factors of inflation vs recession? We can certainly feel the negative effects of inflation on our pockets. And we keep hearing about a looming recession, although by some parameters we are already in one.

One consideration to make: typically, inflation has been associated with an expanding economy, in fact, many previous bouts of inflation have seen a booming one. Since rising prices are a symptom of strong demand and that leads to more sales and production and an expanding GDP, it's not uncommon for inflation to match expansionary economies.

However, something happened in the 1970s for the first time in modern history. We saw very high and sustained inflation, but this time the economy did not react as you would have expected. GDP growth instead of expanding actually contracted, giving rise to the term stagflation.

Let's take a look at the different aspects of inflation Vs recession. We will first define them both and then look at the causes and consequences. Finally, will discuss how you might protect your portfolio against the adverse effects of inflation and recession.

Terminology

- GDP: The Gross Domestic Product is how economists measure the creation of wealth in a nation. It includes all services and products.

- CPI: Consumer Price Index: this is how the Federal Reserve and economists measure inflation.

- Full Employment: This is the concept that all available workers are employed, and that any unemployment is structural, i.e., due to people in between jobs, or other reasons.

- Monetary Policy: This is the policy the Federal Reserve Bank applies to keep inflation in check. Usually by increasing or decreasing interest rates.

- Interest Rate: In this concept, interest rate relates to the ones that the Federal Reserve sets as part of its monetary policy.

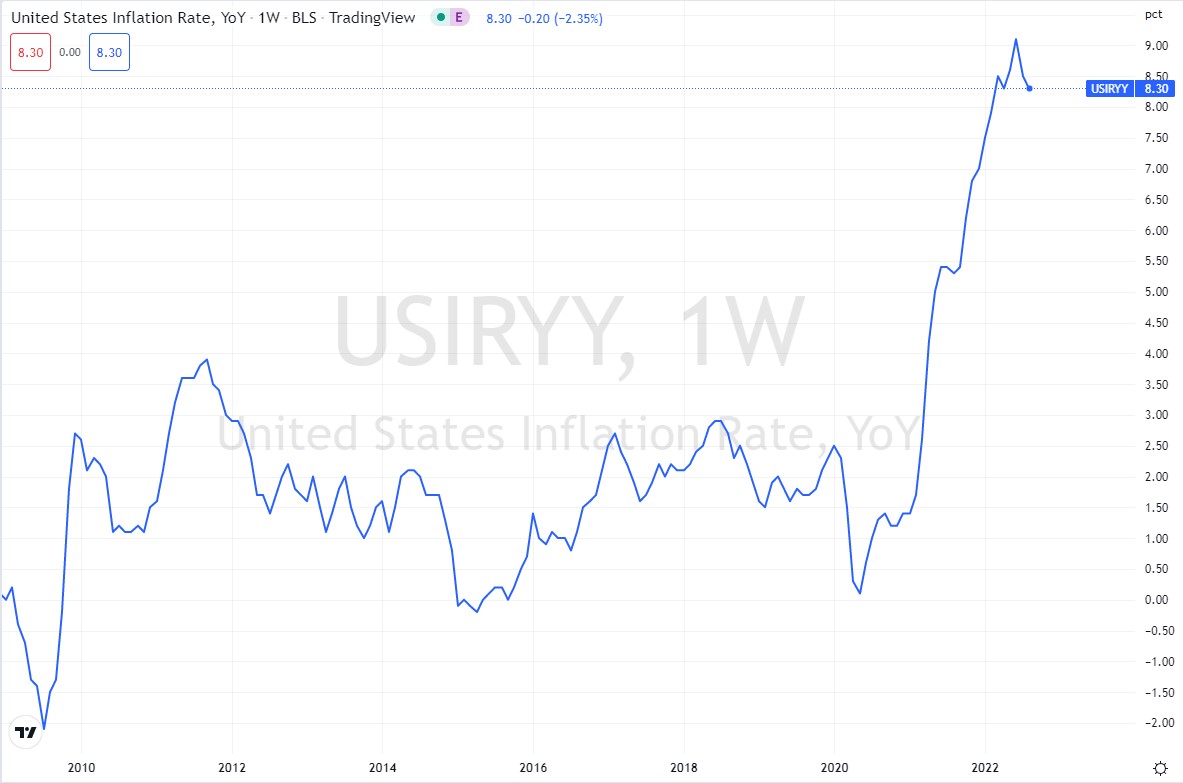

Source: TradingView

Table of Contents

How Do You Define Inflation

The definition of inflation in very simple terms is the rate of change in the increase of prices over time. So, let’s say a loaf of bread costs $1 today and a year later that same loaf of bread costs $1.20. We can see that the price of bread has increased by $0.20, or 20 percent.

That’s a straightforward example, and the truth is inflation is very easy to understand. It's something we see in our daily lives, and we can feel how we can buy less with the same amount of money.

How do economists and the government define inflation? Well, this is where we might see some discrepancies between our view of inflation and the official line. Officially, inflation is measured by analyzing a basket of goods, from gasoline to bread and clothes, and then determining by how much those prices have changed over time.

Most economists and more importantly the Federal Reserve use CPI as a measure of inflation. The Federal Reserve has two mandates: maintain full employment and keep inflation at or below 2%. To maintain inflation at the desired level the central bank can tighten monetary policy, which implies increasing interest rates.

Inflation: The Good, the Bad, & the Ugly

Inflation by itself isn’t necessarily a bad thing. Some inflation is thought of as a healthy consequence of an expanding economy. When GDP growth is rising, the increase in demand for goods and services pushes prices up.

For most western countries’ central banks and governments, inflation is desirable at around two percent as a sustainable level. Prices are increasing but the economy is increasing perhaps even faster, and with it wages too.

Things get bad when inflation starts to get much higher than the target rate, and wages fail to keep up. High prices can lead to a slowdown in economic growth, leading to fewer jobs. If inflation is persistent at high levels, things can get ugly causing the economy to shrink or even collapse into recession.

How Do You Define Recession?

There is some debate about what constitutes a recession technically speaking. However, in general terms, a recession is a prolonged period of declining economic activity. That is to say, a period where GDP growth is negative.

For most economists and analysts, the economy is in a recession after two consecutive quarters of negative growth in GDP. Having said that the National Bureau of Economic Research states that:

“A recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

The way I look at defining a recession is using some metrics other than two consecutive quarters of shrinking GDP. I also consider the following factors to indicate we are in a recession:

- Greater than 20% stock market decline YTD: Stock markets anticipate the future health of the economy.

- Declining personal savings: Decreasing income means people need to spend their savings

- Mortgage default rates: A strong indicator of the overall health of the economy. Currently at levels not seen since the fall of 2020

Causes of inflation

High inflation can raise its nasty head for several reasons. At times these reasons may cause temporary or passing inflation, if the cause can be dealt with swiftly. Other situations arise due to longer-lasting systemic and infrastructural changes.

These changes can come about due to various factors the most common are listed below:

- Excessive government fiscal policy: Governments that overspend can generate money without actually creating a wealthy economy. The extra cash causes price pressure while the economy has not adjusted to produce more.

- Excessive monetary easing by the central bank: Loose monetary policy puts cheap money into the economy, eventually the excess in cash will put pressure on prices.

- Supply constraints: These constraints can happen because they are imposed through geopolitical inference or government intervention. The scarcer goods are the higher their price.

- Jump in demand: When consumers accumulate larger amounts of wealth, spending becomes easier, putting pressure on the price of available goods and services.

- Inflationary expectations: If the general sentiment is for inflation to persist and grow higher, workers and businesses will adjust their requests for payment. Workers may ask for higher wage increases causing a spiral effect.

Causes of Recession

Recessions happen when demand for goods and services slows down drastically. The problem can be further exacerbated when expectations are for the economy to get worse. People and businesses will take preemptive actions in an attempt to offset the most dire consequences.

This phenomenon is often referred to as a self-fulfilling prophecy. When the public sees that the stock market is falling, people start getting laid off. And there is a general sensation of uncertainty, leading to spending declines.

We can further identify the cause of a recession in the bullet points below:

- Decrease in consumer spending: Less consumer consumption also leads to lower production of all things, services, and goods. Businesses will review the future outlook and cut back on spending including salaries. This creates a downward spiral pushing economic activity lower still.

- High production costs: Rising prices of commodities and labor can force businesses to raise their prices to the public. This in turn reduces consumer demand and raises inflation.

- Credit squeeze: When economic outlooks deteriorate banks may be less willing to lend money or lend money at higher costs. Both aspects reduce the financing of the economy, companies, and consumers leading to a reduction in economic activity.

- Stock market crashes: Sharp declines in general stock prices can jitter the confidence of corporations and individuals alike. Wealth is also decreased, and consumers will spend less, while businesses will invest less, impacting the economy negatively.

Consequences of Inflation

The economic consequences of high inflation have a big impact on individuals the most. Particularly affected are middle to low-income families where a 10 percent increase in the cost of living can make a big difference.

There’s also the dynamic whereby the official inflation rate is never as high as the real inflation rate. This means that consumers fight a tougher battle with expenses and the cost of living than might be perceived when looking at official inflation figures.

In the financial markets, different assets may be affected differently as inflation may benefit some and hurt others:

- Stocks: If inflation is high and sustained leading to GDP contraction, the general stock market will decline to meet the reduced earnings forecasts of most companies. If inflation is not too high and the economy can still grow along with real wages and jobs, then it can be beneficial.

- Bonds: Inflation of any level but in particular higher than expected and higher inflation forecasts have a negative impact on the price of bonds. Some bonds like TIPS and Inflation-linked bonds will instead benefit from higher inflation.

- Real Estate: Housing prices tend to decline in periods of sustained high inflation. However, investments in REITs that make their income from rents may find some benefit as rents are revised periodically to match increases in the CPI.

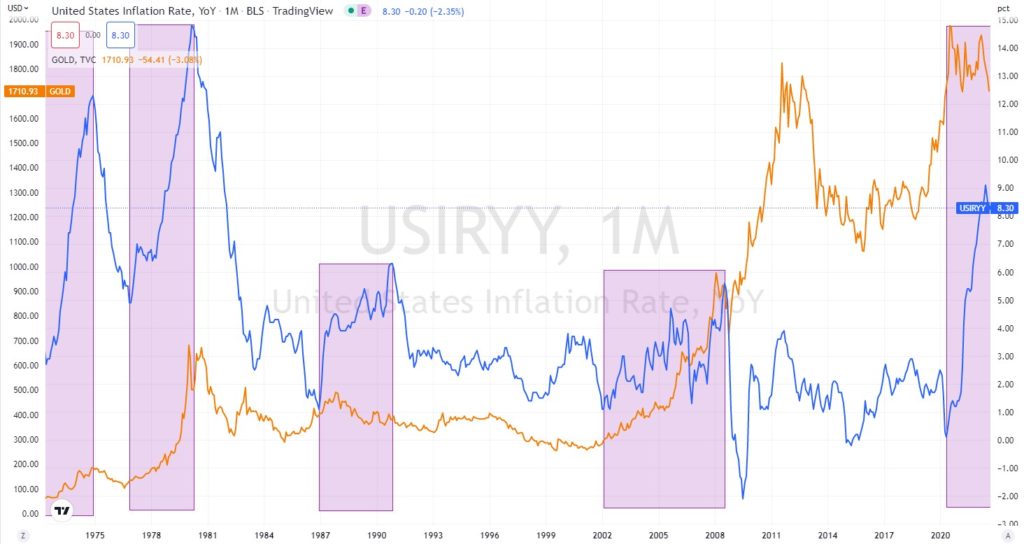

- Precious metals: Precious metals, and gold, in particular, are known for keeping or increasing their value during times of high and sustained inflation. Looking at the chart below, you can see how in all except one period of high inflation gold has managed positive returns.

Source: TradingView

Consequences of Recession

Recessions have dire consequences on the general population. People lose jobs, and consumer spending declines. This leads to companies cutting back on new investments which further decreases new hiring.

The one good thing is that recessions in the US tend to be relatively short-lived. When looking at modern times, and excluding the Financial Crisis of 2008, on average a recession lasts 10 months according to NBER data.

Financial securities are usually hit in a bad way when a recession strikes:

- Stocks: A contraction in economic activity means that companies are earning less and forward evaluations for their income streams are depressed. Stock prices are pushed lower until the market believes the economy is expanding again.

- Bonds: Bonds may fare well in a recession when the central bank decreases interest rates in an attempt to spur the economy into expansion. If the economy is also experiencing inflation at the same time, then bonds will suffer also as mentioned above.

- Real Estate: Housing prices tend to decline in times of prolonged recessions. Because sales of real estate take longer, and evaluations are stickier, you may not see a decline in value if the recession is short-lived.

- Precious Metals: In times of recession precious metals tend to perform positively. Gold in particular is seen by investors as a safe haven in times of calamity. During the three recession periods, 2001, 2008, and 2020, gold had positive returns while stocks slumped heavily.

Gold Price $/oz.

Source MacroTrends

Inflation Vs Recession: How to Mitigate Adverse Effects on Your Portfolio

In times of recession, you can expect the stock market to experience large bouts of volatility and declines. To offset the possible losses that you might experience, you can reduce your holdings in stocks.

However, simply replacing stocks with cash or bonds may not be the best alternative. If inflation remains low, bonds are a good alternative to stocks while the storm weathers itself out. But in an environment of prolonged high inflation bonds will suffer.

And holding cash will simply see your purchasing power reduced. If bonds are your choice, TIPS and Inflation-linked bonds can be a good option as they benefit from higher inflation. Another option is inverse bond ETFs.

These ETFs take short positions in bonds, so as higher inflation leads to higher interest rates these funds tend to benefit and have positive returns. However, the one asset that, as we have seen, tends to perform positively during both inflation and recession is gold.

Holding a percentage of gold in your portfolio can protect you from the negative consequences of a stock market rout and high and persistent inflation.

Bottom Line

If you are considering investing in gold, you may want to take advantage of a tax-enhanced environment by using a gold IRA. Many companies offer specialized services that include storage and transportation as well as guidance on which gold products you can or cannot include in an IRA.

We have gone through the many gold IRA companies out there, and come up with a list of the best. You can read our reviews on the ten best gold IRA companies here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24