Housing Market News: What You Need to Know for Q4 2022

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

When considering housing market news, you should always look at the hard statistics. Various institutions provide hard data on home sales, new constructions, and mortgage rates among others. We are going to have a look at what news has been showing up in the housing market.

At the same time, we’ll analyze what these may mean for the housing market and how it correlates to the economy. Many investors and homeowners are becoming concerned about the current environment for real estate.

Most housing market news is concerned about the rising costs of mortgages as a consequence of the Federal Reserve’s tightening monetary policy. Another factor often considered by economists and real estate pundits is the overall state of the economy, as more unemployment leads to fewer home buyers.

Table of Contents

Economic Outlook

Although there is plenty of debate as to whether we are in a recession or not, some factors are not looking so good. For the moment unemployment is low, but that can be seen as normal as we have recently come out of a nationwide lockdown. And people are just going back to the jobs they lost during the pandemic restrictions.

A usually reliable barometer of the state of the economy is the broad stock market. The S&P 500 at the time of writing was down 23 percent YTD. For most economists and analysts, the stock market trend is a Bear one once the loss YTD goes beyond 20 percent.

And the stock market would only sell-off in anticipation of a recession, stock investors don’t wait for the bad news to arrive, they attempt to anticipate it. The next factor that is not favorable to an expanding economy is monetary tightening by the central bank.

The Federal Reserve is on course to raise interest rates higher to stamp out rising inflation. The central bank estimates that interest rates are heading to around 4.6 percent by the end of 2022. Higher interest rates are a burden on the broader economy and that’s how the Federal Reserve fights inflation. By reducing economic activity through higher financing costs.

So, with this economic scenario in mind let’s have a look at what the housing market data shows us through the various institutions that publish data on the state of real estate in the US.

Home Sales & Mortgage Rates

Home sales and mortgage rate levels tend to go hand in hand. That is to say, when mortgage rates are low home sales tend to be higher. So, we can deduce that when mortgage rates rise, home sales will decline.

Mortgages

Let’s have a look at the data we have on both. Mortgage rates as we know are subject to the interest rate the Federal Reserve decides at its scheduled monetary policy meetings. On September 21, 2022, the central bank raised rates again to the target range of 3% – 3.25%.

As a consequence, mortgage rates have reached as high as 7.08 percent on 30-year loans. That rate is not necessarily applicable to all mortgages. However, Freddie Mac reports that mortgages have risen six weeks in a row.

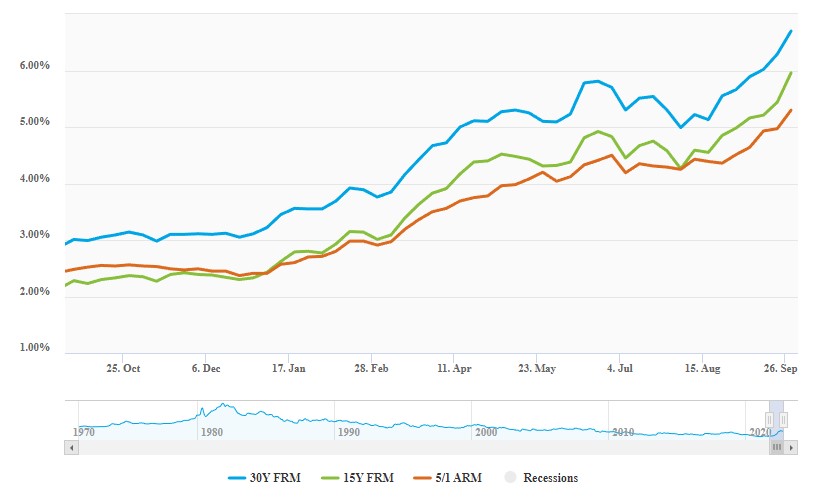

Freddie Mac currently sees the average mortgage rates per term as follows:

- 30-year fixed rate – 6.7%

- 15-year fixed rate – 5.96%

- 5/1-year adjustable rate – 5.3%

Mortgage rates have been on the rise consistently since the beginning of 2022. As you can see from the chart below. The rising cost of mortgages means that buyers have less purchasing power when it comes to buying a house with a loan.

Source Freddie Mac

Home Sales

Any housing market news must consider home sales. The National Association of Realtors data shows that home sales fell for a seventh consecutive month. Existing-home sales in August 2022, were a seasonally adjusted 4.8 million, a drop of 0.4 percent from July.

That might seem like a small decrease but when we look at the year-on-year decline, home sales fell by 19.9 percent. While the median existing-home sales price rose to $389,500 or 7 percent from a year ago.

Over the month in question, the four major US regions had mixed results in existing-home sales. Two regions saw an increase, one experienced a rise, while one region remained unchanged. However, all four regions were down over the past twelve months.

“The housing sector is the most sensitive to and experiences the most immediate impacts from the Federal Reserve's interest rate policy changes,” said National Association of Realtors Chief Economist Lawrence Yun.

It’s easy to see how Federal reserve policy, which pushes mortgage rates higher, can impact home sales. The higher monthly mortgage cost from one year ago on a median-priced house of $389,500 with a 10 percent down payment equals $919.13.

You get that number by calculating a 30-year mortgage at the current average rate of 6.7 percent and subtracting the cost of a mortgage one year ago with a rate of 2.77%. So, over the course of the past year, an average home just became almost a thousand dollars more expensive.

Regional Home Sales

A regional breakdown is also required as some housing markets are slowing down faster than others.

- Northeast: The region saw existing-home sales rise by 1.6 percent. However, they showed a decline compared to the previous year, by 13.7 percent. The average price in the region was $413,200, a rise of 1.5 percent from last year.

- Midwest: In the Midwest, existing-home sales fell by 3.3 percent from the previous month. While from last year the drop was 15.9%. The average home sales price was $287,900, an increase of 6.6% in the past year.

- South: Existing-home sales remained the same in the West from the previous month, However, compared to last year the decline was 19.3 percent. The median price increased by 12.4 percent to an average of $356,000.

- West: This region saw existing-home sales expand by 1.1%, but the region experienced the worst yearly drop of 29%. The average sales price was $602,900 up by 7.1 percent.

Where Housing Market Prices Are Falling Fastest

Even though the data we have seen so far doesn’t paint a rosy picture, some areas of the country are faring worse than others. Redfin released a report on the housing market in the US on September 21, 2022. The report showed that the majority of cities where the housing market was cooling fastest were on the west coast.

At the top of this unfortunate list is Seattle WA, and three of the top five cities are in California. Redfin uses a variety of metrics to classify the state of the housing market for each city. Factors they consider include price drops, inventory drops, and pending sales compared to last year.

Following is a list of the top 20 cities nationwide with the fastest cooling housing markets and the average home price.

Where Housing Market Prices Are Cooling Slowest

Redfin also takes into account the factors mentioned above to compile a list of housing markets where real estate is still holding its ground. Or, in other words, is cooling down less quickly than in other areas. Again, the areas are listed by city.

Many of the areas on the list may not have experienced the rise in housing demand due to work-from-home rules during the pandemic. Since these areas didn't see a large rise in prices the demand for housing is more constant.

Conclusion

The housing market news we have seen so far this year does not bode well for the last quarter of 2022 and going into 2023. Various factors are converging to depress the real estate market. Firstly, rampant inflation is forcing the Federal Reserve to tighten monetary policies.

Higher interest rates are a drag on the economy and an even bigger impediment to the housing market. Supply chain concerns and rising energy and commodity costs are fuelling the cost of living and that directly affects home buyers.

The Federal Reserve has stated that interest rates will need to be higher for longer than initially expected. So, probably the worst of it isn’t over just yet. However, many investors see a dip in asset prices as an opportunity. In a way, it’s like seeing the glass half full or half empty.

Bottom Line

During times of duress stocks and bonds are typically negatively affected. And as we have seen given the current scenario, so will the housing market be impacted. However, not all asset classes are made the same.

Precious metals, and in particular gold have shown signs of being able to withstand financial crises, recessions, and high inflation in the past. If you are thinking of adding gold to your portfolio you can take advantage of a tax-enhanced environment with a gold IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.83

Gold: $3,355.83

Silver: $38.43

Silver: $38.43

Platinum: $1,468.02

Platinum: $1,468.02

Palladium: $1,286.05

Palladium: $1,286.05

Bitcoin: $117,574.14

Bitcoin: $117,574.14

Ethereum: $2,959.38

Ethereum: $2,959.38