- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Gold Breaking Above $1,400 A Sign That All Is Not Well

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

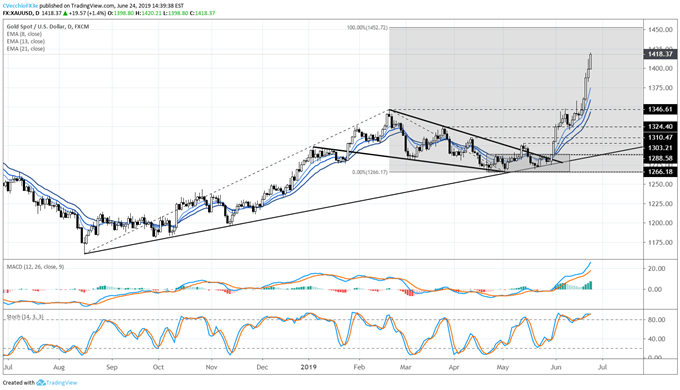

This past week saw gold smash through levels not seen since 2012. They yellow metal did more than hang around the $1,350 per ounce levels. It roared on higher to $1,421 per ounce last Monday and then extended this gain to over $1,430 on Tuesday. The surge originally started to gather steam after U.S. Federal Reserve Chairman Jerome Powell hinted at an upcoming interest rate cut for July.

This was not the only factor that has supported gold lately though. Almost everywhere you look around the world these days there are geopolitical situations pushing the yellow metal higher. This includes the ongoing U.S.-China trade war, tensions with Iran that have come close to armed confrontation, and OPEC plus Russia making plans to support higher oil prices.

Gold Had Been Constricted By the $1,350 Per Ounce Barrier

Gold had been held back by the $1,350 per ounce barrier price for over seven years. Every time it managed to probe above this level, gold speculators would sell it off hard, taking their profits. The Head of Gold Strategy George Milling-Stanley of State Street Global Advisors remarked that this has happened on three occasions as investors could not maintain the level through the market close. He stated:

“(Investors) have effectively been playing whack a mole with gold. They didn't do that this time because they probably were very impressed by Powell's statement.”

Other strategists agree that gold's technical levels have changed for good now. Commodities Strategist Nicky Shiels of Scotiabank reminded that gold has attempted unsuccessfully to break away from this $1,350 level around six different occasions in only the past four years. She argues that this means gold's prior ceiling is now its floor. This chart below shows what a significant move gold made this past week:

A Variety of Geopolitical Forces Came Together to Give Gold A Big Push Higher

Historically, gold tends to move in the opposite direction from interest rates in the U.S. As the Federal Reserve cuts the rates, the dollar would weaken and investors would rush to gold to protect their money's purchasing power. Gold also enjoys safe haven appeal in tense geopolitical situations. Milling-Stanely pointed out that there is uncertainty surrounding the ongoing trade war between the U.S. and China along with potential for a literal confrontation between America and Iran. Milling-Stanley said this meant that everything was lined up for a rally except for one missing element:

“The Fed's statement was basically the last match the bonfire needed.”

Now the bonfire for gold prices has been lit.

Markets Are Pricing in Interest Rate Cuts Now

What is interesting is that the Fed has not yet officially announced the rate cut. Fed Chairman Powell made enough dovish comments at his June meeting that most analysts now expect it to happen this year (and soon). According to Scotiabank's Sheils, the markets are pricing in the rate cut now. Any more outlook for future rate cuts from the chairman could increase excitement and demand for gold still more. Shiels reminded that:

“The Fed doesn't hike or cut in one offs. They normally do it in cycles so I'd really look at the messaging after the cut to determine how dovish the outlook is.”

Shiels believes that if the door remains open for additional easing, the $1,400 per ounce level would become gold bullion's new floor.

The Trade War With China Is On Pause But Not Over

One of the elements that has been supporting gold is the continuing trade war with China. Over the weekend, President Trump met with Chinese President Xi Jinping at a G-20 summit in Osaka. President Xi reminded of the animosity that is still present on both sides with his barbs at the U.S. criticizing protectionist trade policies and praising multiculteralism in the opening remarks which he gave. President Xi repeated this sentiment later when he argued that he seeks to avoid “friction and confrontation.”

The meeting between the U.S. and Chinese presidents did not end with a final breakthrough on the trade issue. They did postpone further tariffs for now while the negotiators re-engage. They are returning to where they were in talks held a month ago.

Oil Prices To Be Supported By OPEC and Russian Decision to Extend Cuts

Oil policies are also supporting gold lately. This past weekend, Russia and Saudi Arabia agreed that they would continue their expiring oil reduction arrangement for somewhere from six to nine months more. Russia's President Vladimir Putin has been attempting to keep oil prices higher as they have been pressured by the slowing world economy and increasing American oil supplies. American policies are aimed at encouraging lower oil prices.

Putin met with Saudi Arabia's Crown Prince Mohammed bin Salman on G-20 sidelines before sharing the results in a news conference. The Russian president claimed that the deal would get an extension at present production volumes, with:

“We will support the extension, both Russia and Saudi Arabia. As far as the length of the extension is concerned, we have yet to decide whether it will be six or nine months. Maybe it will be nine months.”

The Saudi Arabian Energy Minister Khalid al-Falih argued that the oil deal would get an extension of nine months without any additional reductions to the present oil output. The entire OPEC+ group will have its sit down policy meeting in Vienna today and tomorrow (July 1-2) to discuss and approve extending the deal that cuts the global oil production by 1.2 million barrels daily. Falih added:

“I don't think the market needs that (deeper cuts). Demand is softening a little bit but I think it's still healthy.”

The Saudi minister believes that the market will reach balance over these next six to nine months. Meanwhile, oil prices will continue to be supported. Supported oil prices tend to shore up gold prices along with them.

Gold Is the Ultimate Safe Haven Hedge for Your Retirement Portfolio

The news from around the world continues to reveal to you why gold makes sense in an IRA. You should not let your investment and retirement portfolios become hostages to the geopolitical affairs that unsettle markets seemingly every week. What you need is an effective safe haven with a proven history of more than three thousand years to hedge your portfolio. Gold is the only asset class that can boast this.

You can take steps to diversify your portfolio more effectively using the time tested yellow metal. It is a good idea to consider some gold IRA allocation strategies and to review the top five gold coins for investors while you are thinking about IRA-approved gold. This list of top rated Gold IRA companies and bullion dealers is a valuable resource. It will help you to make an informed decision.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81