- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Increasing Problems With Iran Threaten Oil and Financial Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th June 2019, 10:10 am

This past week, Iran attacked an American spy drone operating in international waters near the critically important Strait of Hormuz. This follows that attacks on six oil tankers that have occurred there since May. The Straits of Hormuz separate Iran from its Gulf oil exporting neighbors. It is a dangerous set of developments in the busiest oil shipping lane on earth.

Unfortunately, this is already having dramatic impacts on oil prices. This threatens financial markets that hate uncertainty as well. Rising geopolitical tensions in the region have the potential to get worse before they get better.

Tensions With Iran Growing Worse Since May

Today the U.S. President Donald Trump threatened to apply what he called “major” additional sanctions against the Iranian republic. This increases already high pressure against Iran when its economy is reeling from tough financial restrictions. It makes them more dangerous and less predictable than ever.

The tensions have been rising since May. These frequent attacks on the oil tankers (two of which happened in June) have only made the situation more volatile over the last two months. Saturday, the President stated he would impose more sanctions on the country to stop them from obtaining nuclear weapons. These will follow the American sanctions on Iran's oil segments and related sectors that are already in place. President Trump promised that other additional economic pressure will be used until the leadership in Tehran changes its policy direction.

Iranian Oil Exports Are Already Dramatically Reduced

International observers have been closely watching to see what impacts the existing sanctions would have on Iran's oil exports. Global Economist Cailin Birch of the Economist Intelligence Unit observed:

“We can safely say that Iran's revenue from oil has been cut by at least two -thirds, so they are in a very dangerous economic position. They… put on a strong face to get themselves out of this conflict but they are not in a position to fight a war either.”

Birch and the EIU estimate that Iran was successfully exporting from 10 to 15 million barrels of oil each week during the first quarter in 2019. Today the EIU observes significantly reduced export volumes amounting to from four to five million total barrels of oil each week. Birch claimed that half this amount had been moved around in domestic ports and was not seaborne exports. It means their actual exports could be even significantly less than the low figure that his group has reported.

Sanctions on Iran Are Having Major Impacts on Oil Markets

The Washington-led sanctions have included financial restrictions on almost 1,000 Iranian companies and institutions. Among these were banks, shipping vessels, and individuals connected with the energy and export industries. In May, the administration extended these to stop companies from buying Iranian copper, aluminum, steel, and iron.

The U.S. government also pulled waivers granting eight nations (China and India included among them) exemptions allowing them to import Iran's oil. America's goal is to entirely cut all Iranian oil exports. The government hopes that this will force the regime in Tehran to stop supporting terrorist groups across the Middle East and to renegotiate the nuclear activity suspension deal.

These increasing geopolitical tensions and the decrease of Iranian exports are having massive impacts on the global oil markets. Last week saw the international London-based Brent benchmark rise approximately five percent. U.S. based WTI West Texas Intermediate skyrocketed over 10 percent. It was the index's largest increase dating back to December of 2016. Prices continued to rise today as Brent crude reached $65.48 Monday morning, another .4 percent higher. The U.S.'s WTI notched up to $57.92 for around another one percent gain.

The Situation in Iran Could Easily Spiral Further Out of Control

The volatile situation in Iran and the Gulf could easily spiral further out of control. Last Thursday after Iran shot down the U.S. drone, President Trump was reported to have signed off on military strikes on Iran in retaliation. He later backed off of this decision with a threat. Should war with Iran break out, he has promised on an NBC News interview “obliteration like you've never seen before.” The president has also stated that he is still open to negotiating with Iran, but their Supreme Leader Ayatollah Ali Khamenei has already said bluntly there will be absolutely no talks with the Trump administration.

Meanwhile a former energy adviser to the Iranians Fereidun Fesharaki (now Facts Global Energy consultancy chairman) warns that the possibilities of the conflict becoming larger and more dangerous are “very, very high,” with:

“We have to remember Iran is a regional superpower. The U.S. says, ‘I'll put you in a box, please die.' They are not going to stay in a box and just die. They will strike back one way or the other. I think chances of tensions becoming bigger is very, very high in the near future. Chances of a conflict are at least 50 percent right now. It may not be a full war, but conflict which would disrupt (energy) supplies.”

Fesharaki has also issued a geopolitical war premium for military strikes on Iran. He says it would rise from the current one to two dollars a barrel priced in now to anywhere from as much as five to ten dollars per barrel. Fesharaki feels today's premium is not nearly high enough with all the dangers hanging over the country.

Greater Geopolitical Tension Is Not Good for Markets

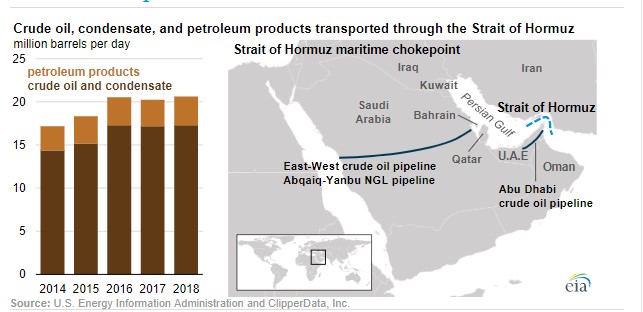

This is all pointing to a potential worst case type of scenario for markets. Iran has previously threatened that it would completely block the Strait of Hormuz. This arguably most critical oil link on the planet is the de facto connection between major oil producers throughout the Middle East with their consuming customers around the world. About 30 percent of all ocean going oil comes through here, making it crucial to global energy security as the graphic below shows.

Gold Is A Portfolio Hedge In Times of Geopolitical Trouble

The President has stated earlier in June that if Iran really does block up the Strait of Hormuz, “it's not going to be closed for long.” This reminds you of the possibility for armed conflict in the region. Continuing economic sanctions are a given, and this uncertainty threatens world financial and stock markets. Whether or not there is a future physical confrontation in Iran and the Strait of Hormuz, the news clearly indicates why so many consider that gold makes sense in an IRA.

Now is a good time to consider gold IRA rules and regulations. The IRS allows a number of IRA-approved precious metals in these retirement accounts. You can store your account hedging precious metals in top offshore storage destinations for if you prefer too. It is always a good idea to use one of the top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06