Fed Policy July 2023: What Happened and How to Respond Before September’s FOMC Meeting

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 26th July 2023, 10:12 pm

This article was updated on July 26 at 3:00 p.m. EST to include new information following the FOMC's post-meeting press conference.

The Federal Open Market Committee (FOMC) gathered for the fifth time this year on Tuesday, July 25th, 2023, lasting until mid-day Wednesday. Economists were near-unanimous in expecting yet another interest rate hike by Federal Reserve Chair Jerome Powell, constituting a 25-basis-point increase.

In what may be the Fed’s final rate augmentation of the year, the central bank brought the federal target rate to 5.5 percent in the hopes of reining in inflation. Although July’s consumer price index (CPI) report marked a significant month-over-month deceleration (3.0%), Chairman Powell signaled his continued resolve to use all policy tools at his disposal to bring inflation down to its target level of two percent. On the news, the stock market bounced before eventually settling in the green, with the Dow Jones Industrial Average closing 82 points above open.

Whether you’re a gold investor or not, you should anticipate changes in the market in the aftermath of the FOMC announcement, as well as during the lead-up to the next FOMC meeting in September. Below, we will touch on how you may want to adjust your investment strategy following Wednesday's news and in the weeks ahead.

Table of Contents

What to Expect From the September FOMC Meeting

Now that the FOMC has officially announced a July 2023 interest rate hike of a quarter percent, eyes are now turning to the next FOMC meeting scheduled for September 19 and 20, 2023.

The Federal Reserve is continuing its mission to achieve the elusive “soft landing” from the generational inflation seen in 2021 and 2022. The Fed pulled its monetary policy lever yet again during the July 25 meeting and has since signaled ambiguity regarding whether they will continue to do so in September and beyond. The August and September CPI reports will play a large role in determining future interest rate policies, as inflation is still well above the central bank's target 2% rate.

In the run-up to July's meeting, the Fed Rate Monitor tool assigned a 99.2% likelihood of a 25-basis-point hike decision during the July 25th FOMC meeting. Optimism permeated the markets with multi-sector futures hitting three-month highs on the Monday before the meeting.

Whether Chairman Powell will continue to authorize additional interest rate hikes later in the year will depend on the extent to which the FOMC will tolerate higher-than-target inflation rates. If inflation remains around 3% or higher, we may see yet another 25-basis-point hike before the year is through in order to stymie the rising costs of goods.

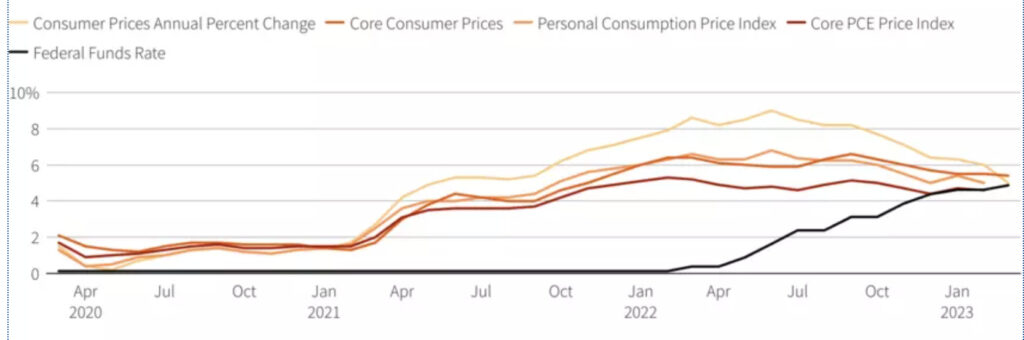

ˆFigure 1: Displaying Converging Trendlines in Inflation and Interest Rates (Source: WEF)

The chart above demonstrates the relative success of the central bank’s hawkish interest rate policy to date. As the federal funds rate has increased, the annual percent change in the CPI has fallen largely in step.

Given the proven efficacy of Chairman Powell’s interest rate campaign, it stands to reason why the central bank gave another kick at the can during the FOMC meeting on July 25th.

Since it is unlikely that another 25-basis-point hike is already priced into the markets, we could see the following market activity transpire immediately following the September FOMC meeting:

- Rapid fluctuations in the S&P 500, DJIA, and other major stock indices

- Large price fluctuations in gold prices

- Increased borrowing costs, reflected by higher mortgage and loan interest rates

If the Fed unexpectedly cuts rates, we could see much larger asset price fluctuations as this prediction is not currently priced into the market and would take observers by surprise. However, such an extreme measure would be contingent on deep CPI reductions reported in both August and September.

What Happens at FOMC Meetings?

At an FOMC meeting, some of the most influential decision-makers in the U.S. economy convene to deliberate and set the nation's monetary policy.

Assembled eight times a year, the FOMC is responsible for determining key interest rates and other critical economic measures that can significantly impact financial markets, consumer borrowing costs, and overall economic growth. Below is a quick overview:

1. Attendees and Key Players:

The FOMC is composed of the Board of Governors of the Federal Reserve System, which includes:

- The Federal Reserve Chair

- The Vice-Chair

- Seven other Governors

- The presidents of the twelve regional Federal Reserve Banks

These meetings bring together these key players, totaling 19 participants, but not all regional presidents have voting rights at every meeting. During sessions, each participant shares their analysis and perspective on the current economic conditions, forming a comprehensive understanding of the nation's economic health.

2. Economic Assessment:

At the outset of each FOMC meeting, the attendees review a comprehensive set of economic data and indicators. This includes reports on employment, inflation, gross domestic product (GDP), consumer spending, recessionary signals, and other vital financial metrics.

3. Monetary Policy Decisions:

A primary focus of FOMC meetings is the determination of the federal funds rate, which is the interest rate at which depository institutions lend funds to each other overnight.

This rate serves as a crucial benchmark influencing other interest rates in the economy, including those on loans, mortgages, and savings accounts.

4. Communication and Transparency:

Following each meeting, the committee releases a statement outlining its decisions on interest rates, along with a summary of its economic outlook and rationale for any policy changes. Moreover, the Federal Reserve Chair holds a press conference to elaborate on the committee's decisions and field questions from journalists, investors, and economists.

These press conferences are available on the Federal Reserve’s YouTube channel as well as C-SPAN. Both platforms broadcast the conference live, and are available for watching on-demand within minutes afterward. Therefore, September's FOMC press conference will become available for recorded viewing by Wednesday, September 20, at about 1:00 p.m. or 2:00 p.m. EST.

5. Forward Guidance:

The FOMC also provides forward guidance on its future monetary policy intentions. This guidance is designed to offer clarity to investors and businesses about the committee's likely future actions based on its assessment of economic conditions.

Implications for Gold Investors

The Federal Open Market Committee (FOMC) decided to hike the overnight rate from 5.25 to 5.5 percent, as announced during the Wednesday, July 26, press conference. The overnight federal funds rate is now at a 22-year high. Here are the several potential implications for gold investors:

1. Temporary Changes in the Appeal of Gold as an Investment:

Higher interest rates typically lead to increased yields on fixed-income assets, such as bonds and savings accounts. As a result, investors may shift their allocations away from non-yielding or low-yielding assets like gold towards those offering more attractive returns.

Gold, as a non-interest-bearing asset, may lose some appeal compared to higher-yielding alternatives.

2. Potential Changes in Gold Prices:

Gold prices often have an inverse relationship with interest rates. When interest rates rise, the opportunity cost of holding gold increases since it does not provide a yield like interest-bearing assets. This can lead some investors to sell their gold positions to pursue higher returns elsewhere, potentially putting downward pressure on gold prices.

3. Impact on the U.S. Dollar:

Higher interest rates can strengthen the U.S. dollar, as foreign investors seek higher returns on their dollar-denominated assets. A stronger dollar can negatively affect gold prices since gold is priced in U.S. dollars on international markets.

When the dollar appreciates, it takes fewer dollars to buy an ounce of gold, resulting in lower gold prices for investors holding other currencies.

4. Market Sentiment and Volatility:

Interest rate decisions by the FOMC can influence market sentiment and create volatility in financial markets. Since gold is a safe-haven asset, it is often sought by investors during times of uncertainty or economic instability. Therefore, any unexpected interest rate hike may trigger market uncertainty, potentially increasing demand for gold as a hedge.

5. Consideration of Inflation Outlook:

If the FOMC continues to raise rates to combat inflation, but inflation continues to rise significantly, real interest rates (nominal interest rates minus inflation) may remain negative or low, which can increase investor demand for gold as a hedge amid generationally high inflation.

More Hikes May Be Coming: Prepare Your Portfolio Today

Every FOMC meeting serves as a critical event where key policymakers shape the trajectory of the U.S. economy. With the nation's monetary policy decisions at stake, these gatherings garner close attention from market participants, economists, and the public at large.

As the committee navigates the complexities of economic conditions, its deliberations and actions can significantly influence the direction of financial markets and the overall economic landscape. It’s crucial that you take the necessary steps required to get ahead of the September 2023 FOMC meeting. As indicated by Jerome Powell's post-meeting press conference, “the totality of incoming data” on inflation (and, likely, the impacts of student debt repayments) will determine whether future hikes will take place.

If the overnight rate continues to rise, asset prices will be impacted. This includes gold and other precious metals. To take control of your gold and precious metals investments, consider opening an account with one of America’s top-rated gold IRA companies today. Speak to your financial advisor about how you may want to adjust your gold investment strategy in light of the upcoming FOMC meeting.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24