Biden-Harris Student Loan Forgiveness Fails, Relief Expires: What Gold Investors Should Know

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 21st July 2023, 04:39 pm

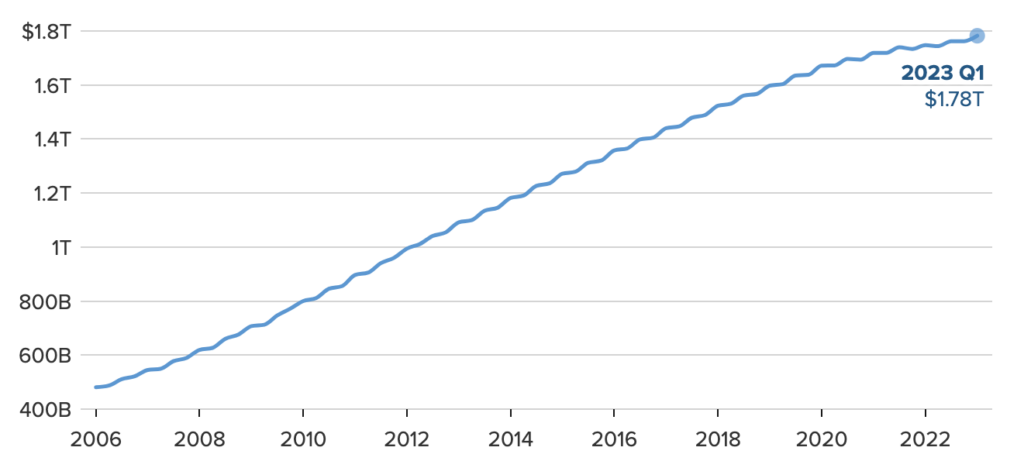

On September 1, 2023, America’s approximately $1.8 trillion in student loan debt will resume accruing interest, adding fuel to an already out-of-control liability fire. The result? Millions of young Americans will, on average, have an extra $503 monthly payment to make, while billions in discretionary spending will be sucked out of consumer circulation.

Initially introduced in March 2020 by former President Donald Trump as a short-term debt relief solution amid the coronavirus outbreak, the pause on student loan interest was officially lifted by a bipartisan deal to raise the U.S. federal debt ceiling in May 2023.

In the White House, the Biden-Harris student loan forgiveness campaign largely failed. To provide additional debt relief via executive action, the Biden administration approved a stripped-down plan to offer $116 billion in loan forgiveness for 3.4 million student borrowers. The initial relief program, which included $430 billion in relief to over 40 million borrowers, was struck down by the Supreme Court on June 30.

Chart 1: Total American Student Debt Burden (2006-23) [Source: CNBC]

Amid a mounting student debt crisis, the Biden administration’s failed attempt at comprehensive debt relief is a serious blow to tens of millions of Americans’ financial security. Now, with billions in monthly spending about to evaporate from the money supply, we could see the country’s macroeconomic security cast into uncertainty as well.

For gold investors—a subset of mostly risk-averse money managers—the resumption of student loan repayments and its economic consequences should be top of mind. As economic uncertainty rises, so too could public and institutional interest in the yellow metal.

Table of Contents

Trump Freeze, Biden-Harris Student Loan Forgiveness: A Recap

The Trump and Biden administrations have taken contrasting approaches to tackle the mounting student loan debt issue, with potential implications for the gold investor community. Let’s take a look at the landmark student debt relief policies implemented by each administration and their potential effects on the gold market.

1. The Trump Administration's Approach:

Policy Tool: CARES Act (H.R. 748; March 27, 2020)

During the Trump administration, student debt relief policies focused primarily on reducing federal regulations and encouraging private-sector initiatives. Former President Trump aimed to stimulate economic growth and job creation, believing these measures would provide a more sustainable solution for graduates burdened by student loans.

Deregulation and Private Sector Initiatives:

Trump's administration sought to ease the regulatory environment surrounding student lending, emphasizing the importance of free market mechanisms. The belief was that private lenders and institutions would have more flexibility to offer competitive interest rates and repayment terms, potentially benefiting investors in the private student loan market.

Limited Federal Forgiveness Programs:

While the Trump administration acknowledged the need for student loan assistance, it maintained a conservative stance on widespread federal loan forgiveness. Instead, it implemented targeted programs aimed at specific groups, such as veterans and public servants, while emphasizing individual responsibility for student loan repayment.

Impact on the Gold Market:

The Trump administration's focus on stimulating economic growth and limited federal intervention in the student loan market tended to favor traditional investment assets like equities, thereby potentially reducing the appeal of gold as a safe-haven asset during his tenure.

2. The Biden Administration's Approach:

Policy Tool: Saving on a Valuable Education (SAVE) Plan

With the advent of the Biden administration, there has been a shift in the approach to student debt relief. President Biden has taken a more interventionist stance, seeking to address the issue through a combination of loan forgiveness and income-driven repayment plans.

Broad-Based Loan Forgiveness Initiatives:

The Biden administration has proposed plans for substantial student loan forgiveness, aiming to ease the burden on millions of borrowers. This approach has sparked debates on its potential economic implications and long-term effects on the financial markets.

Income-Driven Repayment Plans:

Additionally, President Biden has sought to expand and improve income-driven repayment plans, allowing borrowers to cap their monthly loan payments at a certain percentage of their discretionary income. This initiative intends to provide relief to struggling graduates and improve their overall financial well-being.

In particular, the student loan Biden plan involves a 12-month ramp program for low-income borrowers to make income-adjusted repayments until September 30, 2024. Those who miss their payments will not be considered delinquent.

Impact on the Gold Market:

The Biden administration's more interventionist stance on student debt relief and increased government spending have the potential to elevate uncertainty in financial markets, potentially enhancing the appeal of gold as a safe-haven asset for investors seeking to hedge against inflation and economic instability.

The Deflationary Effects of the September Loan Thaw

The expiration of Trump's student loan interest rate freeze on September 1, 2023, and the subsequent resumption of monthly repayments for millions of American student loan borrowers may indeed have deflationary effects on the economy. Here's why:

1. Reduced Consumer Spending:

When student loan borrowers are required to resume making monthly repayments, it can significantly impact their disposable income. A substantial portion of borrowers' income may be diverted towards loan repayment, leading to reduced discretionary spending on other goods and services.

As consumer spending decreases, businesses may experience lower demand for their products, potentially leading to reduced production and investment, which can contribute to deflationary pressures.

2. Impact on Household Budgets:

For many student loan borrowers, the resumption of repayments can impose a financial burden. With a significant portion of their earnings allocated to servicing debt, there may be less room for savings and investments. A decrease in household savings and investment can slow economic growth and further contribute to deflationary trends.

3. Inhibited Economic Mobility:

High levels of student loan debt can limit individuals' ability to pursue other financial goals, such as buying homes or starting businesses. Reduced economic mobility can have broader implications for the economy, hindering overall growth and contributing to deflationary pressures.

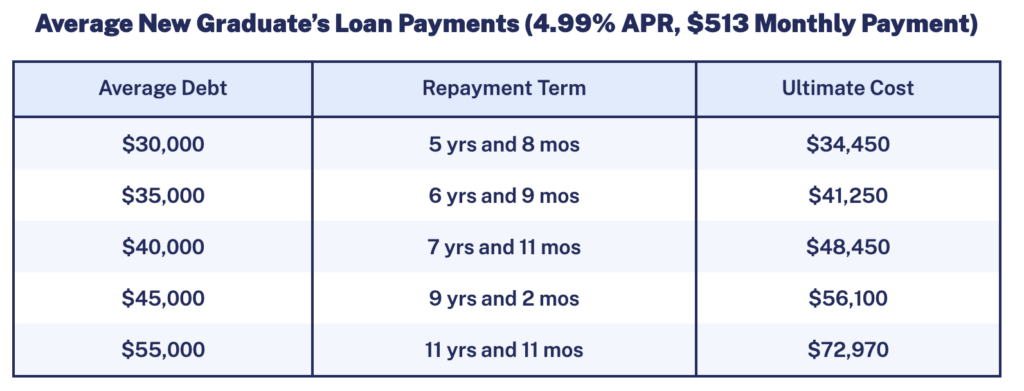

Table 1: New U.S. College Graduate Loan Payment Averages [Source: EducationData]

The median student debt load in the United States for college graduates is over $37,000. According to Table 1 above, the average debtor would therefore be straddled with monthly payments of over $500 for a duration of over 7 years—diverting capital away from savings, investing, and other mechanisms of economic mobility.

4. Potential Credit Constraints:

As borrowers divert funds towards loan repayments, they may be less likely to take on additional credit, such as mortgages or auto loans. Reduced borrowing can lead to lower demand for credit, affecting financial institutions and potentially restricting access to credit for businesses and consumers, further engendering the conditions of an economic recession.

5. Investor Sentiment:

The expiration of the interest rate freeze and the subsequent burden on student loan borrowers may raise concerns among investors about potential risks in the financial system. Investor uncertainty can lead to a flight to capital preservation options in safer assets, such as government bonds or gold, rather than riskier investments.

This shift in investor sentiment can dampen demand in the stock market and contribute to deflationary pressures.

Analyst Opinions Are Mixed on Recession Likelihood

There exists a wide range of opinions on the systemic impacts that student loan repayments are likely to have in the coming months.

On the pessimistic side of the spectrum is Thomas Simons, a senior economist at equity research firm Jefferies, will cause a 2% drop in total consumer spending—something that could constitute a “tipping point” that ushers in a recession.

“This is an additional straw on the camel's back. And it might be the one that puts us into a recession.”

(Thomas Simons, Economist at Jefferies)

More optimistic opinions also abound, with Bernard Yaros of Moody’s Analytics calling the upcoming student loan repayment reinitiation a “modest headwind”.

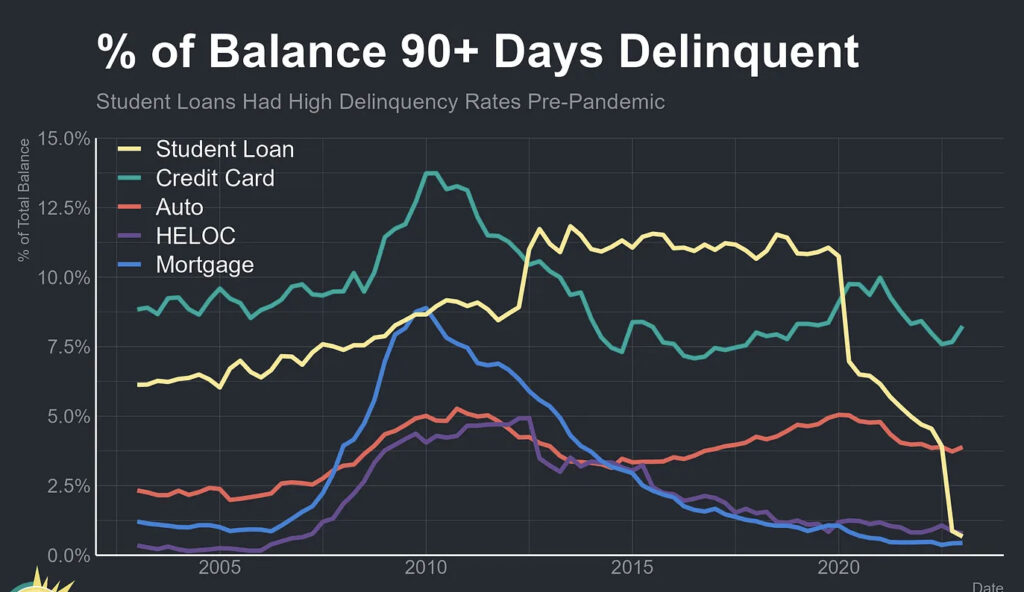

Chart 2: Loan Delinquencies in the U.S. [Source: Apricitas.io]

Financial commentators at Fortune and Investopedia both speculate that the resumption of student loan repayments will constitute a large enough financial impact that it could trigger recessionary activity in the United States. However, the latter outlet considers it “unlikely” that such an event would match that of the late 2000s Great Recession.

Stay Ahead of the Market: Diversify With Precious Metals Today

Today, student loans are the second-biggest source of household debt in America. Once Americans have to start actually repaying the debt, we could see a so-far resilient yet fundamentally fragile economic landscape descend into a hard landing.

Perhaps the best we can do as responsible investors is to prepare for potential adverse outcomes. Although it may be unlikely that America’s looming student loan burden will set off a recession, the possibility exists nonetheless. Investing in gold and other recession-resistant assets can help Americans weather the potential storm.

As the United States grapples with the growing issue of student loan debt, the policies pursued by the Trump and Biden administrations have offered divergent paths. While Trump's deregulatory approach may have favored traditional investment assets, Biden's more interventionist policies could drive demand for safe-haven assets like gold.

This is especially true if contracted consumer demand kicks off downstream recessionary activity. Should this come to fruition, investors well diversified in precious metals and other assets less vulnerable to market cycle risk may fare better than those who aren’t.

Get started investing in precious metals today with one of America’s top-ranked gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24