What Is Capital Preservation? Examples of Capital Preservation Portfolios + More (2021 Guide)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 06:32 pm

If you come into a sudden windfall, cash settlement, or inheritance, you might find yourself with a lot of money sitting unexpectedly in your bank account. For most of us, this is an electrifying experience. But after the “Look at all this money” stage of the honeymoon phase, you’ll be left needing to figure out how to preserve all that capital in a volatile market.

After all, nearly 70 percent of windfalls end up in bankruptcy within only a few years. This underscores the importance of capital preservation if you want life-long wealth.

Capital preservation investors aren’t as concerned with growth as much as preventing losses. Even for regular retirement investors without a windfall, capital preservation strategies are essential for keeping one’s wealth throughout their lifetime.

Whether you’re a lottery winner, trust fund beneficiary, a settlement claimant, or even just a soon-to-be retiree, learning the essentials of capital preservation is vital for your financial success. Below, I’ve put together a short guide to the fundamentals of capital preservation.

Table of Contents

What Is Capital Preservation?

Capital preservation is a catch-all term for describing conservative, risk-averse investing strategies designed to protect one’s wealth through recessionary periods in financial markets. A good wealth preservation strategy protects one’s money and assets from market swings, bear markets, inflation, third-party seizure, and financial risk.

Naturally, investment portfolios of this kind primarily seek exposure in the lowest-risk assets, safe short-term certificates (e.g., Treasuries, CDs), and even cash. However, well-diversified capital preservation portfolios often include alternative assets such as:

- Real estate

- Precious metals

- Annuities

- Stablecoins

- U.S. Savings Bonds

- State and federal bonds

It should go without saying, however, that a true wealth preservation fund should be invested in majority low-risk or virtually risk-free assets with low yields. At the same time, there is certainly room for growth in a capital preservation portfolio that many investors overlook.

Do Capital Preservation Portfolios Yield a 0% Return?

Not necessarily, although many do. For extremely risk-conscious investors, it may be preferable to manage a fixed-income portfolio that generates 0% returns, or even less than 0% after accounting for inflation. This is seen as preferential compared to exposing your wealth to risk in the equities market.

To illustrate what a capital preservation portfolio might look like in practice, I’ve provided two model portfolios that follow capital preservation strategies. The first is highly conservative and assumes little to no risk, whereas the second assumes some risk while also allowing for growth potential.

Capital Preservation: Conservative Portfolio

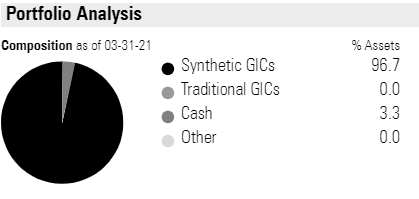

The following capital preservation portfolio takes a decidedly conservative position, as exemplified by its highly weighted holdings in guaranteed investment certificates (GICs) and cash reserves. These allocations are oriented more toward stability and wealth protection than earning competitive yields.

Investments of this type are considered to be extremely low-risk and essentially guaranteed to generate a small return. They act like a savings account in which you leave your money for a defined period of time, usually between several months and up to 5 or 6 years. Upon expiration, your deposit is returned from the borrower in addition to the accumulated interest.

Source: Morningstar Inc.

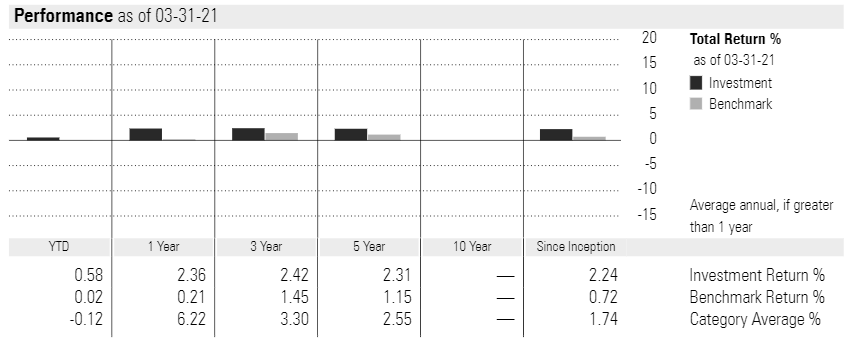

By necessity, little risk entails little potential reward. The performance record of this fund, which charges a 0.10% expense ratio, doesn’t keep pace with inflation. As depicted in the chart below, its 5-year return sits at 2.31% and its all-time best 3-month return is 0.63% (March-May 2019).

Source: Morningstar Inc.

For reference, the average annualized inflation rate in the US since 1960 is about 3.1%. Therefore, on average, the money in this portfolio loses about 0.8% of its value year over year after adjusting for inflation. Still, this outcome may be preferable to potential greater losses in a more risky portfolio, or to losing 3% annually to inflation outright if it were exclusively in cash.

Capital Preservation: Moderate Growth Portfolio

While providing a conservative approach, a negative yield (in real terms) may be a turn-off for investors looking for moderate growth. For many, simultaneous growth and wealth preservation are equally important investment objectives in a capital preservation fund.

There are a variety of alternative assets (e.g., not simple stocks or bonds) that have, historically, performed well based on their average annual return (AAR). These assets include, but aren’t limited to, the following:

- Real estate and REITs: 10.5% AAR

- Gold bullion: 10.6% AAR over 10 years

- Silver bullion: 3.7% AAR since 1915

- Long-term U.S. federal bonds: 5-6% AAR

- Tax liens

- Annuities and secondary-market annuities

In a portfolio containing some combination of the above assets, preservation of capital isn’t the sole concern. Although it is risk averse, there is still room for meaningful capital appreciation in the long term as demonstrated by their competitive AARs.

In other words, a moderate growth portfolio dedicated to capital preservation could resemble the following allocation that satisfies both risk management and growth objectives:

- 50%: Synthetic and Traditional GICs

- 15%: Real estate and REITs

- 25%: Precious metals (i.e., gold and silver bullion)

- 10%: Bonds, tax liens, and annuities

The assets allocated above have historically formed well in the market, and they do not share the same type of financial risk. By diversifying across them, investors can preserve capital while also allowing for a modicum of growth. Of course, past performance is not an indicator of future results. Always exercise due diligence before making any investment decision.

The Role of Gold and Precious Metals in Capital Preservation

When holding cash in a capital preservation fund, you assume significant inflation risk. If left unhedged, your cash will gradually devalue by approximately 3.1% every year—the average annual rates of inflation over the past 60 years.

For example, a $1 million cash deposit will only have about $737,000 in purchasing power relative to the year it was deposited after 10 years. If you want to preserve your capital, holding cash or cash-like assets in the long-term might be inadvisable.

Fortunately, gold and silver may have unique inflation-hedging properties that could make them excellent resources for investors looking to preserve their wealth over time. Gold has historically excelled during periods of inflation or deflation, which is when the stock market typically contracts. Therefore, gold serves a dual function as an inflation hedge and a diversification tool against stock market overexposure.

However, there is some evidence that government bonds can serve the same result in a portfolio with lesser risk, albeit with lower upside potential for growth.

Offshore Strategies for Ultra-High Net Worth Individuals

Some wealthy investors choose to enter into complicated tax and legal arrangements to avoid taxation, seizure, or forfeiture. For example, there are Cooks Island asset protection trusts in which, as long as your assets—on paper, anyway—are held within them, they are untouchable to foreign entities and interests.

Notable ultra-wealthy individuals such as Russia’s Dmitry Rybolovlev, infomercial salesman Kevin Trudeau, and Facebook founder Eduardo Saverin have all employed capital management strategies similar to these to avoid liabilities they would otherwise owe.

Is this an advisable strategy? Well, that’s for you, your lawyer, and your financial advisor to ascertain. However, this is a common and perfectly legal wealth preservation strategy for high net worth individuals looking to minimize one’s tax or settlement obligations and therefore should be noted in the conversation regarding capital preservation.

Get Started With Capital Preservation Investing Today

Being a capital preservation investor starts with simple diversification and by managing your exposure to risky and highly liquid securities. For many, gold and silver bullion are an excellent solution thanks to their inflation-hedging properties. To preserve more of your wealth, and to potentially enjoy competitive returns, consider diversifying with gold or silver in a tax-advantaged retirement savings account.

When it comes to capital preservation, you won’t want to take any chances with a less-than-reputable precious metals custodian. To get started finding the right vendor for you, check out our list of the most trusted gold IRA companies today.

The information provided here is not investment, tax or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24