- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Delinquencies for SubPrime Credit Cards and Auto Loans Skyrocketing

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 27th February 2020, 02:53 pm

This past week you saw discouraging news emerge from the subprime borrowing markets. The most recent data release from the Federal Reserve showed that credit card delinquencies (over 30 days late payments) from the 4,500 banks under the top 100 largest roared to 7.05 percent during the fourth quarter in 2019. This new high in the statistic represented the greatest rate of delinquencies for the sector dating back to the 1980s. When combined with the delinquency rate for the top 100 largest bank credit cards, the total delinquency rate reached 2.7 percent, the highest amount since the year 2012. Combined with the data released the week before on rising auto loan delinquencies, this is alarming news for the United States' economy.

Smaller Banks Are Exposed the Most to Sub-Prime Credit Borrowers

It is essential to comprehend the way that the credit markets work in order to understand the major discrepancies between the various credit card delinquency rates. The largest banks are able to issue their credit cards to the borrowers with the best credit scores. These individuals have larger incomes and excellent credit histories.

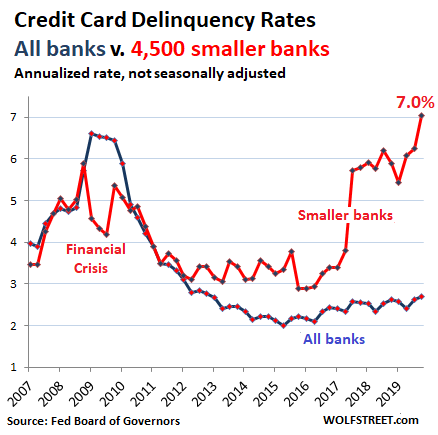

Subprime borrowers and their credit needs remain for the smaller banks. These banks must assume a larger amount of credit risk in order to increase their portfolio size. It means that the credit card delinquency rates for the smaller banks are usually higher, as the chart below clearly demonstrates:

As you can see, there is considerably more risk to offering credit to the category of subprime borrowers. The rewards are also greater potentially though. Subprime borrower interest rates can be as high as from 25 to 30 percent.

The smaller banks may write down a larger amount of such credit card loans, but they generally are still profitable thanks to the higher interest rates that they can charge. The banks have also figured out how to reduce their level of risk by packaging up these subprime credit card loans as securities backed by assets. Lenders were busy doing this (with Mortgage Backed Securities or MBS) with the subprime mortgages until they largely caused the Global Financial Crisis back in 2008.

Significant Auto Delinquencies Also Reach Record Levels

The auto delinquency rates have also been rising to new records in recent months. According to economist Jonathan Smoke and Equifax data, all-time high delinquency rates for auto loans during November and December showed that a greater number of consumers will get behind on their car payments for the months of January and February. This will likely cause car lenders to reduce the amount of credit that they issue to subprime borrowers for 2020, Smoke warned.

Consider that the data for November showed the severe delinquency rate on car loans set a new all time high of 5.48 percent. These are the category of loans that were at least 60 days past due. This most recent delinquency rate was even greater than the highest one notched in the Great Recession over a decade ago. Smoke cautioned that:

“When November is bad, it's guaranteed that December, January, and February are going to be worse.”

As Smoke suggested above, the December data in fact did come in worse. This severe delinquency rate for subprime autos reached 5.52 percent. November and December's new records eclipsed the prior all time high of 5.37 percent severe delinquency rate set back in January of 2009. Smoke is now forecasting that the severe delinquency category in car loans could reach 5.78 percent for February. This would be 38 basis points higher than the February figures in 2019. Smoke warned that:

“The new peak this year would mean more than 55,000 more subprime auto loans would be in severe default status compared to last year. We are likely to see lenders be more restrictive in some ways like no longer lengthening terms, but the real challenge is just how high consumers can go with the rates before the payments no longer work.”

Auto loan delinquencies are just another sign that all is not as well in the U.S. economy as many pundits would have you to believe.

Both Credit Card and Auto Delinquencies Are Warning Signs for the Economy

This new record high in the delinquency rates of subprime credit cards and car loans reveals significant problems in the lower end of the U.S. economy. This is all the more worrying because it is occurring while the economy as a whole is supposed to be expanding significantly (according to GDP and unemployment figures). Remember that after the 2008 crash, the delinquencies in car loans and credit cards skyrocketed because more than 10 million Americans had been laid off and could no longer make minimum monthly payments. WolfStreet remarked on this, with:

“But these are the good times – with the unemployment rate near historic lows. And yet, there are these skyrocketing delinquency rates in the subprime subset of credit cards and auto loans. It means these people are working, and they're falling behind [on] their debts.”

Total consumer debt has set staggering new record highs. When only credit card debt is considered, Americans have balances of around $1.1 trillion. Yet borrowing has slowed over the past few months (including peak Christmas shopping time). It is a potential sign that consumers are finally financially exhausted. These growing delinquency rates in both subprime markets are a significant warning sign of upcoming problems in the overall economy.

Bifurcation in the Economy Means Many Americans Are Not Doing Well

It has been the continued consumer spending that pushed GDP growth the past few years. This has been funded by the better off 40 percent of wage earners. The bottom 60 percent of earners have suffered from an actual stagnation in their wages. Inflation has also been hurting Americans with lower incomes. Prices are rising regardless of what the official CPI claims. It has been borrowing that has powered the so-called spending spree, primarily in credit card and car loans. Today you are witnessing the troubling decline of these markets at their outer margins.

WolfStreet calls this phenomenon the “bifurcation” of the economy. The top income earners are faring well still, thanks to artificially lower interest rates and higher trending stock prices. Yet as WolfStreet claims:

“There are other consumers whose incomes have not budged much – maybe it went up in line with CPI, but CPI doesn't reflect actual price increases of cars and homes and other items. Everything big they're trying to buy or rent or use has soared in price – new and used vehicles, housing, healthcare, education, etc. And those consumers, though they're working hard, are getting squeezed. That's the bifurcation. These are the people that are strung out. They have jobs but are living from paycheck to paycheck, and not because they're splurging but because, at their level of the economy, prices of basic goods and services have run away from them.”

Unfortunately the news this week regarding record high delinquencies in credit card and car loans is not good for the upcoming prospects of the U.S. economy. The need to diversify your investment and retirement portfolios is a good reason why gold makes sense in an IRA. One way you can do this is by considering the Top 5 gold coins for investors for your retirement account. Before you do anything, you should read more about Gold IRA allocation strategies and Top Gold IRA Companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68