American Household Debt Sets Staggering New Record

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 17th February 2020, 01:34 pm

This past week the news emerged from the Fed's Quarterly Report on Household Debt and Credit that U.S. total household debt has set another staggering record. The debt level hit $14.15 trillion after rising another $193 billion (1.4 percent higher) during the fourth quarter of last year 2019. Most alarming was a conclusion of this report that all household debt has now reached $1.5 trillion more than at the height of the last bubble ($12.68 trillion during 2008's third quarter).

All Categories of Household Debt Rise

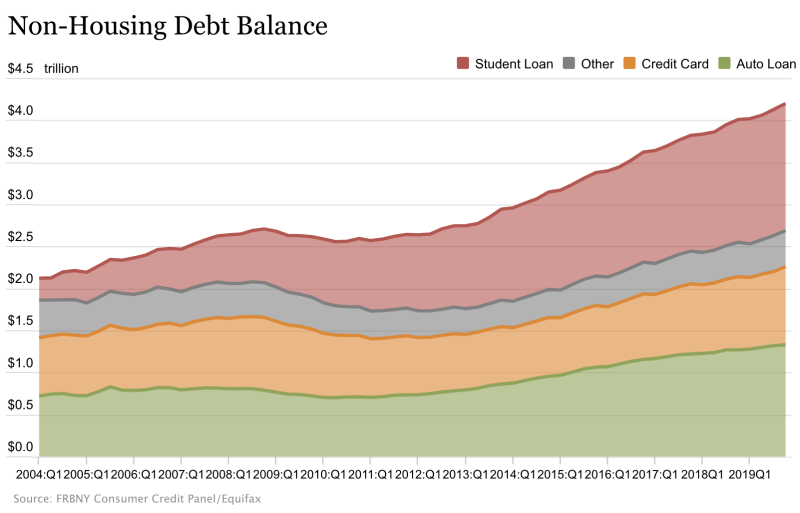

This increase in American household debt was the 22nd quarterly increase in a row. Mortgage and housing balances led the categories by growing $120 billion to finish 2019 at $9.56 trillion. Other categories also rose significantly though. The non-mortgage balances rose by $79 billion to reach an all-time high of $4.2 trillion for the fourth quarter. This quarterly rise was comprised of growth amounting to $46 billion worth of new credit card balances, $16 billion in car loans, and $10 billion worth of additional student loans. The chart below shows the non-mortgage debt growth breakdown:

The debt increase across all categories is alarming, but student loans continue to show the highest default rates.

American Borrowers Struggling Under their Debt Load

Senior Vice President Wilbert Van Der Klaauw of the New York Fed warned that this data revealed:

“that transitions into delinquency among credit card borrowers have steadily risen since 2016, notably among younger borrowers.”

Student loans in the past year may have only risen $51 billion (comparatively low to many years), yet the borrowers continue to struggle under the burden of their debts. Student loans continue to show the highest percentages of seriously derogatory or severely delinquent outstanding balances.

Student Loan Defaults Continue to Rise

One analysis of American metro areas shows how student loan defaults continue to rise. The student loan borrowers across 59 different metro areas experienced increases in their student loan balances. Four of these areas reported increases that were double digits. The borrowers from Harrisburg, Pennsylvania suffered the largest increases in these student loan balances over the year 2019.

Borrowers in Harrisburg had increases in their student loan balances amounting to 11.9 percent from an average $22,408 up to $25,081. The second worse metro area for student loan increases was Des Moines, Iowa that saw 11.3 percent growth in the balances from the previous year's $21,894 up to $24,374 for 2019. Across the country, the student loan balance of the average borrower amounted to $23,089 at year's end, up two percent from $22,763 at the beginning of the first quarter. Research Manager Kali McFadden of LendingTree revealed to Yahoo Finance that student loan:

“Borrowing across the board has dropped dramatically. But because of the [income-based] repayment programs or deferments… you could definitely see that your interest outpaces your monthly payments. That is a big reason why some of these numbers went up.”

The Department of Education's data from year 2018 reveals a disturbing statistic. Almost 30 percent of these student loan borrowers were not making repayments. Instead, they were either delinquent on payments, defaulting on loans, or in deferment or forbearance. Even though fewer individuals were taking student loans, interest rates surpassing payment amounts caused balances to increase all the same.

There were a few metro areas that actually saw a decline in student loan balances due to technical factors. Winston-Salem, North Carolina student loan borrowers experienced a 12.6 percent drop in their total loan balances to $22,578 from $25,830. Student loan borrowers from Springfield, Massachusetts also had a decline of 10.5 percent to $17,382 from $19,419.

McFadden addressed these anomalies, stating that several reasons explained the significant student loan debt declines. These included individuals moving out of the area and demographic shifts. In college towns like Winston-Salem, graduates mostly go home or move somewhere else to seek out employment opportunities.

Fed Chairman Claims Economy Is Fine But Admits to Pursuing Extraordinary Monetary Policy

Despite the ballooning total household debts across America, Federal Reserve Chairman Jerome Powell told Congress this past week in his congressional committee testimony that “There is nothing about the economy that is out of kilter or imbalanced.”

While Powell was talking about how strong he believes the economy is, he did make an honest admission that the U.S. central bank has already begun to pursue extraordinary monetary policy. More alarming still, Powell confessed that the Federal Reserve could lack enough firepower to battle a future recession. In his testimony, he admitted that:

The present low interest rates environment “means that it would be important for fiscal policy to support the economy if it weakens.”

Fiscal policy equates to government stimulus. Bloomberg called this statement from Powell:

“an unusual appeal by the head of a politically independent institution that is used to combat economic contractions on its own.”

This begs the question of how Chairman Powell will be able to move the federal government to help fight the next recession when he is already enmeshed in extraordinary policies before a recession breaks out. Consider that the federal government is also already engaging in stimulus typical in recessions. The budget deficit is forecast to surpass one trillion dollars for fiscal year 2020, something that has previously occurred only four times and all in the wake of the 2008 Global Financial Crisis. It means that the only way the government will be able to support a weakening economy is with more borrowing, something that poses a significant risk to the economy.

The next recession will also require the Federal Reserve to engage in still more debt monetization. Powell shared in his Senate Banking Committee testimony that the central bank possesses two main tools to battle a recession. The debt monetizing is when the Fed purchases government bonds in what has become known as QE quantitative easing. The other tool is to cut interest rates, what Powell called “forward guidance.”

Powell Admits He Lacks Room to Cut Interest Rates

Powell stated that all options will be on the table when the next recession hits, with:

“We will use those tools – I believe we will use them aggressively should the need arise to do so… We will have less room to cut.”

Powell admitted that there is little room left for slashing interest rates aggressively. Before the 2008 crisis, interest rates stood at over five percent. Today they are at a mere 1.5 percent. Rates are so low because the Federal Reserve has already slashed interest rates. Just last year they cut rates three separate times, all without the country entering a recession.

Powell dismissed one idea that the central bank could potentially fund the federal government directly with, “That's really an untested and not widely supported perspective.” Yet this is precisely what quantitative easing does using a roundabout means. CFA Daniel Amerman explained that:

“The Federal Reserve is doing what no responsible central bank is supposed to do, and effectively funding the growth in the debt at well below free market interest rates via monetary creation on a massive scale— without admitting that it is doing so… This is all about funding the fast growing national debt at lower rates than what rational investors would accept in a free market, and the repo crisis was a symptom of that problem, not the cause.”

The Federal Reserve has been forced to inject billions of dollars in liquidity to the repo markets for months now. Some indications are that these repo operations will not ever be fully stopped. Unfortunately, the news this week about record high household debt and a Fed that is already being forced to pursue extraordinary policy measures in a non-recession economy is not good. It does help to explain why gold makes sense in an IRA. You can learn more on diversifying your retirement holdings by reading about Gold IRA allocation strategies and Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,727.53

Gold: $2,727.53

Silver: $33.49

Silver: $33.49

Platinum: $1,014.28

Platinum: $1,014.28

Palladium: $1,136.33

Palladium: $1,136.33

Bitcoin: $67,743.12

Bitcoin: $67,743.12

Ethereum: $2,495.34

Ethereum: $2,495.34