- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

CBO Warns Rising National Debt A Significant Risk to American Economy

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week the Congressional Budget Office released its latest projections on the U.S. Budget and Economic Outlook. News from the report was discouraging. The CBO projected that the federal government will amass huge budget deficits for the near to medium term future. They warned that the rising national debt load threatens “significant risk” for the financial system and economy.

Federal Budget Deficit Will Surpass Trillion Dollars This Fiscal Year and Rise

The CBO updated its figures for the federal budget deficit to show where it is headed through 2030. The government's financial watchdog revealed that this budget shortfall in FY 2020 will touch $1.02 trillion and then continue to rise for the foreseeable future. They project that the annual deficits will run an average $1.3 trillion each year from 2021 through 2030. Their forecast calls for higher than $1.5 trillion in annual deficits by the conclusion of the decade. At this rate, the CBO forecasts that the total deficits for the coming decade will amount to $13.1 trillion.

The news is significant because the federal budget deficit has only surpassed a trillion dollars on four occasions in American history. Each of these instances occurred after the 2008 Global Financial Crisis. Yet the new report reveals that forecast deficits will increase from today's 4.6 percent of GDP (for 2020) to a more alarming 5.4 percent in 2030. According to the CBO:

“Other than a six year period during and immediately after World War II, the deficit over the past century has not exceeded 4.0 percent for more than five consecutive years. And during the past 50 years, deficits have averaged 1.5 percent of GDP when the economy was relatively strong (as it is now).”

The CBO perspective shows that the dangerously high deficits are not sustainable for the future.

National Debt to Top $34 Trillion by 2030

These new projections from the CBO reveal a troubling total national debt amount for the near future. The country's debt will top $34.4 trillion by the year 2030. That portion of debt which the public holds amounts to approximately 81 percent of the country's GDP for 2020. The CBO forecasts that this will rise to 98 percent in 2030. When the CBO looks out into the next few decades, the numbers become much bleaker.

Consider that in February of 2019, the country's debt surpassed $22 trillion for the first time. As U.S. President Trump came into the White House back in January of 2017, this debt figure stood at $19.95 trillion. The difference shows that borrowing has increased by $2.06 trillion in only two years. Yet the pace of borrowing is continuing to accelerate. In only two months of the past summer, the U.S. Treasury had to borrow $800 billion.

Even though economic growth today is considered to be comparatively healthy by the CBO, the federal government will still incur an enormous budget deficit for the year. This is against a backdrop of CBO forecast 2.2 percent GDP growth for the present fiscal year (thanks to still-stronger consumer spending).

CBO Could Be Underestimating Effects and Overestimating Growth

It is important to realize that the CBO could be underestimating the effects of the government's spending and overestimating economic growth over the next decade as well. Their projections are generally more conservative and do not allow for any alterations to the present day tax and spending laws. Consider that the CBO's current deficit projection for 2020 has increased by $8 billion since the August estimate that they released.

Their assumptions assume that the deficits will continue to be huge (by historical comparison). In this assessment, the federal debt will rise to 98 percent of total GDP in (or before) 2030. They have the U.S. economy growing at a 1.7 percent average yearly rate over the period of 2021 to 2030.

For these projections to work, it would require that consumers can continue to spend. Signs of weakness in the American consumer's spending abilities are already appearing. They have maintained the economy by spending (borrowed money against the future) on credit. Consumer debt has set a few all-time high records several months in 2019. This debt rise has started to slow down, possibly warning that Americans are nearing their limits. If this is the case, then the CBO could easily have overestimated the country's economic growth potential.

Economic Expansion Periods Should See Lower Deficits

The budget deficits that the government is running are far more typical of what you would witness in substantial economic slowdowns. In 2009, you saw the deficit peak (so far) at $1.4 trillion with the government pursuing extraordinary emergency policies to handle the 2008 Global Financial Crisis. Now the government is nearing these deficit amounts once again while the country is in the midst of economic expansion that the administration has called the “greatest economy in the history of America.”

When the economy is growing, typically the government is able to reduce its social program spending even as tax revenues rise from greater economic activity. While government revenues have expanded in the past year, they have not been able to keep up with the rise in federal government spending.

Look at the initial three months of the present fiscal year as an example. In this period, the deficit roared higher to reach $356.6 billion. It represented a full 11.8 percent rise from the prior year same period. It only took the federal government one quarter to burn through $1.16 trillion.

The spending during those initial three months for the fiscal year 2020 has risen by 6.5 percent versus the same months in fiscal year 2019. Yet the CBO forecasts spending rising substantially higher over this decade. They anticipate that the federal outlays will increase from today's $4.6 trillion to $7.5 trillion for 2030.

CBO Sees Significant Risks to Economy

Shocking numbers aside, the CBO is concerned about what these figures mean for the future of the U.S. economy. They report that this anticipated debt increase threatens:

“significant risks to the fiscal and economic outlook, although those risks are not currently apparent in financial markets.”

The CBO sees two substantial ways that the increasing deficits may impact the economy. First, the mounting debt would decrease economic output in time. Second, the increasing debt-related interest costs will cause the government to have to make higher interest payments to international holders of the debt (like China and Japan). The CBO states that this will lower the U.S. household income in increasing amounts.

Projections Beyond 2030 Are Even More Dire

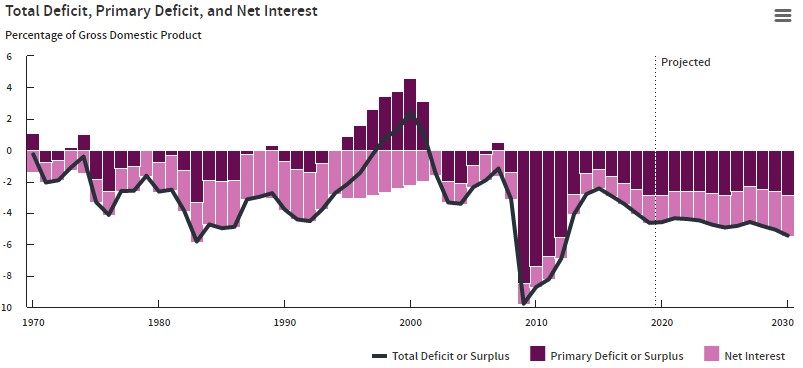

These projections through 2030 are bad enough. The CBO has the forecast deficits rising from a high 4.6 percent of total gross domestic product now to reach 5.4 percent come 2030. This chart below puts the dangerous levels in perspective:

As mentioned before, this will have the public debt total rise from 81 percent now to 98 percent in 2030. It is bad enough that the debt to GDP will touch its highest levels since 1946 at the end of this decade. The projections beyond 2030 are far more dire. The CBO shows the federal debt increasing to 180 percent of GDP on or before 2050. This would be by far the greatest level it has ever reached.

Runaway Federal Spending Calls for Retirement Portfolio Diversification

The CBO is warning you that the United States government's fiscal picture is rapidly deteriorating. This rising spending trend can not be sustained. Imagine what the deficits will look like in the next recession when the federal government is racking up over $1 trillion deficits today in a period of sustained growth.

This week's federal spending warning reminds why gold makes sense in an IRA. Diversifying your retirement portfolio can help to protect it against the government's irresponsible financial decisions. One way to do this is with IRA-approved precious metals. You can read about Gold IRA Rules and Regulations and Top Gold IRA companies to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68