- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Currency and Trade Battle Lines Being Drawn as Germany Strikes Back

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 29th December 2020, 12:51 am

A new transatlantic rivalry replaced the traditional cross ocean alliance this past week as the still-new American President Donald Trump accused the European Union and especially Germany of manipulating their currency to keep it artificially depressed against the U.S. dollar.

Germany refused to take the new criticism of their beloved European integration project quietly. Both Premier Merkel and the German finance minister responded to these attacks in an effort to deflect opening salvos in what looks increasingly like a trade war even between the U.S. and its traditional allies in Europe.

Meanwhile, sandwiched uncomfortably in between the two now-rival trading powers, Britain continued to grapple with the international Brexit debate and found an unlikely sympathizing supporter in the German finance minister.

As banking troubles continue to crop up throughout the developed world, Germany's Deutsche Bank ran afoul of regulatory agencies and suffered yet another steep fine for its misconduct over recent years. The bank is responding by cutting staff dramatically across its European and global operations. This is no time to reduce your exposure to the ultimate safe haven of IRA approved gold.

President Trump Accuses the European Union of Currency Manipulation

President Trump turned his critical eye towards long-time American allies Europe and Japan this past week, giving China a sure to be short-lived break. Tuesday he accused Japan of playing “the devaluation market and we sit there like a bunch of dummies.” In Europe, his attacks on Germany, the European Union, and the Euro this past week raised concerns about the American commitment to supporting the multi-decade trans-Atlantic defensive and economic alliance.

The administration has been attempting to pick off the various countries of the European Union at a point when they are politically most vulnerable and divided. EU President Donald Tusk went so far as to list the new United States' policies along with the rise of Chinese Power, Russian aggression, and global terrorism as the main sources for worldwide instability. President Tusk claimed in his letter to fellow European leaders ahead of their February 3 EU summit:

“The change in Washington puts the European Union in a difficult situation, with the new administration seeming to put into question the last 70 years of American foreign policy.”

This is not the first time Germany has been attacked for its economic policies within the EU. The International Monetary Fund and various renowned economists such as long-time former Federal Reserve chairman Ben Bernanke have accused Germany of running a huge trade imbalance, enriching themselves at the expense of their Southern European neighbors and other global trading partners.

The German government has responded that it is their superior exporting and competitive power which causes the the imbalance. President Trump is not buying this explanation. He has told various European newspapers only days ahead of his inauguration that the European Union represents “basically a vehicle for Germany.” He subsequently forecast the future demise of the world's largest trading block as other countries follow the Brexit leave vote example of Britain within the next 18 months.

EU Superpower Germany Responds to Manipulation Charges

Naturally Germany disagrees with this point of view and assault on their pet project the EU common market and euro single currency. She refused the suggestion that Germany is “gaming the foreign exchange markets” even as the EU leaders huddled in the fortress-island nation Malta on February 3 to devise their defensive counter-strategy.

Premier Merkel argued the exchange rate of the largest trading block belongs to the fully autonomous European Central Bank, which the German government has long supported for its complete policy independence. Merkel argued:

“We won't exercise any influence over the European Central Bank, so I can't and I don't want to change the situation as it is now. We strive to trade on the global market with competitive products in fair trade with all others.”

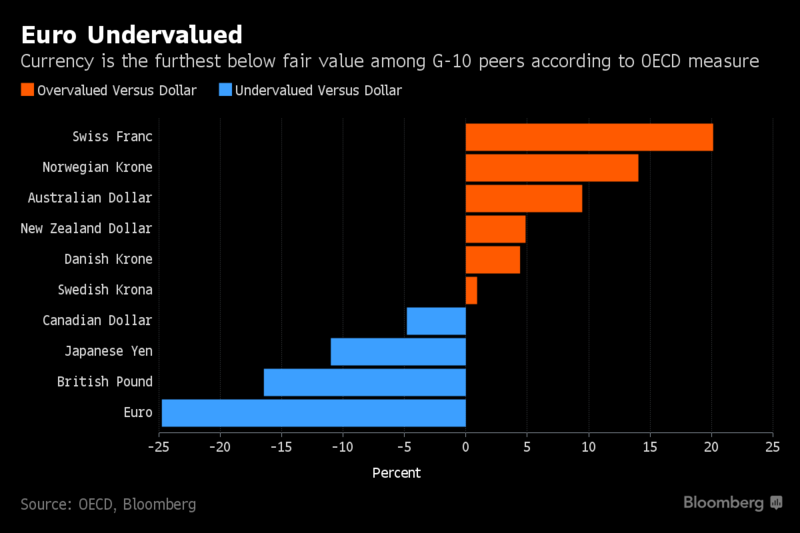

Meanwhile Germany's Finance Minister Wolfgang Schauble has attempted to deflect criticism of the high euro value from Germany and onto the backs of the ECB. In response to Trump's leading trade advisor Peter Navvaro arguing that the currency of the Eurozone members is “grossly undervalued,” Schauble responded:

“The euro exchange rate is, strictly speaking, too low for the German economy's competitive position. When ECB chief Mario Draghi embarked on the expansive monetary policy, I told him he would drive up Germany's export surplus… I promised then not to publicly criticize this course. But then I don't want to be criticized for the consequences of this policy.”

A great number of analysts and commentators have supported Trump's trade pointman Navarro and his perspective on the value of the euro being too low for the biggest economy Germany.

Brexit Debate Escalates as Prime Minister May Finds An Unlikely Supporter in Germany

At the same time as the cross Atlantic currency barbs were being exchanged, Prime Minister May found an unlikely ally in her continuing struggle at home and abroad to bring all parties on board with next month's long delayed British triggering of Article 50 to leave the EU officially. German Finance Minister Wolfgang Schauble has softened his tone and approach (since his hawkish comments against Brexit last November), breaking ranks with a number of European Union leaders who have put down the British for their decision in past months.

The standard line has been that the United Kingdom would not receive a better deal for existing outside the common market than within it. Schauble asserted this past week that the City of London delivers real advantages to Europe in the world of finance which are worth keeping available to the single market with his statement:

“We don't want to punish the British for their decision. We want to keep Britain close to us. London offers a quality of financial services that are not to be found on the continent. That would change a bit after a separation, but we have to find reasonable rules here with Britain.”

When Schauble was questioned a year ago by the Director General of the British Chamber of Commerce what he would do if the U.K. left the European Union, he replied, “We will cry.”

Deutsche Bank's Global Troubles Continue to Mount as It Announces Layoffs

Largest German-based bank Deutsche Bank never seems to reach the end of its financial and legal woes. On top of its other penalties it has agreed to with the U.S. regulators amounting to over $7 billion, it has now been fined another 560 million British pounds sterling (approximately $700 million) by the combined American and British authorities for its supposed money laundering operation in Russia.

The Department of Financial Services for New York stated the scheme revolved around what are known as mirror trades that facilitated the moving of $10 billion outside of Russia. Per Mario Vullo, Superintendent of the DFS:

“This Russian mirror-trading scheme occurred while the bank was on clear notice of serious and widespread compliance issues dating back a decade. It is obvious, though, that the scheme could have facilitated capital flight, tax evasion, or other potentially illegal objectives.”

The Deutsche Bank operatives involved with this practice disguised it very cleverly. Wealthy clients would purchase stock using rubles in Moscow. Shortly thereafter associated parties sold these exact stocks using the London branch of Deutsche Bank. The $2 million to $3 million trades then would be cleared by the New York branch of Deutsche Bank, where the clients paid in U.S. dollars.

Deutsche Bank argues these and other billions in fines are not the reason they are now massively cutting trading staff. Regardless, they are laying off as many as 17 percent of their global staff of the equities division and six percent of their fixed income division personnel. By eliminating 9,000 high paying staff jobs, they will “raise profitability.” This is Deutsche bank-speak for cover the enormous fines without having to sell off any more assets. It is only one of the many reasons that gold makes sense in your IRA.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81