- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Italian Referendum Threatens Euro Future As Britain Risks Losing Single Market Access

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

The old spectre of a Eurozone breakup resurfaced this past week as the Italian constitutional referendum final polls show the vote heading to a sounding rejection and the country leaping towards a dangerous leadership crisis. Britain also received disturbing news from the top Eurozone finance minister that the country will lose access to the single market after withdrawing from the European Union next year. With all of this as a backdrop, the ECB President Mario Draghi pledged to continue the quantitative easing in the Eurozone until inflation becomes a durable presence. Repeated geopolitical dangers throughout the world continue to argue strongly the case for holding on to your gold holdings.

Italian Constitutional Reform Referendum Looks Set for Defeat Putting Euro in Danger

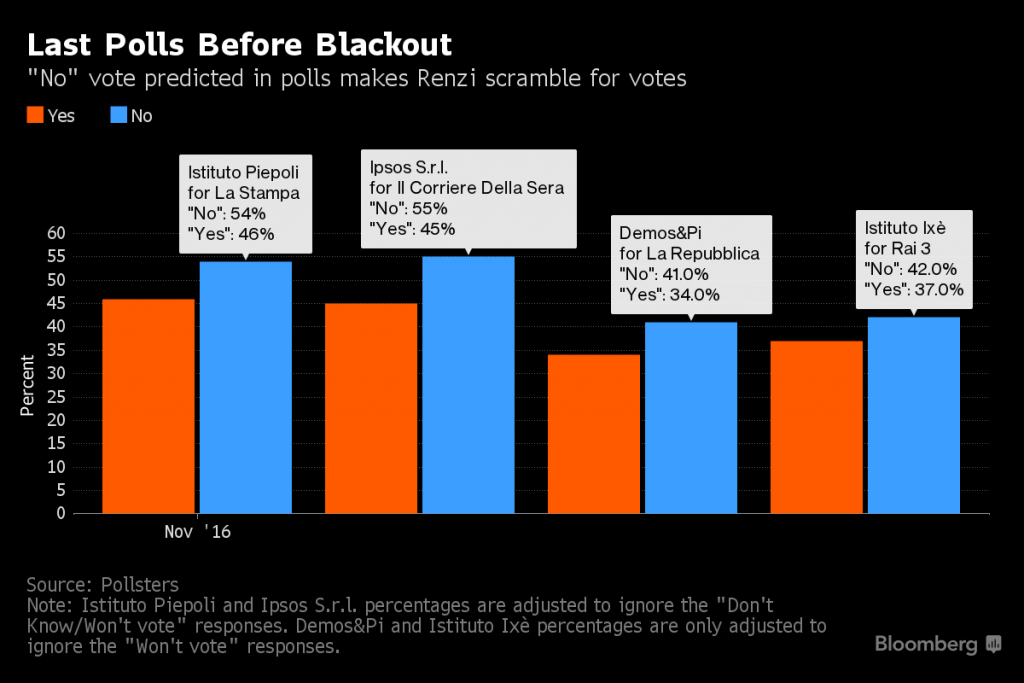

The final public opinion polls' results from Italy's looming referendum in early December are out, and they reveal an Italian electorate ready to vote down the critical constitutional reforms. A final four polls released Friday demonstrated that the “No” campaign has a substantial lead, in the continuation of a trend that has been growing for a few weeks now. This is a critical moment for Italy as Prime Minister Matteo Renzi has pledged that he will resign if the voters turn down his referendum reforms to simplify the decision making process of the Italian government. Look at the chart below to see how bleak things look for him with the poll blackout beginning:

The results of this December 4th vote matter significantly more than just the prime minister's political future. The effects of a “no” vote in the Italian referendum are actually a great deal more worrisome for Europe than they are for Italy, per analysts. They believe an upsetting no vote would be a continuation of the recent march of populist revolts against the governing status quo as demonstrated in Brexit and Donald Trump's shock U.S. election victory. The 32 various opinion polls which 11 different pollsters have published during the last four weeks all show the “no” campaign enjoying a solid lead, usually by a growing amount, per Reuters.

The Berenberg Bank Chief Economist Holger Schmieding stated that the risks associated with Italy's referendum make it an even greater political event than Brexit for Europe. “For me, this is the biggest political risk for the eurozone this year … Less the referendum and more the tail risk,” he said. “If the aftermath of a ‘no' victory results in an early election, in which parties propose a referendum of leaving the euro then this is much more of a problem, there will be serious contagion effects for the whole of the euro zone,” Schmieding added.

The Five Star Movement of Italy has campaigned hard against reform to the constitution and stands to gain the most from being on the winning side of the early December vote. Renzi will likely honor his promise to resign if and when he loses the referendum. The Five Star Movement is looking to utilize this substantial momentum it would garner from victory in the referendum to tip Prime Minister Renzi's Democratic Party out of power in the next elections, which would likely be forced for the early spring.

Strain on Italian Bonds Shows Italy Can Not Afford Another Shock

The risk of one of the principal three economies in the Eurozone withdrawing from the shared single currency is considerable. Besides setting a dangerous precedent, it would also mean the size of the economic union would diminish for the first time in its history. This political uncertainty is extremely perilous for Italian banks and markets as well. The strains are already showing in the Italian markets. Fathom Consulting Economist Florian Baier has warned that the nation's still fragile banking industry can not afford yet another economic shock. Italy's bonds are sounding the alarm as well. They were leaders in the global bond rout that transpired last Monday. As a result, Italy's yields on its 10 year bonds soared to their loftiest peaks for more than a year.

UK Likely to Be Shut Out of Common Market After Leaving EU

Britain continues to wrestle with a way to withdraw from the European Union without losing the all important access of its businesses and banks to the single market. This past week, the top finance minister for the EU reiterated his stance that the U.K. leaving the European Union will translate to British companies dealing from the outside of the single continental market. This has crushed what hopes remained that the British corporations could still enjoy unfettered access to the Union after completing their Brexit. “If you choose to leave the EU, you basically choose to be outside the single market. Once you are no longer part of the club, you don't get the perks,” Eurogroup President Jeroen Dijsselbloem said while at a London conference of Swiss bank UBS.

Dijsselbloem has also warned the British not to delay with concluding their final plans for the exit, since the longer amount of time the uncertainty continues the more perilous the economic scenario will become. Everyone acknowledges that free movement of people and trade are the two stickiest points in the Brexit negotiations with the EU. This is because the officials of the European Union insist that Britain can not hold on to full, free access to the single market while restricting the free movement of people.

EU QE to Continue Until Inflation Pickup Becomes Durable

In light of the various problems that are threatening the European Union, it should not come as a great surprise that European Central Bank President Mario Draghi remains committed to continuing quantitative easing in the block. He is extremely concerned about how heavily the European economies depend on loose monetary policy to stay afloat. Draghi stated at the Frankfurt European Banking Congress that the recovery in prices has been primarily accomplished by the inexpensive financing environment which the ECB remains committed to with its continuing accommodative monetary policy. This policy has been in place since January 2015 and would expire without an expected extension in March 2017.

President Draghi noted that, “Despite the uplift to prices provided by the gradual closing of the output gap, a sustained adjustment in the path of inflation still relies on the continuation of the current, unprecedented financing conditions. It is for this reason that we remain committed to preserving the very substantial degree of monetary accommodation, which is necessary to secure a sustained convergence of inflation towards levels below, but close to, 2 percent over the medium term.” Draghi has highlighted three principal risks to Eurozone growth going forward as the profitability of banks, geopolitics, and weakness in inflation. Gold remains your best protection against these dangers in Europe and beyond.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81