- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

World Economic Forum Reveals Growing Pessimism As IMF Cuts Growth Forecast

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This past week saw the world financial, business, and technological elites and global powerbrokers meet in Davos, Switzerland for the 50th annual World Economic Forum week. The mood at the annual gathering was less than optimistic though. Just as the financial titans were gathering, the IMF cut global growth forecasts ahead of the meetings' start.

Executives who gathered expressed concern in their outlook for global business based on a number of other challenges, including trade tensions and questions concerning the future of capitalism. It has taken all of two years time for the global chief executives to go from an all-time high level of optimism to a record level of pessimism at this week's meeting, per a survey released by PwC at the beginning of the week.

IMF Cuts Global Growth Forecast As Davos Begins

This past Monday, the IMF unveiled its most recent World Economic Outlook update for January. In this report, the International Monetary Fund cut its estimate for global growth in 2020 by .1 percent (from the last October release) down to 3.3 percent. The IMF stated that the global economic slowdown has started to ease but that recovery will continue to be slow going into this year. The economic news was a bad way to start the WEF week, setting the darker tone a day ahead of the business and political leaders' gathering at the World Economic Forum held in Davos, Switzerland for half a century now.

Kristalina Georgieva the IMF's managing director presented the downward revised numbers at the global conference. She managed to find a silver lining in the report, stating that:

“After a synchronized slowdown in 2019, we expect a moderate pickup in global growth this year and next.”

Yet despite her claims of positive developments in global industrial output and international trade, the IMF managing director warned that the 2020 world economic growth forecast is vulnerable. Threats include recent escalated tensions between Iran and the United States, the continuing trade war pitting Beijing and Washington against each other, and political protests continuing in many nations. Georgieva cautioned that:

“We are all adjusting to live with the new normal of higher uncertainty. We are already seeing some tentative signs of stabilization but we have not reached a turning point yet.”

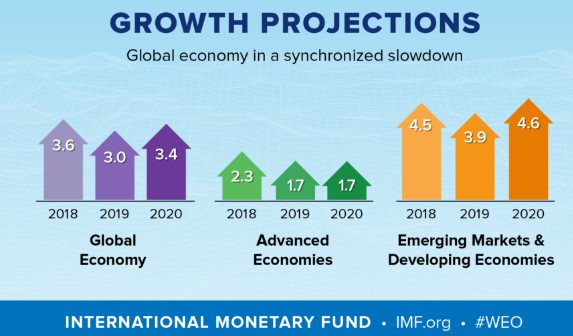

This chart below shows the IMF's pessimistic outlook for the major global economies from their prior report (before they revised it down in this week's report):

Growth in India Slow While U.S.-China Trade War Remains Unresolved

Two particular economic concerns were at the forefront of the IMF warning. In order for the projections to materialize, the IMF counts on their not being any “further escalation” of the still unresolved trade war between China and the U.S. Last week, United States' President Donald Trump inked a deal with China to reduce short term tension, but it did not remove the existing tariffs on fully two-thirds of goods imported from China into the U.S. Georgieva from the IMF had remarked that this “trade truce is not the same as trade peace.” The IMF's quarterly report officially warned that any future:

“Policy missteps at this stage would further enfeeble an already weak global economy.”

The second concern from the IMF is a forecast slowdown in economic giant India. The IMF stated that this has led to a significant drag on growth for the world. They attribute the major share of the downward revisions to the slowdown in India. According to the IMF, India is wrestling with falling investments and consumption alongside high budget deficits and delays to much needed structural reforms.

Surveys of Business Leaders Reveal Economic Pessimism Increasing

The chief executives from around the world came to the World Economic Forum already discouraged. The traditional PwC survey from the beginning of the week showed that the point at Davos two years ago where record high optimism characterized the business leaders has now swung to a new record of pessimism. Two of the concerns weighing on executives' minds should also be a warning to you as a retirement investor. These include the rise of anti-capitalist sentiment around the U.S. and world as well as the unresolved problems hanging over the U.S. and China.

Rise of Anti-Capitalist Sentiment Troubling

This major increase in sentiment against capitalism and what the gathered leaders at Davos could do about it stood high on the list of top executives' worries at the conference. A number of them made the case for reforming capitalism to bring in a greater and broader number of stakeholders than only financial investors who have been top priority.

An anecdote from one of the private Davos' dinners illustrates the challenges facing capitalism today. Forty top-level executives had to answer if they still believed in the 1970 theory from economist Milton Friedman that a corporation's sole responsibility lay with its shareholders. Not one executive raised a hand. Instead, the executives concurred that they must take serious action to avoid having company employees and customers become mistrustful of the corporate pledges for sustainability. Chief Executive Julie Sweet of Accenture stated that:

“We need to go from vision to execution to tangible action and we need to do it fast.”

The chairman of Tata Sons in India agreed that this requires a “sense of urgency.” Yet despite the positive tone and rhetoric, sceptics have expressed doubts that any of this will occur. While the attitudes among CEO's have transformed, this is unlikely to lead to actual change as Maurice Levy of Publicis opined.

Outlook for Global Economy Seen As Uncertain Even as Liquidity Is Everywhere

Another troubling sign is that executives and investors believe that growth can only be sustained with the help of low interest rates from major world central banks. Chief Executive Officer Anne Richards of Fidelity International argued this sentiment with:

“A flip of petrol on the fire (from central banks) can get things going. Nobody should bet against central banks.”

The Davos elite were also willing to concede that this attitude has caused the prices of investments to rise to levels that are not easily justified by the core fundamentals. A widespread belief at the week was that there will be a reckoning that comes due for this in upcoming years. It is especially the case as the world has been flooded with liquidity.

Longer Term Concerns Over U.S.-China Breakdown Remain

Many at Davos kept coming back to the risks of a more serious breakdown between the United States and China. Longer term problems have not been resolved in trade, strategic competition, or technology transfers, to name a few. Long time WPP Chief Executive Martin Sorrell (currently running S4 Capital) warned that:

“There is a very great sense of optimism about phase one but there is some worry about whether phase two will ever get signed.”

A last observation from Davos provides a warning. Executives were talking about growing sentiment that the proverbial party must come to an end. Yet according to a leading hedge fund investor at the event, “if the music is still playing, we need to dance.”

The economic news out of the IMF and World Economic Forum at Davos this week reminds you why gold makes sense in an IRA. Diversification of retirement assets can help to cushion against financial downturns. IRA-approved gold is one way to effectively diversify. You can read more to learn about Gold IRA allocation strategies and Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81