- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

While President Trump Meets with Chinese President, U.S. Missiles Strike Syrian Air Base

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 10th April 2017, 11:59 am

This past week, the world changed dramatically geopolitically. The highlight of the week had been anticipated to be the much-scrutinized U.S.- China Summit set for the end of the week. This meeting did go off smoothly and led to an agreement that seems poised to help with the Chinese-American trade imbalances which President Trump had promised to address.

Even as the summit meetings were beginning though, President Trump had ordered a major missile strike on a Syrian air base from which a devastating chemical weapons attack was launched against innocent civilians in the north of Syria. This step evoked admiration and support from traditional U.S. allies Great Britain and Israel and condemnation and threats of retaliation from typical American foes Russia and Iran.

By the end of the week, the news emerged that in the wake of the muscle flexing with Syria, the U.S. navy had ordered a major aircraft carrier strike group to relocate to the Korean Peninsula in an effort to tackle the rogue North Korean state issue as President Trump had promised last week before the summit with China began.

Everywhere you turn, you see signs of geopolitical instability and potential financial market black swans. IRA approved silver and gold are the hedges and insurance that your investment and retirement accounts need to survive the potential armed conflicts. Now is the time to consider the precious metals allowed in an IRA.

President Trump and Chinese President Xi Summit Goes Smoothly

After Chinese President Xi Jinping's closely watched stopover in Finland (as part of China's pivot to the EU), he arrived in Florida at President Trump's Mar-a-lago Resort in Palm Beach for the first in-person meetings with new U.S. President Donald Trump.

The two presidents struck an amicable tone, sidestepped any potentially upsetting political posturing or mistakes, and also focused on a plan to work on the trade imbalances which exist between the United States and China. Britain's Financial Times reported that China agreed to trade concessions to provide the U.S. with improved access to two of its key markets.

The first of these will be investments in the financial sector of China. The second will be with U.S. beef exports to China. President Xi agreed to this in an effort to head off a President Trump-threatened trade war with China's largest trade partner. These are the first two steps in a bigger picture “100 day plan” on which the two leaders and their negotiating teams are still working out the details.

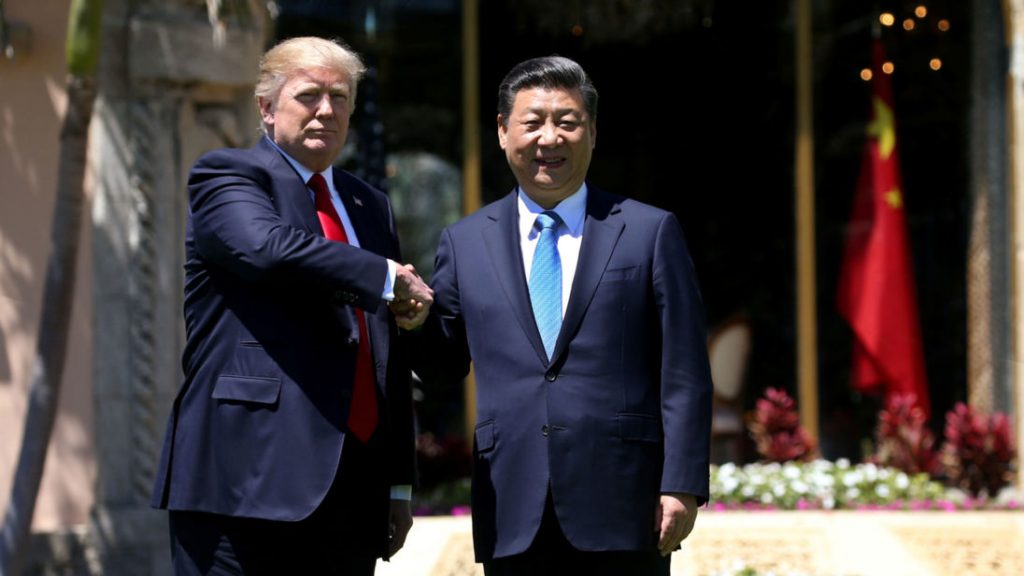

Presidents Trump and Xi Photo Courtesy of REUTERS/Carlos Barria

Presidents Trump and Xi Photo Courtesy of REUTERS/Carlos Barria

While the Chinese-American summit clearly highlighted the tensions between the two leading economies of the world on trade issues, analysts and economists stated that the meetings were successful for both sides as they stayed calm and cordial while moving towards addressing the trade imbalance by China promising to boost American imports into their country. High Frequency Economics Chief Economist Carl Weinberg wrote:

“This is the ‘good' way to close the bilateral trade grap. U.S. consumers' access to less expensive imported goods will be unaffected, but incremental jobs will be created by incremental production.”

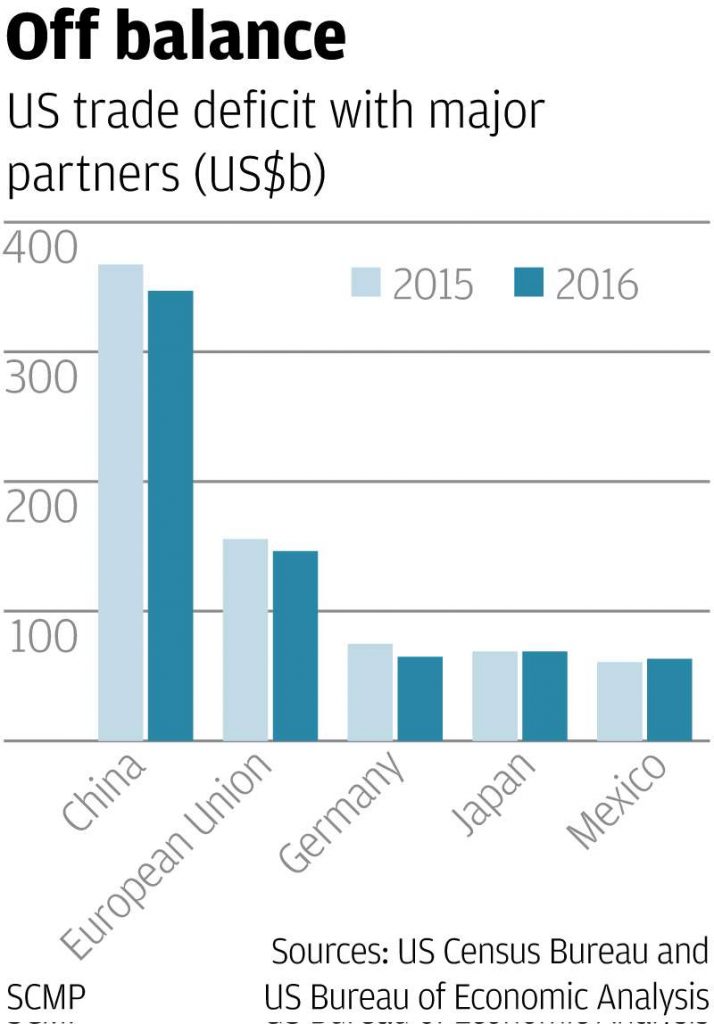

The eye watering trade deficit the U.S. runs with China of over $300 billion (as shown in the chart above) has given President Trump ammunition in his argument that China does not play fair in trade. China had maintained that U.S. consumers were benefitting because they received less expensive goods from China and more foreign investment in America from the Chinese.

The successful summit has put the imminent trade war threats on hold for now. U.S. Secretary of Commerce Wilbur Ross still warned:

“If we don't get some tangible results within the first 100 days, I think we'll have to examine whether it's worthwhile continuing them.”

The U.S. Department of Commerce announced it is undergoing a U.S. trade deficit review on a product by product level. This will be released at the end of June. Still, the meeting went well enough with sufficient positive results for President Trump to receive and accept President Xi's invitation to come visit China later in the year. President Trump reminded everyone that while an “outstanding” relationship had begun to develop with President Xi:

“Goodwill and friendship were formed, but only time will tell on trade.”

U.S. Missiles Strike Syria, Drawing Both International Praise and Condemnation

Despite the fact that the meeting with China was considered to be a success, it was massively overshadowed by the U.S. naval missile strike against the air base in Syria from which the Syrian government planes had taken off to drop chemical weapons on civilian men, women, and children alike.

Shortly after the meeting between the U.S. and China ended, the Chinese state-controlled media was quick to insult President Trump for the missile strike he ordered on Syria even as the diplomatic summit was underway. Xinhua scolded the U.S. president, calling the strike on Syria the actions of a weakened politician who was merely trying to flex his muscles while convincingly showing he was not tied to Russia, long time ally of the Syrian regime.

The J.P. Morgan Chief Asian and Emerging Markets Equity Strategist and Managing Director Adrian Mowat opined:

“Clearly what the Syrian situation does is illustrate that the Trump administration is willing to use force.”

Naturally Russia and Iran, long time rivals and foes of the United States respectively criticized and condemned the strike, even offering thinly veiled threats of retaliation for the unilateral attack on Syria. Other nations who are friendlier to the United States and its leadership role in the world were quick to praise the retaliation against the use of chemical weapons on innocent women and children.

Prime Minister Theresa May's office said that the government of the United Kingdom fully supported the American response to Syrian President Bashar Assad's violation of international laws regarding the use of chemical weapons. Israeli Prime Minister Benjamin Netanyahu similarly praised the American action.

Still many were surprised by the attack on a country that candidate Trump once tweeted about, “we should stay the hell out of Syria.” Strategists and analysts are warning there could be more American involvement in Syria thanks to the continued U.S. presence in the Middle East near Syria. Think tank President Richard Fontaine of The Center for a New American Security observed:

“Since the missile strike, the U.S. has continued to fly sorties over Syrian airspace. They have been flying F22s, the most advanced fighters you can put in that airspace, to make sure the Syrians don't respond by turning on their air defense systems or the Russians don't retaliate.”

This new development in the Middle East bears close watching, as it could have a major impact on the markets and assets within your investment and retirement portfolios.

American Aircraft Carrier Group Steaming to the Korean Peninsula in Effort to Deter North Korean Nuclear Progress and Missile Launches

In another escalation against the rogue regimes and states of the world, the U.S. navy dispatched a full aircraft carrier strike group to the Korean peninsula over the weekend. This came in response to the March 6th four missiles launch to the Sea of Japan, the March 22nd failed launch of a ballistic missile, and the April 5th successful ballistic missile test launch the day before the President Trump and Xi summit.

The rising threat against Japan, South Korea, and the United States abroad was prominent on the agenda between the U.S. and China at the summit. President Trump has threatened to deal with North Korea by any means necessary. The administration demanded a massive change in the U.S.' policy towards North Korea.

This informed the navy's decision to send the U.S.S. Carl Vinson Carrier Strike Group closer to the outlaw regime's territory. Officially, the U.S. Pacific Command said their intention was merely to maintain their presence and readiness in the region. Analysts and observers called it a measure destined to escalate the tension in the theater.

CEO Stephen Yates of DC International Advisory claimed, “After the strikes on Syria, this is seen largely as another demonstration effect.”

In fact North Korea is using these incidents of the impending carrier group arrival and the missile strikes on Syria as more arguments for why it must acquire nuclear weapons. The pariah state, a long time ally of Syria, called the strike against Syria “ever more reckless moves for a war.”

The nuclear threats from North Korea are the most sobering reminder of all that is going on in the world today. Gold makes sense in an IRA. Now before one starts is the time to remember that gold outperforms traditional asset classes during market crisis periods.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68