What is a Crypto IRA? (2021 Updated Guide)

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 16th September 2021, 07:09 pm

An individual retirement account (IRA) that contains cryptocurrency, such as Bitcoin or Ethereum, is commonly referred to as a “crypto IRA”. These kinds of investment accounts provide deep diversification benefits for investors looking to spread their wealth beyond stocks, bonds, and mutual funds. Plus, they provide a vital hedge against market instability.

In today’s economic climate, it’s wise to diversify your holdings across a broad array of asset classes. Today, 14% of the U.S. population (and counting) now owns some amount of cryptocurrency in their investment portfolio. This should come as no surprise, given the explosive growth of the crypto sector over the past few years.

Interested in learning more about a crypto IRA? Look no further. In this short guide, we’ll cover everything you need to know about Bitcoin IRAs and other cryptocurrency IRAs so you can make an informed investment decision.

Table of Contents

What Is A Crypto IRA or a Bitcoin IRA?

A crypto IRA is any tax-advantaged IRA account that contains cryptocurrency. These accounts, however, are not limited to cryptocurrency, and often also include conventional assets such as stocks, bonds, ETFs, and mutual funds.

In most cases, crypto IRAs are concentrated in Bitcoin, but also other non-Bitcoin cryptocurrencies (a.k.a “altcoin”) are equally eligible for inclusion. Technically, even a portfolio that’s mostly invested in stocks and mutual funds can be considered a “crypto IRA” if it holds any portion of cryptocurrency at all.

Typically, crypto IRAs must be self-directed investment accounts. These account types usually aren’t offered by brokerage firms like Vanguard or Charles Schwab. Brokerages tend to place heavyhanded restrictions on the kinds of assets you can invest in, such as cryptocurrencies. Therefore, you have to contact a crypto IRA provider to inquire about opening an account in which you can invest in a wide variety of cryptocurrencies.

Benefits of Bitcoin Investing for Retirement

Traditionally, Bitcoin and other digital currencies were viewed as a “high-risk, high-reward” asset class. As such, it was rarely promoted by brokerages and often the subject of criticism and caution from professional asset managers. However, these days Bitcoin is becoming increasingly adopted by the investing public as an invaluable diversifier for any portfolio.

Don’t believe us? Below, we’ve listed some of the top benefits of owning a crypto IRA account for retirement investors, all backed by relevant statistics and data points.

- Save on 20% Capital Gains Tax: IRS Notice 2014-21 indicates that cryptocurrencies are treated as an investment property for federal tax purposes. However, Bitcoin and altcoins (e.g., Ethereum, Ripple, Litcoin, etc.) are free from capital gains taxes when held within a Roth IRA.

- Bitcoin Volatility is Stabilizing: As of mid-August 2021, the 30-day Bitcoin Volatility Index (BVI) is 3.33%; in December 2013, the BVI sat at 12.9% and in April 2020 it was 9.39%, thereby indicating that Bitcoin prices are gradually stabilizing.

- Diversification Outside the Stock Market: The price of Bitcoin has an extremely weak correlation with the U.S. stock market (+0.29 with the S&P 500). Therefore, investors with holdings primarily in stocks could find a safe haven in Bitcoin if the equities market goes down.

- Lower Transaction Fees: If crypto IRA account holders want to take an early distribution and send funds overseas or to a foreign receipt, the relative costs of a cryptocurrency transaction are much lower than wire transfers. Plus, they don’t encompass any currency conversion costs.

Crypto Roth IRA vs. Traditional IRA

There are two main types of IRAs that can hold cryptocurrencies: Roth IRAs and traditional IRAs. The latter is composed of funds that haven’t yet been taxed (i.e., pre-tax) and the former of after-tax funds. This is the most important difference between them since they result in vastly different tax implications during one’s retirement.

In the case of Roth IRAs, since they’re already taxed, the account holder does not owe any taxes when they withdraw funds in their retirement. However, withdrawn funds are considered taxable ordinary income for traditional IRA holders even after they’ve reached retirement age.

Although they’re very similar investment vehicles, Roth and traditional IRAs offer different tax benefits. Roth IRAs allow your cryptocurrency to accrue value on a tax-free basis, whereas traditional IRAs permit tax-deferred growth (i.e., gains are taxed upon withdrawal).

Which Should I Choose: Roth Crypto IRA or Traditional?

Usually, the choice between a Roth and Traditional IRA is an easy one. If you expect to be in a higher marginal tax bracket during your retirement, it makes sense to choose a Roth IRA. Conversely, if you expect to be in a lower tax bracket when you eventually withdraw funds, it would make more sense to select a traditional IRA.

Generally, younger investors who are early in their careers are better off with a Roth IRA. Those with lower incomes have lower relative tax liabilities and would therefore benefit from paying tax now, while their tax bracket is low, than paying later at a higher rate.

The opposite is true of older investors at the peaks of their careers. If you’ve already maximized your earning potential, it would likely make sense to opt for a traditional IRA since you would probably be knocked into a lower tax bracket during your retirement.

How Can I Invest in Cryptocurrency in an IRA?

Unfortunately, traditional brokerage firms that offer IRA, 401(k), and 403(b) plans do not permit many types of cryptocurrencies in their accounts. Although some brokerages are warming up to cryptocurrency tokens with large market capitalizations (e.g., Bitcoin and Ethereum), they prohibit investments in many smaller cryptocurrencies.

Investors who want full freedom over the kinds of cryptocurrencies they can invest in should contact a crypto IRA company about opening a self-directed account.

Dedicated cryptocurrency IRA companies specialize in unrestricted IRAs, which allow account holders to invest in a wide variety of alternative assets. These include more than just cryptocurrencies, and generally permit investments in, but aren’t limited to, the following:

- Physical precious metals (i.e., gold, silver, platinum)

- Paper-backed gold (i.e. mining and exploration stocks and ETFs)

- Hedge fund securities

- Annuities and secondary market annuities

- Certificates of Deposit (CDs)

- Tax liens

- Cryptocurrency tokens and ETFs

Most traditional brokerages prohibit investors from including the assets listed above in one’s IRA, or any other tax-advantaged account for that matter. Therefore, if you want full exposure to the cryptocurrency asset class, you must open a self-directed IRA with full complete checkbook control.

The Risks of Cryptocurrency IRA Investing

All asset classes encompass risk—otherwise, there would be no potential upside for generating a return. However, nascent investment types such as digital currencies carry more risk than other, more conventional types of assets like stocks or bonds.

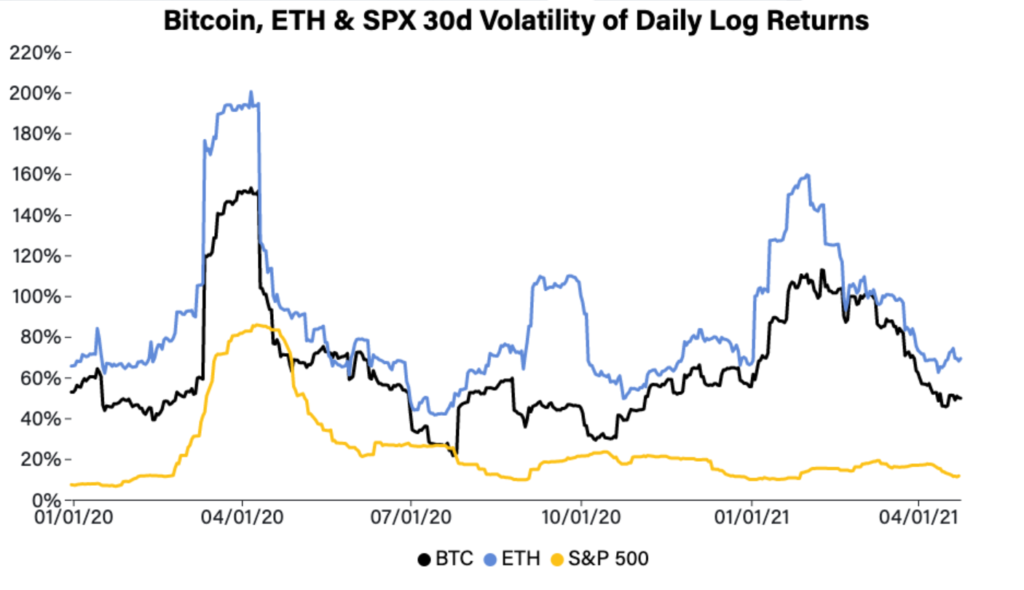

As mentioned previously, the Bitcoin Volatility Index has been declining over time, thereby indicating that Bitcoin’s price is gradually stabilizing. While this is true, investors must still be mindful of the crypto market’s large and unpredictable price movements. The relative volatility of Bitcoin (BTC) and Ether (ETH), the two largest cryptocurrencies by market cap, is depicted in the graph below (Fig. 1) against the S&P 500.

Fig. 1., Source: Coindesk

In mid-July 2021, the price of Bitcoin bottomed out at a level about 50% lower than its peak during the previous April. Although Bitcoin’s decline in price still represented a net gain since January of that same year, this serves as yet another case in point that Bitcoin—and the crypto market more broadly—still suffers from severe price volatility.

As a rule, never invest more than you can afford to lose. This is especially true of cryptocurrency investing. Many investors find that diversifying one’s portfolio with a small portion of one’s wealth in cryptocurrency is more beneficial than holding the majority of one’s wealth in crypto.

Funding a Bitcoin or Crypto IRA

If you choose to invest in cryptocurrency via an IRA, the process of funding an account is relatively straightforward. After applying for a self-directed Roth or traditional IRA through a reputable cryptocurrency IRA company, you can choose to fund the account via one of three ways:

- Direct Cash Transfer: Transferring cash from the account holder’s bank to the third-party custodian, which is then used to purchase assets held within the account.

- Custodian-to-Custodian Transfer: A “hands-off” exchange between one’s current IRA brokerage and the new crypto IRA custodian, requiring no intervention by the account holder.

- IRA Rollover: Withdrawing a portion of one’s current IRA holdings and depositing it into one’s new self-directed IRA, a process subject to strict rollover rules and regulations per the IRS.

In most cases, a direct IRA transfer is the best means of funding a crypto IRA because it minimizes the possibility of error and is generally the most efficient.

Get Started Today: Open a Self-Directed Crypto IRA

If you’re ready to diversify with cryptocurrencies in your IRA, you can get started by applying for a crypto IRA account. The process is simple, and you can have your account opened and fully funded within a matter of days. Your first step is to choose a trusted cryptocurrency IRA company, and contact them about opening a self-directed account.

The information contained in this article does not constitute financial advice. Always speak with a qualified financial advisor about your personal circumstance before making an investment decision.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $117,538.42

Bitcoin: $117,538.42

Ethereum: $3,591.21

Ethereum: $3,591.21