- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

What Do the Russians Know That No One Else Does?

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2019, 02:51 pm

Last week, the Central Bank of Russia was out trumpeting their latest acquisition of assets. They bought yet another 31.1 tons in gold for February, raising their full national reserves up to 2,149 tons. It is safe to say that the Russians continue buying gold in an effort to reduce their exposure to U.S. debt and dollars.

You should take an example from the Russians who are far savvier than people give them credit for in this activity. They know that the days of the global dominance of the dollar are swiftly coming to a close. This is why gold makes sense in an IRA. Today is the time to look into some popular IRA-approved gold. A good place to start is with the Top 5 Gold Coins for investors. You should not wait until it is too late.

The Gold Buying Central Bank Trend Continues to Gain Momentum

Fund Manager Ronald-Peter Stoeferle of Incrementum AG explained that this gold buying trend of central banks only grows stronger as the amount of American debt exposure and burden gets larger. He stated about Russia's situation that:

Russia's demand for gold is part of the whole de-dollarization story that continues to get stronger and stronger.”

What is interesting is that the U.S. government can no longer turn a blind eye to the rising trend. Long time gold analyst Jim Rickards issued a warning regarding the latest gold buying by the Russians, noting that:

“Washington is finally noticing.”

If the U.S. government has taken note of this global trend, then shouldn't you as well?

Russia (and China) Knows How To Reduce Dollar Exposure the Smart Way

While other global central banks are buying gold, the Russians have elevated the practice almost to a science. They have been steadily working down their dollar exposure during the past few years through selling off their once-considerable holdings of U.S. Treasuries and plowing the proceeds into gold bullion. For 2018 alone, the Russian gold hoard reserves grew by an impressive 274.3 tons.

This marked the fourth year in a row that their holdings experienced more than 200 tons growth for the year. In fact, Russia has achieved a milestone for last year. By February of 2018, Moscow had eclipsed Beijing to seize the coveted spot of fifth biggest gold reserves nation on earth.

The Russians have cunningly paired this gold spending spree with their divestiture of American government and dollar denominated debt. It only needed the spring of 2018 for Moscow to liquidate nearly its entire collection of U.S. Treasuries to global markets. Bank of America analysts estimate that the total of Russian held U.S. dollars plunged from 46 percent down to 22 percent last year alone.

Russians Not the Only Central Bank Buying Gold Nowadays

But though Russia deserves the spotlight it has gained, it is not the only superpower playing this dangerous (to the dollar) game. China also boosted its official total gold reserve holdings for their third consecutive month this February. A good number of analysts and market observers now conjecture that Beijing is also secretly building its stockpile of gold beyond its official reserve disclosures.

Other central banks have observed the Russians (and to a lesser degree the Chinese) and figure that they must know something. This has only encouraged these other central banks around the globe to increase their gold holdings as well. For 2018, the global central banks added an incredible 651.5 tons of gold to their hoards. In fact 2018 became the greatest year of net central bank gold purchasing since the U.S. suspended dollars into gold convertibility in 1971, according to the World Gold Council. This was also good enough to secure the second greatest yearly total ever.

For 2018, it came as no surprise that Russia acted as world leading purchaser for gold. Yet besides China, Turkey and Kazakhstan also acted as major buyers of the yellow metal. Even traditionally skeptical EU national central banks boosted their country's gold reserves in both Poland and Hungary.

The Russians have plenty of reasons to purchase gold these days. They know what CCN says about them:

“Gold is traditionally used to hedge against economic uncertainty. As sanctions fell into place and the screws tighten on other nations, the U.S. dollar loses power within the world economy.”

Maybe the Russians Realize the World Is Running Out of Mineable Gold

The Russians must realize something, piling into gold wholeheartedly as they have been for years now. It could be that they agree with global gold mining experts and executives that mankind has already unearthed the vast majority of the minable gold on earth. Just last year, Chairman Ian Telfer of Goldcorp warned that:

“We are at peak gold here.”

Similarly, Chairman Randall Oliphant of the World Gold Council declared at the Denver Gold Forum back in September of 2017 that the world had likely already passed that point. Others like Chairman Pierre Lassonde of Franco- Nevada have similarly declared that they anticipate significant declines in gold production over the next few years.

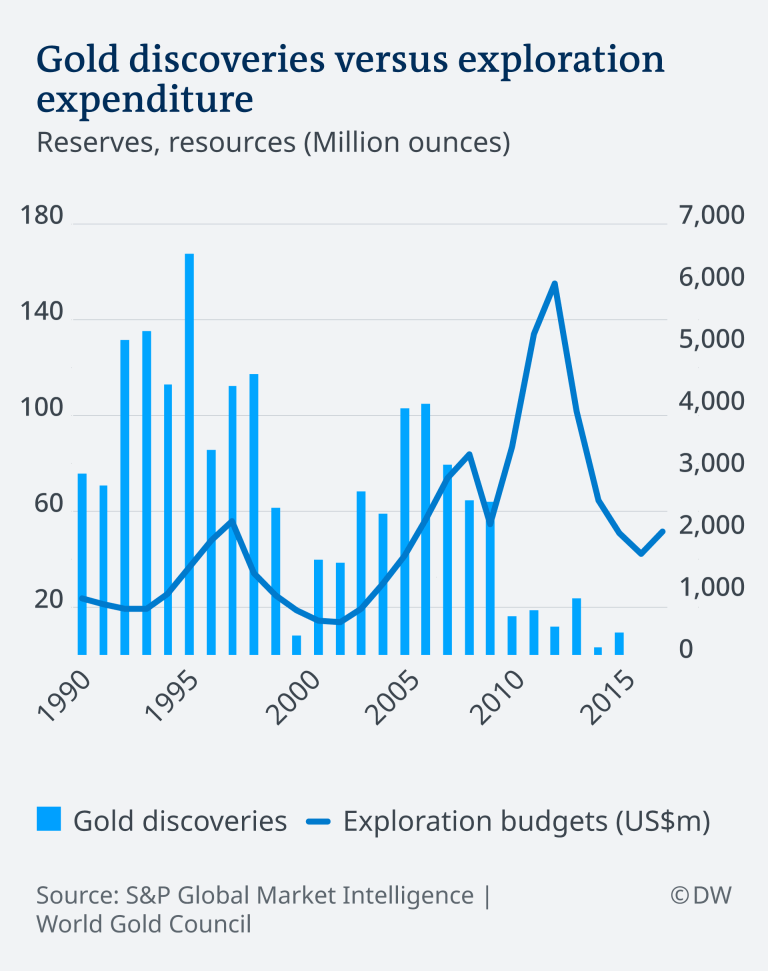

They are collectively referring to the concept of Peak Gold. This is the level where all gold taken from the planet will start decreasing each year. While the output from worldwide gold mines may have seen its tenth consecutive year of yearly growth for 2018, it continued to slow. And now, there has been a three decades long gold discovery decline when measuring new gold deposits found verses exploration funding (which actually increased during this time). This became worse from 2010 to 2013, when budgets for gold exploration skyrocketed yet the amounts of gold discoveries plunged. This chart reveals the situation all too clearly:

Research Analyst Matthew Miller of CFRA warned that gold miners simply can not keep their reserve growth at pace with production, with:

“The largest and most prolific reserves have already been found.”

This is not the only indicator showing gold production is in trouble either. New gold deposit quality finds continue to decline. According to analysts, there have barely been any world class gold deposits uncovered in years. These are the big deposits that contain more than five million ounces in gold reserves which can be turned into commercially viable mines producing more than 250,000 ounces in gold.

Dollar Free Payment Systems Represent Another Step Away from Greenbacks

The Russians and even U.S. allies the Europeans have been seeking another way to escape from global dollar domination besides selling Treasuries and buying gold too. They have done this through establishing alternative financial channels and payment systems which do not use the dollar in transactions. The Russians have constructed their alternative to SWIFT that has passed the American system in popular use in Russia already. The Russian Central Bank states that over 416 Russian firms and governmental organizations have already teamed up with this SPFS System for Transfer of Financial Messages back in September.

More worrying still is the fact that the Europeans are doing the same thing to get around revived U.S. sanctions on Iran. In September, the EU began working on plans to design their own specific payment system to facilitate their companies' trading with Iran.

The handwriting for the future of the dollar is clearly on the wall. The Russians just figured out the fate of the dollar ahead of everyone else. Now is the time to start buying gold incrementally in monthly installments. Today the IRS will even allow you to store your hoard in top offshore locations for storing IRA gold. You should start considering top Gold IRA companies and bullion dealers now too.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum