What Are Bearer Bonds? Everything You Need to Know in 2023

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 27th August 2024, 09:34 pm

What are bearer bonds? Bearer bonds are bonds issued by a government or corporation to raise capital. The bonds have a maturity date and an interest rate payment for the life of the bond. Basically, they are the same as registered bonds in structure, except that the owner of the bond is anonymous.

Table of Contents

What Are Bearer Bonds? Definition

Bearer bonds are defined as bonds issued by a corporation or government where the owner remains unregistered. These securities act in a similar fashion to banknotes, where the owner of a banknote is the person currently in possession of it.

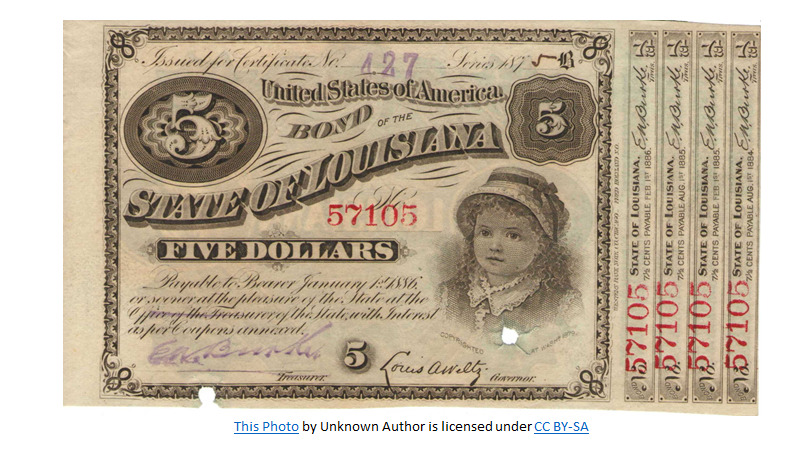

Bearer bonds come in paper format and are not registered electronically like they are nowadays. These bonds have coupons attached to them that give the bearer the right to redeem an interest payment.

The paper format creates complete anonymity for the bondholder. And for this reason, it is necessary to physically carry the paper coupon to a bank or broker to receive an interest payment.

The interest streams and the principal amount will be paid to the person presenting the paper bond on the appropriate coupon schedule and maturity dates. To receive your principal back and all interest payments you must have the relative piece of paper.

Are Bearer Bonds Still Available?

In the United States bearer bonds were phased out in the Tax Equity and Fiscal Responsibility (TEFRA) Act of 1982. Which was also America’s biggest tax hike in history. Among the various laws passed in the act, there was also a provision to forbid the further use of these bonds.

The last bearer bonds from the United States treasury have long since expired. It may still be possible there are bearer bonds from corporations, but it might prove difficult to redeem any money from them.

To further kill the use of bearer bonds, in 2010, the US government passed a law that removed the requirement for banks and brokers to process the coupons of bearer bonds. Previously the responsibility of redeeming interest payments was on banks and brokers.

If you do want to buy bearer bonds you would have to do so outside of the United States. Some Eurobonds are issued as bearer bonds and priced in a currency different from the issuing nation, corporate, or government.

As these bonds fall outside the jurisdiction of the United States you would be able to hold them in offshore accounts. Be aware you would also not be afforded the security offered by US authorities and are liable to possible fraud.

Why Were Bearer Bonds Prohibited?

Bearer bonds are still allowed and in use in some less developed countries. However, in the western world and the rest of developed nations bearer bonds have vanished from circulation. The main reasons for putting an end to them were safety and crime.

Bearer bonds were subject to theft and loss in the same way cash would be. That’s why people usually don’t carry around tens of thousands of dollars in cash with them. But a bearer bond could allow people to do just that.

In fact, a bear bond may have been for $1,000 or $5,000 a piece. So, within a very small space, it would have been possible to accumulate large amounts of wealth. That's fine when they stay in one place like a safe deposit box in a bank. But what about when you need to move them around?

Another concern of western governments was the financing of criminal activities. Clearly, bearer bonds opened up the door to money laundering schemes on a large scale. There was also the risk of tax evasion, and trafficking in illegal items using bearer bonds as payment.

What Can I Do with My Bearer Bonds?

If you still hold or found bearer bonds in your grandparent’s loft, you may try to approach the company that issued the bond. If the company no longer exists, it may have been bought by another firm.

In any case, it will be extremely difficult to get the company to pay your remittance. There may be complications with the IRS for the company and the bearer bondholder. It might be easier if the company and bearer bonds were issued abroad. In either case, if you do have bearer bonds consult a tax specialist before taking any action.

Conclusion

Bearer bonds belonged to a pre-digital era, although they were still around before the digitization of assets became widespread. The 1982 TEFRA act foresaw many changes to the US fiscal system, and bearer bonds were seen as an easy way for individuals to escape government control with their money.

In a way, it was like a paper cryptocurrency. Everyone and anyone could hold them, buy them, and exchange them for goods and cash anonymously. You could also use them as a store of wealth. While at the same time benefiting from the income stream of the coupon payments.

But, of course, governments do not like this kind of stuff, it’s called freedom. So, for the greater good, your safety, and to stop criminal activity, bearer bonds were abolished. And quite frankly, they haven't stopped with bearer bonds. But rather than continue on that note, we see how they are scrutinizing cryptocurrencies.

Again, they want to heavily regulate crypto in the US, although it seems to me they have done so already. The reason again is for your safety as an investor and to close down any way people can commit fraud. However, the benefits of cryptocurrencies reside in factors that transcend the simply financial.

You may not have access to bearer bonds but in times of inflation and recession the need for diversification becomes more impending. We always recommend adding alternative assets to your traditional portfolio of stocks and bonds.

Bottom Lime

When contemplating where you put your money you may want to consider retirement accounts such as IRAs. As any savvy investor knows, diversifying your portfolio is key to capital preservation. Think of adding gold and other precious metals. You can hold precious metals in a gold IRA. We have shortlisted the top gold IRA companies, you can read our reviews on them here.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24