- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Weak Manufacturing Numbers Sounding Warning on Economy

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 24th December 2019, 03:56 pm

This past week saw mixed data released on the state of the U.S. economy. The statistics on spending and personal income were positive enough to lead stocks higher. While talking heads were crowing about the “strong economy,” they were overlooking other important negative data that is sounding a warning on the economy. Yet another manufacturing number released was weak. The Kansas City manufacturing index saw its most dimal print in four years. This represented the sixth monthly decline in a row for the index.

Production Data Continues to Disappoint

The Kansas City manufacturing index is not alone in showing economic weakness. Looking deeper into this past week's final Q3 2019 GDP numbers revealed that the headline figure of unchaged at 2.1 percent is misleading. While government spending and consumer spending received positive revisions, net exports, home bulding, and inventory accumulation suffered from negative revisions. What the figures tell you is that the U.S. economy is still showing positive growth because of the consumer borrowing to spend money (hitting higher debt records in the process).

Euro Pacific Capital Group Economist Peter Schiff explained this phenomenon with:

“That really is par for the course. We get stronger economic data when it comes to people spending money, but we have weaker data when it comes to generating real production, real wealth, goods production, manufacturing — all that data comes out weaker than expected. Really, what the GDP numbers are confirming is what I've been saying all along — that this is a bubble economy; this is not legitimate economic growth. This is a bubble, because the only thing that is driving that 2.1 percent increase in GDP is consumers spending borrowed money and the government spending borrowed money.”

Money that is borrowed to spend today has to be paid back tomorrow.

Decade Without Recession Has Witnessed Extremely Low Growth

Even though there has not been a recession this decade, the economic growth has not shown an impressive average. Schiff points out that this has in fact been a decade with “extremely low growth.” There have been numerous decades where the country suffered through a recession and still showed a larger average GDP growth.

What is most striking is that the low growth occurred even when the interest rates throughout the past decade were the lowest of any 10 year period. Considering inflation numbers, the country's interest rates ended up being negative for many of the last 10 years.

Enormous Fiscal Stimulus To Prop Up Economy Has Created Huge Budget Deficits

Another troubling feature of the last decade is that it has required huge fiscal stimulus to keep the economy growing. Fiscal Year 2019 (concluded September 30th) finished the largest budget deficit in America for seven years. This budget shortfall came in slightly under a trillion dollars. The country is looking to surpass that figure for next fiscal year. The budget deficit for Fiscal Year 2020 came in at 12 percent larger than last year's for its first two months. It is rapidly approaching the trillion dollar level.

For November, the federal budget deficit amounted to $208.8 billion, per the Monthly Treasury Statement. This was already two percent higher than the deficit in November of 2018. The numbers are worse for FY 2020‘s first two months, coming in at $343.3 billion. This number is 12 percent higher than the same time frame in fiscal 2019.

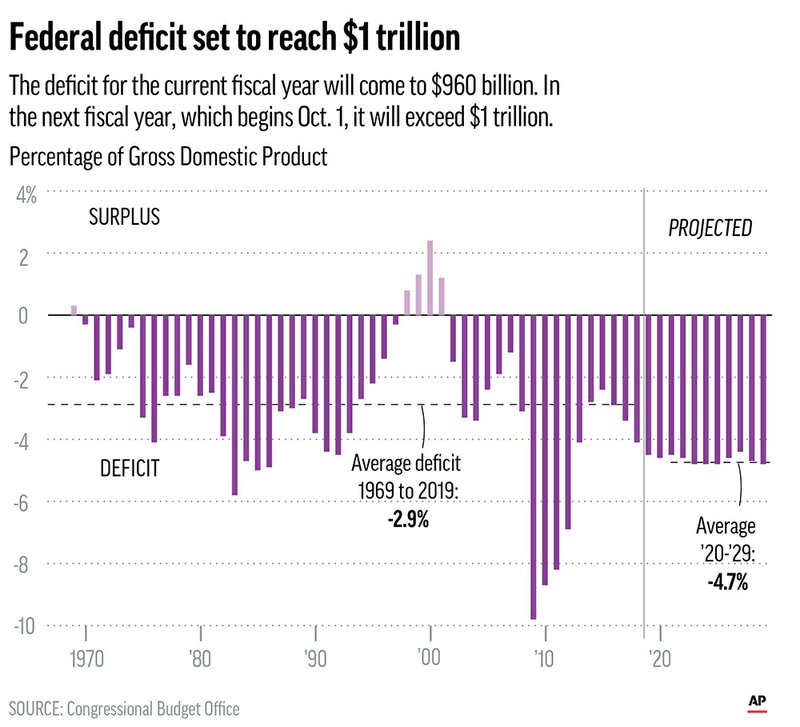

The total budget deficit in Fiscal Year 2019 was $984 billion. It represented 4.7 percent of the country's GDP and was the greatest such percentage dating back to 2012. More disturbing, this was the fourth year in a row where the deficit grew in its percentage of American GDP. Estimates have the debt to GDP ratio rising a shocking 26 percent versus last year. This chart below shows that the situation is not projected to improve over the coming decade either:

The Government is running deficits that will put it over $1 trillion in FY 2020. Keep in mind that the country has only surpassed trillion dollar deficits on four occasions. Each of these happened in the Great Recession and Global Financial Crisis. Even as the President hails the “greatest economy in the history of America,” the country is on track to add a trillion dollar deficit for a fifth time now.

The total debt of the country actually grew by $1.2 trillion in Fiscal Year 2019 the Treasury Department now reveals. This pushed the national debt to over $23 trillion. It was only last February that the debt surpassed $22 trillion. When President Trump entered office back in January of 2017, the debt stood at $19.95 trillion. In only two years time, the country has added another $2.06 trillion to the debt. The borrowing pace is only accelerating now too.

Greenspan Warns Rising Deficit Will Cause Higher Inflation

There is a consequence of all the high deficits the U.S. government continues to run. Last week, the long-time former Federal Reserve Chairman Alan Greenspan issued a warning that inflation will become a bigger threat to the American economy with the continuously rising budget defecits. Greenspan explained on CNBC's “Squawk on the Street” program that:

“Right now, there's no real inflation at play. But if we go further than we are currently, inflation is inevitably going to rise. That, on top of the stagnation we are seeing in many areas, is not very beneficial for the world economy and certainly not for the United States and China.”

For the moment, the U.S. rate of inflation remains below the two percent target level that the Federal Reserve believes is a healthy sign for a growing economy. Yet the fiscal deficit from 2019 was just shy of the trillion dollar mark. History shows that as the huge amount of extra dollars flow through the economy, inflation goes higher. The deficit has already swollen under the President Trump administration from $665 billion in his first year in the White House back in 2017 to 2019's $984 billion. It represents a rise of almost 50 percent.

If the President had his way, there would be still more stimulus pouring into the economy. The President tweeted this past week that it:

“Would be sooo great if the Fed would further lower interest rates and quantitative ease. The Dollar is very strong against other currencies and there is almost no inflation. This is the time to do it. Exports would zoom!”

Declining Production and Future Inflation Are A Dangerous Combination

Once the inflation genie escapes from the bottle, it is difficult to recapture it as the recently deceased former Federal Reserve Chairman Paul Volcker knew all too well. Volcker was forced to drive interest rates up to 20 percent to bring inflation back under control in the first term of President Ronald Regan's administration. The combination of slow, stagnant growth and high inflation led to an era of “stagflation.”

Unfortunately, the economic news this week is not so rosy as some news anchors would have you to believe. It is why gold makes sense in an IRA. You should not just be limited to stocks and bonds in your porfolio when economic conditions may deterioriate. IRA-approved gold is one option for diversifying your holdings. These days, the IRS will let you buy gold in monthly installments and store your precious metals in top offshore storage locations for your gold IRA. You can read all about the Top Gold IRA companies if you would like to learn more about acquiring safe haven assets.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68