- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Warnings About the Biggest Bubble In History Should Be Taken Seriously

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Just last week you saw another warning about the stability of the U.S. economy emerge from a respected voice advocating responsible geopolitics and economics. Longtime Congressman Ron Paul warned that the entire American economy has been built up on very shaky foundations. He is not alone in this assessment of the U.S. government's habit of spending more than it takes in consistently. The Congressional Budget Office backed up his assessments with facts and figures of their own.

This is the latest reason for why you should acquire some IRA-approved precious metals. The historical safe haven gold makes sense in an IRA because it has always been considered real money. When the asset bubbles deflate (as they inevitably must) or even explode, gold will be the tangible asset you want to call your own. Now is the time to think about gold IRA allocation strategies while there is still opportunity. Once the bubble has begun to pop it is too late to save the value of your investment and retirement portfolios.

Ron Paul Sounds the Alarm on the Real State of Government Finances Today

Looking at the stock markets today, you might think that the U.S. economy is performing admirably. After a significant and volatile market correction back in late January/early February, the Nasdaq has touched new all-time highs, the S&P 500 has bounced back to its highs of March, and the Dow Jones Industrial stocks have reached positive territory for the year 2018.

Yet Ron Paul warns that all of this is constructed atop unstable foundations. He told the “Futures Now” program last Thursday:

“I see trouble ahead, and it originates with too much debt, too much spending…It's the biggest bubble in the history of mankind… The Congress spending and the Federal Reserve manipulation of monetary policy and interest rates — debt is too big, the current account is in bad shape, foreign debt is bad, and it's not going to change.”

Ron Paul knows a few things about runaway government spending. He is one of the leaders of the Libertarian Party that focuses on controlling the spending of government. He and others like him believe that the Federal Reserve's monetary policy and the government's out of control spending are the two pumps that have inflated what he calls a stock market bubble of epic proportions.

Ron Paul Is In Good Company with the CBO

If it were just Ron Paul alone crying the alarm, you might discount him. Yet he is not the lone voice of warning. A range of political leaders have expressed their worries about the runaway government deficits. Paul Ryan the present Speaker of the House is one of these. He issued a similar warning over the country's national debt back in year 2012.

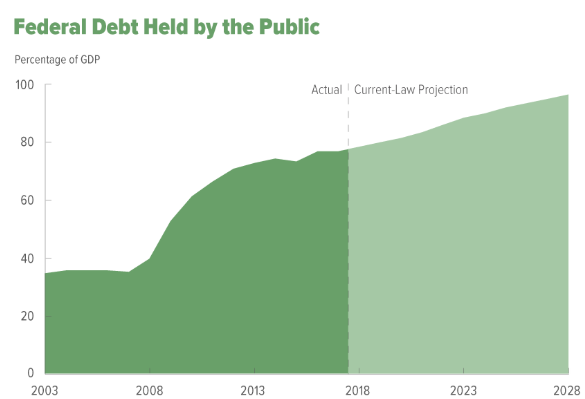

Besides this, Paul is in safe company with the Congressional Budget Office. The CBO forecasts that the country's deficits will come in around $1.2 trillion each year starting in 2019 and continuing through 2028, per its economic outlook back in April. This 2018 deficit forecast increased by a sobering $242 billion versus earlier estimates they put out back in June of 2017. The agency argued that this revision became necessary because of tax reforms that were causing a decrease in projected tax revenues.

This chart shows how it all will impact the Debt to GDP ratio over the next decade:

According to the CBO, the debt held by the public will nearly reach 100 percent by the end of the projected period in 2028.

Ron Paul is at odds with both the legislative and executive branches of government. He equally faults the Federal Reserve decision makers for causing the bubble in the market in the first place. His outlook for the future of the government spending, the debt level, and the economy is not optimistic:

“The Fed will keep inflating, and that distorts things. Now they're trying to unwind their balance sheet. I don't think they're going to get real far on that.”

With the Fed Tightening Monetary Policy, Economic Pain Will Inevitably Follow

It has been over two years since the Federal Reserve began their gradual withdrawal of the stimulus that they put into the economy ever since the Global Financial Crisis and Great Recession began back in 2007. Along with these rate boosts, they have also begun to roll off the balance sheet assets that they brought up to the amount of $4.5 trillion in their quantitative easing programs (the famous QE and QE2).

Ron Paul has warned you that the government and Federal Reserve are not going to change their ways to stop the looming financial disaster he predicts of a full 50 percent collapse in the U.S. stock markets, with:

“The government will keep spending, and the Fed will keep inflating, and that distorts things. When you get into a situation like this, the debt has to be eliminated. You have to liquidate the debt and the malinvestment.”

Just In Time for A Serious Economic and Market Retreat, Gold Is Becoming Scarcer

It is exactly the wrong time for gold to start to run out in the world. Yet several billionaires and revered mining experts have begun warning that this is exactly what is happening. Billionaire founder of Franco-Nevada the gold royalty conglomerate (and previous boss of Newmont Mining) Pierre Lassonde recently warned:

“If you look back to the 70's, 80's, and 90's, in every one of those decades, the industry found at least one 50+ million ounce gold deposit, at least ten 30+ million ounce deposits, and countless five to 10 million ounce deposits. But if you look at the last 15 years, we found no 50 million ounce deposits, no 30 million ounce deposits, and only very few 15 million ounce deposits.”

This Lassonde is considered to be among the most knowledgeable and highly regarded experts on mining anywhere on the planet. He fears that we are approaching “peak gold.” This is the point where less gold is discovered and mined over a period of years than in the past.

He is not unique in this position. The CEO and Chairman Rudy Fronk of Seabridge Gold stated last month that:

“Peak gold is the new reality in the gold business with reserves now being mined much faster than they are being replaced.”

Also you have CEO Nick Holland of Gold Fields the biggest gold producer in South Africa who warned:

“We were all talking about how production was going to increase every year. I think those days are probably gone.”

The starkest warning on this peak gold idea originated with Chairman Ian Telfer of Goldcorp. The legendary resource man told the Financial Post:

“If I could give one sentence about the gold mining business… it's that in my life, gold produced from mines has gone up pretty steadily for 40 years. Well, either this year it starts to go down, or next year it starts to go down, or it's already going down. We're right at peak gold here.”

President Kevin Dushnisky of international mining behemoth Barrick Gold contemplated the future of gold prices with these facts in mind:

“Falling grades and production levels, a lack of new discoveries, and extended project development timelines are bullish for the medium and long-term gold price outlook.”

They're Not Making Any More Gold

One thing that is abundantly clear now is that in the midst of what could be another severe market collapse (or at least painful correction) there is less and less gold to go around. They are simply “not making” it anymore. It should motivate you to get your hands on some of the top five gold coins for investors now while the prices are reasonable still. The good news is that you can even buy gold in monthly installments now.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68