- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

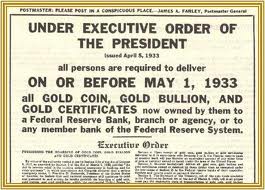

US Government Outlaws Gold

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 23rd October 2013, 07:40 pm

In an unprecedented move, the United States government declared it illegal for citizens to own gold.

Our president was quoted as saying, “ I declare that said national emergency still continues to exist and…do hereby prohibit the hoarding of gold…”

That happened on April 5th, 1933. And this year is the 80th anniversary of that heinous directive ordered by US president Franklin Delano Roosevelt.

Executive Order 6102, as it was officially known, banned private gold ownership in the United States and forced gold owners to take their bullion to a bank and exchange it for dollars at the prevailing rate.

Making private ownership of gold illegal, FDR in fact nationalized what had been private property. He also imposed 10-year jail terms and $10,000 fines for disobedience.

The nationalizing of private property is typically reserved for the banana republics of the world, or countries with greedy dictators looking to line their own pockets.

But no, this happened in the good ole US of A.

Unfortunately, not many Americans are aware that this ever happened.

In fact, most people do not even think such an extreme government confiscation is possible in a country like ours.

I assure you it is. And it happened.

Why They Won’t Confiscate Now

The question is, considering all the financial problems our government is having, will they confiscate our gold again?

The good news is, no they won’t.

The government doesn’t need to confiscate gold nowadays.

In the past, the US was on the Gold Standard. This means that dollars were backed by gold, and you could take your paper money to any Federal Reserve Bank and redeem your dollars for an equal amount in gold.

Gold used to be the foundation of the American currency and economy, and at the time of FDR’s order the Dollar’s value was tied to gold at a rate of $20.67 per ounce. This was the price at which the government offered to buy and sell physical bullion.

Executive Order 6102 allowed the government to control the entire domestic supply of gold, and Roosevelt was then able to devalue the Dollar against gold by raising its price. Roosevelt was acting on the advice of the agricultural economist George Warren, who believed that the best way of solving a deflationary depression was to create inflation and push prices higher.

This was the main thrust behind devaluing the Dollar – the goal of producing inflation.

In the weeks following EO 6102, FDR and his advisers would arbitrarily decide what the price of gold should be, nudging it higher a bit at a time until they settled on $35 an ounce.

The price of gold remained at this level until President Nixon closed the gold window in August 1971, meaning that you can no longer redeem your dollars for gold.

And this brings us to the bad news…

What You Don't See Can Hurt You

Because we are now off the gold standard, it is much, much easier to devalue the dollar without people noticing. When FDR devalued the dollar, the process was much more transparent – you could tell because all you had to do was watch the price of gold. If the price of gold was arbitrarily raised, then you knew your dollars were worth less.

But nowadays, the destruction of the dollar is happening right under your nose with the $85 billion monthly Fed purchases of government bonds.

The reason that we have a hard time noticing the effects of this is that it’s much more subtle way to fleece Americans out of their savings.

The price of gold does not go up the instant the Fed makes the purchases. Other commodities do not go up instantly either. You have to watch them over longer periods of time to be able to notice the effects.

But the warning signs are there…

Since Fed chairman Bernanke took office eight years ago gold is up +127% and silver up +125%. In other words, it takes more than twice as many dollars nowadays to buy the two oldest and most reliable forms of money, gold and silver. In terms of gold, the stock market is down -43%.

Compared to other weak currencies where other governments are inflating wildly as well, the dollar index is down -12%.

This is condemning evidence that the policies of our government are destroying our savings and minimizing the benefits of our annual incomes.

Recommendation: Buy gold or other hard assets now to preserve your wealth. As we discussed, there’s little chance the government will confiscate it this time. *

*However, there is an asset class that our government is targeting for confiscation. Click here for the full story… New Government Target

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81