- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Unfolding U.S.-EU Trade War Latest Threat to Economy and Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

This last Monday, the fragile trade situation between the U.S. and Europe reached a new boiling point. After the WTO World Trade Organization ruled that the EU was illegally subsidizing France and Germany's aerospace company Airbus, the United States administration announced that it will target $11 billion in European goods with special tariffs. Naturally the EU has responded angrily. This threatens to erupt into a much larger trade war before long if both sides are not willing to back down.

Clearly these kinds of events are beyond your control. What you can do is take measures to safeguard your investment and retirement portfolios with some form of save haven assets. Trade wars and the unpredictable end results of them are another reason that Gold makes sense in an IRA. Today is the time for you to look into gold IRA allocation strategies and the Top five gold coins for investors while you still have time.

The WTO Ruled In Favor of America's Claim Regarding European Airbus

At the end of last year, the WTO ruled in favor of the United States on this case of illegal subsidies to the European firm Airbus. The World Trade Organization stated that the payments had created what they cited as “adverse effects” for the United States. This decision was reached following a multiple year court battle between the U.S. and EU concerning each of their aviation titans Airbus and Boeing.

The EU did not take the results of the ruling sitting down. Representatives of the European Commission immediately moved to put down the proposed remedies, with:

“The EU is confident that the level of countermeasures on which the notice is based is greatly exaggerated. The amount of WTO authorized retaliation can only be determined by the WTO-appointed arbitrator.”

This was merely the opening salvo in what looks like a new battleground in the Trump administration's vaunted trade war.

EU Looks to Be Next Battleground in the Ongoing Trade War

Last Monday the Office of the U.S. Trade Representative pledged that it would apply punitive tariffs on a range of EU produced goods in retaliation. These goods will range from fish to airplanes, to olive oil and wine, to binoculars and dairy products per a preliminary list.

The Trade Representative stated that the “harm from the EU subsidies as $11 billion in trade each year.” It will not be until the summer that the WTO details how much this amount should be. Trade Representative Robert Lighthizer issued a statement claiming that:

“This case has been in litigation for 14 years, and the time has come for action. The administration is preparing to respond immediately when the WTO issues its finding on the value of U.S. countermeasures.”

U.S. President Donald Trump was jubilant at the latest trade retaliatory salvo. He tweeted last Tuesday that “The EU has taken advantage of the U.S. on trade for many years.”

The French came out arguing for restraint after America's decision. Their Finance Minister Bruno Le Maire argued that it was the wrong time to begin a trade war between the EU and the U.S. with global growth in slowdown mode. He claimed that it would be both an economic and political mistake to open up a new front in the global trade war with the U.S. and Europe at the center of it.

Meanwhile Donald Trump called the EU a “brutal trading partner.” Brussels stated through another European Commission spokesman last Tuesday that Brussels will retaliate to any trade tariffs in kind. They hold out hopes that the parallel running Boeing subsidy dispute will favor them, claiming that:

“the determination of EU retaliation rights is also coming closer and the EU will request the WTO appointed arbitrator to determine the EU's retaliation rights.”

Its Trump Versus The EU In Latest Trade Trouble

This is only the latest trade tensions that have been brewing between the U.S. and EU though. The U.S. administration has threatened to erect tariffs on its auto parts and car exports. This final decision is still pending. Meanwhile President Trump tweeted the following on the behavior of the EU:

“Too bad that the European Union is being so tough on the United Kingdom and Brexit. The EU is likewise a brutal trading partner with the United States, which will change. Sometimes in life you have to let people breathe before it all comes back to bite you!”

The French Finance Minister Le Maire attempted to diffuse the deteriorating situation by calling for calm, with:

“We have to avoid a trade war. We're facing a slowdown both at the global level and the European level and the reason why there is such an economic slowdown is that there are trade tensions all over the world. There are trade tensions between the U.S. and China. We should not add trade tensions between the U.S. an the EU.”

Trump has consistently called out important American trading partners like Canada, the EU, and China for so-called unfair trading practices negatively impacting American companies and workers. President Trump raised tariffs on some imports to the U.S., causing a global trade war that has many analysts and governments crying out it is harming economic activity around the world.

President Trump shows no signs of backing down either, with his tweet:

“The World Trade Organization finds that the European Union subsidizes to Airbus has adversely impacted the United States, which will now put tariffs on $11 billion of EU products! The EU has taken advantage of the U.S. on trade for many years. It will soon stop!”

It is hard to be clearer than that.

IMF Slashes Global Growth

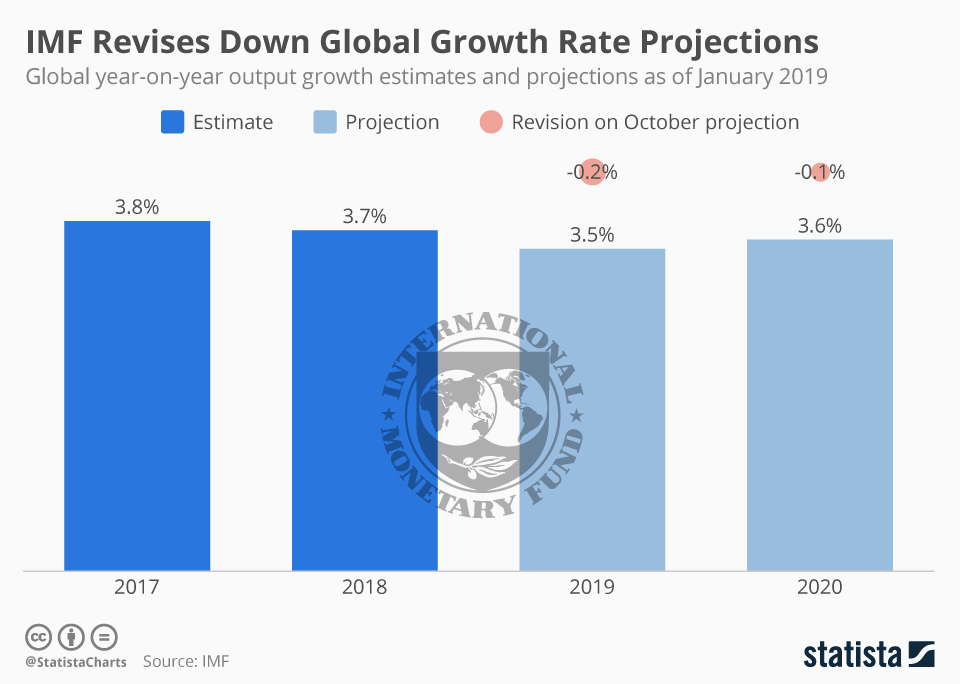

The IMF made matters more dramatic this past week by highlighting the harm that his being done to the world economy. This past week they reduced their global growth forecast for what is now the third instance since only October. According to the IMF, the global economy will only grow in 2019 by 3.3 percent. This was cut from their last forecast of 3.5 percent, which the graph below shows:

Reminding of the risks to Europe from a new trade war, the fund stated that the European economies will be the biggest contributing factor to the worldwide slowdown. This is the an inconvenient time for the EU to be receiving this news, per the European Commissioner for Economic and Financial Affairs, Taxation, and Customs Pierre Moscovici.

This is exactly the moment when the EU is wrestling with another upcoming blow in the form of the United Kingdom departing from the block, with or without a deal this fall.

Both the EU and the U.K. concluded an deal to push off the Brexit crash out deadline date six months to October 31st. The block hopes that the United Kingdom will seriously use the extra time to make sure that they do not leave the block in a devastating no deal, sure to harm both the European and world economy still further. Per Moscovici:

“Let's avoid a no-deal (Brexit). We must really find a way to live together and for that, a deal — I don't know which deal, it's up to (the U.K.) to say precisely what they want — is much preferable to no deal.”

Clearly the EU is worried about the potential damage to their own block's economy with this latest delay to Brexit.

Gold Will Protect You From All the Many Threats to the World Economy and Markets

Between a new front in the trade war with the European Union and the ongoing threat of Brexit waiting in the wings to derail world and national markets, you can not be too careful with your retirement portfolio these days. IRA-approved gold will give you a strong measure of protection against the wheels coming off the global growth engines. You should start buying gold in monthly installments at the very least. Remember to think carefully about the Top gold IRA companies and bullion dealers before you buy.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81