- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Under-Vaccinated Parts of America Threatening Coronavirus Resurgence

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 5th July 2021, 10:46 pm

This past week saw bad news emerge regarding a potential coronavirus resurgence in America. A large part of the country has now been relieved of the twin requirements of social distancing and wearing masks. Yet because of a number of pockets in America where the inhabitants are undervaccinated, the virus is threatening to make a major comeback.

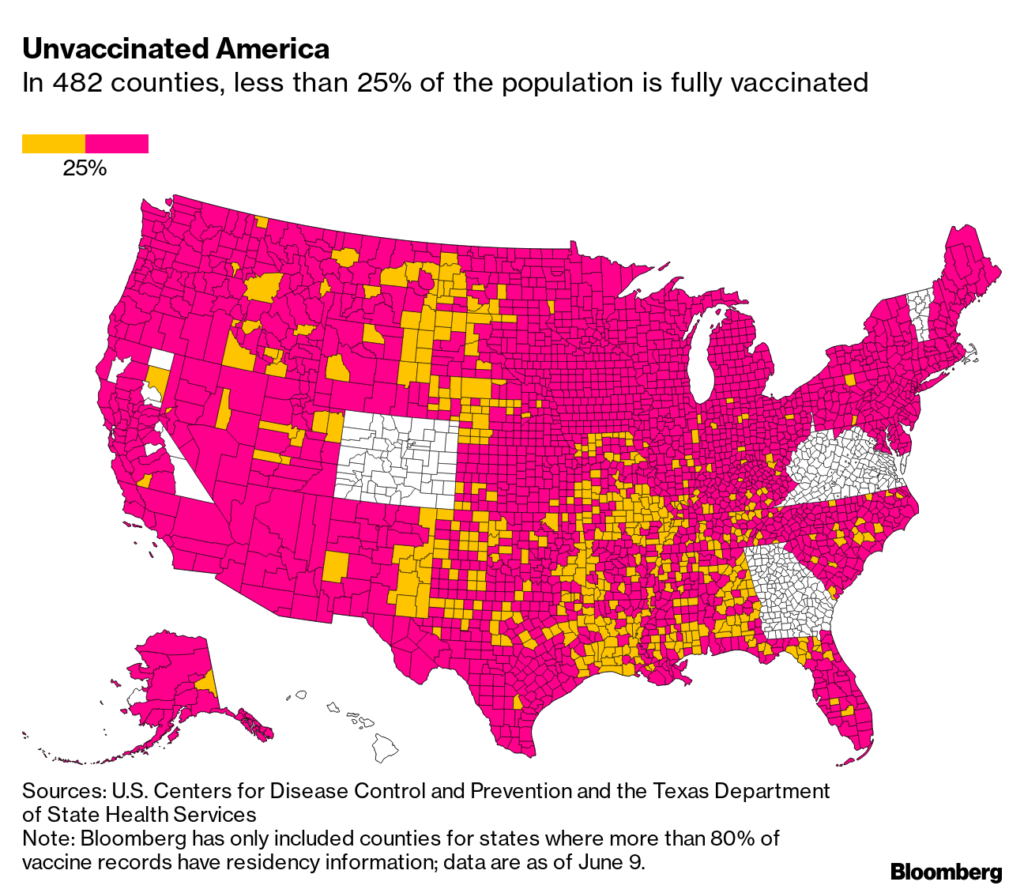

In Hundreds of Counties, Under a Quarter of the Population Is Fully Vaccinated

There are now 482 counties or more where under 25 percent of the residents have been fully vaccinated per the Centers for Disease Control and Prevention. This data analysis reported by Bloomberg News is troubling for an important reason. As with other viruses, the coronavirus spreads to neighbors, family, and friends and not by state or on a national level. Now new permutations of the virus that are more contagious (such as the delta variant) mean that these under-vaccinated areas are providing a breeding ground for the virus to mutate and spread. This chart below depicts the least vaccinated counties across the United States:

The analysis that Bloomberg conducted showed that there are similarities in these holdout counties. A great number of the respective counties turn out to be in more rural areas and with fewer economic opportunities than other parts of the country. What policymakers call vaccine hesitation exists on a personal level, making it more difficult for demographics to account for the various causes for why individuals might not trust the vaccine.

Thanks to these numbers of under-vaccinated pockets that are still around, the coronavirus is likely going to continue to be an issue in the U.S. Health informatics researcher Maimuna Majumder of the Boston Children's Hospital warned that:

“I didn't think we should be ignoring this problem before this pandemic began. I think it's even more important now.”

Meanwhile the Eviction Moratorium Is Killing Smaller Landlords

With coronavirus still impacting many Americans around the country, this past week the Center for Disease Control and Prevention extended its eviction moratorium by another month. This is not the first time they have moved the moratorium deadline forward either. The federal government's ban on evictions had originally been set to expire at the end of March.

While this extension of the ban is helping many hard pressed tenants, it is killing landlords who are struggling now. According to groups that represent landlords in their bid to end this moratorium, one more month will be enough to force some smaller landlords to close down. CEO Bob Pinnegar of the National Apartment Association shared about the danger that:

“Each passing month further escalates the risk of losing an ever-increasing amount of rental housing, ultimately jeopardizing the availability of safe, sustainable, and affordable housing for all Americans. Flawed eviction moratoriums leave renters with insurmountable debt and housing providers holding the bag as our nation's housing affordability crisis spirals into a housing affordability disaster.”

Statistics reveal that most of the landlords in the United States are individual investors. Collectively they own roughly 17 million properties containing 23 million units per the U.S. Census. Their information also showed that over six million renting households have fallen into arrears on their rent.

Landlords do not currently have any real recourse available to deal with tenants who are behind. The Federal government has distributed around $34 billion in assistance to the states for past due rent and utilities. Putting this relief money in the hands of landlords has been difficult though since the process requires that the tenants become involved. On top of this, the process of landlords getting to these funds has been described as “onerous” at best. One landlord Simon explained his frustration with:

“In my particular instance the tenant is not cooperating with even completing the application. I'm just a small landlord, and I'm not a big corporation like many of the other large rental organizations, so although the funding is very helpful, if the tenant doesn't cooperate everything falls apart.”

A closer look at the statistics shows how many fewer evictions are in the pipeline. Zillow calculates numbers based on census estimates. They found that eviction filings for July and August would have amounted to a total of roughly 473,000 before the eviction ban became extended. This figure was already reduced by approximately 100,000 from the forecast that came out in March. They expect eviction filing numbers to drop still more given another month of space for tenants. The numbers have improved for two reasons. On the one hand, the federal assistance has reached some of the renters. At the same time, the employment picture and economy has seen improvement all around.

This has not stopped landlords from expressing their anger and frustration at the ways in which the federal aid of $46 billion has been handled and apportioned. Two individual relief packages have been passed and distributed so far in these efforts. CEO Dean Hunter of the Small Multifamily Owners Association, who is also a landlord personally, explained that:

“If the rental assistance bureaucracy is a monster, then the local governments that created them are Dr. Frankenstein. They've required the states and the cities to create entire new infrastructures to get the money out, instead of using the existing community based organizations and safety nets. This is the most excessively and overly broad taking of private property in my lifetime. The eviction moratorium is killing small landlords, not the pandemic.”

Hunter has argued that the smaller landlords have been treated as if they were big corporations. He insisted that they instead ought to have been a part of the Paycheck Protection Program under the auspices of the small business relief package. This would have enabled impacted landlords to access critically needed relief funds without having to wade through so much red tape.

Biden Administration Outlines Plans for Helping Renters and Landlords Alike

The Biden administration is not finished with its efforts to help out both landlords and renters. Following their extension of the eviction moratorium they offered general assurances that the United States Treasury would make clear “how grantees may achieve economies of scale by obtaining information in bulk from utility providers and landlords with multiple units to help speed the determination of household eligibility and to bundle, in a single payment, approved amounts for the benefit of multiple eligible tenants.”

The U.S. Treasury efforts are coupled with other assistance from local and state governments. Observers believe that these will provide some help. In the case that the landlords do not receive sufficient relief though, the broader housing market can expect to experience negative consequences. This would lead to a number of problems for renters as well as the besieged landlords. CEO Dean Hunter warned that:

“What there is going to be a tsunami of is a loss of naturally occurring, affordable housing, because small landlords are going to sell their properties.”

While the warning is not falling on deaf ears, it remains to be seen if the relief will be sufficient to help the troubled landlords in time. A way to hedge your portfolio against the dangers threatening the housing and rental markets is by using Gold IRA allocation strategies. These are some of the best known alternative IRA investments. Nowadays it is easy to do a Gold IRA rollover.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81