Types of Alternative Investments for Self-Directed IRAs

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 22nd September 2021, 05:04 pm

Self-directed retirement accounts provide investors with far more freedom and flexibility than regular brokerage accounts. However, unless you take advantage of the wide range of alternative assets available to you as a self-directed IRA or 401(k) holder, then you're missing out on the main benefit of a self-directed account.

Whereas brokerage accounts are limited to stocks, bonds, and mutual funds, the possibilities for self-directed IRAs and 401(k)s are virtually endless. Cryptocurrencies, precious metals, annuities, and many other asset types unavailable to brokerage investors are available to self-directed investors—that is, if you're willing to accept the risk.

What many retirement investors often overlook is that alternative assets can help you minimize risk rather than add to it. In fact, a responsible diversification strategy is one that includes a variety of non-correlated assets whose risk factors do not overlap.

Want to get started with responsible alternative investing in an IRA? In this article, we've put together a guide to the various types of alternative investments available to self-directed IRA holders, as well as the types of risks these assets carry.

Table of Contents

What is an Alternative Investment?

Before we begin, let's first define what an alternative investment is. Technically speaking, an alternative investment is any that doesn't fall into the conventional equity, cash, or income investment categories.

An alternative asset can be a piece of tangible property, like a gold bullion bar, a collectible, like a bottle of fine wine, a security, like a hedge fund, or an intangible asset, like a Bitcoin token. Given the sheer breadth of the asset class, it's often more useful to define alternative assets by what they aren't, which includes stocks, bonds, or cash.

The Two Primary Types of Alternatives Investments

There are two fundamental categories of alternative investments: private and public. The former is concerned with private equity, private real estate, and private credit, whereas the latter is generally composed of hedge funds and other funds that deal with public markets.

Although most alternative investors concentrate their wealth in public assets, a truly diversified retirement investing strategy should incorporate a blend of private and public investments.

Types of Alternative Investments for Self-Directed IRAs & 401(k)s

Below, we've listed the most popular types of alternative investments available to self-directed retirement account holders. These assets are generally barred from brokerage accounts, and can only be held within an IRA or 401(k) that is entirely self-directed.

1. Commodities and Futures

If you're looking for alternative investments examples, there's perhaps none more popular than physical commodities and their futures contracts—for example, gold futures contracts.

In fact, futures contracts (i.e., legal agreements to buy or sell a given commodity at a predetermined price in the future) are the most popular form of exposure to the commodities market, and they can often only be purchased through a self-directed IRA.

Typically, commodities and their associated contracts are purchased via commodity futures exchanges owned by the CME Group. These platforms, which are accessible to self-directed IRA investors, facilitate the transactions of many diverse commodities, including:

- Crude oil (e.g., WTI, Brent)

- Natural gas

- Corn and soybeans

- Precious metals (e.g., gold, silver, platinum)

- Non-precious metals (e.g., copper)

- Wheat

- Cotton

2. Physical Precious Metals

Traditional IRA brokerages strictly prohibit investors from purchasing precious metals. Although brokerage investors can purchase “paper gold” (i.e., gold stocks and ETFs), physical metal bullion is off-limits.

Fortunately, these metals are among the bestselling alternative IRA investments for self-directed account holders. There are many IRA-approved precious metals that can be included in any self-directed IRA, provided that the metal is stored and vaulted by a trusted third-party custodian. Even in self-directed accounts, precious metals cannot be stored at home in one's personal possession.

To be eligible for IRA inclusion, precious metals must meet stringent purity standards (typically .9995%+ purity levels). These can take the form of gold, silver, platinum, palladium, and rhodium bars or coins. To ensure your metals meet self-directed IRA criteria, it might help to purchase your metals through a trusted precious metals IRA company.

3. Bitcoin and Cryptocurrencies

Although some brokerage IRA providers are warming up to cryptocurrencies, many place tight restrictions on the coins in which you can invest. If you want diverse, wide-ranging exposure to this exciting and fast-growing asset class, you need a self-directed IRA.

Thanks to Bitcoin's explosive 224% year-over-year growth in 2020 and subsequent all-time highs in 2021, investors are finally taking note of cryptocurrency's true potential. The good news is that the party's only still getting started.

However, if you want to capitalize on the growth of altcoins such as Ethereum, Litecoin, XRP, Cardano, or Stellar, you’re going to have to invest through a self-directed IRA. To take some of the footwork out of the process, consider opening a dedicated crypto IRA through one of our trusted Bitcoin IRA providers.

4. Hedge Funds

One of the lesser-known types of alternative investments are hedge funds. These professionally managed investment funds generally use high-risk shorting strategies to generate profits on trades involving land, real estate, equities, derivatives, and even currencies.

By contrast, mutual funds tend to stick to long positions in stocks and A-rated bonds. Due to their riskier approach, hedge funds tend to outperform mutual funds and the stock market at large. The downside, however, is that hedge funds are exclusive to accredited investors, have large capital buy-ins (i.e., usually >$100K), and steep performance fees (average of 16.4%).

5. Private Equity and Private Debt

An underappreciated category of alternative retirement investments is private equity and private debt. These types of investments are certainly unconventional and, as such, are limited to self-directed IRA holders. In this context, “private equity” refers to shares in a private equity firm, whereas private debt refers to buying someone's loan debt.

In the case of private equity, these firms buy a controlling stake in mature companies and make managerial changes in order to boost profits. Once these profits have been realized, they resell the company and obtain a net profit.

Private debt, on the other hand, is repaid at interest by an individual (i.e., a relative or family member) or a corporate entity. If the lender is creditworthy, private debts provide steady cash flow at regular intervals.

Only self-directed IRAs can hold private equity and private debt. Therefore, if you're interested in self-directed IRA alternative investments of this type, you will first need to open a self-directed IRA outside of the major brokerage firms.

6. Real Estate & Tangible Assets

These days, one of the most popular types of alternative assets includes real estate and other “real” (i.e., tangible) assets that can be physically held by the investor. Most often, this includes real estate such as residential rental properties or commercial leasing properties, or it could include other tangible items, such as:

- Inventory

- Vehicles

- Equipment

Investors should note that any tangible item deemed “collectible” by IRS regulations is prohibited from all IRAs, including self-directed ones. Whether self-directed or not, these assets cannot be included in a tax-advantaged retirement account. Per Internal Revenue Code 401(a), these assets include, but aren't limited to:

- Fine art

- Rare and aged wines

- Baseball cards

- Stamps

- Non-minted numismatics

- Sneakers

- Comic books

Importance of Risk Factor Diversification

One of the key reasons why so many retirement investors are turning to self-directed IRAs is because they want to diversify the kinds of risks to which they’re exposed. Think about it, if your portfolio is 50% exposed to equities, and the stock market drops 20%, you can lose 10% of your retirement savings instantly if those equities are vulnerable to the same market risks.

That's where the value of risk factor diversification becomes clear. Non-traditional assets such as precious metals, cryptocurrencies, and real estate—which are only available to self-directed investors—aren't exposed to the same risks as stocks. Historically, when the stock market has declined, alternative assets have held their value or even grown in value.

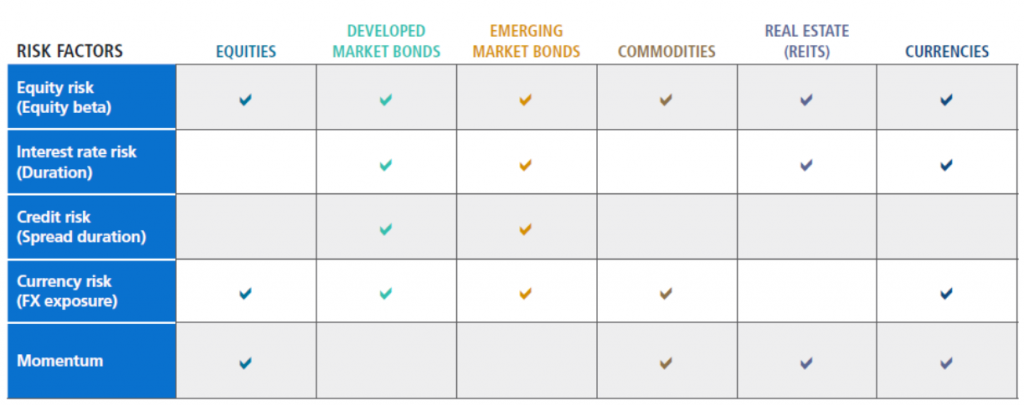

The risk factor map below (Fig. 1) displays the various risk categories that an asset can be exposed to. For comprehensive portfolio protection, you might want to include a broad mix of risk factors. This way, risk is spread across assets rather than shared between them. In the event of a market crash or downturn, a portfolio with many diverse risk factors tends to incur fewer losses than one whose risks are concentrated.

Source: PIMCO

To diversify across all risk categories noted above, you need a self-directed investment account. Otherwise, brokerage administrators will place limits on your investment options that will prevent you from being able to seek out risks they haven't pre-approved.

Diversification: The Key to a Secure Retirement

A secure, robust retirement portfolio starts with asset class and risk factor diversification. But to achieve true diversification, you need a self-directed retirement account.

Only a self-directed IRA allows you to invest in the types of alternative investments that can protect your wealth during a market downturn or recession. To protect your financial future, open a self-directed account today. Don't wait—check out our list of self-directed retirement account providers and see which best suits your retirement goals.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,423.58

Gold: $3,423.58

Silver: $38.96

Silver: $38.96

Platinum: $1,350.99

Platinum: $1,350.99

Palladium: $1,099.84

Palladium: $1,099.84

Bitcoin: $108,577.54

Bitcoin: $108,577.54

Ethereum: $4,343.41

Ethereum: $4,343.41