- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Gold Still Glitters For Many World Leaders

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 26th April 2021, 08:08 pm

Legendary Spanish Conquistador Hernan Cortes once said, “We Spaniards know a sickness of the heart that only gold can cure.” It was not only the Spanish leaders with a lust for gold. Today's leading nations and world leaders still collect and acquire the most popular precious metal nearly 500 years later. Here we look at the gold positions and affinities of these outspoken national gold holders.

United States – President Donald Trump

On July 15th before the Presidential election, President Donald Trump, then candidate Trump, submitted his required financial statement to the FEC Federal Elections Committee. In this, he listed out his assets and liabilities. The document which totalled 92 pages showed that he owns between $101,000 and $200,000 in physical gold holdings, as detailed on page 36. What makes his position unique is that his holdings are entirely in physical gold bullion, as opposed to gold Exchange Traded Funds or other paper forms of gold.

President Trump's affinity for tangibly held gold goes back several years. He once accepted gold bullion in bars forms as a lease deposit from one of his office space tenants in a marquee property he owns in New York City. In the “40 Wall Street” 70 stories tall skyscraper located in the heart of Manhattan's Financial District, he leased out office space to APMEX precious metals dealers.

Chart Data Source: World Gold Council

Trump made a huge deal about this transaction. After he accepted APMEX's explanation for why he should take the gold for their security deposit instead of American dollars, he arranged a media event for the hand off. In the lobby of the Trump Tower located at 725 Fifth Avenue, he accepted the gold in a showy ceremony event. Michael Haynes, the APMEX Chief Executive Officer made the payment for a 10 year commercial form of lease security deposit for the whole 50th floor of the 40 Wall Street building, also unofficially called The Trump Building.

Presumably these are the mainstay of President Trump's much-touted tangible gold holdings per the FEC financial filing. These gold bars he received were .9999 purity and weighed in at 32.15 troy ounces apiece. The three of them amounted to nearly 100 ounces of gold, worth approximately $117,000 as of time of publication.

Switzerland – Swiss National Bank President Thomas Jordan

Switzerland is a country with a long connection to gold. It is also the only leading country in the world that backs its paper currency up partially with gold by law. The Swiss National Bank maintain a 25% physical gold to existing Swiss franc paper notes backing in their official reserves. This makes them the only substantial nation which is still operating according to at least a partial gold standard. It helps to explain why their currency is among the most popular and highly desired on earth, regularly treated as possibly the ultimate safe haven currency in times of economic turmoil or geopolitical unrest.

Germany – Premier Angela Merkel

Germany is the officially second largest holder of gold in the world with an impressive collection of 3,381 metric tons of the precious metal. German Premier Angela Merkel has demonstrated her serious interest in gold in the last few years by pushing her central bank the Bundesbank to repatriate all of its physical gold holdings back to Germany in 2013. The majority of their hoard has been inventoried and safeguarded in either the Federal Reserve Bank of New York or the Banque de France depositories for decades.

France – Nationalist Leader Marine Le Pen

Marine Le Pen may not be the head of France now, but she is the current front runner for the presidency of France in the upcoming elections this year. The leader of the Front National Party of the far right has called on her nation's central bank to repatriate its gold reserves. Le Pen wrote an open letter to the Governor of the Banque de France Christian Noyer demanding the immediate repatriation of the total of France's gold reserves vaulted abroad.

In the same letter, she demanded that all gold sale schemes be immediately discontinued. She has also argued for a full and transparent third party audit of the French physical gold holdings of 2,435 metric tons of gold. The fiery leader is insisting on the French people learning the location of where their huge gold holdings are stored.

As if this were not enough, Le Pen also wants the French central bank to being purchasing additional gold reserves on every substantial dip in world gold spot prices. France owns the fifth largest inventory of gold in the globe, per the World Gold Council's central bank holdings report from January 5th. The country keeps 65.1 percent of all its large foreign reserves in the precious metal.

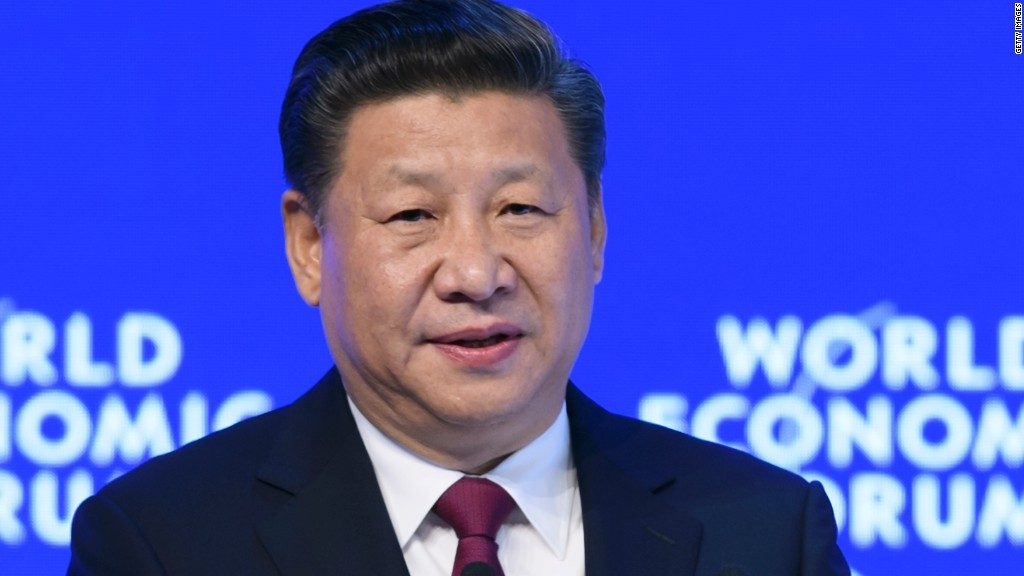

China – President Xi Jinping

China has spent the past nearly decade importing literally thousands of metric tons worth of gold. Their obsession with the precious metal goes beyond mere international purchases. Under President Xi Jinping and his predecessor, the nation has purchased up the entirety of its domestic production. As China is also the world's largest gold producer, this is an enormous quantity of gold.

Bloomberg Intelligence estimated on April 20, 2015 that the gold holdings of the People's Bank of China had been tripled to 3,510 metric tons since April of 2009. If this is the case, then the current official totals which the World Gold Council accepts with China as the number six largest holder (with 1,778.5 metric tons) of gold are woefully underestimated. In fact, if Bloomberg's estimate is correct, China has grown under President Xi into the second biggest holder of gold in the world, behind only the United States and its 8,133.5 metric tons of the precious metal.

China likes gold because they feel it will help them to one day launch their currency the Yuan as one of the world's main reserve currencies. Their motivation in collecting also lay in impressing the International Monetary Fund into giving their currency a spot in the SDR Special Drawing Rights basket. They did achieve this with a weighting roughly equal to Great Britain's, making their love affair with gold a great success story.

Italy – Former Prime Minister Matteo Renzi

Italy may have major banking troubles and an economy that has been stagnant for decades, but it can proudly claim to own the third largest gold reserves in the world to this day. As the third largest national economy of the eurozone, the eight biggest GDP in the globe, and a founding member of the G7 and eurozone, they are also the eighth biggest exporter on the planet with an impressive $514 billion in exports for the year 2016.

Critics of the large and unused gold horde in Italy called upon Prime Minister Matteo Renzi to sell off part of their national reserves treasure to salvage the ailing banks in the past years. He staunchly refused, showing his affinity for the precious metal.

United Kingdom – Queen Elizabeth II

The Queen regularly visits the Bank of England's enormous gold hoard, which is one of the single largest collections on the entire planet. Britain is no longer the biggest gold holder in the world as a nation, though it still ranks at number 18 with 310.3 metric tons in its national reserves. Besides this still-formidable gold holding, these vaults contain the gold assets of numerous other countries which have entrusted it to the Bank of England and its vault on Threadneedle Street.

In fact the Bank of England is regarded as one of the two biggest gold vault custodians in the globe. Its only rival in the world is the (FRBNY) Federal Reserve Bank of New York. The Bank of England actually reports its annual gold holdings. The 2015 annual report showed that it contained 130 billion British pounds sterling in gold. Based on the prior day's gold prices, this amounts to 5,134 tons of gold, around 411,000 Good Delivery bars.

Russia – President Vladimir Putin

Russian President Vladimir Putin has been working up a healthy appetite for gold for years now. Thanks to all of the money he and the country earned selling oil, they obtained the ability to financially diversify their once limited national reserves into huge amounts of the precious metal. Of the many central banks which have chosen to increase their gold holdings (and which make their reserve actions transparent and public), Russia has proven to be the biggest and most active gold accumulator in recent years.

Among the Russian arguments for purchasing more gold, two have stood out. The World Gold Council report has suggested that it was “driven by a number of factors including a continued diversification away from the U.S. dollar and the backdrop of ongoing geopolitical tensions.”

Libya – Former President Muammar Gaddafi

Gaddafi may be dead and his country struggling to recover from the five years plus of chaos that ensued, but he was a not so secretive gold bug. Thanks to an email released from Hillary Clinton's Department of State, it became public knowledge that Gaddafi held gold reserves to the tune of 143 metric tons and a similar quantity in silver reserves. This reportedly over $7 billion in treasure, which he planned to use to create a gold-backed currency as an alternative means of paying for oil, attracted a great amount of unwanted international attention.

France's then-President Nicholas Sarkozy was persuaded to attack him in part because Sarkozy learned of Gaddafi's intent to use the gold horde to help establish a pan-African currency based on the Libyan Dinar. Among Gaddafi's goals was to supplant the use of the French franc still being utilized by a number of French speaking African nations. Many experts believe that he was murdered because he was too fond of and ambitious with his gold.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum