- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Third Yield Curve Inversion In A Week Signals Recession Ahead

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th August 2019, 03:58 pm

This week on Thursday saw the the main Treasuries yield curve fall below 50, signalling recession. It means that the 10 year Treasury benchmark note was trading for less than the rate of the two year notes. This typically unusual event is bigger news still because it is the third time this has happened in just over a week (since last Wednesday).

Jackson Hole Fed Meeting Comments Trigger Latest Yield Curve Inversion

Just after 10 am EST on Thursday, this crucially important indicator the yield curve became negative. By 10:20 the two year yield on Treasuries sat at 1.601 percent while the 10 year yield traded under it at 1.597 percent. The yields of these bonds trade inversely to prices. This third occurrence of the inversion had investors scared, and markets turned negative on the news.

The inversion followed comments from two Federal Reserve members who were speaking from the annual Fed meeting at Jackson Hole, Wyoming. Esther George, the Kansas City Federal Reserve President, and Patrick Harker, the Philadelphia President, shared their comments in a CNBC interview. Neither of them could see a case for more interest rate cuts at the coming September meeting. George stated that:

“We've added accommodation and it wasn't required in my view. With this very low unemployment rate, with wages rising, with the inflation rate staying close to the Fed's target, I think we're in a good place relative to the mandates that we're asked to achieve.”

The comments intensified Wall Street concerns that the Federal Reserve will not rescue the economy in time if GDP growth shows contraction. Investors still believe that another quarter point rate cut is coming for September, though they have cut their expectations back Thursday morning.

The Fed July Rate Cut Was Not Unanimous

The news also has emerged that the decision on the Fed rate cut in July was not unanimous. The Federal Open Market Committee reduced America's benchmark interest rates on July 31st. They cited “global developments” amid “muted inflation.” Yet as the closely scrutinized last meeting notes showed when released this Wednesday, two policymakers voted against lowering rates. One of these was Esther George.

Fed Philadelphia President Harker also expressed concern about future rate cuts. He stated that the Fed needed to wait and see “a while” before it cuts rates any more. Harker is not one of the current voting members on the committee, but observers still weigh his opinion. The July Federal Reserve meeting minutes revealed that the officials who did vote to cut rates at the end of July were reserved in their appetite for more rate reductions. They concurred that the interest rate move is not an indication of a “pre-set course”with future interest rate cuts.

IHS Markit Survey Reveals Manufacturing Sector in Decline

As the yield curve was inverting for this third time, additional negative economic data was released. Manufacturer growth in the U.S. hit its slowest rate in nearly 10 years for August. It was the most recent sign that the trade war with China is making the economic slowdown worse.

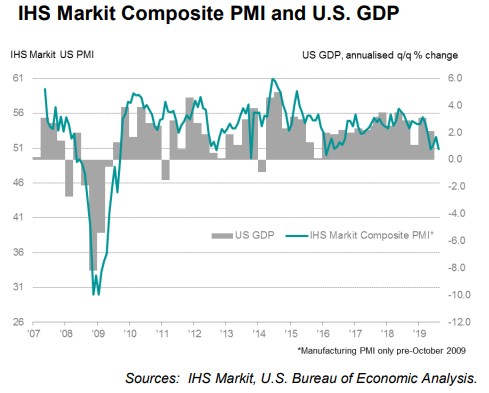

Per IHS Markit, the U.S. Manufacturing Purchasing Managers Index (PMI) fell from July's 50.4 reading to 49.9 for August. This was the first time the reading dipped below the crucial 50.0 level since September of 2009. Any reading that dips below 50 represents an economic contraction. The chart below shows the last ten years' data from the PMI:

This important indicator dip below 50 has changed the U.S.'s economic picture. Markit Economics Associate Director Tim Moore explained the negative economic data and its importance with:

“Manufacturing companies continued to feel the impact of slowing global economic conditions. August's survey data provides a clear signal that economic growth has continued to soften in the third quarter.”

Trade War Slows Manufacturing Activity and Export Sales

Manufacturing has been among the brightest spots in the Trump administration's growing economy. Yet the tariff war with China has taken a toll on the sector. Recent data from the Institute for Supply Management also showed that American manufacturing activity declined to an almost three year low for July.

This older data was eclipsed by this past week's Markit survey revealing that the new orders manufacturers received has plunged to a ten year low. The new data also revealed that export sales have plummeted to their weakest point dating back to August of 2009. Manufacturers kept cutting their inventories for August. This has only added to mounting concerns surrounding the demand outlook as Markit's Moore pointed out, with:

“The most concerning aspect of the latest data is a slowdown in new business growth to its weakest in a decade, driven by a sharp loss of momentum across the service sector. Survey respondents commented on a headwind from subdued corporate spending as softer growth expectations at home and internationally encouraged tighter budget setting.”

Overall business activity also declined in the U.S. according to the IHS Markit Flash Composite PMI Output Index. It declined to 50.9 for August, showing that there is a “renewed slowdown” in the growth of the American private sector's business activity. This seasonally adjusted statistic represented a three month low, per Markit.

Morgan Stanley Warns Risk of Worldwide Recession Is High and Increasing

All of this troubling data has influenced the opinions of analysts following the U.S. and global economies. Morgan Stanley has warned that this downtrend afflicting some international economies is now contagious. Manufacturing sector weakness has started to spread. They are warning clients that the “wheels for a slowdown are in motion.” Morgan Stanley's Chief Economist Chetan Ahya expressed in a recent research note that:

“Even as we have been revising our growth projections lower, we continue to highlight that the risks remain decidedly skewed to the downside. We expect that if trade tensions escalate further… we will enter into a global recession (i.e., global growth below 2.5 percent for the year) in three quarters.” The chance of a global recession resulting from tightening financial conditions “is high and rising.”

Some economists claim that the United States has been an exception to the global deceleration, yet it is harder to argue given the troubling new economic data. Ahya warned that the global slowdown's impacts have already begun to show up in U.S. data prints. One other area of concern the economist pointed out is the payrolls data, which has been suffering from a “significant loss of momentum.” Over the last seven months, it has declined from 234,000 (on a six month moving average basis) in January to 141,000 for July.

IHS Markit's Chief Business Economist Chris Williamson has explained the U.S. economic downturn as:

“Falling business spending at home and declining exports are the main drivers of the downturn, with firms also cutting back on input buying as the outlook grows gloomier. U.S. manufacturer's expectations of output in the year ahead sunk to its lowest since comparable data were first available in 2012.”

Unfortunately the data from this past week reveals why gold makes sense in an IRA. One way to diversify retirement assets is through acquiring IRA-approved gold. The IRS makes this more appealing now by allowing retirement investors to keep their metals in top offshore storage locations. You can research top gold IRA companies and bullion dealers to learn more.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81