- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The World Gold Council Releases Its New Consumer Research Report Highlighting Substantial Global Opportunities For Gold

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

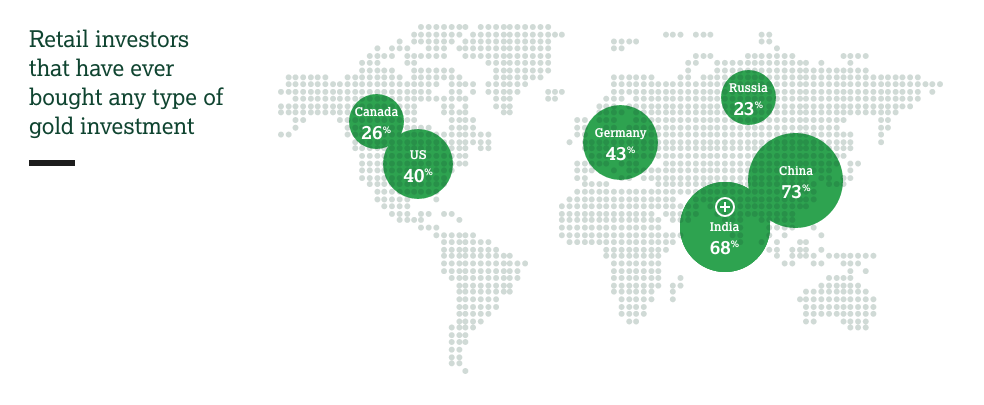

The world’s preeminent authority on gold and its production, the World Gold Authority released its consumer research report highlighting significant opportunities for the gold market around the globe. Based on a consumer survey sample of 18,000, the report analyzes several different markets including North America, India, Russia, Germany, and China. It also provides comprehensive insight into the markets for contrast and comparison.

Table of Contents

Gold Is The Third Most Popular Investment In The World

The findings of the Gold Retail Insights 2019 Report by the World Gold Council, concluded that people around the globe have tremendous confidence in the investment potential of gold – being the third most popular choice of investment among retail investors:

“Gold is the third-most consistently bought investment — 46% of global retail investors have chosen gold products, behind savings accounts (78%) and life insurance (54%),”

Based on the consumer survey, the predominant perceptions of the yellow precious metal are that it is a traditional store of value, being both safe and durable. The main factors for retail investors purchasing gold are for long-term returns and to safeguard wealth.

Interestingly, the consumer survey which classified respondents as either ‘retail investors” or “fashion and lifestyle consumers”, found that the vast majority of both groups trusted gold more than fiat currencies. For instance, of the respondents from India, 75% of retail investors trust the precious metal more than currencies. In China, it is 69%, and 60% of American investors echoed the same sentiment. Overall, 61% of retail investors and 65% of fashion and lifestyle consumers have more trust in gold than fiat currencies.

The consumer survey found more than two-thirds of global retail investors believed that gold was a good safeguard against inflation and currency fluctuations, and over the long term, it would not lose its value.

Generational Attitudes Towards Gold and Investment

The World Gold Council’s consumer report delved into generational attitudes towards gold, which then translated into investment choices. The report concluded that by and large, retail investment sentiment towards gold was the same between younger and older generations. It found that globally, 34% of 18-38 year-olds had invested in gold in the past year.

“Almost half stated that they would definitely invest in gold in the future (46%). Interestingly, younger investors tend to be less risk-averse and less likely to adopt a long-term approach to investing,” stated the report.

Based on data collected from the consumer survey, the Council said three factors contributed to retail investors investing in gold: risk, recommendation, and price. According to the report, 44% of retail investors purchased gold to hedge against risk and diversify portfolios, 31% bought gold because it was recommended by a financial advisor or trusted individual, and 29% based upon an upward trajectory of the price of gold.

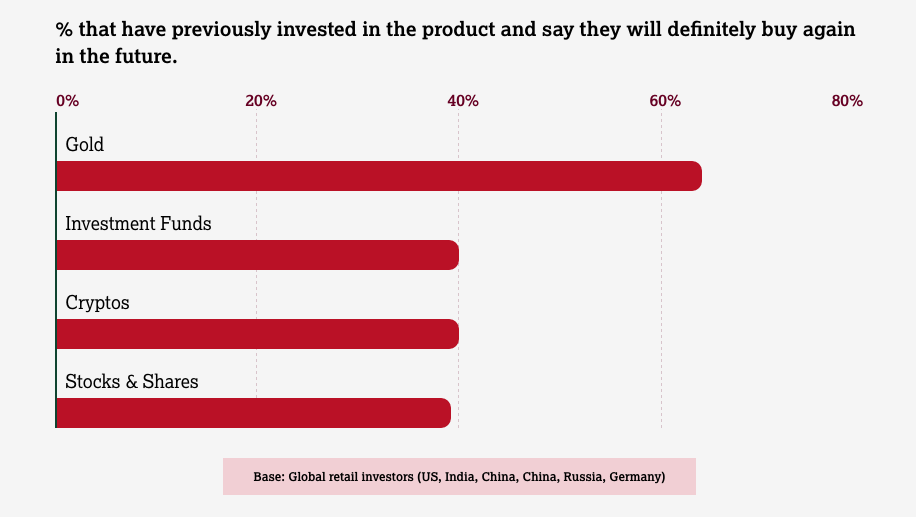

Compellingly, the consumer report found that gold investors possessed a higher degree of loyalty than any other investor.

“64% of people who have invested in gold in the past – be it jewelry, bats and coins, or ETFs – would definitely buy again in the future,” the report said.

Substantial Market Opportunities With Potential Gold Buyers

In its consumer report, the World Gold Council identified substantial market potential in a group of individuals it deemed “gold considerers”. These were potential gold buyers who had never purchased gold, but were open to the idea. This group (over a third of all respondents) encompassed both the retail investor and fashion and lifestyle consumer categories.

“There is a huge opportunity for the market to grow. Thirty-eight percent of those surveyed had never bought gold, but were open to doing do in the future,” the report explained.

However, the Council found a compelling factor that it cited as a barrier to expanding gold market growth with this aforementioned group of individuals: mistrust.

“While people have confidence in gold, there is some mistrust among those that have never bought gold in the past, but are open to the idea of buying it in the future, with 48% and 28% of all potential investment and jewelry consumers respectively citing lack of trust as a significant barrier. That could be mistrust around fake or counterfeit bars and coins, product purity, or the trustworthiness of some retailers,” the World Gold Council said in a press release.

Within the retail investment category, in addition to the mistrust component, 28% cited concerns about purchasing counterfeit gold, 21% were worried about the purity of the precious metal, and 14% mistrusted companies selling the gold.

Another barrier that the consumer report identified to expanding gold market growth was awareness. The Council found that two-thirds of potential gold investors were unaware of the particulars of investing in the precious metal, which impeding their investment decisions:

“66% of potential new gold investors don’t know enough about gold, don’t know how to buy it, or think it is not affordable to them. This ranges from unfamiliarity with the functional aspect of buying and selling the investment through to a lack of knowledge of what drives the gold price.”

Yet, despite the apparent lack of awareness in gold with potential investors, the Council did identify solutions that could remedy this problem. “Greater awareness of gold needs to be created through TV, print and social media; quality education is required on the benefits of owning gold; and, while it is not a mainstream issue now, the next generation of potential gold buyers need to know more about the industry's ethical credentials,” the WGC explained.

The consumer report also identified further solutions, which would increase awareness about gold investing. Principally, further education was required apropos of specific gold investment products, those products relative affordability compared to other investment vehicles, and what influences their prices could be more effectively communicated. The World Gold Council believes that implementing this education strategy would generate market growth with potential gold buyers.

Utilizing Technological Innovation Would Further Expand The Gold Market

Another key component that the consumer report concluded would expand the gold market, was utilizing technological innovation. Although the Council said facets of the gold sector had already embraced technological innovation, such as the mining industry using artificial intelligence in gold exploration, there were still significant improvements needed to achieve a competitive advantage. The consumer report stated that the gold sector has embraced new technologies at a far slower pace than other industries, at times, to its detriment:

“We know there are some pioneering, tech-savvy players in the gold market. But our data suggests there are too few. Gold compares poorly to other retail investments and fashion items when looked at through the lens of digital distribution, marketing and communications. Global retail investors only buy 9% of gold coins and 6% of jewelry online, compared with 25% of gold-backed ETFs.”

However, the consumer report concluded that digital engagement was an integral component in achieving a competitive advantage. It explained that retail gold investors desire a seamless user experience when purchasing gold online.

“The retail gold market is healthy, with gold being considered a mainstream choice. But what really excites me is the untapped part of the market: those people who have never bought gold but are warm to the idea of doing so in the future

Two issues need to be addressed to engage with these potential gold buyers: trust and awareness. This market can flourish if we can build trust across the broad spectrum of gold products being sold and raise awareness around the positive role gold can play in protecting people's wealth,” commented David Tait, World Gold Council Chief Executive Officer.

There Is No Better Time Than Now To Invest In Gold

Considering that precious metals such as gold have enjoyed a bullish market, there is no better time than now to invest. This is yet another reason why gold makes sense in an IRA. Learn more about Gold IRA rules and regulations and information about the Top Gold IRA companies.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81