The Song Remains the Same–For Now

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 10th November 2021, 01:23 am

Based on recent reports, many investors believe the turbulence that impacted various markets earlier this year has come and gone. But that doesn't necessarily mean that sentiment is ripe–sufficiently complacent–for a broad range of negative fundamental and macroeconomic forces–discussed here, here and here–to reassert themselves.

In fact, there are reasons to believe that many markets remain in the midst of a corrective dampening of excessive pessimism. Aside from the sentiment indicators and other data detailed in “Not Yet Time to Pull the Trigger,” other measures suggest that many in the trading crowd are positioned for the worst. From a contrarian standpoint, that is not what you would normally expect to see if the bottom was set to fall out.

Set up for a rally?

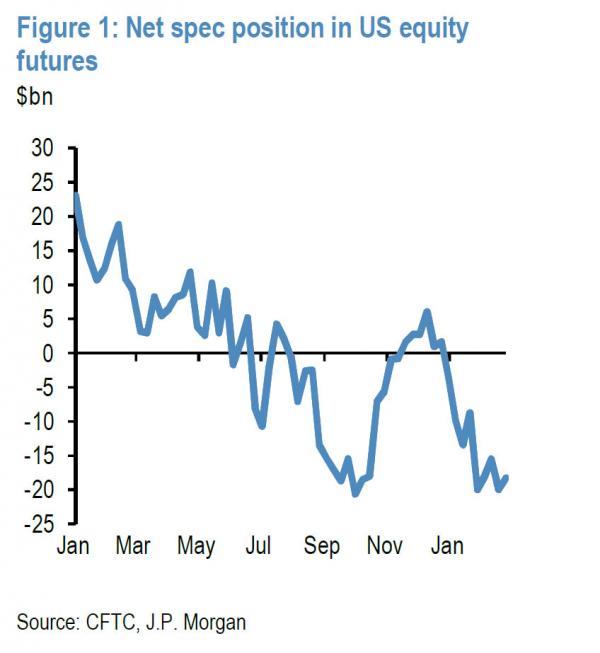

Among other things, the net speculative position in U.S. stock index futures is hovering near last fall's bearish extremes, setting the stage for a sharp rally in equities and other risk-on markets, while short interest in the S&P 500 SPDR exchange-traded fund, the equity market's largest ETF, is somewhat elevated. According to J.P. Morgan, this combination suggests there is (further) room for short-covering.

Meanwhile, short interest totals at the New York Stock Exchange have rebounded toward their 2015 peak, and are only a stone's throw away from their July 2008 highs, indicating that investor pessimism is not yet in short supply.

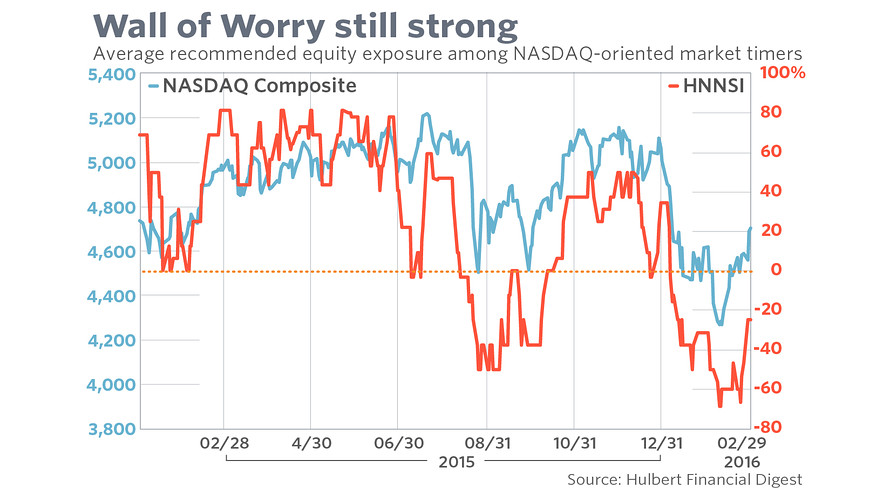

According to Mark Hulbert, who tracks the advice of 160 newsletter writers in the Hulbert Financial Digest, “a considerable number of market timers remain completely out of stocks, if not outright bearish.” He adds that “fewer market timers have jumped back on the bullish bandwagon than what you would expect given a rally as strong as the one over the last few weeks.” Taken together, Hulbert says, sentiment among this group is “encouraging from a contrarian point of view.”

Still, even if the near term outlook is fairly benign, that doesn't mean investors shouldn't be thinking about what might happen down the line. While the prospect that things will unravel over the next few days or weeks seems unlikely, it is not something that can be ruled out.

Lurking on the horizon

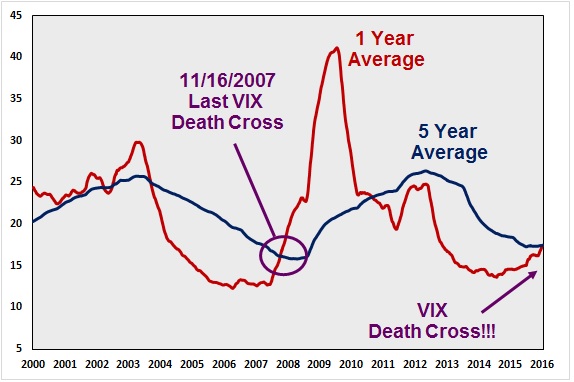

One slow-moving volatility measure, for example, is signaling major upheaval on the horizon. Admittedly, this message contrasts somewhat with some shorter-term developments. As noted previously, a sizable contingent of hedge funds and other speculators is reportedly betting that volatility has reached a floor–meaning share prices have seen their peak–which, for a contrarian, means things probably won't turn out as they expect. Nonetheless, the fact, detailed by the Chicago Board Options Exchange's Russell Rhoads, that the VIX's one-year moving average is trading above its five-year counterpart for the first time since 2007 suggests that volatility is on the cusp of a secular–and destabilizing–rise.

Moreover, a related measure indicates that concerns about the prospect of large price swings somewhere down the line are muted, which often means that the opposite will hold true. Zero Hedge notes that the CBOE's VVIX Index, which represents the expected volatility of the 30-day forward price of the VIX, has dropped back to levels that preceded prior jumps in that measure. In other words, complacency looks to be near a major peak.

Other developments indicate that investors in some markets and sectors are returning to their old, overly exuberant ways. Citing data from Lipper, the Financial Times recently reported that “investors piled into U.S. junk bond funds at the fastest pace on record.” The newspaper said that “the moves highlight an easing of investor anxiety after a string of better than expected economic reports in the U.S., a stabilization in crude prices and the view that central banks in Europe, Japan and China are prepared to provide further economic stimulus if needed.”

A darkening outlook

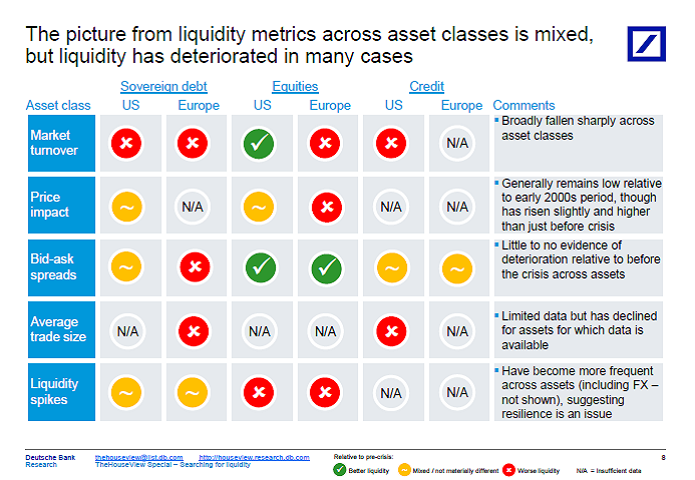

Little has changed in terms of the bigger picture, however. Indeed, the threat of an imminent economic downturn seems to have increased rather than diminished; such an event will be bad news for high yield bonds and other assets, including the stock market overall. In “The Nine Horsemen of the U.S. Recession Apocalypse,” Zero Hedge highlights nine charts that, when taken together, are anything but reassuring. Separately, research by Deutsche Bank, detailed at The Big Picture, shows that liquidity has deteriorated across asset classes, virtually ensuring that a rush for the exits will be messy and unsettling.

In sum, these developments continue to suggest that conditions will remain somewhat uneventful in the near term, affording investors the flexibility to pick and choose entry and exit points. Longer term, however, the picture remains decidedly negative. Given how much risk has built up over the course of seven years of easy money and reckless, Federal Reserve-inspired risk-taking, it is likely that what we saw earlier this year represents only a taste of what is to come.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,355.97

Gold: $3,355.97

Silver: $38.49

Silver: $38.49

Platinum: $1,343.72

Platinum: $1,343.72

Palladium: $1,137.56

Palladium: $1,137.56

Bitcoin: $123,451.88

Bitcoin: $123,451.88

Ethereum: $4,763.55

Ethereum: $4,763.55