- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The “Largest Trade War in History” Terrifies and Confuses Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th July 2018, 04:27 pm

Last Friday you saw the United States launch the first salvo in the long-promised trade war with an initial shot of $34 billion in Chinese goods. They came from 818 different categories of products. China immediately responded with its first official round of retaliation on a number of American imports that matched the $34 billion per a Reuters report. It means that the long-feared trade war between the world's largest and second largest economies has finally begun in earnest.

This is the starkest warning so far that you need to protect your investment and retirement portfolios from a downward spiral in the global trade regime that has built today's prosperous world economy. Gold makes sense in an IRA because it has such a long history of safeguarding assets in times of trade wars (and economic malaise that they tend to create). Now is a good time to start thinking about the top five gold coins for investors. Gold can and will protect you in this dangerous time for the U.S. and global economies.

One Tariff Leads to Another in Damaging Tit for Tat Trade Dispute

It was midnight in Washington D.C. when the administration of President Trump officially imposed the first-round of tariffs. China responded to the trade barriers by matching them as closely as it could within two hours. The Chinese are erecting a comparable barrier of 25 percent duties on their selected items in a determined effort to match the U.S. import tariff rate, per the Xinhua Chinese official state news agency. These includes pork, soybeans, and electric vehicles from the U.S.

China Responds With Heated Rhetoric

China did not take the start of the trade war well or quietly. Their China Ministry of Commerce spokesperson at the ministry of commerce site stated on Friday that the Middle Kingdom had continuously refrained from any efforts to

“fire the first shot.” We are forced to retaliate against the United States which “launched the largest trade war in economic history… This act is typical trade bullying. It seriously jeopardizes the global industrial chain,… hinders the pace of global economic recovery, triggers global market turmoil, and will affect more innocent multinational companies, general companies, and consumers.”

Besides the bellicose rhetoric, the Ministry of Commerce warned that it would officially report the United States at the World Trade Organization. They accused the U.S. of having broken the global laws that govern world trade.

Market Confusion Erupts In China

The immediate consequences of the enacted tariffs and promised counter tariffs were that the futures for Chinese soy meal tanked more than two percent in the afternoon trade on Friday. They did manage to recoup the majority of these losses in a violent, whipsaw action. The volatility resulted from temporary confusion in the futures markets as to whether or not the Chinese government had already erected the promised soybean tariffs and those on the additional American goods.

Soy meal is only one particular item that economic experts anticipate will become more costly in China as a result of rising soy meal prices on the futures markets. It could be especially acute as the United States was just set to capture the prize of main soybean supplier to the country. Besides hurting Chinese consumers and casting doubt around Chinese investment markets, this injures American farmers and U.S. exporting businesses as well.

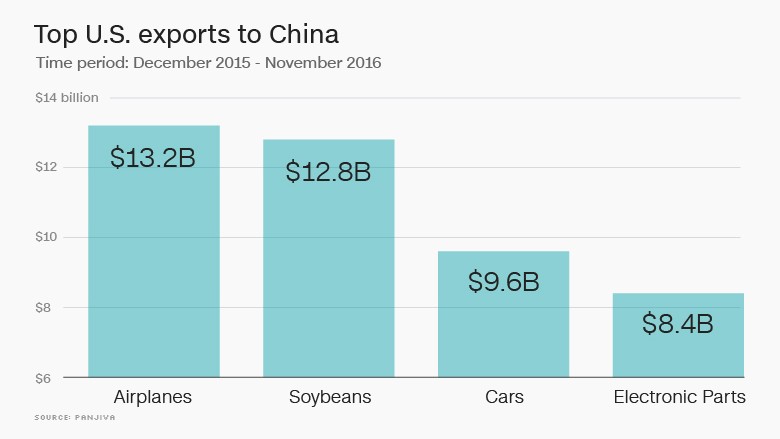

It bears watching to see how it will impact the U.S. markets as the knock-on effects from it spread to other related industries. The graphic below demonstrates the top trade exports to China that will be impacted by the tariffs:

Despite the fact that the danger is already growing and the damage is just beginning to spread, no signs have emerged that the two opposing sides will manage to agree on a trade dispute compromise in the near to intermediate future.

Next Round of Tariffs To Be Even More Damaging

This is only the beginning though. Even though Washington D.C. and Beijing have engaged in a few high level talk discussions since the beginning of May, the U.S. administration is pushing forward with a larger list of Chinese imports it is targeting for more tariffs. On Thursday the president warned that there are still another second round of tariffs which will take effect in another against China in two weeks.

He then reminded that the additional punitive measures could amount to in excess of $500 billion in tariffs on China's other exports that may soon become a casualty of the war. Trump elaborated on these with his statement:

First “34, and then you have another 16 in two weeks and then as you know we have 200 billion in abeyance and then after the 200 billion we have 300 billion in abeyance. Ok? So we have 50 plus 200 plus almost 300… It's only on China.”

The President's statement is a sobering reminder for China that the U.S. is prepared to see the trade war through if necessary.

China Not the Only Asian Nation Damaged by the Trade War

China stands to lose the most in Asia, but other regional countries will be impacted by the spreading tariffs as well. Taiwan, Singapore, Malaysia, and South Korea (as well as other Southeast Asian nations) represent the biggest so-called “intermediate goods” exporters to China. The Middle Kingdom next takes these goods and assembles them together to make the final goods that become transshipped to the United States.

This means that declining Chinese exports (from the U.S. tariffs) will also noticeably impact the exporting Southeast Asian “Tigers” and their economies. They are among the front line countries to potentially suffer severely as world trade becomes threatened. The DBS Chief Economist in Singapore warned that:

“Given the trade open-ness and exposure to the supply chain, there will be no respite whatsoever for Malaysia, Singapore, South Korea, and Taiwan in this tail risk scenario.”

Economic problems in Southeast Asia have an unsettling historical tendency to shake the entire world's economy and stock markets. It was only back in the late 1990's that you saw an economic pullback because of the Asian currency crisis.

Germany and the EU Also A Casualty of the Expanding Trade War

The Asian countries are not the only ones which will suffer impacts from the spreading global trade war that started between the U.S. and China. Germany's closely followed Ifo Institute warned this past week that the country's track record of exporting a larger amount than it imports is creating a huge dilemma for the German national economy. He pointed out that:

“(The trade surplus) is turning out to be an increasing issue, not just with the U.S. but with other trade partners as well, and also within the European Union… The surplus is becoming toxic, and also within Germany many argue now that we need to do something about it with the purpose of lowering it. It turns out to be a liability rather than an asset.”

The export-centered manufacturing powerhouse economy of Germany has earned bitter criticism for the trade surplus it has created at the expense of other European countries and the United States. Partners have leaned on Berlin to press them to spend more money domestically and increase their imports in the process.

Germany had a trade surplus in 2017 that fell for the first time going back to 2009 down to a still whopping $300.9 billion. Meanwhile its trade surplus with only the United States was $64 billion, according to the February published data of the Federal Statistics Office. It was only last year that President Trump expressed his frustration in a tweet with:

“We have a massive trade deficit with Germany, plus they pay far less than they should on NATO & military. Very bad for U.S. This will change.”

Global Markets Are Reeling from the Escalating Trade War

This trade war dispute between the United States and China has shaken U.S. and global financial markets severely. Stocks, commodities (ranging from coal to soybeans), and currencies are all bearing the brunt. This is why you see wild volatility swings and sometimes steep declines in equities markets these days.

It explains why you need to pick up some IRA-approved gold quickly. The IRS now will allow you to take advantage of the safest top offshore gold storage locations for your IRA. You should review the gold IRA rules and regulations now while there is still a good gold price available.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81