- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

The Dawn of the Currency War Is Not Good News for Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 23rd July 2018, 04:47 pm

This past week you saw a new wrinkle unfold in the expanding trade war, as a new currency war began. Some of the brightest minds in the foreign exchange market have warned that this is happening even as you read this. It started on Friday when American President Donald Trump went on Twitter and warned that both China and the European Union are manipulating their own currencies and keeping their interest rates artificially low.

It reminds you why gold makes sense in an IRA. Currency wars are only the latest threat to your investment and retirement portfolios. Gold is the world's most legendary and long-running safe haven asset that can protect you in uncertain and dangerous financial and geopolitical times like these. You should start looking at Gold IRA rules and regulations now and think about the top offshore storage locations for your IRA-approved gold before the situation deteriorates any further.

President Trump Calls Out China and Europe for Currency Manipulation

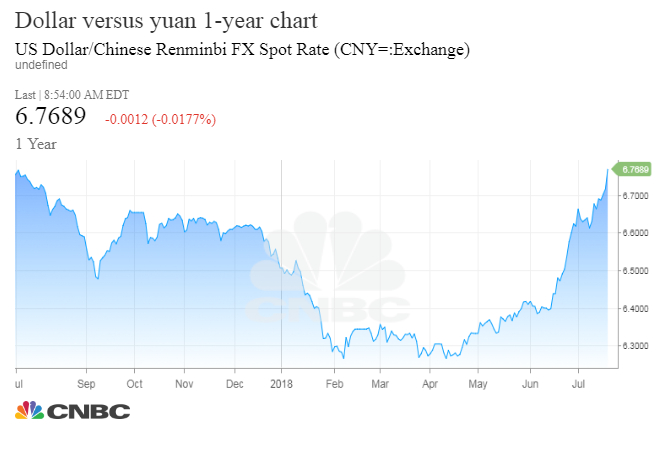

The U.S. President called out both China and the European Union starting on Thursday and again on Friday for engaging in currency manipulation. He accused them of artificially keeping them too low versus the U.S. dollar. The President issued such comments only after the Chinese yuan cratered over 6.80 for one dollar. This was the first time it had happened for a year. The Chinese central bank demonstrated very little interest in intervening to arrest their currency slide.

Reuters reported that U.S. Treasury Secretary Steve Mnuchin warned that the administration is carefully watching to see if China actually did manipulate its currency. President Trump issued his stern rebuke in a tweet:

“China, the European Union, and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollar gets stronger and stronger with each passing day – taking away our big competitive edge. As usual, not a level playing field…”

It was a matter of hours after President Trump's comments first appeared that the People's Bank of China changed the reference rate of the dollar to 6.7671 yuan. This brought the currency a significant .9 percent lower. It represented the largest single weakening of the yuan in fully two years. This chart shows how dramatically the yuan is moving against the dollar:

President Trump gave an interview to CNBC on Friday on the Squawk Box program on Friday. Here he explained the United States' position, saying that the American trading partners are:

“making money easy and their currency is falling… In China their currency is dropping like a rock and our currency is going up, and I have to tell you it puts us at a disadvantage.”

The question that everyone wants answered is: Will there be a full-blow currency war now? Exante Data CEO Jens Nordvig warned that:

“It's starting to smell like it. We've had a trade war that's been going on for a while, and now we're starting to hear talk about ‘you shouldn't be doing that with your currency'.”

Consequences of a Currency War Could Have Far-Reaching Implications

The importance of this brewing currency war can not be overstated. China and the United States are the two largest global economies, and this new front in the trade war is becoming increasingly hostile. The consequences of a break down in at least somewhat harmonious relations could be severe and spread throughout the world financial and currency markets fast.

Collateral damage could quickly include global markets ranging from stocks and bonds, to oil prices, to assets in the emerging markets. The cold war-styled conflict that has been brewing for decades between China and the United States now has the potential to upend the present financial order of the whole world. Best-ranked currency markets strategist of Wall Street for the last consecutive five years Jens Nordvig commented on this idea with:

“The real risk is that we have broad-based unraveling of global trade and currency cooperation, and that is not going to be pretty.”

It is all the more dangerous because China already has a recent history of devaluing its own currency when they feel the need to do so.

China's History of Shock Currency Devaluation

China surprise devalued the yuan during the year 2015. This gives us a hint of what such currency war contagion can morph into if it spirals out of control, per Chief Economist Robin Brooks of the Institute of International Finance (and prior lead currency strategist of leading investment bank Goldman Sachs Group). He sees collapsing oil prices and values of risky assets resulting from rising fears about global growth prospects.

This would ripple over into the countries which export commodities and their currencies. Nations whose economies would suffer especially badly would be Russia with its ruble, Malaysia with its ringgit, and Columbia with its peso. Next would fall the Asian currencies and their economies. Brookes explained that:

“Asian central banks will initially try to stem currency weakness through intervention. But then Asian central banks will step back, and in my mind, the big under-performer on a six month horizon could be EM Asia.”

Treasury Secretary Mnuchin warned China in no uncertain terms that this is far from over, with:

“There's no question that the weakening of the currency creates an unfair advantage for them [China]. We're going to very carefully review whether they have manipulated the currency.”

Reporters asked Treasury if the United States was officially engaged in a currency war. The only reply was stony silence and “no comment.”

U.S. Dollar is a Primary Victim of the Opening Currency War Salvos

Some strategists have argued that China is not deliberately weakening the yuan, yet was simply not stopping its decline as they have in the past. Yet with Thursday's steep adjustment, it was hard to argue that it resulted from natural causes. Instead it seemed like a carefully crafted salvo and warning message. Nordvig explained that:

“It looked pretty deliberate to me it has been moving so fast. Clearly, the currency moving this fast negates the tariffs so from that perspective it's pretty understandable that [Trump] doesn't like what he's seeing.”

Nordvig went on to explain that China's moves in the currency market this week will reveal much. Meanwhile, the dollar will most likely keep suffering. Investors will take the hint from the U.S. president and withdraw from their long against the dollar positions in currency markets, per Global Head of FX Trading Strategy Shahab Jalinoos of Credit Suisse Group. He explained that:

“It has now been virtually defined as a currency war by the U.S. president, given that he explicitly suggested foreign countries are manipulating exchange rates for competitive purposes. The barrage of commentary will likely force the market to scale back long dollar positions.”

The dollar index was certainly moving lower. It had declined over one percent (by the weekend) since the first comments from President Trump. The value of your retirement portfolio is measured in U.S. dollars, a fact that you can easily forget as you watch your investments.

Gold Can Not Be Manipulated By One Country Like This

The good news is that gold does not suffer from currency manipulation. It is a finite natural resource that is quickly running out. Only a few weeks ago, a number of prominent gold analysts declared that we have already passed or reached Peak Gold. This means that there will be less gold discovered, mined, refined, and available every year on average going forward than there was in the recent past. There simply are not enough IRA-approved precious metals to go around. Consider yourself warned, and buy some now while you still can.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81