- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Stock and Bond Bubbles Threaten Financial Markets

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 5th February 2018, 12:14 pm

This last week of January, long-time former Federal Reserve Chairman Alan Greenspan gave an interview outlining two simultaneous threats to financial markets. He warned of bubbles in both stock and bond markets. He is not the only policy maker sounding the alarm either. Outgoing Federal Reserve Chair Janet Yellen offered similar remarks over the weekend. She expanded the danger to include commercial real estate markets.

Such bubbles in stocks, bonds, and real estate pose a serious threat to financial markets and your investment and retirement portfolios. This is why you need IRA-approved precious metals, the time tested asset hedge. Gold makes sense in an IRA because it protects against market turbulence today as it has for thousands of years. Now is a good time to look into it before the bubbles burst. Consider the top five offshore storage locations for your gold IRA.

Alan Greenspan's Remarks on Stock and Bond Bubbles

Alan Greenspan is best remembered for coining the phrase “irrational exuberance” to describe the mood and habits of investors in the late 1990's. The legendary leader of the Federal Reserve served as its head from 1987 through 2006. This phrase he coined came to symbolize what you now know as the dot-come bubble that burst in the early 2000's.

Now Greenspan sees investors doing it all over again. The danger he fears is that this time it is not only in stock valuations. A bubble in more than one market means that investors will have fewer safe places to hide from the next asset value popping.

The comments from the former chairman coincided with stock levels at almost record highs. Stock selling that had begun before his comments accelerated through the past week. At the same time, interest rates on government bonds and notes were near their historic low points. This also began to change last week as the ten year Treasuries yielding rates steadily inched closer to three percent.

Analysts and economists had already warned that interest rates would rise in future years with the Federal Reserve increasing rates through a tighter monetary policy. Greenspan warned about these two financial markets:

“There are two bubbles: We have a stock market bubble, and we have a bond market bubble. At the end of the day, the bond market bubble will eventually be the critical issue, but for the short term it's not too bad. But we're working, obviously, toward a major increase in long-term interest rates, and that has a very important impact, as you know, on the whole structure of the economy.”

Greenspan's warning on bonds may have been as prescient as it seems to have been for stocks. The yields of bonds have started climbing significantly. They reached a four year long high point of 2.84 percent last week. Investors have begun to fear that the rout in the Treasury's market forecasts doom for equities.

This is feeding back into American stocks. It played a part last week in the U.S. equities declining by their greatest amount over the last two years. Sunday night saw the stock index futures going lower as the selloff continued.

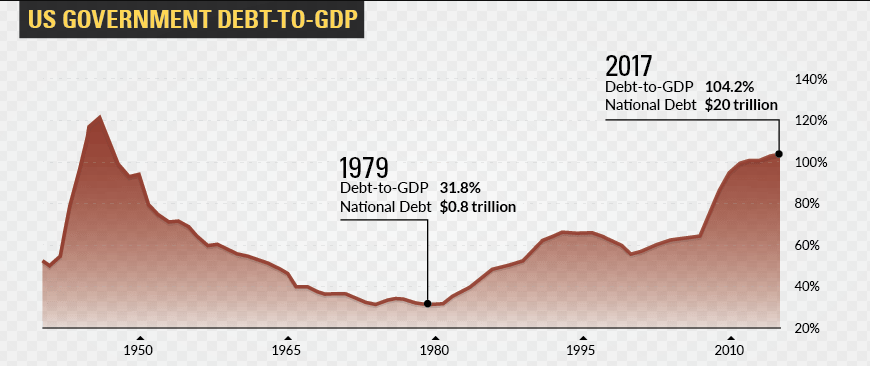

Former Chairman Greenspan's alarm is based on government forecasts that the U.S. Federal deficit will continue to rise in terms of its percentage of the gross domestic product. This is why he expressed surprise that U.S. President Donald Trump did not spell out where he will get the revenues for the new State of the Union-promised government initiatives.

The tax cuts which the president signed in January may also significantly increase the budget shortfall. This chart shows how high debt to GDP is already:

It is this increasing shortfall in the Federal budget that spurred Greenspan's warning for bonds. Greenspan explained his concerns about the bond bubble with:

“What's behind the bubble? Well the fact, that, essentially, we're beginning to run an ever larger government deficit.” Compared to the GDP percentage the “debt has been rising very significantly. We're just not paying enough attention to that.”

Greenspan is not alone in his warnings on the high levels in asset markets now though.

Outgoing Fed Chair Janet Yellen Adds Her Voice to the Alarm

Janet Yellen was the Federal Reserve chair until this past Saturday. After she served one term, President Trump chose to appoint Fed Governor Jerome Powell (who has been one of the governors from 2012) to replace her. It is significant that outgoing chair Yellen made comments that were similar to former Chairman Greenspan's own over the weekend.

While she did not use the word bubble when discussing equities, she did express concern about the price levels of American stocks over the weekend with her CBS “Sunday Morning” exit interview:

“Well, I don't want to say too high. But I do want to say high. Price earnings ratios are near the high end of their historical ranges.”

Yellen did not comment on bond yields in this interview. She did talk about another danger to markets that Greenspan had not brought up with his remarks. Yellen warned that the prices for commercial real estate are:

“Quite high relative to rents. Now, is that a bubble or is it too high? And there it's very hard to tell. But it is a source of some concern that asset valuations are so high.”

The outgoing Federal Reserve chair then tried to downplay the dangers to the financial system and overall economy by arguing that the banking system today is “more resilient” while the U.S. and global financial systems have become far better capitalized as compared to ten years ago at the start of the Global Financial Crisis. Yellen stated:

“What we look at is, if stock prices or asset prices more generally were to fall, what would that mean for the economy as a whole? And I think our overall judgment is that, if there were to be a decline in asset valuations, it would not damage unduly the core of our financial system.”

This does not change the fact that she has already warned stock valuations are historically high in the same interview. The system may hold up, but this will not keep the markets from severely correcting or even bursting.

Large Investors Add Their Warnings for the Markets

A severe pullback is also overdue. Today's American economic expansion run has almost reached nine years now. This makes it the third longest lasting one since the end of the Second World War as the National Bureau of Economic Research has pointed out.

Major investment funds have also been warning about a coming downturn in U.S. and global equities. Australian AMP Capital Investors Ltd. manages around $141 billion. Their Global Investment Strategist Shane Oliver recently express his concern with:

“It's likely the pullback has further to go as investors adjust to more Fed tightening than currently assumed. The pullback is likely to be just an overdue correction, with a say 10 percent or so fall, rather than a severe bear market.”

It remains to be seen whether former Fed Chairman Alan Greenspan is correct in his more dire assessments for stocks and bonds. He and Janet Yellen are the trained economists.

You should not take chances with your retirement portfolio when you can offset equity and bond declines with gold as insurance. Consider the top five gold coins for investors today as well as the Gold IRA rollover rules and regulations before the pullback gets any worse.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81