- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

S&P Warns Nations Must Spend More to Support Struggling Economies

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 20th July 2020, 02:40 pm

This past week it became more clear that the effects of the global pandemic are going to be with us for a long, long time to come. Two highly regarded and respected voices spoke out on the continuing financial and economic crisis in America and around the world and on the need to continue to spend hugely to support struggling economies. An S&P Global Ratings chief economist and the CEO Jamie Dimon of bellwether bank JPMorgan Chase both expressed grave concerns for the foreseeable future if more is not done to address the ongoing crisis and its second order economic effects.

S&P Warns of Economic Stimulus Fatigue in the U.S. and Other Developed Countries

The slowdown that began in the economies of the U.S. and world may have tapered off a little, but this has been a head fake. S&P Global ratings warned this past week that the economic damage has only begun to filter through to the economics of individuals and businesses. Governments will be left without a choice on increasing and expanding their financial support to both households and businesses not only for this year, but well into the coming year 2021 per economists at S&P Global Ratings.

A great many governments began deploying significant amounts of financial support after the pandemic first hit the world in earnest beginning back in February and March. Yet a number of countries including the United States have since demonstrated “a degree of fiscal fatigue.” Per Chief Economist Shaun Roache of the Asia Pacific region at the S&P Global Ratings, these countries are contemplating paring back stimulus measures now. He grimly warned about this with:

“We're seeing some fiscal policymakers think about pulling back some of their measures or maybe letting them expire without renewing them, and that's quite a dangerous thing to do when demand in the rest of the economy still remains quite suppressed. So we expect and hope to see some of those fiscal measures being renewed, pushed forward into the next year. That is going to mean more fiscal easing, but at the moment there is no alternative to that.”

Roache further warned that this added spending is going to cause dramatic deterioration to government balance sheets and finances. Yet it is mandatory in order to “prevent things from getting even worse.” It is all the more true because governments and authorities are being forced into enacting measures that will discourage economic activity for the future as a trade off to trying to contain the coronavirus now because there is still no available medical answer to taming the pandemic, Roache explained.

S&P Downgrades Outlook for Global Economy

It was only this month that the S&P Global Ratings decided to reduce their economic forecasts for the world economy as a whole. They now call for a painful decline in global GDP of 3.8 percent for 2020. This was lowered from their prior estimates of a 2.4 percent decline for the year.

While they forecast that the world economy will later rebound to an average four percent growth rate between 2021 and 2023, S&P Global Ratings expects that the economic output level will remain lower than the 2019 levels (when the virus began to quickly spread) for a number of years, per their report. Roache expanded this with:

“So we're not going back to where we would have been in the absence of the virus and to a very large extent this reflects a lot of the damage that's been caused… to labor markets but particularly to balance sheets and that's not going to be fixed easily or quickly.”

The dramatic fall in economic activity is painfully obvious according to specific statistics emerging after the end of the national lockdown. Several examples show that economic activity enjoyed a brief bounce back following the lifting of lockdowns across the U.S. before those same measures peaked and started to decline once again.

American hotel bookings data from STR, a worldwide hospitality research firm, reveals that there has not been any improvement since June. Occupancy of rooms is still down to roughly 45 percent of capacity versus 73.8 percent of occupancy a year prior in July 2019. STR said that the average daily prices for the rooms are similarly down significantly around 27 percent versus 20 percent from last week.

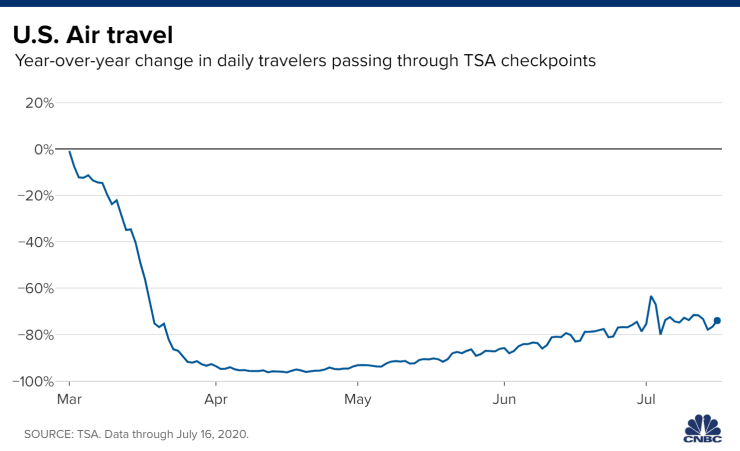

Restaurant bookings were also rising in May through early June, but these have begun to plateau as well. The numbers for this week reveal that restaurant bookings remain off 60 percent versus the same time last year. Airline passenger figures are almost as bad. Quantities of people going through airport security checkpoints in the U.S. are under 70 percent of the past year's totals after having briefly recovered somewhat in early July as this chart below reveals:

JP Morgan's Jamie Dimon Also Increasingly Pessimistic on Future Path of Economy

CEO of JPMorgan Chase and revered predictor of financial trends Jamie Dimon has also admitted that the future path of the U.S. economy is no longer certain. He leads the mega-American bank that boasts an incredible $3.2 trillion in assets and that counts nearly half of all households in America as customers along with many businesses. The banking titan with a unique perspective on the U.S. economy stated grimly that:

“The word unprecedented is rarely used properly. This time, it's being used properly. It's unprecedented what's going on around the world, and obviously Covid itself is a main attribute.”

Dimon warned that after four months deep into this global pandemic, the financial harm that it has wreaked has not yet begun to truly register. The reason for this in the U.S. is that the prior economic stimulus package pumped billions of dollars into businesses and households, which papered over the effects of the unprecedented shutdown of the economy. Yet as Dimon and other economists have observed regarding a so-called unemployment cash cliff, upwards of 25.6 million Americans are set to lose their expanded unemployment benefits at the end of July unless Congress elects to extend the $600 a week in extra payouts that have kept many Americans afloat. This looks unlikely.

Dimon explained that:

“In a normal recession unemployment goes up, delinquencies go up, charge-off go up, home prices go down; none of that's true here. Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you're just not going to see it right away because of all the stimulus.”

As a case in point, JPMorgan Chase has already given forbearances for 1.7 million accounts. Over half of these mortgage and credit card customers have managed to make at least a single payment up to now. Yet he warned that the customers are vulnerable and that they are likely to quit paying entirely once their expanded federal unemployment benefits end in 10 days.

Matters have only been aggravated by the resurgence in American coronavirus cases that are now topping out at over 70,000 new cases per day with the pandemic worsening in the Sun Belt of the West and the South. It has caused important economic states such as California to reverse their reopening of businesses, with a number of cities across the country also pulling back.

Meanwhile, JPMorgan and Co have five individual scenarios for the economy going forward in the chaos and confusion. They are now more pessimistic in their base case that has national unemployment remaining at a high 11 percent at year's end. This is 4.3 percent worse than when they forecasted it back in April.

Their worst possible scenario has the virus making a second wave surge for the fall and causing another wave of large-scale shutdowns across the nation. This would lead to a peak national unemployment rate of approximately 23 percent, the bank warned. Just the huge range of possible outcomes itself shows the dangerous uncertainty facing American businesses, households, and investors as Dimon warned:

“If you look at the base case, an adverse case, an extremely adverse case, they're all possible and we're just guessing at the probabilities of those things; that's all we're doing… We simply don't know, and, by the way, we're wasting time guessing.”

Unfortunately the news of this past week on continuing fallout from the national economic shutdown is anything but good. It goes to show you why gold makes sense in an IRA. You can not do anything about the government's stimulus spending decisions going forward as the pandemic continues to rage. You are able to consider IRA-approved gold as the ultimate historical safe haven for possible inclusion in your own investment and retirement portfolios. Reading more about Gold IRA storage options and the Top Gold IRA Companies first makes sense.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68