- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Solid GDP Number Actually Grossly Misleading

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 30th August 2019, 04:02 pm

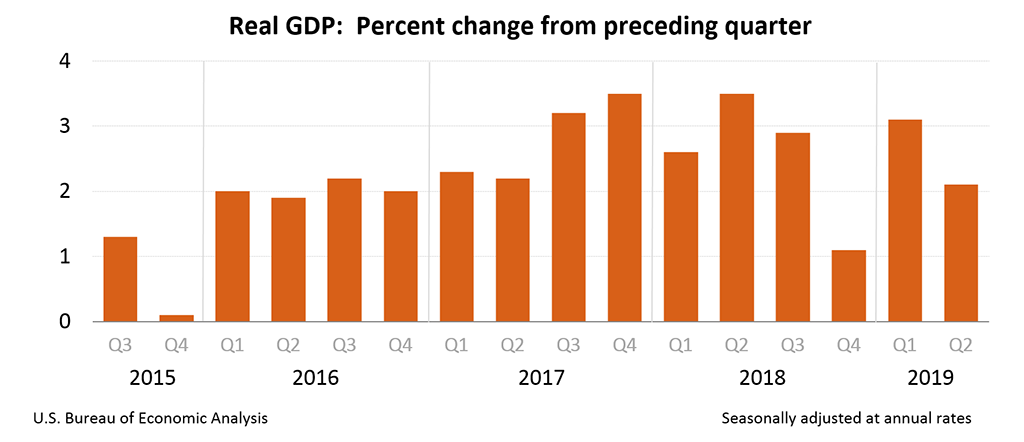

Last Friday saw the release of the second quarter GDP estimate from the government. On the surface the figure did not appear too bad. Growth in the U.S. economy decreased to 2.1 percent. The number was still just better than what economists had been projecting. The chart below shows the positive headline GDP figures over the last few years:

This headline figure does not tell the full story about the economy though. When you drill down into the report, the quarter actually turned out to be a disaster. Nearly every important sub-category figure declined.

Most Important Part of GDP Figure Was Substantially Down

In fact, the most crucial component of the Gross Domestic Product declined significantly. Gross private domestic investment dropped a substantial 5.5 percent. To put this into context, this is the worst quarter for this critical sub-category going back to the fourth quarter of 2015.

Other critical categories were also off. Non-residential business investment dropped by .6 percent. The category of residential investment saw a 1.5 percent decline. This sub-category has now dropped for six consecutive quarters. It represents the longest downward trend in the figure dating back to 2009 and the height of the Great Recession and Global Financial Crisis. Net exports also experienced their largest fall in a full decade.

The revealing details of these sub-categories raises the question of how the GDP number looked as strong as it did. Exports are cratering as business investment is falling substantially. The economy in reality appears weak.

Two Categories Positively Impacted the GDP Number

There were two categories that did have a massive positive impact on the GDP. These were government spending and consumer spending. The problem is that both of these were underpinned by heavy borrowing. In other words, the GDP rose because of increasing debt.

Looking at the government spending category, it increased by a huge five percent. All by itself, this added .85 percent to the total GDP print. For the second quarter, non-defense categories of spending increased by an incredible 15.9 percent. It has been more than 21 years since you saw government spending increase by so much in only one quarter.

During that time frame there were two significant recessions, one of which was the Great Recession. Economist Peter Schiff of Euro Pacific Capital explained it as:

“Non-defense spending – domestic spending – rose last quarter by more than it did in any quarter during either of those recessions. Think about that. Trump keeps complaining that we're not getting as much monetary stimulus as Obama got. But look at all the fiscal stimulus we're getting that Obama didn't get. The fiscal stimulus that we're getting now is larger than what we've gotten in the prior two recessions. Yet we're getting this stimulus when the economy isn't even in recession… If the economy is so good, why does it need so much fiscal stimulus? And if it's getting so much fiscal stimulus, and if you believe fiscal stimulus works, why isn't GDP even stronger?”

In other words, this type and amount of spending is typically present when the economy itself is weaker.

Government and Consumer Spending Are Carrying the Economy Now

The reasons you saw the GDP rising were due to massive government spending and solid consumer spending. These were enough to overshadow the drop in business investment, declining corporate profits, and falling imports. Consumer spending played the next most important part in the equation after the government spending category. The consumer spent 4.3 percent more. This represented almost all of the growth in GDP. It should not come as a surprise that headlines shared the common theme of American consumers having saved the economy.

Schiff asks an important question as he points out that this can not continue for long:

“The problem is if the consumer rescued the economy, who is going to rescue the consumer? Because if you look at where the consumer is getting the money, it's from credit. Year over year, consumer debt has increased by five percent. So, what is driving consumer spending is debt.”

American consumer debt has reached a troubling point. Today the American consumer owes almost $4.9 trillion. This figure does not even take into account mortgage debt. The unsustainable figure can not go up forever.

Schiff and other economists have pointed out that these two debt spending categories of consumer and government debt represent the balance of the positive GDP figure. It is not derived from growing business and industry as some have touted. Instead the GDP growth comes from spending additionally borrowed cash.

Government Set to Spend Even More Borrowed Money

Last week it became more clear that the government is going to continue even more massive borrowing to finance greater spending still. The bipartisan spending bill from President Trump came closer to becoming law when the House of Representatives passed this legislation with a 284 to 149 vote.

Looking into this spending bill, it will boost current discretionary spending up from $1.32 trillion for fiscal year 2019 to reach $1.37 trillion for fiscal year 2020. The spending rises still more in fiscal year 2021 when it reaches $1.375 trillion. This will please both parties in Congress by boosting spending in both domestic and military categories. An important component of this bill is that it will also add $320 billion in spending beyond what the debt ceiling law currently allows. To get around this, the bill suspends this debt ceiling through the middle of 2021.

Party politics played a part in getting such a massive spending bill through the House. Ironically the Republican president's bill relied on the overwhelming support of Congressional Democrats. Many Republicans representatives were able to vote against the bill for increasing spending beyond what they felt were fiscally responsible limits. As for the chances of the bill successfully getting through the Senate, the Senate Majority Leader Mitch McConnell has stated that:

Boosting the Pentagon's budget “achieves the number one goal of the Republican side of the aisle, providing for the common defense.”

Observers believe the bill has a near certainty of making it through the Republican party controlled Senate. President Trump has pledged to sign the spending bill that he worked tirelessly to see passed by the House of Representatives.

Deficit to Top A Trillion Dollars in Fiscal 2019

All of this means that the debt pile is only going to continue growing for the foreseeable future. For the month of June, the U.S. administration incurred yet another $8.5 billion deficit. The Treasury Department reported that the May deficit was far worse, coming in at a staggering $208 billion for just the month. It was the historical record for such a May deficit.

Combined together, the 2019 fiscal spending has now (already) exceeded revenues by $747.1 billion according to ABC News. This in itself represents a 23.1 percent rise versus last year. In 2018, this budget deficit for the entire year was $779 billion. President Trump's administration is forecasting an over one trillion dollar deficit for this fiscal year.

These sobering numbers do not consider the mandatory spending categories like Social Security, Medicare, and Medicaid. The government has already spent more than $3.36 trillion for fiscal year 2019. This represents a 6.6 percent rise versus last year.

GDP Rise Is A Case of Slanted News

A detailed look behind the numbers of the latest GDP estimate report shows that the headline number does not reveal the full truth. Government and consumer debt is rising in order to pay for the two categories of spending that are carrying the economy. This is why many observers have come to the conclusion that gold makes sense in an IRA. It is easier than ever to buy gold in monthly installments for a retirement portfolio. The IRS even allows for top offshore storage locations for gold IRAs nowadays. It is always a good idea to look into top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68