- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Societe Generale CEO Warns Looming No Deal Brexit Threatens Global Recession

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 9th October 2019, 11:58 am

This week saw the deadline for Brexit move uncomfortably and dangerously close with no breakthrough on the negotiations between Great Britain and the EU in sight. As of today there are only 22 days left until Britain leaves the EU without a deal unless an unlikely last minute compromise is reached or Prime Minister Boris Johnson renegs on his consistent pledge to leave October 31st “do or die.” As the CEO of banking giant Societe Generale pointed out at an investment conference in London, such a disruptive British exit from the world's largest trading block has potentially huge implications for the world economy and banking system.

PM Boris Johnson Tells German Premier Angela Merkel A Deal is Essentially Impossible

The situation between Britain and the EU went from bad to worse this past week as the talks broke down. Both sides have become angry with each other. Britain blames the EU and vice versa for not successfully reaching a deal. After a phone conversation with German Premier Angela Merkel, British Prime Minister Boris Johnson told her that based on new tougher conditions the EU is now imposing for Brexit arrangements, achieving a deal has become “essentially impossible.”

After Blame Game, Failing Hopes Lie In Last Minute Meetings With Ireland

The Johnson administration claimed today in London that the EU has taken a tougher position on the talks. Meanwhile the European Parliament President David Sassoli asked if Johnson had ever taken seriously the task of reaching a deal. Negotiators from both sides indicated that they would not meet in Brussels on Wednesday. EU Commission President Donald Tusk took the rhetoric to a new low level with his tweet:

“Boris Johnson, what's at stake is not winning some stupid blame game. At stake is the future of Europe and the UK as well as the security and interests of our people. You don't want a deal, you don't want an extension, you don't want to revoke, quo vadis?”

All last ditched hopes for an agreement now come down to a single meeting between Prime Minister Johnson and the Irish Prime Minister Leo Varadkar that will take place in the next two days. Neither leader has the political maneuvering room to move appreciably enough to satisfy the other side though. Irish Foreign Minister Simon Coveney warned about the upcoming meeting that:

“The narrative seems to be leaning towards a blame game rather than actually trying to solve the issue.”

EU Rejects Johnson's Offer from Last Week

Just last week, Britain's Prime Minister had submitted an offer to resolve the tense standoff. He suggested that Northern Ireland (in the U.K.) should leave the European Union's customs union with a limited customs check at a distance from the border frontier. Varadkar quickly shot this offer down, stating that checks of any kind would jeopardize the peace of Northern Ireland (which formerly experienced decades of IRA terrorism).

There was also an argument on how the Northern Irish would be able to democratically agree to such arrangements. Johnson had suggested that the regional assembly could periodically sign off on the deal. The assembly has not sat for around three years thanks to internal political disputes. The EU and Ireland took the position that such a periodic sign off would create routine periods of uncertainty for the arrangements. A primary disagreement preventing a Brexit deal with the EU is still the dispute over how to handle the border between Ireland and the U.K.'s Northern Ireland.

British Government Preparing for Talks with the EU to Collapse

With so little time until the Brexit October 31st departure date remaining, the British government is making preparations as if talks will imminently collapse (for which they will blame EU and Ireland leaders), per a Spectator Magazine report. Meanwhile, the Irish Prime Minister and French President Emmanuel Macron have both set an informal deadline of this Friday to make serious progress on the issue.

Unfortunately the only issue that all sides of the argument agree on is that a deal is unlikely to be reached. Prime Minister Johnson reiterates that the United Kingdom will simply leave the European Union in a No Deal Brexit on October 31st in such a scenario. His government's reports warn that such a move might lead to economic chaos, not only in Ireland and the U.K., but also the whole of the EU.

Johnson also states that he will abide by a recently passed law that mandates he seek out and accept a Brexit delay from the European Union. Speculation is that he has found a way to comply with the letter of the law while still leaving the EU on the 31st in a No Deal exit. Whichever scenario occurs, a British Parliamentary election is likely to result so that the new prime minister can seek a mandate from the public to leave with or without a deal (or to get their approval for having left without one). It was only a few months ago that Johnson assured his own party ministers that the odds of leaving with a No Deal Brexit were a million to one.

Societe Generale Chairman Warns of Systemic Banking Threat and Global Recession

The economic consequences of a No Deal Brexit are far reaching beyond the U.K., Ireland, and even the EU. Societe Generale Chairman Lorenzo Bini Smaghi warned at the Bloomberg Invest London conference that it could force the entire world into recession and create a serious disaster for the global financial system (of which London is a major center). He stated that:

“This uncertainty, I think, would create quite an impact on the emotion, on the sentiment, on entrepreneurs all over the world. Consumption would stop, investment would stop, and we could have a recession. It is a systemic event. For the financial sector, it is a big risk because if we don't have continuity, for the financial system it is a disaster. An agreed Brexit would have an equivalence concept that would at least allow for a transition. If we had a hard Brexit, then it is a problem because the continuity of contracts, the continuity of business will be put into question. We have seen in the past when there are doubts and uncertainties, these financial shocks become real economy shocks.”

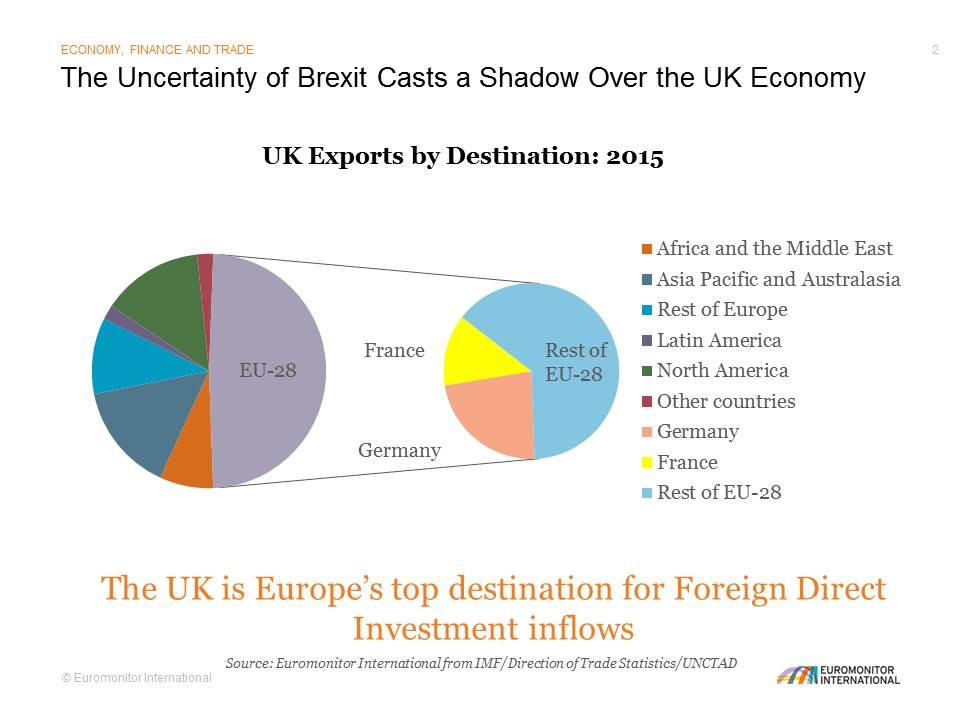

Smaghi went so far in his discussion as to compare the possible disruption of a No Deal hard Brexit with the impacts that the Lehman Brothers collapse had on the world banking system back in 2008. At the time, the Global Financial Crisis resulted. This graph below shows countries and regions to which the U.K. exports:

IMF Chief Warns of Painful Brexit for the World

The Society General CEO is not alone in sounding an alarm for the potential economic impacts of this Brexit event in three weeks. New International Monetary Fund Head Kristalina Georgieva also just warned that any form of Brexit will be “painful” and will only add to the effects of an ongoing global slowdown. She declared that the split repercussions will go far beyond the EU and UK, even as IMF data has already revealed that growth has decelerated in around 90 percent of the globe. Georgieva warned on the BBC that:

“It is very obvious that this [Brexit] is going to be painful. It is very important that we all concentrate also on spillover impacts for the rest of the world, and I particularly worry about low income countries that are in a significant way dependent on the European Union and the U.K.”

This week's news about the Brexit talks breakdown (with only three weeks until the event occurs) is a reminder of why gold makes sense in an IRA. One way to diversify your investments against such unfortunate news is through taking advantage of a Gold IRA Rollover. It is helpful to review some Gold IRA allocation strategies before considering top gold IRA companies and bullion dealers.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81