Recession 2023: What the Experts Have to Say, and What You Can Do About It

Disclosure: We are reader-supported. If you purchase from a link on our site, we may earn a commission. Learn more

Last Updated on: 31st May 2023, 09:33 pm

Investors, economists, and analysts are talking a lot recently about the increasing risk of a recession in 2023. The upcoming global slowdown would hurt even more as we are heading into a tightening cycle of monetary policy initiated by central banks worldwide.

How real is the threat of a recession in 2023? How long would it last? What are the effects of a contracting economy and high inflation on traditional and alternative assets? These are some of the most common questions investors are asking us, and we are going to answer these questions as concisely as possible.

Let’s have a look at what some of the leading voices in the financial markets are saying. We’ll take a look at what the leading financial institutions are advising their clients, as well as some opinions of major analysts.

Then we'll consider what you can do to alleviate the negative effects of a major reduction in economic activity coupled with higher inflation.

Table of Contents

Global Recession 2023 Risk

For those asking how we define a recession, the definition is very simple. A recession is characterized by an extended period where economic activity shrinks instead of expanding. Consumer spending decreases as people fear the negative effects. And companies produce fewer goods in expectation of lower sales.

This time around there is also a concern about rising prices. When inflation is low, between 2% and 3% it is considered, and we have seen, that the economy can expand, jobs are created, and general wealth rises.

The problem with high inflation is that it drastically reduces the buying power of consumers. People will also be concerned about their future in general as there is a sensation of instability. But that's not the end of the story. High inflation rates mean that the Fed and central banks around the world will be obligated to raise interest rates.

The first adverse effect that comes to mind when we talk about high interest rates is higher mortgage payments. High interest rates can at least stifle and at worst cripple the housing market. As interest rates go up, so do the interest rates banks charge for a mortgage.

Since most mortgages are around 30 years long, the difference in total cost is high. However, as interest rates keep rising so do monthly payments get much more expensive. So, for a house a potential buyer may have been looking at, at some point, it may no longer be a viable option.

The housing market is an important part of the overall economy. Remember what happened in 2008, when the bubble burst and housing construction and sales fell dramatically. This scenario is indeed unlikely to repeat itself, but it shows the impact that sector has on GDP.

What Economists Say About Recession 2023 Risk

A Financial Times Survey conducted together with the Initiative on Global Markets Chicago interviewed 49 macroeconomic experts. The survey showed that a recession is likely to begin next year.

Institutional investors and economists consider that the US is actually in a recession when the National Bureau of Economic Research (NBER) signals a substantive decrease in economic activity over an extended period. The period required is usually two consecutive quarters. The first drop in GDP happened in 1Q when the GDP fell by 1.5%. The NBER will release the next data for 2Q in late September.

The survey mentioned above found that almost 70% of economists believe that GDP will contract in 2023. While 38% believe that it will begin in the first two quarters of that year, and 30% believe that the recession will begin during the second half of the year.

However, the other 30% also believe a recession is coming but not for 2023 and put their predictions on 2024. While only 1 economist estimated there would be a recession called within this year. For sure from what this group of macroeconomic experts believes we will see a recession, it is most likely to occur between 2023 and 2024.

The Bloomberg Angle on Recession 2023

Let’s have a look at what the guys at Bloomberg Analytics are saying about recession risk in 2023. According to their economic models, the preluding interest rate hikes from the Fed have increased the risk of recession to 72%.

The team sees the economy shrinking by early 2024, which they hadn’t even contemplated only a few months ago. Their revision of their forecast for GDP growth came after the Fed’s last open market committee meeting where they raised interest rates by 0.75%.

Wall Street & Mike Novogratz

A long lineup of Wall Street institutions is more or less on the same boat when it comes to predictions of a recession. What changes among the different opinions is not if but when? That a recession is looming seems discounted by analysis and comments published by the following banks:

JP Morgan

JP Morgan’s CEO Jamie Dimon has repeated on various occasions he sees a growing likelihood of a recession. His most recent comments came in April 2022, in an interview with The Wall Street Journal.

Dimon cited the war in Ukraine, high inflation, and the Fed’s tightening cycle of interest rates as factors converging to significantly increase the possibility of a recession.

Bank of America

Bank of America’s chief investment strategist stated on June 11, 2022, that “we are already in a technical recession but just don’t realize it”. In an interview with Reuters, Bank of America economists saw a 40% chance of the US heading into a recession next year.

Nomura

Economists at Nomura wrote in a note on June 20, 2022, that they see a high chance of the US heading into a recession by late 2022 as the Fed continues to raise interest rates. The Fed has a mandate to stabilize prices, and with the current high inflation momentum, Nomura sees the Fed hiking up to 4%.

Goldman Sachs

Goldman Sachs economists cut their US growth forecasts as they see growing risks of a recession. On June 21, 2022, the bank's economists told Bloomberg they see a 48% probability of a recession over the next two years, up from 35% previously.

Mike Novogratz

Mike Novogratz, a Wall Street veteran, and Bitcoin investor, on June 13, 2022, told MarketWatch he saw a recession as likely for 2023. His prediction is one of the most severe as he stated, “the economy is going to collapse”.

Novogratz cited a cooling housing market and increasing inventories as signs the recession is looming on the horizon. He also mentioned that the Fed is in a conundrum as it tries to stabilize prices and protect jobs.

War in Ukraine

The war in Ukraine is causing price shocks to various commodities, soft and hard. Food prices are increasing rapidly also spurred by Russia confiscating grain supplies that were set to leave Ukraine by boat.

Russia has also threatened to cut off gas supplies completely to Europe. If Putin were to follow through with his threat it would mean rationing for things like natural gas. The news also sent natural gas prices even higher.

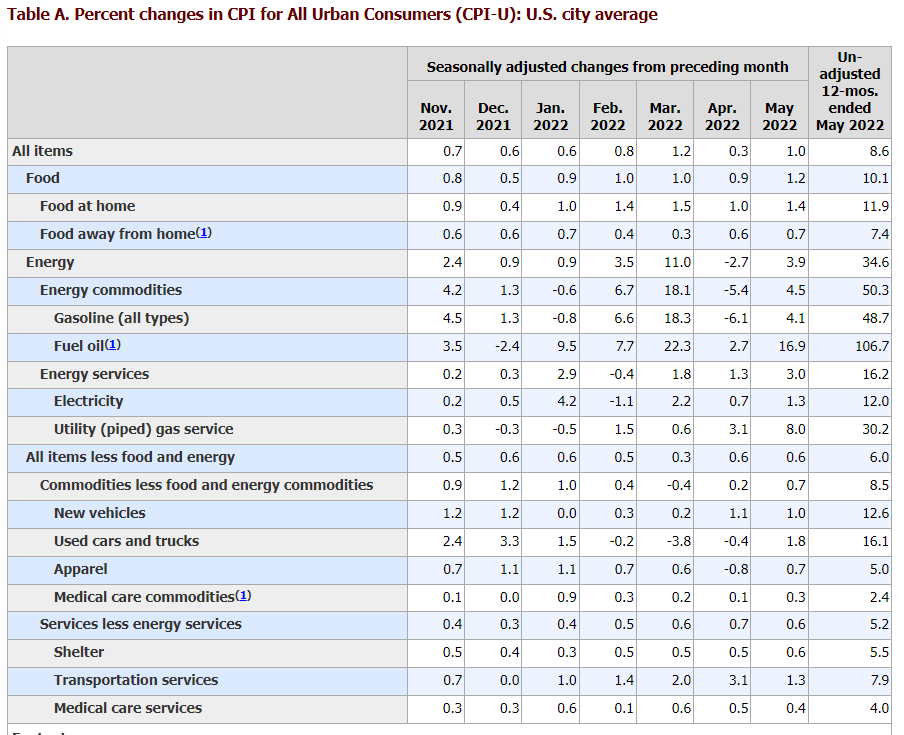

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

The negative effect of the price of commodities that are also produced in Ukraine has had a knock-on effect on many other products. Electricity costs have skyrocketed in Europe as much of the electricity supply is produced with natural gas.

Food staples are also higher, and in a globalized economy price pressure across the pond is quickly transferred in both directions.

What Does it Mean for Traditional Assets?

A recession is bad news for stock and bond markets. Stocks will suffer a sell-off as investors will lose faith in the capability of companies to continue to produce profits. And higher interest rates will squeeze profit margins for most companies.

The broad stock market, as measured by the S&P 500, has already lost nearly 22% YTD. Technically speaking, when the stock market loses more than 20% it means that the sentiment is negative and a market crisis is imminent.

Source: TradingView

Source: TradingView

In particular, companies with high debt-to-equity ratios will be hit the hardest as they will have to pay considerably more to finance their debt burden. Bonds will also be hit hard as interest rates rise, investors will want to buy bonds at cheaper prices to gain a higher yield to compensate for the higher interest rate environment.

Bond prices have had a bumpy ride since the beginning of the year, as the market adjusted to news headlines from the Federal Reserve's intention on rate hikes. Bond prices in general are likely to suffer as the Fed continues to tighten its monetary policy with higher interest rates.

Source: TradingView

Source: TradingView

What Does it Mean for Alternative Assets?

Alternative assets are known for their capability to not have returns correlated to the stock market. Gold, crypto, real estate, and commodities have shown in the past how they can at times act as a counterweight to negative times for traditional assets.

However, more recently we have seen how cryptocurrencies have not fared particularly well over this last high inflation period. The major crypto coins so far this year have shown a high correlation to the stock market. Yet many institutions are getting involved in crypto.

JP Morgan replaced its preferred alternative assets class, real estate, with cryptocurrencies. They also stated that they saw Bitcoin as undervalued by 28%. These comments haven’t stopped the continued selloff for now, but we are sure it will help in the long run.

Gold has shown characteristics that indicate it’s an asset that is resilient to inflation and stock market crises. In general, gold has various characteristics that make it a valuable addition to your portfolio.

Real estate as an asset class can have high correlations to stock market returns. Especially when the investment in real estate is made through REITs. This investment vehicle acts in a very similar fashion to the broader stock market.

For commodities, things are a little more complicated. Some commodities may have a positive correlation to stocks. That is to say, their prices move in line with the broad stock market. However, some commodities such as crude oil have shown to have no correlation to the broad stock market.

While crude oil prices may impact the stocks of certain sectors such as energy companies, they have no correlation with the broad stock market. Holding investments in crude oil may reduce your overall exposure to stock market returns and protect your portfolio from negative stock market shocks.

Recession 2023 Summary

From what most economists, analysts, and investment pundits across the spectrum are saying the chances of a recession are building. All analyses agree on the driving factors: galloping inflation, the war in Ukraine, and rising interest rates.

Rising interest rates will stifle corporate growth and especially hurt companies with high debt-to-equity ratios. Unemployment rates will rise coupled with high prices, which together will greatly undermine purchasing power and ultimately GDP growth.

In my personal opinion, holding alternative assets like gold and crypto is an effective way to reduce your exposure to traditional assets. In times of crisis, gold will typically not follow the returns of the stock market.

And that doesn’t mean I wouldn’t hold stocks, just that diversifying investments by investing in several asset classes can bring down the overall risk of a portfolio. I also believe that buying on stock market dips is a profitable investment strategy in the long run.

For example, if I make monthly investments in a broad stock market fund I would keep making them even as the market goes down. All I’m doing is buying at lower prices. And the rewards will come at some point when the stock market rallies again. And I can apply the same theory to crypto, especially when talking about Bitcoin and Ethereum.

Bottom Line

Investing always carries risk, this is why risky assets can produce attractive returns, to compensate investors for holding them. Always seek advice from your financial advisor to determine which investments suit your needs best.

You can also take advantage of investing in a tax-enhanced environment through a self-directed IRA. You can read about the top picks for gold IRA and crypto IRA companies in our reviews.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $3,348.95

Gold: $3,348.95

Silver: $38.17

Silver: $38.17

Platinum: $1,443.60

Platinum: $1,443.60

Palladium: $1,294.77

Palladium: $1,294.77

Bitcoin: $118,036.85

Bitcoin: $118,036.85

Ethereum: $3,549.24

Ethereum: $3,549.24