- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Puerto Rico Facing Growing Pressure to Default

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th December 2020, 06:11 am

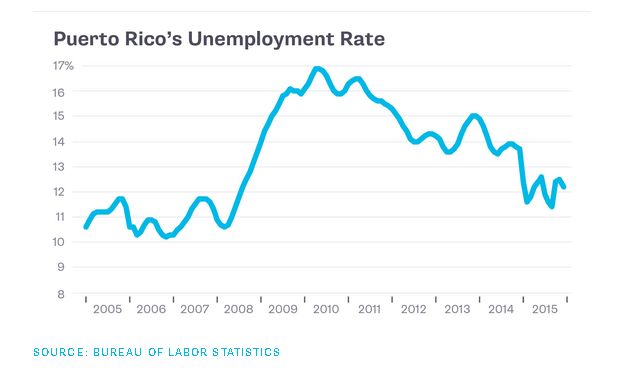

Puerto Rico has been in a period of economic stagnation that goes back decades. Along with the decline in GDP, it has also been losing citizens to the mainland, a trend that is causing a decreasing population. High government spending and low economic activity are a recipe for disaster. The island now has a total government debt or $70 billion, and a population of just 3 million. If that wasn’t enough the commonwealth also has 12% unemployment and 50% of the population employed by the government. There are also free schools and free healthcare for all, as well as benefits schemes that may in some cases be better than a paycheck.

Bailout or default?

The protectorate has made pledges in the past not to default; however, calls are being made for the inevitable to happen, and for Federal Government intervention. There is also a political connotation to the whole idea of allowing intervention and ultimately bailing out the commonwealth, and that is the morality to the whole issue and the consequences for other states with high debt burdens.

source: tradingeconomics.com

It may be extremely tempting for other states with high levels of debt to follow suit and ask for bankruptcy protection. The legislation is already in place in the US for States to file for bankruptcy under chapter 9. Some politicians believe that current legislature, as it stands, would not be suitable for Puerto Rico’s particular situation. But creating a special legislature to protect investors in Puerto Rican bonds may not be the right way for politicians on both sides of the aisle.

How Washington D.C. sees this

Democrats are more inclined to bail out Puerto Rico and offer some kind of relief for the local government’s debt burden. The republicans are highly unlikely to be willing to spend tax payers money unless there is some kind of systematic reformation in Puerto Rico’s policies. These policies would have to open up the labor market create lower tax regimes for corporate and basically put together a healthy environment for job creation and economic activity.

Clearly the path chosen by Puerto Rico of excessive government, high taxation, and high minimum wages has not produced the effects that its politicians may have hoped for. Clearly the threat of a general default on the commonwealth’s debt is there. The government has already defaulted on some bonds. The bonds that have seen default were issued by the Puerto Rico Public Finance Corp, and are currently rated D by Standard & Poor’s. Other issues from Puerto Rico, such as General Obligations are rated CC.

Puerto Rico ratings already at default level

Standard & Poor’s considers that ratings of CC are awarded when they expect default to almost be certain. That Said technically Puerto Rico cannot file under chapter 9, hence the need for new legislation. But that is only half the story, how the legislation is implemented may have significant consequences for other states going forward, and more importantly will determine what sort of pay out bond holders will receive.

Puerto Rico’s Governor Padilla has called for Federal Oversight to be subdued, and the Obama administration has stated that intervention must be paired with a plan to grant Puerto Rico a bankruptcy process. This sounds extremely like a bailout, and the worst part is there is no provision for reforms to be established so as to avoid this situation in the future. The Obama administration argues that a bankruptcy route will avoid costly litigation and help cut Puerto Rico’s liabilities. On the other hand, investors oppose this type of intervention as it will force them to take losses.

It would seem that losses at this point may be necessary and unavoidable. How the situation plays out now will define what will happen in Puerto Rico and what may happen in mainland states in the future. This situation sounds very similar to what happened in Greece, a country with high levels of unemployment, restrictive labor laws, high level of government employees and plenty of handouts. In the long run, it simply wasn’t sustainable and the country did need a bailout. However, their watchdog did not allow a bailout to happen without a guarantee of the necessary reforms to re-stabilize the countries debt to income ratio. Eventually, bond holders took a haircut, and the country was saved from disaster, but it wasn’t for free and significant reforms were needed to guarantee the whole process.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81