- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Prominent Yale Economist Predicts Doomsday Fall for U.S. Dollar

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Legendary former Morgan Stanley Asia Chairman Stephen Roach, currently a respected and widely followed Yale University economist and senior fellow has just shaken up the global FX currency markets with his latest sobering prediction. He warned dollar bulls last week that the age of the dominant U.S. dollar is coming to a brutal end. Roach now predicts that there will be a full 35 percent or more crash in the American dollar versus its global rivals. The Yale economist referenced both the falling national savings rate and out of control deficit and debt as two of his principal reasons for the dramatic sea change to the world reserve currency order that he sees coming soon.

Doomsday Scenario for U.S. Dollar Is In the Proverbial Cards

Roach revealed his dire forecast for the U.S. dollar in an episode of “Trading Nation” on CNBC last Monday. He warned viewers that the dramatic rise of China alongside the U.S. decoupling from its key trading partners means that the American currency will dramatically weaken in strength and value over the coming several years. It will end badly with the fall of the U.S. dollar dominance as the world's main reserve currency. Roach warned the world that:

“The dollar is going to fall very, very sharply.”

Roach had made these insinuations in an op-ed piece that he penned for Bloomberg the week before. In this article, he declared in no uncertain terms that the:

“The end of the U.S. dollar's exoribtant privilege as the world's primary reserve currency is coming to an end.”

It was in this prior article that the respected economist revealed how stressed the American economy already was by the effects of the coronavirus pandemic. He insinuated that the recession that broke out across the United States back in February due to the national and international health crisis will only worsen the problems for the American currency.

Rest of World Becomes Skeptical of U.S. Exceptionalism

The expert on finance and economics warned American consumers and investors alike that the world has begun to suffer:

“serious doubts about the once-widely accepted presumption of American exceptionalism.”

This past Monday, Roach declared that the American federal fiscal deficit is only making the situation for dollars worse for the near-future. The government is attempting to print its way out of the coronavirus economic collapse to the tune of several trillion dollars in new money creation and federal spending.

At the same time, the currency of China the yuan is getting greater appeal with investors around the world. Beijing is embarking on a series of structural reforms which may change the focus of the Middle Kingdom's economy from a heavy concentration on manufacturing to one that is more domestically oriented to services and consumer-driven growth at home. Roach makes a convincing argument that the weaker dollar that has often been encouraged by the current U.S. President would have a positive shorter-term impact on American exports at the expense of the longer term viability of the greenback.

Consider that a widely followed level of the dollar is the ICE exchange traded U.S. Dollar Index. This has been falling throughout many of the last 30 days and is off 3.9 percent. It is still roughly even for the year though, according to the data provided by FactSet.

Dollar Index Leaning Into a Sucker Punch to the Gut

This dollar index in fact measures the value of the U.S. dollar against six of its strongest rival currencies. Among these are the EUR/USD (Euro), the GBP/USD (British pound), the USD/JPY (Japanese yen), the USD/CHF (Swiss franc), the USD/CAD (Canadian dollar), and the Swedish kroner.

This declining dollar matters hugely to everyone living in and operating with U.S. dollars in their everyday lives. Not only assets and the stock market valuations will be impacted by its decline. The majority of debts in the country (and many around the world) are denominated in these dollars. A majority of international trade and across borders financing is settled in dollars as well. This means that import prices will rise apace with the dollar's decline, driving up critical cost of living measurements for the average American whether or not they are aware of these policies and cause and effect relationships.

In the past, fears on the health of the world economy have generally pushed investors and foreign governments alike into purchasing dollars along with other traditional safe havens like gold, Swiss francs, and bitcoin. This has been because there was a long-standing perception that the U.S. currency and economy were stable and resilient. According to Roach though, the dramatically rising deficits will finally destroy this mis-perception and land the knockout punches to the greenback's gut.

Respected Warren Buffet-Trained Financial Analyst Warns of Stock Market La La Land Levels

Kevin Smith the Chief Investment Officer of Crescat Capital has come out with a stark assessment of stock market valuations in the wake of all the government misspending and economic destruction caused by the country's shutdown response to the coronavirus pandemic. He warned grimly that:

“Speculation is rampant and being championed by a bold new breed of millennial day traders. The mania is based on a widespread hope in the Fed money printing. The catalysts for reckoning are numerous as a major cyclical economic downturn has only just begun.”

Smith learned his stock market trading skills at the proverbial feet of a legendary grand master in Berkshire Hathaway's founder Warren Buffet. The financial analyst has recently stated that endeavoring to short stocks right now is “worthy of a significant allocation today.”

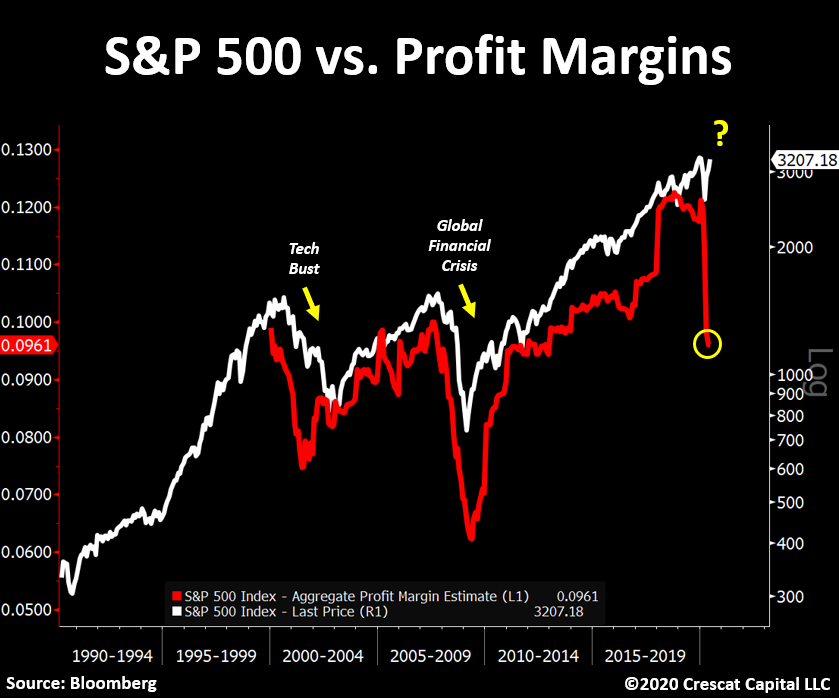

To back up his stark assessment of U.S. equities overvaluation, Smith employed this chart showing plunging profit margins of S&P 500 companies. He declared that investors should at least be worried by:

“How insanely disconnected equity prices are from their underlying fundamentals.”

Smith stated that the buying the dip investors are “not paying attention and have simply been too eager to call the bottom.” Here is his sobering chart showing the radical divergence between profit margins and stock prices of the S&P 500 stocks:

In Smith's Macro Trade of the Century Scenario, Stocks Do Not End Well

The financial analyst Smith repeated his much-touted “macro trade of the century.” His call is for rotating away from what he calls highly overvalued equities and into precious metals that he calls highly undervalued. Smith reminded readers in a note he penned this week that:

“Markets driven by euphoria never end well. The U.S. stock market today is in la-la land. It is discounting a new expansion phase of the economy at the same time as a major recession has only just begun.”

Unfortunately for all Americans, the warnings on near-future valuations of the U.S. dollar and stock markets from revered economist Stephen Roach and respected Financial Analyst Smith are not great news. They do serve as a prescient reminder of why gold makes sense in an IRA today. Now is a good time to consider some sensible Gold IRA allocation strategies as well as Gold IRA storage options. Remember to read more about Top Gold IRA Companies before you invest with any precious metals broker or dealer.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,385.11

Gold: $2,385.11

Silver: $27.83

Silver: $27.83

Platinum: $938.54

Platinum: $938.54

Palladium: $884.45

Palladium: $884.45

Bitcoin: $67,337.49

Bitcoin: $67,337.49

Ethereum: $3,245.06

Ethereum: $3,245.06