- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

President Trump Promises American Protectionism as Prime Minister May Promises Full EU Break

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 24th January 2017, 04:03 pm

This past week turned out to be historic on several levels. Donald Trump capped off the week with his colorful inauguration. In his various speeches, he reaffirmed his intentions to make good on his campaign promises and open a new American era of trade protectionism as part of his “America First” theme.

Naturally Beijing and other capitals are not happy about it. The Chinese official news agency is promising retaliation if China's core interests and understandings are threatened.

Over in the United Kingdom, Theresa May also reaffirmed her post Brexit campaign promises. May is going to deliver the hard Brexit she promised the nation after the historic “no” Brexit Referendum results from this past June.

As the Davos World Economic Forum continued, former U.S. Treasury Secretary Larry Summers warned about the global banking system remaining unsafe. These are all reasons why gold makes sense in your IRA.

Trump Inauguration Sparks Fears of American Trade Protectionism

During and after his inauguration speeches this past weekend, Donald Trump conjured up images of an America in decline and in need of a major overhaul. This was exactly what his campaign rallies and speeches had promised.

He referenced vulnerable borders, unfair alliances, and damaging trade deals in his weekend themes that reinforced his world view of “America First.” It promises a new era of American protectionism that has not been seen in many decades. President Trump stated:

“For many decades, we've enriched foreign industry at the expense of American industry; subsidized the armies of other countries, while allowing for the very sad depletion of our military. We've defended other nations' borders while refusing to defend our own.”

His speeches over the weekend demonstrated that he intends to make good on his campaign pledges. The new policies will focus far less on free trade, globalism, and American alliances.

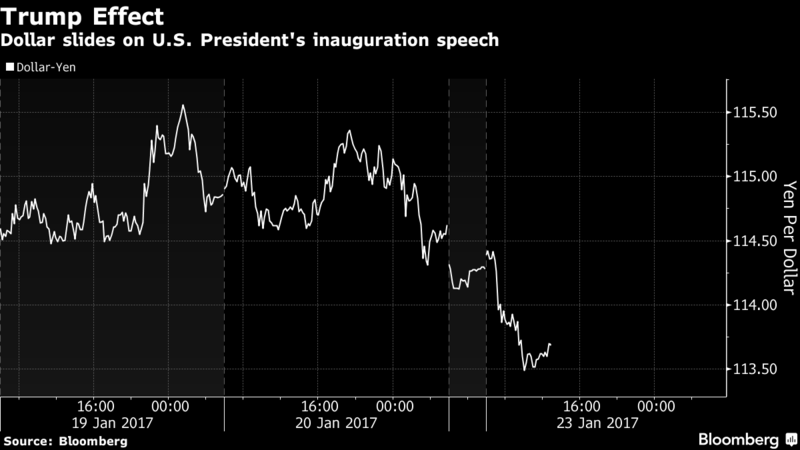

The new administration's updated White House website included promises to pull out of the Trans-Pacific Partnership as well as to start afresh on NAFTA the North American Free Trade Agreement with a renegotiation of the three nation free trade deal. As this chart shows, the dollar has reacted by declining:

Now that President Trump appears serious about his earlier pre-inauguration pledges, China is not taking the previous threats of punitive tariffs well. The Xinhua Official News Agency for the Communist Chinese government wrote:

“Cooperation also demands reciprocal flexibility instead of a beggar-thy-neighbor mentality. Among all his alternatives, the least desirable for Trump is to act on his previous threats to slap punitive tariffs on his country's largest trading partner and label China a ‘currency manipulator' as protectionism only stirs up retaliation.”

Trump also reaffirmed his intentions to hire and buy American. Despite the optimistic tone of the improvements he plans to make for the people who elected him, the international community is focusing on his negative depiction of America today and the putting America first pledge.

“Hard” Brexit Speech Finally Reveals to the World How Britain's Future Will Look

After months of waiting, the European and international business and political establishments have finally received the clarity they were looking for on the future of Britain with regards to the European Union and the rest of the world.

Prime Minister Theresa May delivered the long anticipated speech on her vision for the future of Great Britain. In this she pledged the country will withdraw from the single market entirely. Instead of this four decade long trade arrangement, they will look for a customs agreement with the remainder of the European Union.

Her emphasis is on a “smooth and orderly Brexit,” in which the U.K. will force a full break with the EU. In an interesting twist, May will allow Parliament to have a vote on the ultimate Brexit deal. Regardless of how they vote, the Brexit process will proceed she promised. May told diplomats last Tuesday in her speech:

“I know there are some voices calling for a punitive deal that punishes Britain and discourages other countries from taking the same path. That would be an act of calamitous self-harm for the countries of Europe. And it would not be the act of a friend.”

In this speech, May spelled out her Brexit plans with a number of key objectives. Among the most important of these are the following:

- The United Kingdom will negotiate its own new trade deals with nations not in the EU.

- Britain will seek a new customs union set of rules that allow for no-tariff trade with the single market without needing to force these duties on other countries outside of the EU.

- Prime Minister May wants a transition period for the newly implemented rules to be gradually phased in for financial service firms and other British companies.

- The U.K. will not make any more enormous financial contributions to the European Union budget.

The most surprising revelation from the speech was Prime Minister May's willingness to simply walk away from the EU completely if she can not have the deal she is demanding. She stated:

“We would still be able to trade with Europe. We would be free to strike trade deals across the world. And we would have the freedom to set the competitive tax rates and embrace the policies that would attract the world's best companies and biggest investors to Britain.”

The prime minister also threatened Europe with her remarks. She noted they will suffer as well if no deal can be reached:

“It would jeopardize investments in Britain by EU companies worth more than a half a trillion pounds. It would mean a loss of access for European firms to the financial services of the City of London. It would risk exports from the EU to Britain worth around 290 billion pounds ($359 billion) every year. And it would disrupt the sophisticated and integrated supply chains upon which many EU companies rely.”

The Europeans were mostly tight-lipped in initial response to May's demands and threats. A notable exception came from European Parliament point person for Brexit Guy Verhofstadt who pledged, “we shall never accept a situation in which it is better to be outside the European Union.”

Former Treasury Secretary Summers Calls Global Banking System Unsafe

Former President Clinton's Treasury Secretary Larry Summers has addressed a panel at the Davos World Economic Forum where he made dramatic and grim assessments on the state of the global banking system a decade after the financial crisis erupted.

He believes that the global banking system is far from safe. Summers remarked that there are serious issues of global market liquidity that still have to be dealt with as banks are not ready and able to endure comparable stresses to those they endured in the worldwide financial crisis of 2007-2009.

Summers indicated that the array of global financial rules which the U.S, Britain, the EU, and others have established following the crisis over the last ten years are not enough to prevent or endure another crisis. He argued:

“At the same time, it does bear emphasis that if you look at a ratio that I have found relevant in some of my work — the market value of equity to the total value of assets for large banks — it's lower than it was in the decade before the financial crisis. So do we have any basis for complacency? No. Are there important issues of liquidity in the functioning of markets in difficult circumstances that remain to be addressed? Yes.”

Summers also suggested that the wholesale repealing of all the regulatory framework changes which have been made over the last eight years would be a “grave mistake.” This was a veiled reference to the Republican led calls to reduce the Dodd Frank act regulations.

It is also a clear warning for you to add some gold which is allowed in your IRA into your retirement and investment portfolios.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81