- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Patch of Land Review

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 25th March 2023, 12:05 am

Patch of Land

- Phone : (888) 959-1465

- URL :

- Global Rating

- Very Good

User Rating

- 2 Reviews

Review Summary :

Offering you the chance to invest in both residential and commercial real estate loans, Patch of Land also provides unusually accessible customer support and pays between 8% and 18% interest rate returns on their carefully vetted deals and projects.

Pros:

- Customer service is readily accessible, with even the CEO and board members' email addresses posted on the site.

- Patch of Land invests its own money into pre-funding approved residential and commercial loan deals, so you know they believe in their own product.

- The platform tracks and manages your investments, providing updates and information as available along with the term loan payments.

- Choice between residential and commercial loan deals.

- Only a minor 0%-2% management fee is charged from investors.

- Patch of Land does not charge businesses a percentage of their money raised as with many crowdfunding rivals.

- Deals pay between 8%-18% in interest.

Cons:

- At least until early 2016, only accredited and institutional investors are able to participate.

- Residents of the states Vermont, South Dakota, Nevada, Minnesota, and Arizona are not eligible to invest in or borrow from Patch of Land.

Quick Facts about Patch of Land

Reviewed By:David Crowder

Have you purchased products from Patch of Land? Leave a review!

extremely impressed

I’ve invested in over 12 loans through Patch of Land and have been extremely impressed.

1st the positives:

Patch of Land offers some of the highest risk-adjusted interest rates for risk that is comparable to any of the RECF sites out there

POL’s LTV / Loan to ARV values are sufficiently low so as to offer a healthy buffer in the event that some of their borrowers default.

POL’s unique Bankruptcy Remote Indentured Trustee model protects my funds in the event that POL itself runs aground (but the loans are all performing)

All but a couple of POL’s borrowers paid all their monthly payments on time and without any issues. I was very happy with those returns and all the fixed payments went directly into my bank account.

One of the loans was extended which didn’t bother me much b/c I was able to continue earning a high interest rate for longer. After a 5 month extension, the entire loan was repaid with additional ‘extension’ fees which brought my earned interest rate even higher.

One defaulted loan went dark after an extension but then eventually repaid all due interest and principal after several long months of waiting. Got a really nice interest rate bump there after default interest rates were added in so I am definitely not complaining about the occasional default.

My main suggestion to them would be to offer better, more frequent and more detailed updates on all the properties so that I am kept fully apprised of all & any details on my active performing loans, any that have been extended (Ex: Why did the loan need to be extended exactly, and what work or progress is happening during the extension) and any non-performing loans.

Nonetheless, given that all of their investments are secured by underlying properties, I am extremely satisfied with Patch of Land and the high returns that I have earned.

I would definitely recommend.

May 4, 2017, 12:45 pmBuyer beware

The default rates on the platform is really high. Buyer beware.

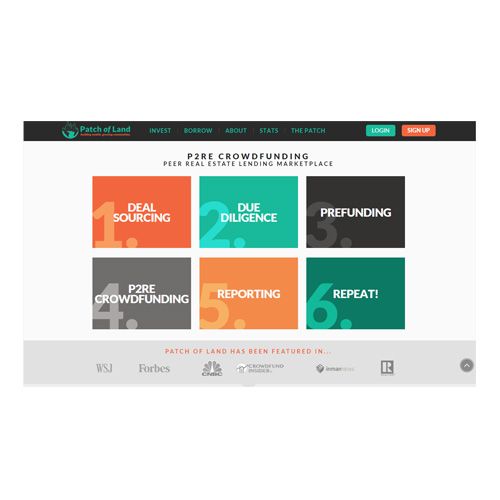

July 28, 2017, 7:30 pmProbably the most creatively named Peer to Peer Real Estate platform on the market is Patch of Land. This is a lending marketplace that puts together institutional and accredited investors with borrowers who are purchasing real estate. The investors are looking for shorter term, asset-backed investments that pay higher yields, while the borrowers want a better, more consistent, and more timely source of funds to use for property rehabilitation throughout the U.S. The end result is a win-win situation for both the investors and borrowers.

Patch of Land Intro & Background

Patch of Land arose back in 2013 in Los Angeles, California. The company had a goal in mind of serving local communities by helping the inhabitants to be able to fund the renovating of older properties. The founder was inspired to try to rehabilitate Chicago's neighborhoods that suffered so badly from the horrible real estate crash. Since the inception of this concept, Patch of Land has found similar Good Samaritan type of work in Newark, New Jersey which has needed rehabilitation since the riots of the 1960's from which that city never recovered. The company prides itself on making a positive difference in local communities by helping real estate rehabilitators to gain the funding they need from the investors on the platform.

Patch of Land Founder and Management Team

CEO and Co-Founder Jason Fritton leads the company's strategy, operations, and execution. He spearheaded the Series-A funding of $14 million for the company. As an expert on real estate crowdfunding and P2P lending, he has been widely referenced and interviewed by The Chicago Tribune, CNBC, Los Angeles Business Journal, Globe Street, The Real Deal, CrowdfundBeat, CrowdfundInsider.com, and others. Besides this, he has provided leadership articles to RealtyBizNews and Equities.com. Jason is also an instrumental part of the recently passed legislation on crowdfunding and the JOBS Acts that are about to finally remove the accredited investor requirement from the process of crowdfunding in the early part of 2016.

CTO and Co-Founder Brian Fritton started a web development business that grew to a few hundred clients strong in high school and college. He has led teams on projects large and small with groups as significant as Entrepreneur's Hundred Most Brilliant Companies, Inc.'s 5000 List, and the Fortune 500 Fastest Growing Companies.

Chairman of the Board and Co-Founder Carlo Tabibi has only worked for companies that he has invested in, started, or assisted in developing into phenomenal financial successes. He has founded and owns numerous businesses, speaks three languages, and became educated in Great Britain, Spain, and the U.S., making him a global leader of business. He contributes significantly to Patch of Land through the real estate development, finance, and marketing departments and needs of the company and platform.

Patch of Land Loans

Patch of Land specializes in real estate loans and bridge loans, and these are the only kinds of loans they do. While they have traditionally been involved with residential real estate loans, they are now getting into commercial and even industrial real estate loans to include multi-family, retail, office space, and industrial loans.

Rates on these loans go from 8% and up, with repayment terms varying from as little as one month to up to 36 months. Minimum loans are for $100,000 while maximum loans range on up to around ten million dollars. They require a loan-to-value ratio of minimally 80% in order for the project to qualify for funding. Collateral is required on all of these loans and a first lien position and personal guarantee are both necessary to secure the loan funds.

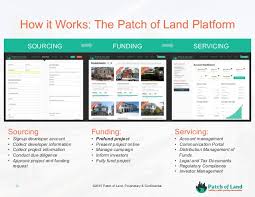

How Patch of Land Works

Patch of Land operates more like a real estate lending marketplace than a traditional crowdfunding site. This is most obvious in the way that they pre-fund all deals they accept for the platform and then worry about the crowdfunding part of the offering after they have already distributed the funds to the borrowers. Investors find it easier to choose from their real estate deals because the platform assigns project viability and profiles of risk assessments. Because of the company's proprietary data management and risk assessment technologies, they are able to dole out funding to non traditional types of borrowers whom the old school lenders would not finance.

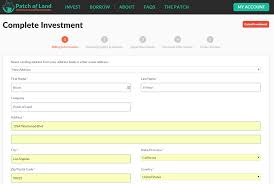

To apply, borrowers must fill out an application online by giving out both personal and important financial information. Items they will likely require include a borrower's proof of funds, credit report, list of comparable sales, property inspection report, general liability insurance, and construction budget, among others. The application itself is so intuitive that you are supposed to be able to finish it in half a minute or less. After they approve the application, borrowers complete all required loan documents. Once it is all finalized, funding is disbursed as quickly as only seven business days.

To be approved, borrowers have to front at least a 20% minimum downpayment. The value after the property is renovated has to be lower than 65% of amount of loan. Prepayment is allowed without penalty. The realty crowdfunding and P2P platform is approved to operate in all fifty states aside from Vermont, South Dakota, Nevada, Minnesota, and Arizona at time of publication. The company claims that it is actively pursuing steps that will allow it to operate in those remaining five states in the near future.

Patch of Land Services

• Diversify into Real Estate Inexpensively and Easily – investor-lenders can make as much as from 8% to 18% in interest payments while helping borrowers to complete projects and investing in community rehabilitation.

• Investor Project Browsing – All posted deals and projects go up on the investor browsing section of the platform where investors can search through them to choose the ones they wish to fund.

• Works with Borrowers with Bad Credit – Since Patch of Land makes every funding decision on a case-by-case basis, borrowers with poor credit may also apply and be accepted if the project itself is strong (though at a higher interest rate, of course).

• Pre-Funding of Loans – Most crowdfunding platforms will not stick their proverbial necks out to pre-fund projects that they have approved, but Patch of Land puts its money where its mouth is and pre-funds all projects that they greenlight.

• Offer Equity Investments and Debt Investments – Equity investments allow you to gain a percentage of ownership in the property of which you are investing, which could mean a greater profit upside, but also entails higher risk. Debt investments are backed by the property itself and permit you to invest in a loan to receive a fixed interest income off of the loan. There is no upside potential beyond the interest rate on debt investments.

• Offer Commercial Real Estate Investments – Commercial real estate is a new department for Patch of Land, but they are moving into it in a big way. They are in the process of accepting and funding projects as varied as:

- Multi-Family

- Retail

- Office

- Hospitality

- Industrial

Patch of Land Locations

Patch of land's corporate headquarters is located in California at 1964 Westwood Blvd, Suite 350, Los Angeles, CA 90025. They also maintain a satellite office in New York City at 195 Plymouth Street, Suite 424, Dumbo, Brooklyn, NY 11201.

Patch of Land Interface Screenshots

Patch of Land Safety

The company takes its security very seriously and has put into place a wide and varied number of defensive measures to ensure that neither your personal nor financial information and data is hacked or stolen. This starts with SSL encryption of all information that is interchanged between company servers and your own web browser via the Internet. Access to their proprietary databases that hold personal information is granted only to those who need to know it. Patch of Land employs automated tools which oversee the network's traffic to identify and catch illegal efforts to upload, hack or change information on their systems.

Regarding information that is obtained and stored from the Qualifying Investors Questionnaire, they store this on a system that is securely isolated away from any connection to the Internet. They also make sure that all information from the investor questionnaires are safely encrypted with the same standard of protection that the major banks deploy to shield their sensitive data of the customers.

Patch of Land Complaints and Ratings

The Better Business Bureau gives Patch of Land their solid A- rating because of the amount of time the business has been running and especially because there are 0 complaints that have been lodged against them with the BBB. A perfect record of no registered complaints is difficult to find in any industry or company.

Patch of Land Customer Support

Patch of land engages in overkill with numbers of ways to contact them. They provide at least four different categorical email addresses, phone number and fax number, a contact form, both their business addresses, and also specific email and Linkedin profiles for each of their team members, including co-founders and board of directors. We think the message they are trying to send is that they are proud of their unusually accessible customer support and platform contact transparency. This is a refreshing change, as too many crowdfunding and P2P outfits tend to hide behind anonymity or a skeleton customer support staff.

Patch of Land Costs & Fees

Investors do not pay any registration or setup fees to participate in the platform deals, nor does the company take any spreads for itself from the interest rate that they receive in from loans then pay out to you as an investor. They do receive a from 0% to 2% interest distribution interest rate that the borrowers make in order to pay for costs and turn a profit. Borrowers are charged default fees and late payment fees as well. Patch of Land does not levy campaign successful fundraising fees or other transaction fees as do so many of their crowdfunding rivals. They do receive closing costs, property appraisal fees, and origination points, as would a traditional marketplace for loans.

Final Words on Patch of Land

Patch of land is providing every aspect of the facilitating and funding operations of all real estate loan and real estate equity investments they put together. For this, they get a very reasonable from 0% to 2% cut from investors as a management fee. With extremely accessible customer service, a wide variety of opportunities in which to invest, and deals that are paying out between 8% and 18% in interest to investors, this is a platform and site that you should investigate as an effective means of diversifying your investment portfolio to include residential and commercial forms of real estate.

Patch of Land

- Phone : (888) 959-1465

- URL :

- Global Rating

- Very Good

User Rating

- 2 Reviews

Review Summary :

Offering you the chance to invest in both residential and commercial real estate loans, Patch of Land also provides unusually accessible customer support and pays between 8% and 18% interest rate returns on their carefully vetted deals and projects.

Have you purchased products from Patch of Land? Leave a review!

extremely impressed

I’ve invested in over 12 loans through Patch of Land and have been extremely impressed.

1st the positives:

Patch of Land offers some of the highest risk-adjusted interest rates for risk that is comparable to any of the RECF sites out there

POL’s LTV / Loan to ARV values are sufficiently low so as to offer a healthy buffer in the event that some of their borrowers default.

POL’s unique Bankruptcy Remote Indentured Trustee model protects my funds in the event that POL itself runs aground (but the loans are all performing)

All but a couple of POL’s borrowers paid all their monthly payments on time and without any issues. I was very happy with those returns and all the fixed payments went directly into my bank account.

One of the loans was extended which didn’t bother me much b/c I was able to continue earning a high interest rate for longer. After a 5 month extension, the entire loan was repaid with additional ‘extension’ fees which brought my earned interest rate even higher.

One defaulted loan went dark after an extension but then eventually repaid all due interest and principal after several long months of waiting. Got a really nice interest rate bump there after default interest rates were added in so I am definitely not complaining about the occasional default.

My main suggestion to them would be to offer better, more frequent and more detailed updates on all the properties so that I am kept fully apprised of all & any details on my active performing loans, any that have been extended (Ex: Why did the loan need to be extended exactly, and what work or progress is happening during the extension) and any non-performing loans.

Nonetheless, given that all of their investments are secured by underlying properties, I am extremely satisfied with Patch of Land and the high returns that I have earned.

I would definitely recommend.

May 4, 2017, 12:45 pmBuyer beware

The default rates on the platform is really high. Buyer beware.

July 28, 2017, 7:30 pm

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.67

Platinum: $931.67

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,909.13

Bitcoin: $67,909.13

Ethereum: $3,254.68

Ethereum: $3,254.68