- GOLD IRA

- Download Our 2024 Precious Metals IRA Investor’s Guide.

Click Here  Gold IRA

Gold IRA

Investing

Investing

-

- CRYPTO IRA

- PRICES & STATS

- RETIREMENT PLANS

- BLOG

Questions? Call (888) 820 1042

Questions? Call (888) 820 1042

Pandemic Eviction Ban Ruled Unconstitutional by A Federal Court

Disclosure: Our content does not constitute financial advice. Speak to your financial advisor. We may earn money from companies reviewed. Learn more

Last Updated on: 20th April 2021, 10:26 pm

This past week a court ruling emerged that the United States' CDC Centers for Disease Control and Prevention eviction ban is not constitutional. It threatened to overturn the so-called pandemic eviction ban that has kept millions of Americans from losing their homes. The issue is certain to be appealed to the highest court as it has major implications for countless Americans.

Federal Judge Rules the Pandemic Eviction Ban As Unconstitutional

A Texas federal judge issued the ruling on Thursday, February 25th stating that the federal government's eviction moratorium is actually unconstitutional. Former President Donald Trump appointee Judge John Barker of the Eastern District of Texas was responsible for the ruling. He did not issue a preliminary injunction as part of his ruling.

President Joe Biden has been seeking to extend the foreclosure ban as well. Judge Barker made it clear that he did expect the Centers for Disease Control and Prevention to abide by his court's ruling to withdraw their moratorium. Barker wrote that:

“The federal government cannot say that it has ever before invoked its power over interstate commerce to impose a residential eviction moratorium. It did not do so during the deadly Spanish Flu pandemic. Nor did it invoke such a power during the exigencies of the Great Depression. The federal government has not claimed such a power at any point during our nation's history until last year.” Even though the Covid-19 pandemic persists, “So does the Constitution.”

Ruling Latest Salvo in Ongoing Battle Of Texas Property Owners and Landlords

The ruling is the latest episode in the legal effort that a group of Texas property owners and landlords began back in October. In this case, they sued both the Department of Health and Human Services and the CDC regarding the former President Trump administration Eviction Moratorium Order. It was this administration order that enforced a temporary stop of residential evictions. The order referred to the underlying pandemic reality that “Covid-19 presents a historic threat to public health.”

This order had been put in place this past September by the CDC as a result of the spreading coronavirus pandemic. Originally the order would have expired on January 31st but the new administration prolonged it until the 31st of March. The Deputy White House Press Secretary Brian Morgenstern from the time of the ruling commented that this moratorium:

“Means that people struggling to pay rent due to the coronavirus will not have to worry about being evicted and risk further spreading… or exposure to the disease due to economic hardship.”

Neither the Department of Justice nor the CDC had any immediate comment or reaction to the ruling. CEO and President Diane Yentel of the National Low Income Housing Coalition urgently requested that the CDC “immediately” appeal the judge's ruling.

Property Owners Contend that Federal Government Overstepped Authority

On the other side of the argument the property owners contended that the federal government lacked the authority to halt evictions. Judge Barker took their side of the case with his ruling that both the administration and Congress did not have the necessary powers to allow the CDC to stop nationwide evictions. He made special note that this ban was threatening the rights of landlords according to state law.

Two conservative legal groups argued the landlords' case. The Southeastern Legal Foundation and Texas Public Policy Foundation represented the plaintiffs and declared it a victory. A Texas Public Policy Foundation case lawyer Robert Henneke declared in his statement that:

“The CDC attempted to use COVID-19 as an opportunity to grab power and the court rightfully corrected this egregious overreach.”

Originally this order from the CDC would have expired on December 31st. The second stimulus package included an extension until the end of January. Among the first acts of President Biden was to work towards another extension of the moratorium through March 31st. The Department of Justice had not revealed whether or not it will seek an appeal to the case.

Invoking the Order Helps Renters At the Expense of the Landowners

There is a simple process for the renters to be able to claim the protection afforded by the eviction moratorium. A tenant signs a declaration form available from the CDC website. The renters declare that they meet the stipulated requirements. Renters must earn under $100,000 per year, have suffered a substantial decline in income, and have done their best to seek out rental assistance to pay their rent.

The moratorium does not either forgive or cancel the rent that the tenants can not pay. Instead the order merely buys the renters more time. When the ban ends, landlords are still able to evict their tenants if they are not able to make up the overdue rent. The CDC moratorium is not always greater than the existing protections for tenants that have been put into place in other cities and states.

Millions of Tenants at Risk of Being Evicted When Moratorium Ends

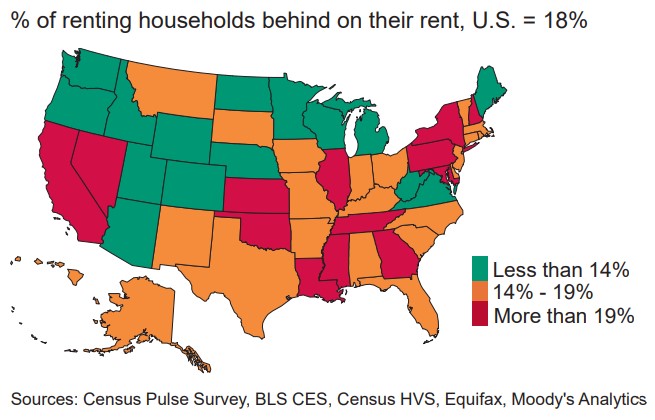

The United States does not maintain complete national data on eviction risk. In January, Moody's Analytics teamed up with the Urban Institute to release their joint analysis entitled “Averting An Eviction Crisis.” This report stated that around 10 million renters have fallen into arrears on their rent and run the risk of being evicted. This chart from the report reveals the states where the percentages of distressed renters are highest:

Their analysis delved into the amount of rent on which they are behind as well. Effective as of January, a typical late tenant is nearly four months behind and owes $5,600 on the combined rent and utility amounts due, the firms' analysis found. Project researchers wrote that:

“To put that into some perspective, approximately seven million households lost their homes in foreclosure during the five darkest years of the global financial crisis. Here we have 10 million families facing a similar fate over a matter of months.” The ones who have fallen into arrears on their rent “are among the most vulnerable members of society and more likely to be families of color.”

Another survey released in February addressed the concerns that minorities and the most vulnerable were suffering disproportionately. It was put together by an advocacy group coalition that included The National Employment Law Project, Color of Change, the Worker Institute at Cornell, and the TIME'S UP Foundation Impact Lab. Their Foundations for a Just and Inclusive Recovery report looked at coronavirus-related inequities.

Researchers in this second report looked at more than just minorities. Their research determined that around 42 percent of African American workers, 39 percent of Latin workers, and also 21 percent of white workers had already “expressed some level of concern that their household would face eviction or foreclosure” over this year 2021. With coronavirus raging on, investment bank JP Morgan has projected a drop in Q1 2021 GDP. Even though the economic recoveries of the EU and Asia lag behind the U.S. there are still serious inequity problems stemming from COVID-19 that the U.S. has to address.

Unfortunately neither report came up with an easy answer to the persistent problem of reconciling the needs of both landlords and tenants in this difficult coronavirus era. Gold makes sense in an IRA because of these economic headwinds. There are many Gold IRA storage options available today.

Silver

Silver Gold

Gold Platinum

Platinum Palladium

Palladium Bitcoin

Bitcoin Ethereum

Ethereum

Gold: $2,387.15

Gold: $2,387.15

Silver: $27.92

Silver: $27.92

Platinum: $931.02

Platinum: $931.02

Palladium: $903.43

Palladium: $903.43

Bitcoin: $67,910.26

Bitcoin: $67,910.26

Ethereum: $3,278.81

Ethereum: $3,278.81